The Scotiabank Gold American Express® Card has seemingly been flying under the radar of Miles & Points enthusiasts. This is not that surprising given that the card is tethered to the Scene+ program, which likewise doesn’t get quite as much love as airline and hotel loyalty programs like Aeroplan and Marriott Bonvoy.

However, the Scotiabank Gold American Express® Card has a slew of great benefits that shouldn’t be overlooked – from its 5-6x earning multiplier at grocery stores and restaurants to its no foreign transaction fee feature, and more.

In this review, we’ll take a deep dive into this underrated card.

At a Glance | |

Annual fee: | $120 |

Supplementary cardholders: | $29 |

Minimum annual income: | N/A |

Estimated credit score: | Good to excellent |

Rating: | 4/5 |

What we love: no foreign transaction fees, great domestic earning rates, flexible Scene+ points

What we’d change: apply earning rates to foreign purchases, make Scene+ points transferable

In This Post

- Consistent Welcome Bonus

- Great Domestic Earning Rates

- Flexible Scene+ Points

- Comprehensive Insurance Coverage

- What Else Does the Card Offer?

- Other Cards to Consider

- Conclusion

Consistent Welcome Bonus

The welcome bonus of the Scotiabank Gold American Express® Card consistently ranges from 40,000–45,000 Scene+ points, which is worth up to $400–450 (all figures in CAD). The all-time high offer on the card was for 50,000 Scene+ points, which is worth up to $500.

Generally speaking, at least part of the welcome bonus on Scotiabank’s suite of Scene+ cards has an easy-to-achieve minimum spending requirement, including on the Scotiabank Gold American Express® Card.

The second half of the bonus is somewhat more difficult to earn; however, the good thing is that you usually have a full year to fulfill the requirement, which you can stagger as needed or fulfill it all when you have trips abroad. After all, as we’ll discuss below, this card doesn’t levy foreign transaction fees.

Great Domestic Earning Rates

A standout feature of the Scotiabank Gold American Express® Card is its accelerated earning rates for purchases made within Canada.

On domestic purchases, the card earns Scene+ points as follows:

- 6 Scene+ points per dollar spent at Sobeys, IGA, Safeway, FreshCo, and other eligible Scene+ partner merchants†

- 5 Scene+ points per dollar spent on groceries, dining, and entertainment†

- 3 Scene+ points per dollar spent on gas, transit, and streaming services†

- 1 Scene+ point per dollar spent on all other purchases†

There are only a handful of cards that offer 5x rewards at restaurants and grocery stores. In fact, among American Express cards, this card’s only rival is the well-regarded American Express Cobalt Card.

Admittedly, the Cobalt Card earns better rewards, since its Membership Rewards (MR) points can be converted to a handful of hotel and airline programs, like Marriott Bonvoy and Aeroplan; however, the card’s 5x “Eats and Drinks” spending category has a limit of $2,500 a month, which you can easily breach if you have a big family or spend a lot of money eating out.

In contrast, the Scotiabank Gold American Express® Card has an accelerated earning limit of $50,000 a year, which is much higher than the Cobalt Card’s overall limit.

Plus, if you do your grocery shopping at Empire Company stores, such as Sobeys and its budget brand FreshCo, you’ll earn an extra Scene+ point per dollar spent, corresponding to a total of 6% back in rewards.

One thing to note about the Scotiabank Gold American Express® Card is that it only earns a flat rate of 1 Scene+ point per dollar spent (after conversion) on foreign purchases. In other words, none of its accelerated earning multipliers apply outside Canada.

This puts the card at a disadvantage against its sister card, the Scotiabank Passport® Visa Infinite* Card, which earns 2 Scene+ points per dollar spent (after conversion) on transit, groceries, dining, and entertainment outside Canada, despite also being a no-foreign-transaction-fee card.

Flexible Scene+ Points

As mentioned, the Scotiabank Gold American Express® Card is attached to the Scene+ program. When redeemed in most ways, Scene+ points are worth 1 cent each.

The main critique of flexible points programs like Scene+ is that you can’t derive outsized value out of their currency like you potentially could with an airline or hotel loyalty program.

However, the beauty of Scene+ is that its redemption possibilities are wide-ranging. Among the places you can redeem Scene+ points include the following:

- Empire Company grocery stores (Sobeys, Safeway, IGA, FreshCo, etc.)

- Cineplex (including The Rec Room and Playdium)

- Home Hardware

- Recipe Unlimited restaurants (Harvey’s, Swiss Chalet, Montana’s, etc.)

However, clearly the redemption opportunity of most interest for the Miles & Points community is the ability to redeem Scene+ points against any travel purchase charged to the card at the standard rate of 1 cent per point.†

With this option, your Scene+ points can be used to offset travel expenses that might not be covered by other loyalty programs, such as boutique hotels, low-cost flights, tours/activities, and cruise deposits.

Lastly, you can also redeem Scene+ points for gift cards, merchandise, and statement credits – though the value you’ll get through these avenues might be less than the optimal 1 cent per point redemption rate.

Comprehensive Insurance Coverage

The Scotiabank Gold American Express® Card provides comprehensive insurance coverage that matches or exceeds similar cards.

As a summary, the card provides coverage as follows:

- Travel emergency medical: Up to $1,000,000 per insured person per trip (25 days for those aged 64 and under; 3 days for those aged 65 and over)†

- Trip cancellation: Up to $1,500 per insured person or $10,000 per trip†

- Trip interruption: Up to $1,500 per insured person or $10,000 per trip†

- Flight delay: Up to $500 per insured person per trip†

- Delayed/lost luggage: Up to $1,000 per trip†

- Hotel/motel burglary: Up to $1,000 per burglary occurrence†

- Rental car collision/loss damage: 48 days; limited to vehicles up to $65,000 MSRP†

- Common carrier travel accident: Up to $500,000 per insured person or $1,000,000 per occurrence†

- Mobile device insurance: Up to $1,000†

- Purchase security and extended warranty: First 90 days from date of purchase in the event of loss, theft, or damage; doubles the original manufacturer warranty period for up to one additional year†

The card’s travel emergency medical coverage is particularly notable, as it offers 25 days of coverage for those 64 and under, while other similar cards usually limit their coverage to only 15 days.

What Else Does the Card Offer?

The Scotiabank Gold American Express® Card comes with a slew of features that make it stand out from other cards that fall within the same annual fee price range.

No Foreign Transaction Fees

Aside from its great domestic earning rates, one of the card’s major draws is that it doesn’t levy foreign transaction fees. This feature alone saves you 2.5% in fees on all purchases made in foreign currencies.

Understandably, you might have qualms about the card being issued under the Amex network since admittedly, outside the US, Amex’s global acceptance isn’t as widespread as Visa or Mastercard.

However, you may be surprised by how widely accepted Amex cards are in many countries around the world, such as Vietnam, Kazakhstan, Indonesia, New Zealand, and Japan. After all, Amex cards are issued locally in many countries outside North America.

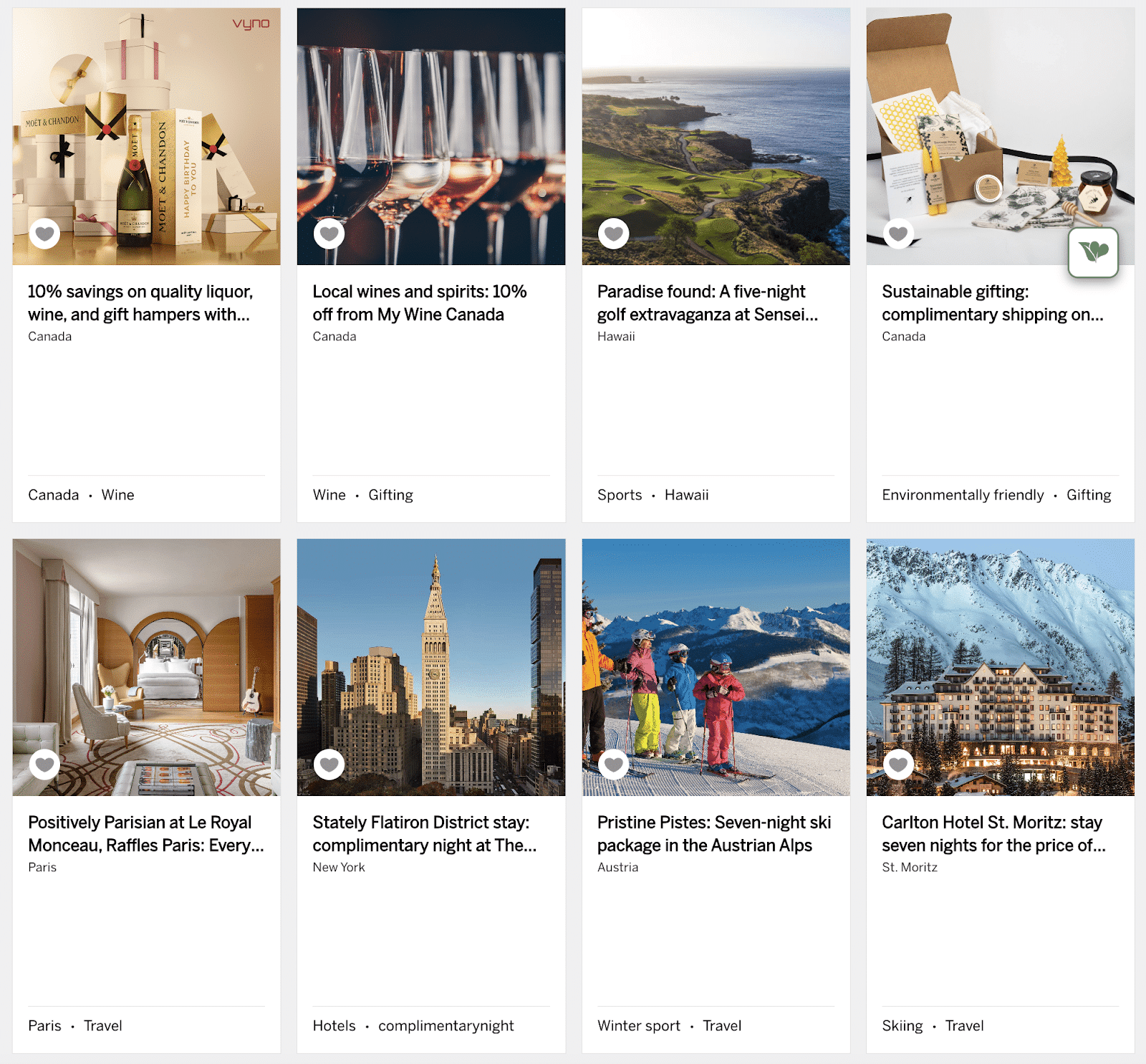

Amex Offers

As an American Express card, the Scotiabank Gold American Express® Card is eligible for Amex Offers, which let you earn statement credits or discounts at participating merchants.

A signature program presented by Amex Offers is the Shop Small promotion, which features small businesses and provides statement credits to cardholders when they spend money locally.

Otherwise, you can benefit from the sometimes-lucrative offers throughout the year.

Concierge Service by Ten Lifestyle

A final feature that’s also worth noting is the card’s concierge service provided by Ten Lifestyle.

Sure, similar Visa and Mastercard products provide concierge services as well, but the service being offered by Ten Lifestyle is more dedicated and personalized.

Ten Lifestyle’s concierge service can assist you in booking restaurants, making travel reservations, sourcing personalized gifts, and more – and not just within Canada, but also elsewhere in the world. As a matter of fact, the service has specialists for each geographic region, who provide personalized recommendations.

Other Cards to Consider

There’s a lot to love about the Scotiabank Gold American Express® Card, but there are also similar options to consider.

Scotiabank Passport® Visa Infinite* Card

The Scotiabank Passport® Visa Infinite* Card similarly features no foreign transaction fees, so you can bring it as a second card when travelling in countries where Amex isn’t widely accepted.

The card also earns Scene+ points at the following rates:

- 3 Scene+ points per dollar spent at Sobeys, IGA, Safeway, FreshCo, and other eligible Scene+ partner merchants

- 2 Scene+ points per dollar spent on transit, groceries, dining, and entertainment

- 1 Scene+ point per dollar spent on all other purchases

As mentioned above, this card’s elevated 2x earning rate for transit, groceries, dining, and entertainment applies to transactions denominated in foreign currencies as well.

As a Scotiabank card that accrues Scene+ points, you can pool the points earned by this card and by the Scotiabank Gold American Express® Card to redeem for bigger rewards.

American Express Cobalt Card

Similarly to the Scotiabank Gold American Express® Card’s 5x category multiplier for groceries, dining, and entertainment, the American Express Cobalt Card offers 5 Membership Rewards (MR) points per dollar spent at restaurants, bars, delivery services, and grocery stores.

But as mentioned, this 5x “Eats & Drinks” elevated earning rate is limited to the first $2,500 spent each month. After exceeding this limit, you’ll earn 1 MR point per dollar spent.

What may make the Cobalt Card more attractive to you is that it earns Amex Membership Rewards points, which can be transferred to Aeroplan, Marriott Bonvoy, Delta SkyMiles, Air France KLM Flying Blue, and British Airways Executive Club, among other valuable loyalty programs.

However, keep in mind that the Cobalt Card tacks on a 2.5% foreign transaction fee when you’re travelling abroad, so you could consider pairing it with the Scotiabank Gold American Express® Card to have all your bases covered at home and abroad.

Conclusion

The Scotiabank Gold American Express® Card is among the most underrated credit card products in the Canadian market.

It offers features that shouldn’t be overlooked, especially its great domestic earning rates that go as high as 6% back in rewards.

Additionally, it’s one of the few cards to offer no foreign transaction fees on the market, saving cardholders 2.5% in fees on all purchases abroad.

Despite being supercharged with features, its annual fee is only $120, which is lower than similar cards that often offer less by way of perks and features.

All in all, the Scotiabank Gold American Express® Card should be among your top picks if you’re looking for a card you can use while in Canada and that you can confidently take with you on your travels abroad.

†Terms and conditions apply. Scotiabank is not responsible for maintaining the content on this site. Please click on the Apply Now link for the most up to date information.