With many loyalty programs and credit cards in Canada, it’s possible to earn points on almost everything you purchase. Even expenses like rent, which has traditionally been paid using bank transfers, can be charged to a credit card these days and consequently earn rewards.

But with so many programs and cards, you might be asking: where do I start? How do I actually earn points on everything?

In this guide, we’ll help you navigate your options and get you earning points on all your expenses.

In This Post

- The Miles & Points Mindset

- Earning Miles & Points Through Everyday Spending

- Earning Miles & Points Through Large Purchases and Monthly Bills

- Building a Credit Card Portfolio

- Conclusion

The Miles & Points Mindset

Canada is a country of loyalty programs. According to the 2023 LoyalT study by Adviso and R3, Canadians participate in an average of 14 programs, earning a wide variety of rewards.

Of course, engagement with these programs varies widely; some people may take a casual approach, enjoying the gradual growth of their points balance, while others are more dedicated, treating each transaction as a strategic move.

Now, it’s up to you on how involved you want to be with Miles & Points. but given that you’re reading this article, wanting to earn points on everything, it’s probably safe to assume that you’re willing to adopt (or at least learn about) a Miles & Points mindset.

A Miles & Points mindset entails that you be more consistently aware and engaged with the different loyalty programs that are out there, and that you aim to stay attuned to new developments in the loyalty and credit card space and be willing to try new offerings and trends.

For instance, while you might initially scoff at the idea of earning points on your groceries through the PC Optimum program since you’ve heard it’s not that valuable, you might be surprised to learn that you can earn as much as 30% back in value through this program’s 20x points events.

The take away from this being that you should be “game” when it comes to earning miles and points and take advantage of most opportunities that cross your path – especially given the fact that most loyalty programs are free to join and engage with.

Even if you’re only earning a few stars on your Starbucks runs, it’s about building a habit and a mindset. After all, people who’ve been in this hobby for a long time – like our founder Ricky Zhang – started small, working their way up until they got to a place where they could consistently jet across continents in First Class at a fraction of the price.

Earning Miles & Points Through Everyday Spending

When adopting a Miles & Points mindset, you want to be deliberate about your everyday spending. To maximize the points you earn on your purchases, you should think about the different rewards you’re collecting and the ways you’re saving on all your daily expenses, from things as small as a cup of coffee to more major expenses like gas and groceries.

With a Miles & Points mindset, you want to consider which credit card you have (or that you’re willing to get) that offers the best return in each major purchase category, such as groceries, gas, dining out, transit, rent, and more. You then want to use these credit cards accordingly, to get the most and best (for you) rewards out of each purchase.

Let’s look at the example of groceries to start. Most major grocery retailers offer an in-house loyalty program that allows members to earn points on their purchases and gain access to member-exclusive discounts. Some of the more prominent loyalty programs include Scene+ (at Sobeys, Freshco, Safeway, etc.), PC Optimum (at Loblaws, No Frills, Superstore, etc.), and Moi (at Metro).

Scene+, for instance, lets you earn blocks of points when you reach specific spend thresholds or when you purchase weekly featured items at Sobeys, Freshco, Safeway, and other stores under the Empire Company banner.

Plus, if you pay for your groceries using a Scene+-affiliated card, such as the Scotiabank Gold American Express® Card, you can earn up to an additional 6% back in Scene+ points.

Since grocery spending is often a considerable expense each month, you want to make sure you’re making these purchases on a credit card that earns a good return in this category, whether that’s up to 5% cash back on groceries with the BMO CashBack® World Elite®* Mastercard®*, or a stack of flexible Scene+ points with the previously mentioned Scotiabank Gold American Express® Card.

Adding the in-house program rewards on top of a strong credit card return will go a long way in support of your Miles & Points strategy.

If you want to go further with your savings, you can also scan your receipt and earn rewards or cash back through a program like AIR MILES Receipts, Checkout 51, or Caddle.

Dining out is another everyday expense that’s a gold mine for earning miles and points as there are many credit cards that offer elevated earning rates at restaurants, coffee shops, and fast food places.

The most notable of these credit cards is the American Express Cobalt Card, which earns its signature 5x “Eats & Drinks” multiplier. Earning 5 Membership Rewards (MR) points per dollar (all figures in CAD) spent is akin to accruing 5 Aeroplan points on the dollar, since Amex MR points can be converted to Aeroplan points at a rate of 1 to 1.

Additionally, some loyalty programs offer rewards on dining whereby you earn extra points when you eat out at partner establishments.

For example, Eat Around Town by Marriott Bonvoy offers up to 6 Bonvoy points per US dollar spent at participating restaurants in the US.

As for your coffee runs, did you know that Starbucks has a partnership with TD? By linking your TD credit or debit cards to Starbucks Rewards, you can get a one-time bonus of Starbucks Stars, and you’ll receive 50% more Stars when you order through the mobile app, paying with the linked card.

The Starbucks Stars you earn through this partnership are also on top of the rewards you earn through your TD credit card – for example, you’ll still earn 1 Aeroplan point per dollar spent with the TD® Aeroplan® Visa Infinite* Card when spending at Starbucks.

Another notable expense for most people is filling up the gas tank, and much like grocery stores, most of the major gas station brands in Canada offer rewards points, such as Petro Points, Journie Rewards points, PC Optimum points, AIR MILES, and more, on every purchase you make.

Signing up for the related memberships and combining these points with the right credit card will help you enjoy more points, faster. Some credit cards have partnerships with specific gas station brands, and many offer solid rewards multipliers in the gas category.

We’ve written a guide to help you choose the best gas station credit card for your particular miles and points priorities, so check it out to further maximize your rewards return.

One last spending category that we’ll explore as a means to earn miles and points on your daily expenses is transit. Several credit cards, such as the Scotiabank Passport® Visa Infinite* Card, offer elevated earning rates on modes of transit like subways, buses, and taxis, and this includes rideshares apps like Uber and Lyft.

Speaking of rideshares, Uber is a partner of both Aeroplan and Marriott Bonvoy, so you can choose to link your account to one or the other and earn points accordingly. With Lyft, you can choose to earn points with partners like Delta SkyMiles, Hilton Honors, Alaska MileagePlan, and Bilt Rewards.

Although, the number of miles or points that you earn through these partnerships is minimal, even this small accumulation keeps your miles or points balance from expiring, which is a nice added bonus.

Earning Miles & Points Through Large Purchases and Monthly Bills

With large purchases and monthly bills, you want to be more deliberate about your Miles & Points strategy. After all, these large, recurring amounts are a chance for you to earn substantial rewards, and critically, to work towards juicy welcome bonuses.

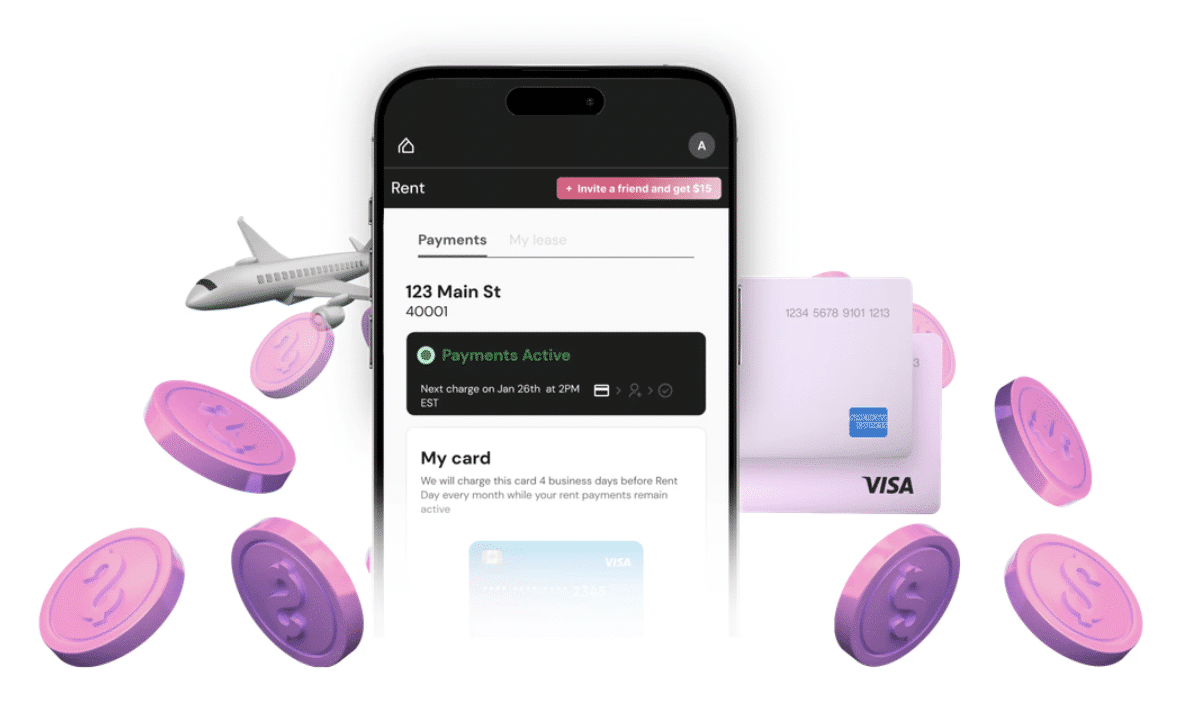

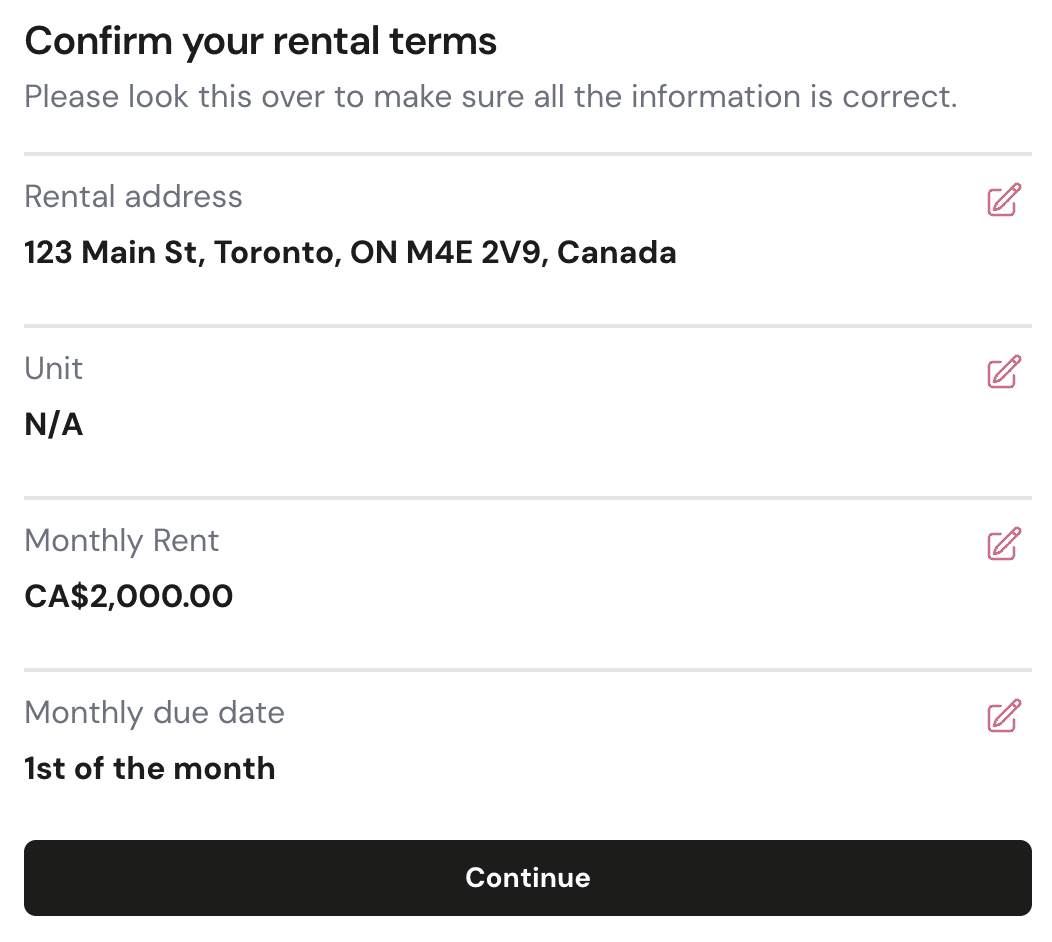

Rent is an excellent example of a large expense that you can leverage to earn substantial rewards. As you likely know, the current conventional way to pay rent in Canada is through bank transfers, However, with a service like Chexy, you can pay your rent with a credit card without having additional conversations with your landlord since Chexy pays your landlord by e-transfer the same way you would.

Paying your rent through Chexy is a great way to work towards large minimum spending requirements, such as the American Express Platinum Card’s usual requirement of spending $10,000 in the first three months of card membership in order to earn its welcome bonus (often around 70,000–100,000 MR points).

If your rent is $2,000 a month, then three months’ worth of rent already covers 60% of that minimum spending requirement, leaving you with a much more manageable $4,000 in charges to be split over the three months.

Despite the 1.75% fee that Chexy levies on payments, using this service could also get you ahead in terms of rewards with the right credit cards. Chexy charges are coded as “recurring bill payments,” and there are several cards that offer accelerated earning rates on this style of payment (which are otherwise known as pre-authorized payments).

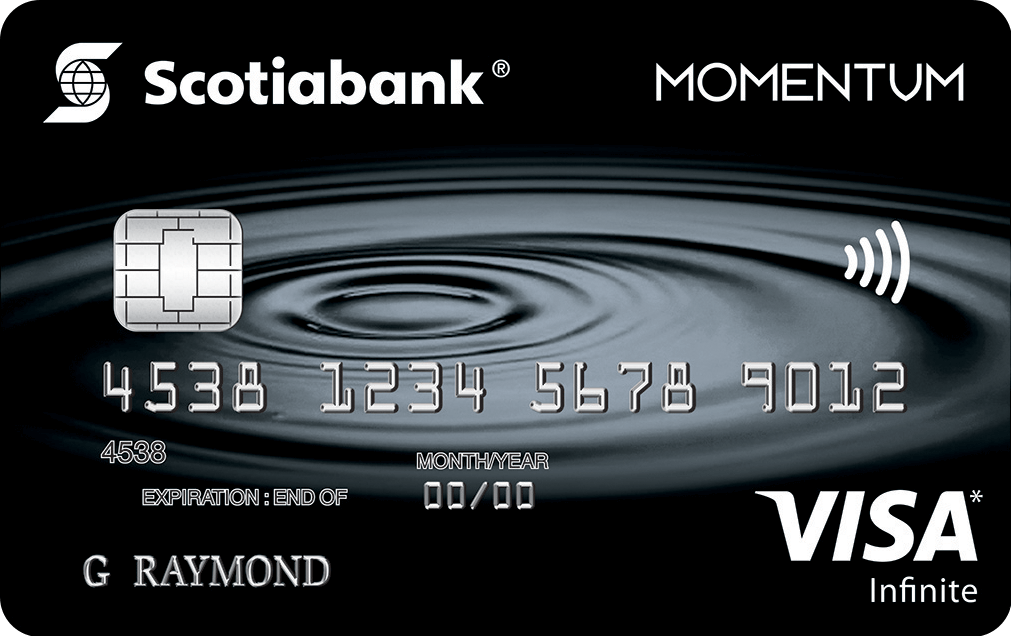

The Scotia Momentum® Visa Infinite* Card earns 4% cash back on recurring bill payments, so even with Chexy’s 1.75% fee, you’ll still come out ahead by 2.25%.

To put this into perspective, with this option, you’d be earning 2.25% on rent that you’d otherwise pay by bank transfer, and you’re also building your credit in the process.

Another key area to keep in mind for earning miles and points is large purchases, like electronics and appliances.

To illustrate the potential value of these expenses, say you’re in the market for a Dyson Airwrap, which costs around $800. Since the elevated earning rates categories don’t usually apply to electronics and home stores, maximizing your rewards here is a matter of choosing a card that provides a decent baseline return on all purchases.

The Air France KLM World Elite Mastercard®, for example, earns 1 Flying Blue mile per dollar spent on all purchases. We value Flying Blue miles at 2 cents (CAD) each, so by choosing this card you can think of it as earning 2% (or more) in value back on every dollar you spend.

That said, as you get deeper into the Miles & Points mindset, you’ll realize that there’s almost always a way to make your purchase an even better value.

In this case, you could order your Airwrap online through a shopping portal like the Aeroplan eStore, AIR MILES Shops, Avion Rewards, or Rakuten, which all list Dyson as a partner merchant and often offer elevated rewards to boot.

Alternatively, you could purchase your Dyson Airwrap at Shoppers Drug Mart, where, during its signature “20x the points” events, you’ll effectively earn 30% back in PC Optimum points, which you can subsequently use to offset the cost of groceries and gas.

Additionally, if you were to use the PC Financial World Elite Mastercard for this purchase, you’d earn an extra 3% back in PC Optimum points.

As a final note, purchasing electronics and appliances with the right credit card has one more upside – you’ll usually get purchase protection and extended warranty coverage for your purchase, which you’d otherwise have to add on at a cost through the manufacturer or retailer.

For example, the no-fee Rogers Red World Elite® Mastercard® offers 90 days of purchase security coverage, which covers theft of or damage to your eligible purchase, plus the card provides a one-year extension of the original manufacturer’s warranty (up to two years).

As you can see from the above examples, it pays dividends to not only choose the right credit card for each purchase but to also join in-house rewards programs, link your cards with partner merchants, and leverage shopping portals and online rewards programs.

Building a Credit Card Portfolio

Now, the Miles & Points lifestyle is best executed with a portfolio of credit cards that earn excellent rewards, and we’ve mentioned some of them above.

In building your portfolio of cards, it’s important to set your goals and cover all your bases. Your Miles & Points goal may be to fly business class once a year or it may be to save as much money as you can through cash back.

Our colleague Tyler has written an excellent Miles & Points for Beginners series and one of the guides focuses specifically on how to set your Miles & Points goals, so definitely check it out if you’d like more information on this part of the journey.

Once you’ve got your eyes set on the proverbial prize, it’s time to read up on the best credit cards on the market and choose the ones that will cover all your bases so you can earn miles or points on everything.

Ideally, your portfolio should comprise cards from each of the three major card networks, namely Visa, Mastercard, and American Express.

Most cards in the Canadian market are issued by Visa, and their acceptance globally is excellent; however, Visa products do have one major limitation: they’re not accepted at Costco in Canada.

Canadian Costco stores only accept Mastercard (check out our guide on the best cards to use at Costco), so you’ll want to make sure you have an eligible card in your wallet to earn solid rewards on those big grocery hauls.

Mastercard is more or less as universally accepted as Visa, but its premium World Elite products have a fairly high income requirement that’s around $80,000 (individual) or $150,000 (household), which can make these cards more difficult to access for some.

By contrast, the equivalent Visa Infinite products typically require a more modest minimum income of $60,000 (individual) or $100,000 (household).

Finally, American Express cards, as evidenced by the Cobalt Card and the Scotiabank Gold American Express® Card mentioned above, offer some of the best earning rates among Canadian credit cards.

However, as you may have heard, their acceptance rate is lower than Visa and Mastercard, and you’ll likely find that some smaller shops and restaurants won’t accept them as payment.

Tying all this together, it’s recommended that you hold different cards for different purposes, if you’re able to. An example of a simple and well-rounded credit card portfolio might be:

- Scotiabank Momentum® Visa Infinite* Card for 4% cash back on rent paid with Chexy

- Air France KLM World Elite Mastercard® for 1 Flying Blue mile per dollar spent at Costco

- American Express Cobalt Card for 5x MR points earned at grocery stores and restaurants

Of course, you can customize your portfolio according to your needs, and we have guides that go over the best credit cards by category to help you make your choices.

Also, if you find yourself needing expert help in setting your goals and building your credit card portfolio, our consultants can surely help you out.

Conclusion

To earn points on everything, adopting a Miles & Points mindset is key. Simply put, this means being strategic in your spending through credit cards and loyalty programs.

This also means being attuned to new developments in the loyalty space, such as Chexy, an innovation that lets you pay your rent with credit cards and earn rewards in the process.

Being deliberate, if not obsessive, in earning miles and points will help get you to your goals – be it to fly First Class around the world or to help you with the rising cost of living in Canada.