If you collect hotel loyalty points, you may have noticed the option to buy points directly from the program for a set price, and you may have wondered whether or not this is a good opportunity.

Given that hotel points are a great way to enjoy free hotel stays around the world and potentially save you a ton of money, it likely seems counter-intuitive to pay for points.

Although you won’t be getting the “free” travel in the same way you would when earning points through credit cards, transfer partners, and hotel stays, there are times where buying hotel points might be your best option to get the redemption you want.

In this article, we’ll show you a few strategic times when you might want to buy hotel points to help you get the most out of the various hotel loyalty programs.

What Hotel Programs Allow You to Buy Points?

Almost every hotel loyalty program that has a points program allows you to purchase points. The cost of the points varies from program to program and also fluctuates throughout the year depending on whether or not there’s an ongoing promotion.

The four most popular hotel loyalty programs, all of which allow you to buy points, are as follows:

- Marriott Bonvoy, which lets you buy Marriott Bonvoy points at the base rate of 1.25 cents per point (USD).

- Hilton Honors, which lets you buy Hilton Honors points at the base rate of 1 cent per point (USD).

- World of Hyatt, which lets you buy World of Hyatt points at the notably more expensive base rate of 2.4 cents per point (USD); however, World of Hyatt points are worth more than both Marriott Bonvoy points and Hilton Honors points.

- IHG One Rewards, which lets you buy points on a sliding scale which fluctuates depending on how many points you buy. If you purchase less than 26,000 points, the price is between 1.15–1.35 cents per point (USD). If you purchase 26,000 points or more, the price is 1 cent per point (USD).

Also, something you’ll want to keep in mind if you’re thinking about buying points is that each loyalty program will offers bonus promotions throughout the year, and if you wait to buy during one of these promotions, you can get significantly more points for your dollar.

In recent years, we’ve seen promotions like the following:

- Marriott Bonvoy: Get up to 50% more purchased points

- Hilton Honors: Get up to 100% more purchased points

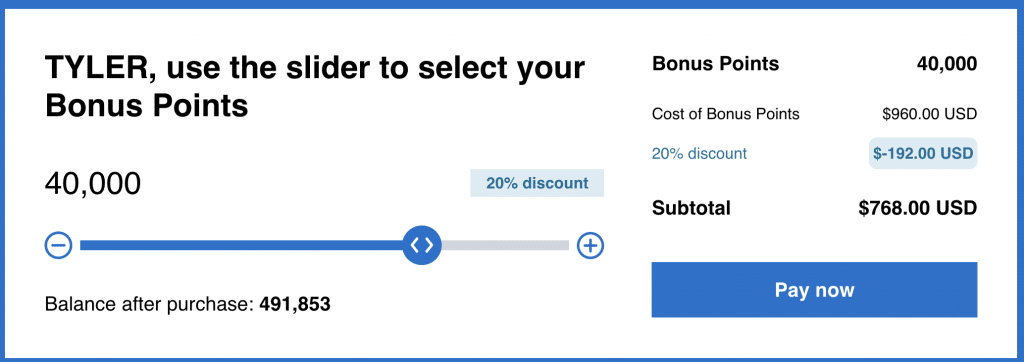

- World of Hyatt: Get up to 25% discount on purchased points

- IHG One Rewards: Get up to 100% more purchased points

To take part in these promotions, you typically just have to purchase points within a specified timeframe (and sometimes in a specified quantity), and the bonus points will be added to the total number you’ve purchased during the transaction.

If you’d like to be notified of when hotel points go on sale, be sure to sign up for our weekly newsletter.

When Should You Buy Hotel Points?

While buying hotel points is not often something we recommend since the cost of the points typically offsets the possible reward value, we do think there are four situations when buying points makes sense.

Buy Points to Top Up Your Account for a Redemption

One of the best reasons to buy hotel points is when you want to make a redemption, but you’re a few points shy of the amount needed.

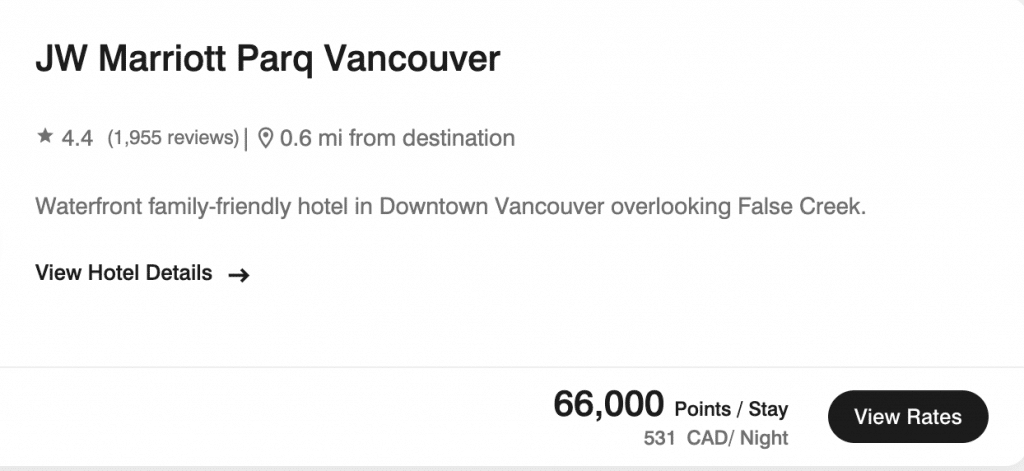

For example, a stay at the JW Marriott Parq Vancouver might cost 66,000 Marriott Bonvoy points compared to a cash rate of $531 (CAD) for the same night.

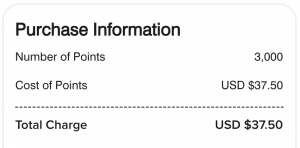

If you only have 63,000 Marriott Bonvoy points, you can buy an additional 3,000 points for $37.50 (USD) to give you enough for the redemption instead of paying the $531 (CAD) for the night.

Plus, if you can buy these points during a 50% bonus points event, those 3,000 points could only cost $25 (USD).

However, keep in mind that purchasing hotel points to top up your account for a redemption will only be worth it if you don’t need too many points.

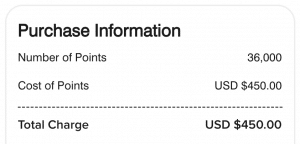

Sticking with the JW Marriott Parq Vancouver example, let’s say you currently only have 30,000 Marriott Bonvoy points in your account.

In this case, you’d have to spend $450 (USD) to buy the additional 36,000 points needed for the redemption, which is more expensive than if you were to just book your one-night hotel stay at the regular cash rate.

Buy Points to Access a Fourth or Fifth Night Free

Both the Marriott Bonvoy and Hilton Honors loyalty programs offer an ongoing feature for members of “stay four nights, get a fifth night free.”

To take advantage of this feature, you have to book the first four nights exclusively with points.

In a situation when you only have enough points for the first three nights, it may be worth purchasing enough points to cover a fourth night since this will ultimately lead to getting a fifth night free.

To illustrate when this could be advantageous, let’s look at an example.

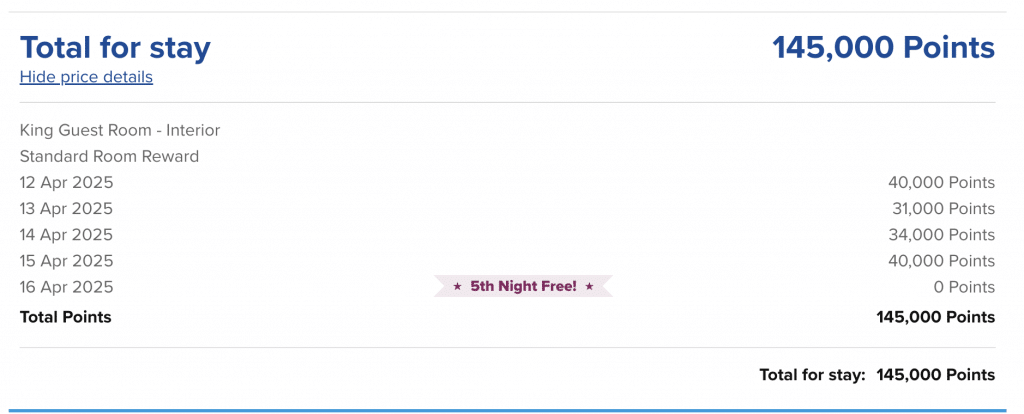

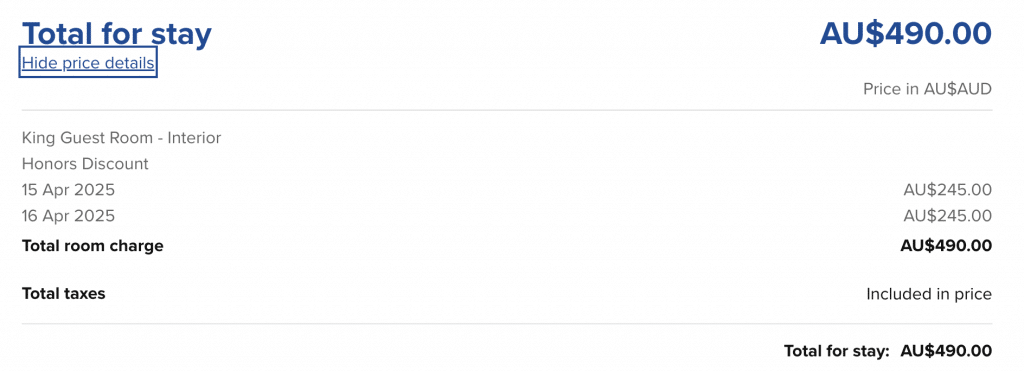

A five-night stay at the DoubleTree by Hilton Hotel Melbourne – Flinders Street in Australia might cost 145,000 Hilton Honors points.

In a situation where you only have 105,000 Hilton Honors points to pay for the first three nights, you’d have to pay $490 (AUD) for the remaining two nights.

However, if you chose to buy points and can time it to purchase them during one of Hilton Honors’ many 100% bonus buy points promotions, the remaining 40,000 points needed to cover the fourth night would only cost you $200 (USD) or around $290 (AUD).

In other words, you’d save around $200 (AUD) or $135 (USD) by buying points as opposed to spending cash on the extra two nights.

Keep in mind that only Hilton Honors elite members have access to the fifth night free benefit, so you’ll need to have Hilton Honors Silver Elite status or higher to take advantage of this option.

The IHG One Rewards program also has a similar benefit, with a free fourth night if you book a points stay of four nights or longer.

However, this benefit is only available if you hold one of the three co-branded Chase IHG credit cards.

Buy Points to Save Money on a Hotel Stay

Even if you don’t currently have any hotel points with a specific loyalty program, you might be able to save money by purchasing the full amount of points for an upcoming stay.

Buying all the points necessary for a redemption usually works in your favour when booking with a program like World of Hyatt, where the points prices are fixed, meaning that they won’t rise in correlation with the cash price for a night at the hotel (as is the case with programs that use dynamic pricing).

Booking with points during peak periods, major events, or in cities that are generally more expensive can also be a great way to save money, even when you’re purchasing points outright.

Essentially, the greater the difference between a hotel’s cash price and its price in points, the more it may make sense to buy points for your stay.

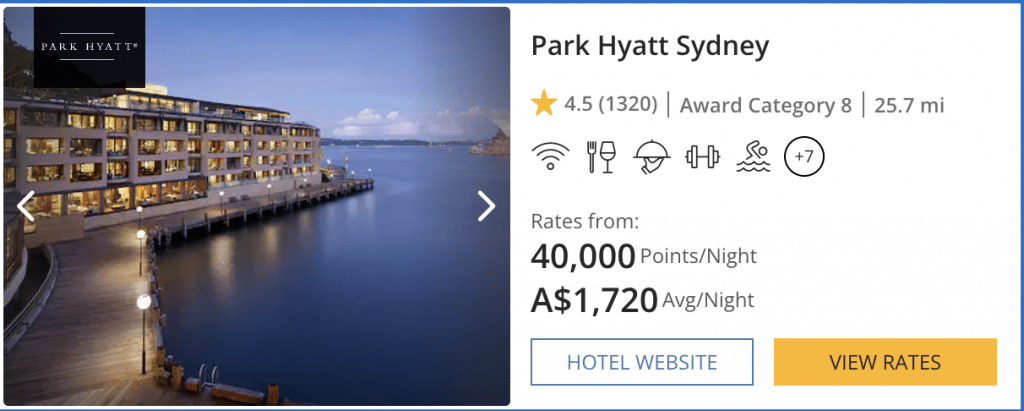

For example, a night at the Park Hyatt Sydney might cost as much as $1,720 (AUD), while the price in points is fixed at 40,000 World of Hyatt points based on the hotel’s category.

Comparatively, purchasing 40,000 World of Hyatt points costs $768 (USD) or around $1,120 (AUD), so if you were to pay for the same stay with points you purchase, it could potentially save you $600 (AUD) or around $410 (USD).

It’s also worth noting that most hotel bookings will also give you more flexibility when you redeem points for your booking instead of paying with cash, so not only will you save money, but you might not have to worry about additional cancellation fees should you need to amend your booking later.

Other Tips and Tricks for Buying Hotel Points

Beyond what we’ve already covered, there are other factors you should consider when purchasing hotel points.

Buy Hotel Points that Are Harder to Earn

Some hotel points, such as Marriott Bonvoy and Hilton Honors points, are relatively easy to earn.

You can rack up Hilton Honors points through four American Express US co-branded credit cards, or by transferring points from American Express Membership Rewards in both Canada and the US.

If you collect Marriott Bonvoy points, they’re even easier to earn with more co-branded cards in both Canada and the US, and more transfer partners including American Express Membership Rewards, Chase Ultimate Rewards, and United MileagePlus.

World of Hyatt points and IHG One Rewards, on the other hand, are a lot harder to earn.

For World of Hyatt, there’s only one personal and one business co-branded credit card in the US, and you can only transfer Chase Ultimate Rewards or Bilt Rewards points to the program at a 1:1 rate.

Similarly, the IHG One Rewards program has two personal and one business co-branded card issued by Chase bank and not many transfer partners (only Chase Ultimate Rewards and Bilt Rewards at a 1:1 rate).

Given this, if you want to expand your hotel points portfolio, but you don’t have access to US cards, you can purchase World of Hyatt points or IHG One Rewards during promotions, and earn Hilton Honors and Marriott Bonvoy points through credit cards.

Use the Right Credit Card When Purchasing Points

World of Hyatt, Marriott Bonvoy, Hilton Honors, and IHG One Rewards all use an external vendor, Points.com, to sell points, and unfortunately, purchasing hotel points won’t code as a travel expense.

This means that you won’t get additional points by using a hotel co-branded credit card or a credit card that would normally give you a higher earning rate on travel expenses.

Instead, you can use whatever credit card you would like to make your points purchase (maybe choosing one that has a minimum spending requirement that you’re working to meet).

The only exception to this is if you’re purchasing IHG One Rewards points.

In this case, if you have one of the three IHG One Rewards co-branded credit cards issued by Chase, you’ll get a 20% discount when you purchase IHG One Rewards points with that credit card.

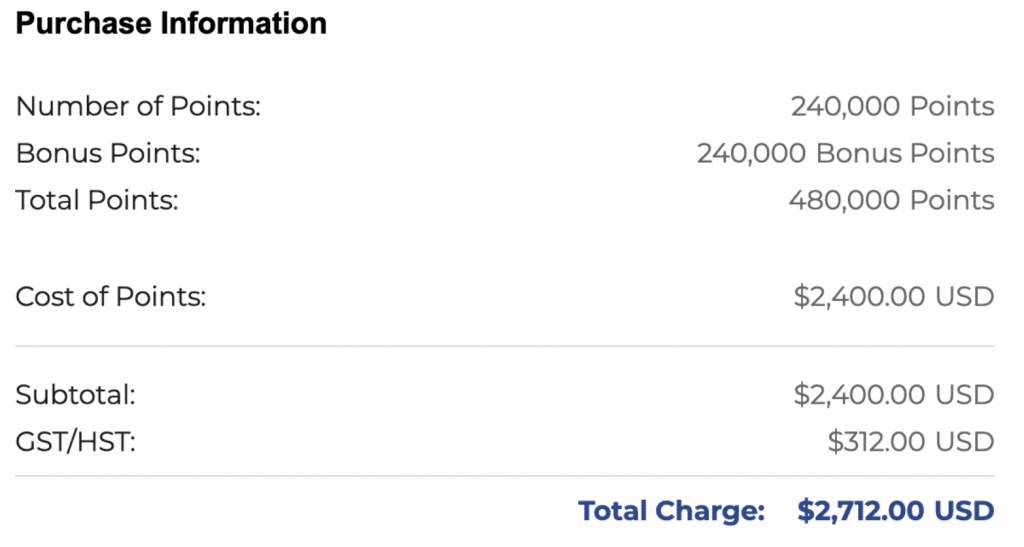

Additionally, it’s important to note that if you use a Canadian credit card for purchases on Points.com, you’ll be charged GST/HST on the points purchased, which could add a further 5–15% to your purchase price.

Instead, by using a US credit card, you can avoid paying these additional taxes. Alternatively, if you don’t have a US credit card, you should use a Canadian card that doesn’t charge a foreign transaction fee, thus saving you 2.5%.

Conclusion

Buying hotel points can be a useful strategy when you need to top up your account for a redemption or when you’re looking to save money on a stay during peak travel periods.

Leveraging certain promotions and circumstances, such as a “fourth/fifth night free” benefit or fixed-rate pricing, during an otherwise expensive stay can make it worthwhile.

When done strategically, buying points can provide flexibility and unlock great value in your travel plans, though ultimately, you need to run the numbers to make sure buying points makes sense in your situation.

And of course, if you’re not in a rush to get more points, you can always sign up for another credit card to help build your hotel loyalty account balances.