The prepaid credit card scene in Canada is showing no signs of slowing down, so if you can’t avoid ‘em, review ‘em!

Last week, we reviewed the Wealthsimple Cash Card – a strong new contender on the Canadian scene. But that doesn’t mean that it has no worthy competitors.

Without further ado, we continue our series on prepaid cards with this week’s feature: the Wise Card by the fintech company formerly known as Transferwise.

A Primer on Wise

Wise may have changed its name from Transferwise, but make no mistake: it’s still trying to shake up the financial industry’s system of international cash transfers. Prior to launching the Wise Card, its main market was allowing consumers to make exchanges at more favourable rates than large banking institutions.

I and many of my friends have used Wise’s services before to safely and conveniently transfer money to our US bank accounts that we use to pay off our American credit cards. I’ve always found the service to be fast and effective, though I do wish their customer service was open outside of 8–5 EST.

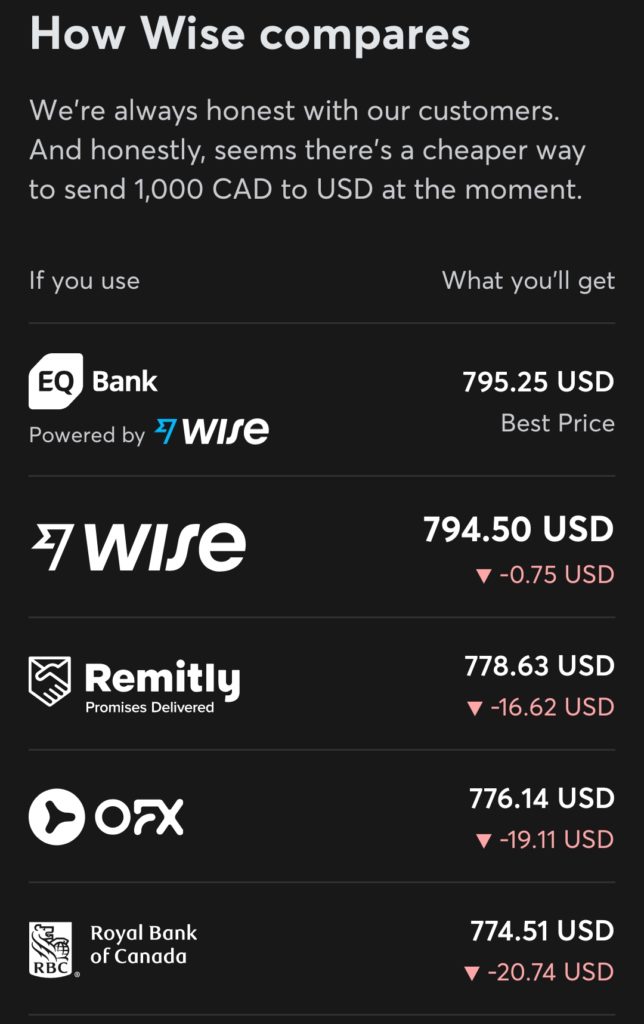

One of the niftiest features of Wise is its transparency with foreign transfer fees.

The company researches the costs of transfers provided by various competitors and lets you know if their app’s rate is actually the best. I respect this and wish more financial services companies offered it as a feature.

Consumers and investors seem to concur: not only is Wise a multi-billion pound company on its native London Stock Exchange, but it’s also expanded into numerous foreign markets, including the United States and Canada.

Time will tell if this business model is tenable in the long-term. Recall that fellow UK fintech company Revolut, which was also excellent for low-fee international transfers, exited the Canadian market just last year after a failed beta launch.

Wise App

Wise is modern fintech company that has always done most of its transactions online. As such, their sleekly-designed app comes as no surprise.

Having the app is a prerequisite to getting the company’s prepaid Visa. It doesn’t, however, require any kind of credit check to install – just hit up the app store and you’re good to go.

Unlike Wealthsimple, there’s no direct peer-to-peer transfer network, so you can’t split your dinner bill or request money from your friends. Instead, the app is optimized for making transfers in a wide range of foreign currencies, payable directly to another person’s bank account.

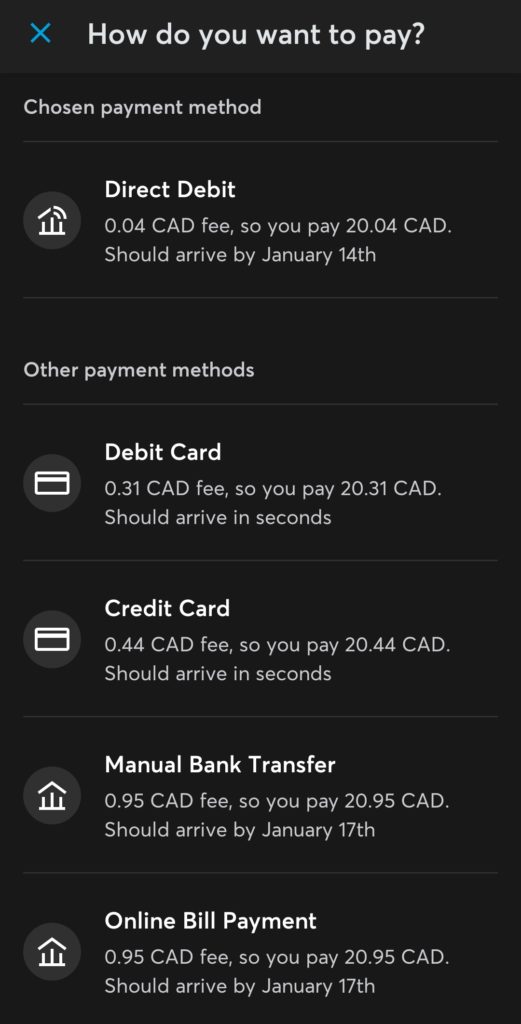

The transfer can then be paid by a suite of options that I wish other prepaid cards offered: bank direct debit, Visa/Mastercard debit, or even credit card.

Note that there are load fees with every method; even though the cheapest direct debit option only costs $0.04, it’s still somewhat grating that it’s there. Moreover, loading via credit card usually has the highest fees and often codes as a cash advance.

You can also opt to pay these transfers from a “Wise Balance,” which is money you store on the app itself. Loading this balance will incur the same fees.

One annoying feature of the app is that it really, really wants your money. If you initiate any kind of transfer, the app will deliberately try to dissuade you from stopping.

Transfers will sit as “incomplete” on your dashboard while the company ruefully hopes you complete them, until you go through a series of screens to actually cancel them. I respect the hustle, Wise, but I assure you I’m certain I wish to cancel my transfer!

Wise Prepaid Visa

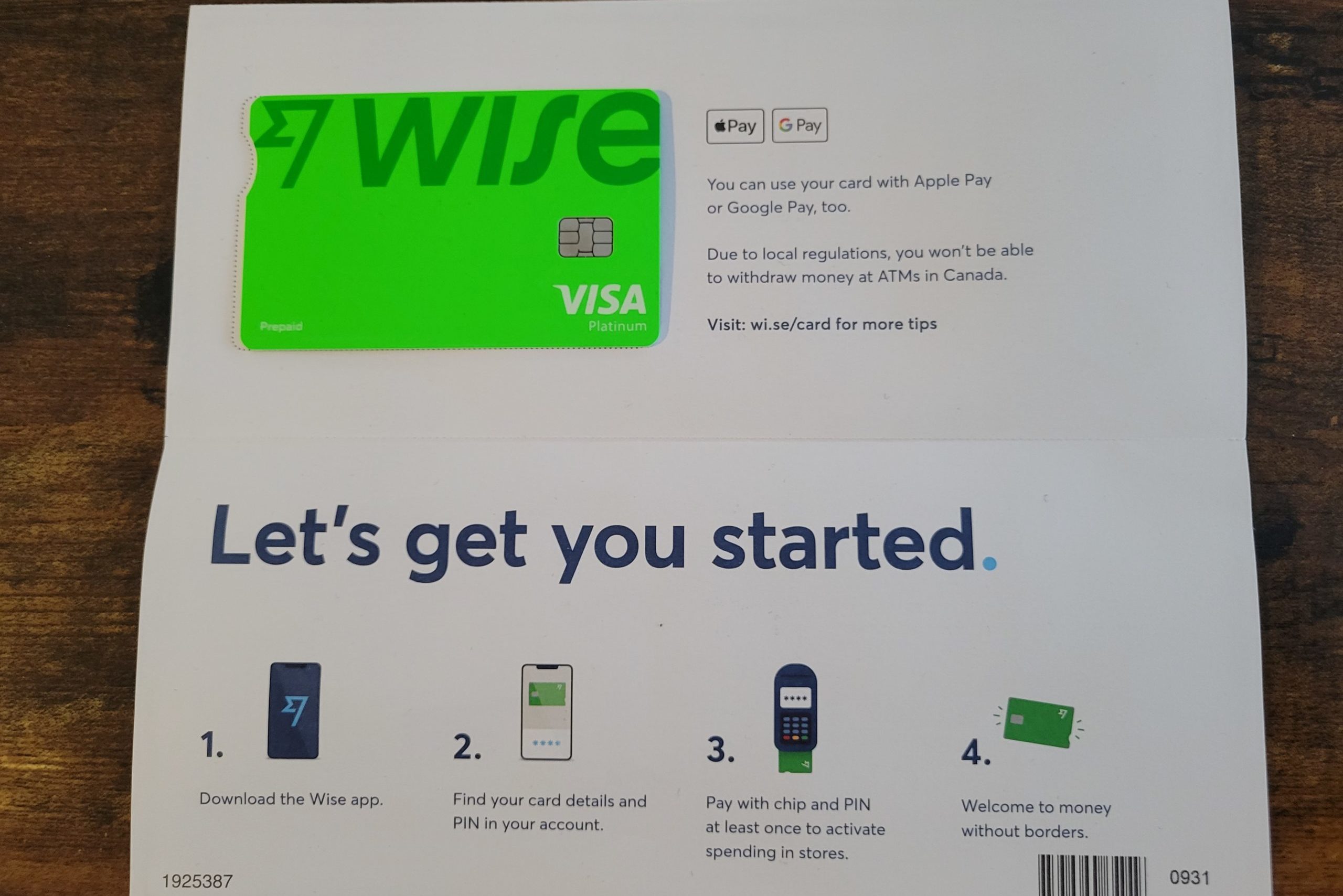

Let’s talk about the Wise Prepaid Visa, also known as the Wise Card, which is brand new to the Canadian market. It was launched on November 30, 2021.

How to Apply for the Wise Card

If you want Wise’s prepaid Visa, merely ask and ye shall receive. Log in to your app, or go to the desktop version of the Wise site, and there will be a big tab labelled “Card.”

Tap the “Card” option while in your account, input your personal information and address, and you’ll then be invited to load some money onto your Wise Balance.

You need at least a little bit of cash stored in your account to get the card, but assuming you choose to proceed, you’ll be approved without a hard credit hit. You also get to choose your PIN at the time of application, and it’s available for viewing within the app.

A friendly warning: getting your card can be a bit of a nuisance. The load of my Wise Balance wasn’t properly tracked by their system, so my card was never shipped. I had to use the Wise live chat during business hours to get them to mail one to me.

This card eschews the now-omnipresent vertical design in favour of a traditional horizontal layout, albeit with the numbers on the back. Once I received it, I made a purchase with the chip inserted, entered my PIN, and my card was activated.

You can also get a virtual card for online purchases or to load to a mobile wallet, including while you wait for the physical card to arrive.

Loading the Wise Card

Load fees are the most irritating element of the Wise card. Your card debits from your Wise Balance, or money stored on the app itself, which means you’re obligated to pay some kind of fee almost every time you load the card.

To minimize these fees, you’d need to always use the bank direct debit option. Alternatively, you could have your payroll deposited directly onto your Wise card – but then you can’t really use your employment income for transactions that are debit-only, such as bills like property taxes.

Once the funds hit your account, though, they are then available for any purpose, including Wise’s very competitive foreign exchange and transfer services.

Foreign Exchange & Transfer Fees

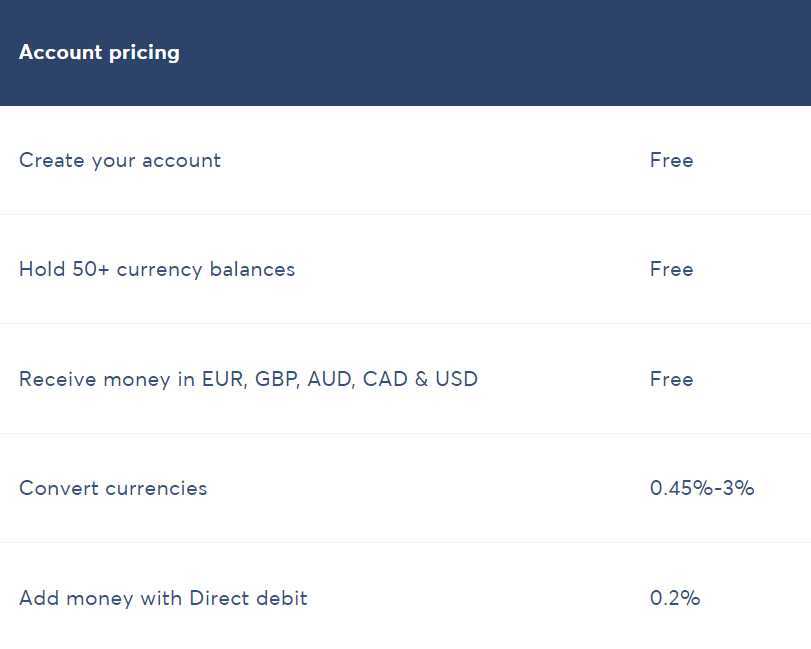

Wise permits you to hold over 50 foreign currencies on the card at once. This can be very convenient if you don’t want to handle cash in any country with decent credit card acceptance rates.

If holding these currencies doesn’t appeal to you, you can opt to keep your entire balance in CAD and transfer at Wise’s mid-market rate. There is an additional small conversion fee that is almost always significantly lower than the 2.5% FX fees charged by most credit cards.

If you withdraw cash from a foreign ATM, you won’t be subject to any additional fees from Wise. The only thing you’d be on the hook for would be the ATM’s own service charge of ~$2–3.

As transfers and foreign currencies are the bread and butter of Wise’s daily operations, it doesn’t surprise me that the Wise card leans so heavily on this category.

Its rates are much better than most other products on the market, and its ability to hold so many different tenders is unique within the Canadian market.

Where Is the Wise Card Accepted?

The Wise Card’s acceptance rate is one of the best I’ve seen in the Canadian credit card market. Just take a look at the very short list of where the card doesn’t work:

While I’m sad it won’t work in the DPR of Korea, it will function on pretty much the entire rest of the Asian continent, and indeed Planet Earth, which is very convenient. And the Canadian-issued Wise card is certainly more flexible than its American cousin!

No Rewards

Sadly, there are no rewards available on the Wise card. Whereas Wealthsimple offers a flat 1% cashback on all purchases and Mogo makes the somewhat nebulous promise of planting trees, Wise offers nothing.

I hope this improves in the future, but I’m also doubtful. The Wise card to me seems much more like a foreign exchange card than one built around rewards accrued from organic spending.

Will I Be Getting the Wise Card?

I’ve already received the Wise Card and plan on using it if I need to work with some of the more esoteric currencies out there. I’ll be keeping it in my repertoire only because it fills a hole no other card on the market does right now.

The ability to load and move around over 50 different currencies is of great value in non-pandemic times, when round-the-world trips are more viable.

I also like that I can move cards out of my Wise balance and directly into another bank account, rather than being forced to keep my funds on-platform, as with Wealthsimple.

But, to be frank, this product could be better. The lack of rewards is annoying, but not a dealbreaker. What I really dislike is the lack of transparency around load fees, even if it’s only $0.04 for direct debit.

Other prepaid cards on the Canadian market don’t charge me to load my account. Wise does, and they don’t advertise this to you when encouraging you to apply for the card.

I definitely don’t like having a company pass its costs onto me as the consumer, and I’d say this could deter many individuals who might’ve considered getting the Wise Card from doing so.

Conclusion

I have mixed feelings about the Wise Card.

Its utility is indisputable because no other Canadian credit card allows you to load this many types of foreign currency onto one card. Most other prepaids also don’t let you wire money overseas as easily as Wise.

However, it’s far from perfect. The app feels as if it’s pressuring you to complete load transactions, and as someone used to receiving incentives or rewards for spending, I sorely feel their absence here. Worse yet are the load fees, which feel higher and more prominent than they should be.

I’m hoping that if the Wise Card gains market share, we might see some of these shortcomings alleviated.

Until next time, may your transfers be speedy.

To add to Derrick M’s comment below, I noticed that it looks like Wise cards issued in Canada cannot be used to withdraw cash locally. I got my Visa debit and am about to travel, but it looks like it won’t serve the sole purpose I got it for… . https://wise.com/help/articles/2935769/how-much-does-it-cost-to-withdraw-cash

**Japan, Singapore and Canada cardholders

If you got your debit card in Japan, Singapore or Canada you won’t be able to use it to make ATM withdrawals locally. But you’ll still be able to use your card to make payments locally and around the world, and withdraw from ATMs overseas.

Not exactly free to withdraw via ATM overseas either. At least not more than twice a month:

If your card was issued in Canada: You can take out money for free abroad twice a month — as long as the total amount is under the equivalent of 350 CAD. But after that, we’ll charge you the equivalent of 1.50 CAD per transaction. This is a fixed fee. If you take out over 350 CAD in one month, we’ll charge you 1.75% on top of that.

In terms of the $0.04 fee; that is the fee you will incur when you use say a Visa Debit Card from your bank to transfer the funds. The minimum is $30. Once you have transferred that amount, it will open up account numbers for the most commonly used currency such as Can$, US$, Euro and British pounds; all of them will be provided with all the details like a local bank account (routing number, BIC, IBAN, Sort Code, institute, transit number etc). So once the first transfer is through, what I did was link a Tangerine account using the bank details for Wise like a bank account. In fact, I recouped the cost thanks to 2 x micro transactions that Tangerine deposits. Once that’s setup, technically, transfers to the card is free via bank-to-bank but of course 2-3 days delay in transfer but with no additional fee. You could do similar setups with banks that allow bank-to-bank transfers such as EQ (?; not sure since I do not have an account).

But agreed, it is difficult to see other uses for this other than cash withdraw outside of Canada at local bank. I *think* should be useful for cash withdraws only; similar to that of Stack. Will have to test once international travel is more friendly at least for me.

Am struggling the understand the mechanism: if you convert your CAD to EUR in your Wise account then use your Wise account to pay in EUR, that applies to only your EUR balance in your account?

I use everforex.ca, they have been the cheapest and best for me to buy and transfer money

would never carry such a bright ugly green colour of a card so can’t even be bothered to try the wise card.

why would companies go out of their way to exclude people who care about aesthetics which is every youngish person. at least with wealthsimple i get a sleek un-embarrassing card to use in public.

Nobody cares about the color of the card dawg

Transferwise seems to change their rules every other month… I didn’t find them at all reliable and had overall negative experiences with them and it was a pain to get my money back. I’ll stick with the bank to bank transfers.

Maybe I’m missing something, but can someone explain what the value is of ‘holding’ FX on multi-currency cards like this, assuming you’re not a forex trader? I understand if you have foreign-sourced funds and don’t want to convert it to CAD, but if you’re just planning to use the card to travel why not just get a 0% FX card like HSBC or practically any US travel card and be done with it?

There probably isn’t. Value is if you need to withdraw cash abroad.