When I wrote about the best US credit cards for an Amex Global Transfer, you may have noticed my suggestion to open some of the links in a private browser window, such as Incognito mode in Google Chrome or Private Browsing mode in Firefox or Safari.

Why might this be important? Well, here in Canada we’re familiar with several American Express credit cards that have higher bonus offers when applying through a referral than through the public offer. For example, the American Express Business Platinum Card gives you 75,000 MR points through a referral, but only a measly 40,000 MR points through the public offer.

This also happens to be the case with Amex US… except there’s yet another category of credit card offers, which tend to only be shown to the user when browsing in private mode. In this article, we’ll aim to track down some of the best “incognito offers” that American Express US doesn’t publicly advertise, and why you should always try browsing in private mode when you’re considering getting another Amex US credit card.

Example of Incognito Offers: The Hilton Honors Card

One of the best cards I had recommended for your Amex Global Transfer was the American Express Hilton Honors Card (if you need a reminder of why, go back and read this article). There are, in fact, several different offers available on this card: the baseline public offer, the refer-a-friend offer, and the incognito offer.

It’s definitely worth spending a bit of time figuring out the best offer here. After all, American Express US strictly imposes a once-in-a-lifetime limit on their credit card welcome bonuses, so it’s best to get the highest known bonus whenever you’re signing up for a new Amex US card to ensure you’re maximizing your earnings.

The baseline offer on this card is a respectable 75,000 Hilton Honors points upon spending US$1,000 in the first three months, which we can see on the Amex website.

However, we know that American Express generally has better offers when applying through a referral, so it’s always a good idea to open up a refer-a-friend link and see what you get.

When you do that, you’ll see the same offer of 75,000 Hilton Honors points; however, in this case, your friend, family member, or favourite blogger whose link you opened would receive a nice referral bonus at no cost to you.

Thus, there’s no downside to using the referral offer compared to the public one, as you can provide the referrer with a benefit while doing no worse for yourself than you would if you applied directly through the Amex website.

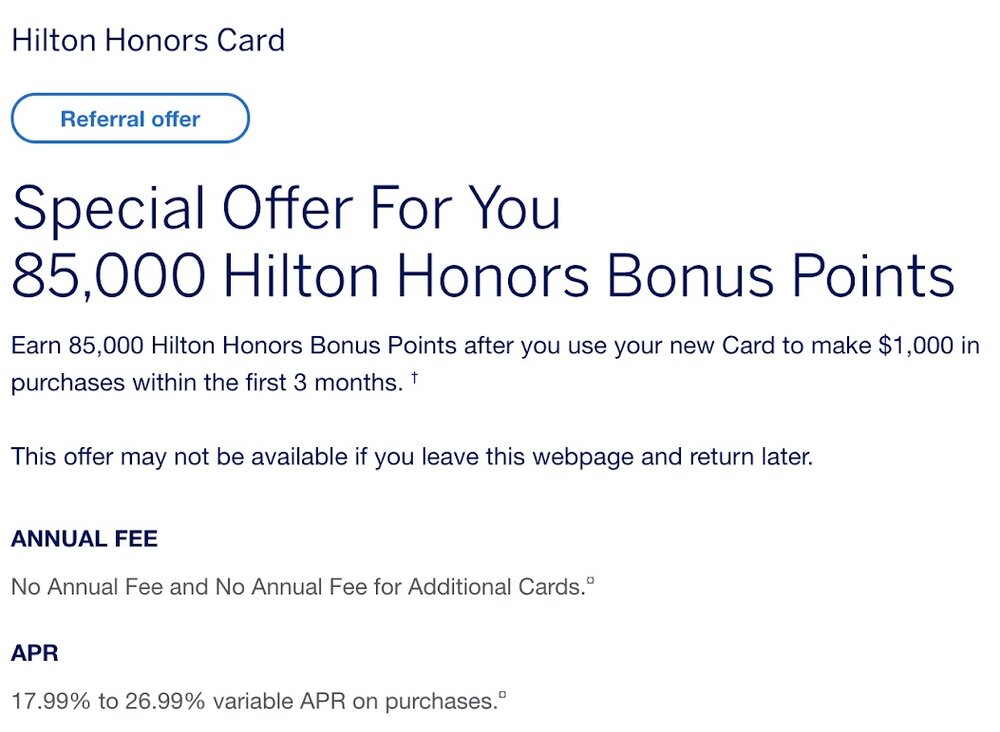

What happens if we open the referral link in an incognito window? Here’s where things get interesting. If this is your first time doing this, you’ll likely see a special offer of 85,000 Hilton Honors points upon spending US$1,000 in the first three months. This is a cool 10,000 points more than the offer we saw last time, with no change in the minimum spend!

A few key signs that this offer is particular to incognito mode are the phrases “Special Offer for You” and “This offer may not be available if you leave this webpage and return later”. Depending on the value and elusiveness of the offer, it may indeed make sense to apply right away when you see this page, especially if it’s a card that you’ve been meaning to get anyway.

Now that we’ve seen a better deal show up in incognito mode, let’s try doing the same with a public offer instead of a referral link. To locate these offers, you could try browsing the Amex US website directly in incognito mode, or you could find the URL of the specific credit card’s webpage (e.g., “americanexpress.com/us/credit-cards/card/hilton-honors“ for the Hilton Honors Card) and then copy-pasting this into your browser in incognito mode.

Navigating to the card in a private browsing window reveals two offers, seemingly at random: one for 95,000 Hilton Honors points and one for 100,000 Hilton Honors points, both after spending the same US$1,000 in the first three months!

Keep in mind that neither of these offers provides a referral benefit to anyone, since they’re ultimately originating from the Amex website itself. Therefore, for people playing the game in two-player mode, it makes the most sense to have Player 1 refer Player 2 for the incognito referral offer of 85,000 points plus the referral bonus of 20,000 points. The total earnings here would be 105,000 points, which is higher than the best-available incognito public offer of 100,000 points.

By the way, the same phenomenon can be observed with the Hilton Ascend and Hilton Aspire credit cards as well. For more details on all the different offers on these Hilton credit cards, check out the table in my Guide to Hilton Honors.

Incognito Offers on Other Amex US Credit Cards

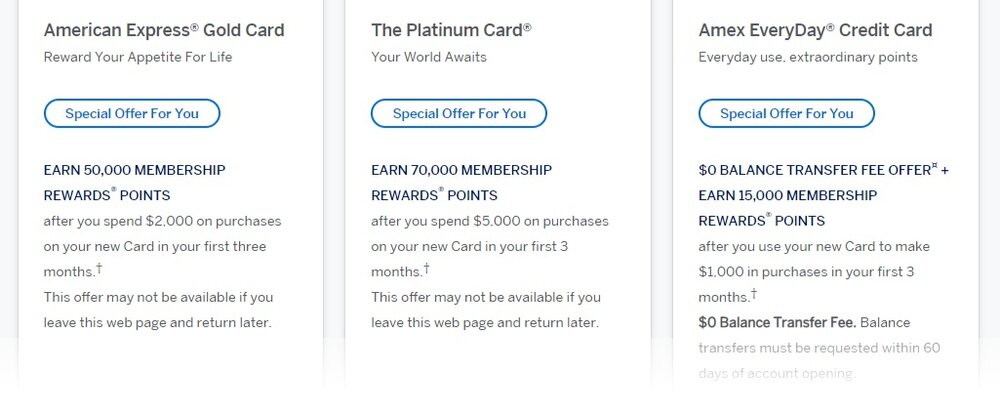

If we expand the scope to the rest of Amex US’s credit cards, we see that there are some fantastic incognito offers (both public and referral) on the credit cards that earn Membership Rewards points.

For example, the second Amex US credit card that I had identified would be ideal for a Global Transfer from your Canadian card was the American Express EveryDay Card, which offers up to 25,000 US MR points upon spending US$2,000 in the first three months through an incognito referral link.

(I’ve also seen offers of 20,000 US MR points pop up as well. If you get the 20,000-point offer, try opening the link in incognito mode repeatedly until you get the 25,000-point one.)

Needless to say, both 20,000 and 25,000 US MR points are extremely generous offers on a credit card that has no annual fee and that ordinarily only gives 10,000 US MR points through the public link.

Another noteworthy incognito offer can be found on the American Express Gold Card, where you’ll earn 50,000 US MR points upon spending US$2,000 in the first three months.

Right now, the referral offer is only 40,000 US MR points, making the incognito offer a much better choice. (Having said that, until July 17, the refer-a-friend channel is the only way you can obtain the Rose Gold version of the card, and the Rose Gold Card looks fresh, you know.)

Should You Apply Now or Wait for Better Offers?

American Express US is certainly much more fluid with their welcome bonus offers than what we’re accustomed to in Canada, moving rather quickly to pull certain offers off the market and put out new ones. For example, with the Hilton Honors Card, we’ve previously seen a welcome bonus of 100,000 Hilton Honors points on incognito referral links, but the current highest referral offer seems to be only 85,000 points.

Since American Express US strictly enforces a once-in-a-lifetime policy on welcome bonuses, you’ll only get one shot at maximizing your welcome bonus on any given card, so it may make sense to wait for the best historically-available offer to come back before applying.

On the other hand, waiting for a better offer has a steep opportunity cost, since you could miss out on several months of building your US credit history (important for getting credit cards from Chase, who tend to require a longer credit history before approving you), as well as being able to collect referral bonuses from friends and family members who want to get into US credit cards.

And of course, you can’t always rely on an incognito offer to show up when you need it. Certain offers are known to exist, but don’t pop up very frequently at all (like the 25,000-point offer on the American Express EveryDay Card), so it can be hard to get an offer to appear at the exact moment that you’re ready to apply.

(If you’ve been refreshing your incognito window with no luck, try using a different device from what you normally use, or using a VPN service to change your IP address and get Amex to treat you as a first-time visitor.)

Overall, I’d recommend you not to dwell on historical offers if you’re ready to apply for an Amex US credit card now. Spend some time browsing through all the possible application channels, find the best currently available offer, and apply away.

Conclusion

Unlike in Canada, American Express US often puts on significantly increased welcome bonuses when navigating to the credit card offers in private browsing mode. While their intended goal is presumably to entice first-time visitors to the Amex website to become new Amex cardmembers, incognito offers are also a fantastic way for those of us dabbling with US credit cards to ramp up our earnings, particularly as Amex US signup bonuses are strictly once-in-a-lifetime.

Next time you’re applying for a US credit card, make sure to check all four application channels – public, referral, incognito public, and incognito referral – to see which one is best!

I was offered the 100000 signup bonus on the Hilton Honors card today. Went through the public site in incognito mode. Good luck to all!

If this is your second card application and you decide to apply via incognito, is there any way to bypass the Global Transfer and apply based on your history with the first card?

Wow that was the first time I actually managed to get the 25k offer via incognito. Thanks Ricky!

That’s what we like to hear! Glad to year you’re having luck with the offers.

What do you say when the rep on phone (if ever contacted for more info) asks where do you work? Is it okay to say you’re working at your real job in Canada and the US address provided is a vacation home? If not any tips?

You don’t need to go into such specifics – just give them your employer’s name. If pressed for details, you can say that you split your time between Canada and the US (like millions of people do). End of story.

Wow Ricky, this is useful info and very timely as I was just looking to apply for an Amex. Thanks!

There’s also the referral thread on Reddit in ChurningCanada. It’s updated monthly and there are lots of US card referrals there, plus you give back to the Reddit community that way. That’s how I got 25,000 points on the EveryDay card and gave a referral to a user who is quite active in the subreddit. I also DM’ed him to tell him and he was appreciative, offering his help on other questions if needed. So also a great way to build some connections in your Churning network!

Of course if Ricky has a referral use that one first!

When you said you got 25,000 points on the EveryDay card, do you mean the Amex EveryDay Credit Card or the Amex EveryDay Preferred Credit Card?

Clarification needed: I am assuming that these applications would be AFTER the initial Amex CC obtained via the Global Transfer method? Or is there another method that is used?

Great tips!!

You could definitely do a Global Transfer on an incognito offer. (Indeed, I had recommended either the Hilton card or the EveryDay card for a Global Transfer to your first US card.) Simply click through to the application and then select the "I’m a cardholder in Canada" button when it asks for your social security number.