Most loyalty programs give you the option to redeem points for merchandise. Whether it’s a multi-slice toaster for your kitchen or some new travel gear, the option is to exchange your hard-earned points for consumer goods is almost always available.

Nevertheless, these redemption options generally provide terrible value – most of the time it’s under 1 cent per point (cpp), which is usually thought of as the baseline value for most points programs.

It’s one of the most well-known beginner mistakes among Miles & Points practitioners, with bloggers routinely deriding those who choose to redeem their points this way, and rightly so.

So it might surprise you that I recently committed the cardinal sin of splashing 21,950 CIBC Aventura points on a spanking-new Heys 26’’ Smart Luggage. Why on earth would I do that?! Before you swear a vow to never read another Prince of Travel article again, let me walk you through my thought process and why it made sense to do so.

Doing the Math

Let’s run the numbers a bit on the value proposition of redeeming points for merchandise. To take one example of a popular Canadian points program in which you can redeem for merchandise, let’s jump on the CIBC Aventura rewards portal and click “Shop”.

Check that out – so many cool new gadgets that you could get for FREE just by redeeming your points. But how free is it really?

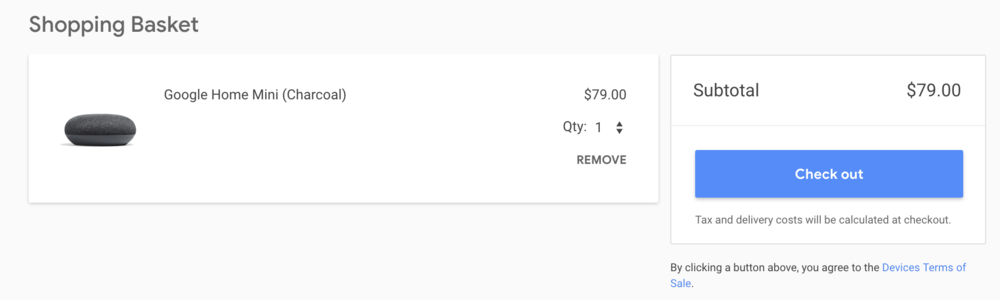

To find out whether or not redeeming points is a good value, we must figure out how much cash we’d have to spend to purchase the same item. A quick search tells us that the Google Home Mini can be purchased for $79 ($89.27 after tax in Ontario)…

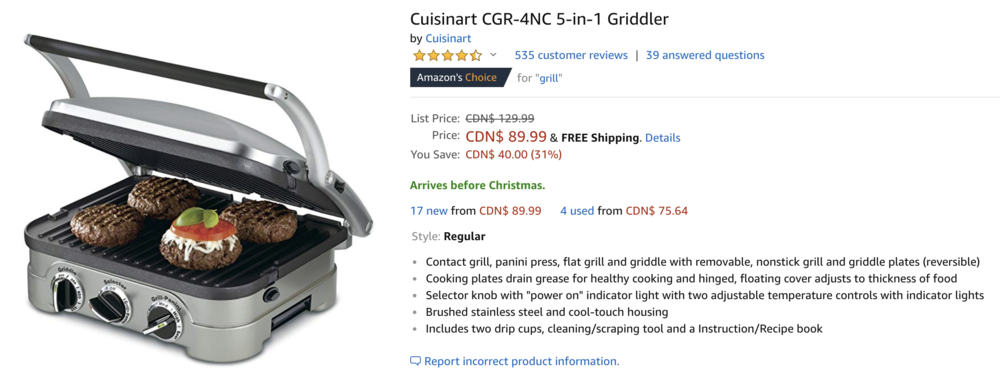

… while the Cuisinart 5-in-1 Griddler is available for $89.99 on Amazon ($101.69 after tax in Ontario).

A quick calculation tells us that redeeming 11,000 and 16,400 CIBC Aventura points, respectively, would give us a value of:

-

$89.27 / 11,000 = 0.81 cpp for the Google Home Mini

-

$101.69 / 16,400 = 0.62 cpp for the Cuisinart Griddler

Now, CIBC Aventura points can be redeemed at 1cpp for travel purchases, such as flights, hotels, or car rentals – and ideally, you should be aiming even higher than that. So if you have any planned travel purchases at all, then redeeming points for merchandise would be akin to throwing money away.

That’s because you could redeem the 16,400 points as $164 in travel purchases instead, and use $101.69 of that savings to nab that new Cuisinart piece for your kitchen, thus coming out $62.31 ahead.

It’s pretty clear to see that the redemption structure for merchandise is set up unfavourably for the consumer. It’s not just CIBC either – most loyalty programs have something similar in place. Take Scotia Rewards’s offer of 20,300 points for a brand new KitchenSlice toaster:

Wow. Being able to slice four pieces of bread at once whilst enjoying the luxury of a high lift lever so that your fingers don’t get burned? How sweet would it be to get that for free just by parting ways with 20,300 Scotia Rewards points?

Of course, a quick look on Amazon shows us that $99.99 is the alternative cash price, so call it $113 after 13% sales tax. Since Scotia Rewards points can also be redeemed at 1cpp for travel purchases, we can therefore surmise that you wouldn’t be getting the toaster for free; instead, you’d be paying $203 – $113 = $90 more than you need to!

The CIBC Aventura Cyber Monday Promotion

Of course, there are a few exceptions to the rule, namely when there are deals and promotions that could shift the balance. Take the recent CIBC Aventura Black Friday and Cyber Monday promotion as an example.

Quite a few items were deeply discounted from their usual points prices, including an iPhone XS and an iPad mini. The discounts were virtually 50% off, meaning that whatever poor value could be had previously was now doubled. In many cases, this meant that there were actually some excellent deals to be had.

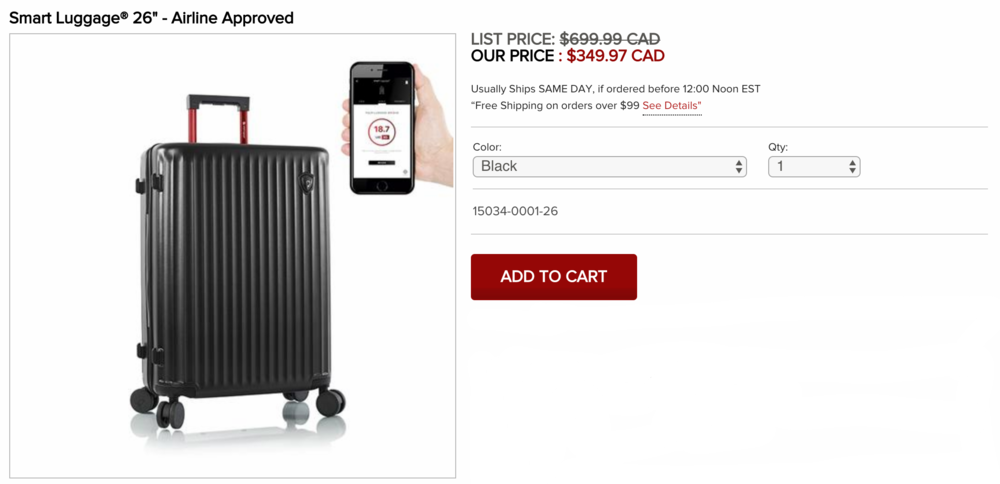

The Heys 26’’ Smart Luggage caught my eye. While this was retailing for $349.97 ($395.47 including tax) on the Heys website, it could be bought for only 21,950 points during CIBC’s Cyber Monday promotion. That meant that I’d be getting a value of $395.47 / 21,950 = 1.8cpp for my points, which I was very happy with!

It’s important to note that even when there are good promotions and the math works out, you should still be exercising discretion as to what items you buy.

For example, during this Cyber Monday promotion I could’ve also purchased an iPad mini or a fancy coffee maker. But I probably wouldn’t have spent the money on those things to begin with, so it wouldn’t make sense to use points to get them just because I can.

In contrast, I do need a new medium-sized luggage – my old one has been pretty beaten up over the past five years or so, and a long continental trek along the Trans-Siberian Railway this summer was the final straw that caused the wheels to come off completely.

It’s been a purchase that has been on my mind for the future, but I haven’t gotten around to properly shopping for one, so this opportunity to exchange my CIBC Aventura points at a good value was excellent timing.

What Are the Alternatives?

Before hitting the “Buy Now” button, there was one last step to decide whether or not the 1.8cpp value was good enough – and that’s to consider what alternative uses I’d possibly have for CIBC Aventura points.

The specific points program matters a lot here. For example, I’d never ever think to redeem Aeroplan miles or American Express Membership Rewards points at 1.8cpp for a new suitcase – hell, I probably wouldn’t even take the offer at double that value, since I know that redeeming Aeroplan miles for business class tickets or mini-round-the-world trips would provide much more than 3.6cpp of value to me, both monetarily and in terms of the satisfaction derived.

On the other hand, CIBC Aventura points don’t quite have that level of utility. They don’t have any airline transfer partners and are often used at the measly baseline valuation of 1cpp towards travel purchases, and 1.8cpp would definitely be better than that.

There are a few other occasions when Aventura points come in handy, and I quickly ran through those scenarios as well to see if they’d be better than redeeming at 1.8cpp on a new Heys bag.

One is their in-house flight award chart, which works similar to RBC Avion in that you exchange a certain amount of points for a round-trip flight within a certain geographic region, up to a maximum ticket price:

Crunching the numbers on this chart, we see that the maximum value you can get is about 2.29cpp, when you redeem 35,000 Aventura points towards $800 off a North American round-trip.

However, I really couldn’t see a scenario in which I take advantage of this particular sweet spot, since I don’t have much intra-North America travel coming up. Even if I did, round-trip flights are usually in the range of $500-600 anyway, so I wouldn’t be attaining the maximum $800 allowance (and thus the 2.29cpp value) unless I really went out of my way to do so.

Another potential use of Aventura points is their seasonal flight redemption promotions, where you can get discounted round-trip flights with certain airlines. The most recent Fall 2018 promotion ended on November 30, but it allowed you to fly with WestJet to certain destinations for as low as 9,000 Aventura points round-trip.

The problem with these promotions, though, is that you still must pay the taxes and fees on the flights, which really eats into the value you get – you’d be lucky to get 1.5cpp out of it, which is much better than the baseline 1cpp but still nothing really worth celebrating.

Eventually, splashing 21,950 points on a brand-new suitcase for 1.8cpp and not having to pay a dime out-of-pocket seemed to be quite a good idea indeed, especially since I had collected these Aventura points earlier in the year and hadn’t really found a good use for them in the time since.

Since this was Black Friday weekend, I’m sure the items took a while to ship, and my new Heys 26’’ Smart Luggage only arrived last week. It looks hella stylish and I look forward to using it along my travels!

Conclusion

Redeeming points for merchandise is something you shouldn’t do under normal circumstances, but you should nevertheless keep an eye out for good deals and promotions that might make it worthwhile. Since I was in fact on the market for a medium-sized suitcase, and I probably wouldn’t have gotten 1.8cpp out of my CIBC Aventura points any other way, redeeming my points for a new Heys suitcase was a move that made sense and that I’m quite satisfied with in the end.

Thanks for writing this. Very insightful. I didn’t realize they had Black Friday deals like that. I’ll be looking out for Boxing Day now.

I just redeemed my Aventura points this month for cash for similar reasons. I have a lot points saved up in Aeroplan, BA, TD Rewards (for hotels or car rentals) etc. and I simply didn’t need the extra Aventura points anytime soon. So between the cards I have with CIBC for myself and my wife, I was able to Pay with Points and got $650 credit towards my monthly statement.

I’ve got 12K Aventura points leftover. What you suggest? Open another Aventura and combine the points for a flight somewhere or just spend them and be done with it.

Don’t get me wrong – Aventura points are pretty useful because they can help you save on the incidental costs of travel, like positioning flights or car rentals. If you have any such costs, it’d still be more worthwhile to redeem Aventura points at 1cpp than spending them on merchandise at a lower value.