It’s finally over. On Saturday, August 18, we witnessed one of the most long-awaited loyalty landmarks in recent memory, when Marriott Rewards and Starwood Preferred Guest combined their operations into a single new loyalty program.

Now that Merger Day has come and gone, we’re left to figure out the details of the new program, take advantage of the sweet spots, and inevitably contemplate the “good old days” of lucrative Travel Packages and favourable Amex to SPG transfer ratios. Without further ado, let’s jump into the good, the bad, and the ugly in the aftermath of the merger, beginning with some updates from Amex Canada…

New Signup Bonus on the Amex SPG Cards

The Amex SPG Card and the Amex Business SPG Card have been closed to new applications ever since July; even in the months before that, they were offering limited signup bonuses that weren’t really worth the time of day.

The general thinking was that Amex were readying the card for a new-and-improved signup bonus once the new Marriott loyalty program kicks in. Indeed, as of today, you’ll earn 50,000 points in the new Marriott program upon spending $1,500 in the first three months for both the personal and business cards.

The annual fees on the cards remain at $120 and $150, respectively. Meanwhile, there’s no word on changes to the referral bonus that you get for referring friends and family to the card – as far as I’m aware, that’s remaining as a $25 statement credit for now, although I definitely expect it to be increased to something more competitive in the future.

The details of the new signup offer were the last piece of the puzzle in terms of changes to these cards – other updates, such as changes to the earning rates, free nights certificates, etc. were announced back in July, and you can read about them here.

Of course, the new signup bonus of 50,000 points represents a devaluation from the historical bonuses of 20,000 Starpoints, which would’ve been equivalent to 60,000 points in today’s program. At the same time, it’s exactly equal to the old signup bonus on the now-defunct Chase Marriott Visa. In my opinion, it would’ve been reasonable for Amex to go with anything in the range of 50,000 points (as a historical baseline) to 75,000 points (if they thought a dazzling offer would be beneficial in generating some fanfare for the new program), and they’ve gone with the lower end of that spectrum.

That’s disappointing but ultimately not surprising, since Canadian travellers are essentially a captive audience when it comes to hotel rewards and associated credit cards. Amex knows that the next-best option in the market would be Best Western Rewards via MBNA, which doesn’t provide nearly as much outsized value.

Any comparisons to the much more competitive US side – where you can now earn 75,000 points and 100,000 points on the US-issued personal and business SPG cards respectively – must therefore be made with this context in mind.

When you look at the big picture in terms of earning hotel points, though, the landscape is definitely less favourable than it was a year ago. Back then, we had two Amex SPG cards and a Chase Marriott card to apply for, plus the ability to transfer points into SPG from American Express Membership Rewards at a 2:1 ratio. Nowadays, the Chase card has been stricken, the SPG cards have devalued in terms of both the signup bonus and the earning rates, and the transfer ratio from Amex MR has weakened as well.

Things are more difficult than they were before the merger, and we’ll have to hustle a bit harder than before to achieve the same level of rewards. It’s part of Miles & Points in general that devaluations happen at a regular pace and things tend to get less favourable over time – yesterday’s “good old days” is today’s reality, just as today will be thought of as the “good old days” by new practitioners sometime down the road.

Merge Your Marriott Rewards and SPG Accounts

With the credit card news out of the way, let’s have a look at how the merger has impacted your individual Marriott Rewards and SPG accounts. Both programs’ websites and apps are now functional – and have been modified to look almost exactly alike – but still carry a display banner warning you to expect some outages and disruptions to certain features from time to time.

Right now, you still have separate Marriott Rewards and SPG accounts, even if you have linked them in the past. The Starpoints that you used to have in your SPG account have been tripled to become a new points balance; however, that balance remains separate from your Marriott Rewards points. To combine the points into a singular account, as well as our elite nights, we must complete a one-time process to merge our accounts.

To clarify: linking your Marriott and SPG accounts, as many of us have done prior to the merger, is different from merging the accounts, as we must do now.

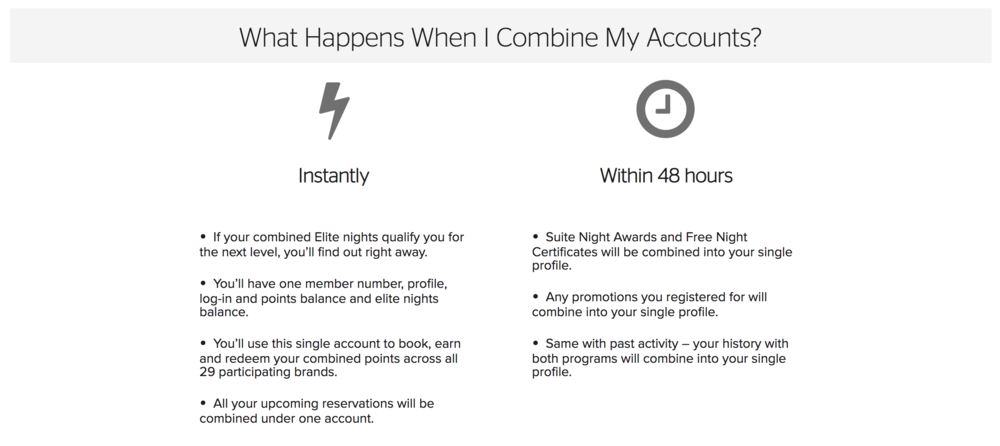

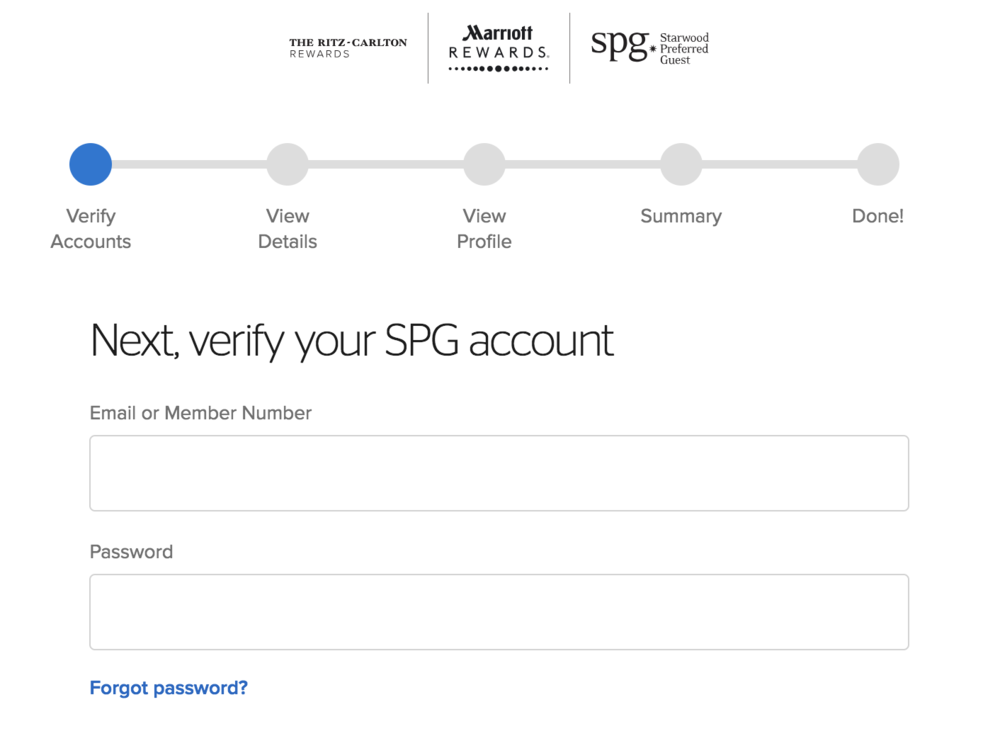

You do this by going to the “Merge My Accounts” page. It seems like the feature has only been enabled for a subset of members, so if you see a “Coming Soon” message, check back in a few hours to complete the process.

When you initiate this process, you’ll be asked to log into the opposite program (if you initiated via Marriott Rewards, you’ll be asked for your SPG login info, and vice versa).

Then, you’ll see the details of the points, elite nights, and lifetime elite status that’s about to be combined, before authorizing the merging of the two accounts on the final step.

Once that’s done, all your points should pool into one profile, and if you had enough elite nights in the two separate programs to boost you to a higher tier, that should happen as well. I myself got boosted to Platinum Elite, having earned enough nights across the two programs to get to the 50-night marker.

Speaking of elite status, there was a brief window yesterday when those of who had SPG Gold Elite via the Amex Platinum Card saw our status matched to the new Platinum Elite, even though it was confirmed that you would only get Gold Elite in this case. It looks like that glitch has now been fixed – those who originally earned SPG Gold Elite via a credit card perk, rather than via stays, now indeed show as new Gold Elites.

Redeem Your Points at the New Rates

One of the sweet spots of the new program is the ability to redeem points for some of the world’s best hotels at only 60,000 points per night. That’s because Category 8 in the new hotel categories won’t be used until 2019 – until then, everything maxes out at Category 7.

Right now, it looks like all the former SPG properties are indeed bookable at these rates, which represent a great discount compared to before. For example, the W South Beach used to cost up to 35,000 Starpoints a night – equivalent to 105,000 points the new program – but now only costs 60,000 points to book.

Get a room at the W South Beach for 60,000 points a night

The only hotels that don’t seem to be bookable yet are those that used to be designated “all-suite” properties under SPG, such as the W Maldives or the St. Regis Bali. It remains to be seen if and when these properties will open up award space, although Marriott has confirmed that they are intended to be bookable at the standard points rates.

One last thing to keep in mind is that just because you can redeem 60,000 points per night at hotels that will eventually become Category 8, doesn’t mean you should do so without being judicious about which properties you choose. Some of these hotels don’t actually retail for that much (say, $350/night) despite being classified at the highest end of the hotel categories, whereas others are astronomically expensive if booked with cash ($800+/night).

As with any other potential use of your points, consider first how much value the redemption brings to your travel plans, then the nominal value in terms of cents per point.

Existing Marriott Travel Packages

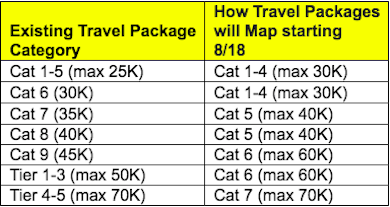

It blows my mind how much virtual ink has been spilled on this singular question over the past few months. Namely, what will happen to existing 7-night hotel certificates that were redeemed as part of the Marriott Travel Packages?

Marriott did not release any details until the day of the merger, resulting in volumes upon volumes of speculation all over the blogs and forums. Ultimately, the below conversion is what’s going to happen, as confirmed via the Starwood Lurker representative on FlyerTalk:

You’ll notice that Old Categories 1-5 and 6 are both being mapped to New Category 1-4, Old Categories 7 and 8 are mapped to New Category 5, and Old Category 9 and Old Tiers 1-3 are mapped to New Category 6.

People who had certificates for Category 6, Category 8, or Tiers 1-3 therefore “wasted” the incremental points, since they could’ve gotten the same thing by redeeming for one category lower. In response to this, the Starwood Lurker representative on FlyerTalk has confirmed today that those members will be able to get a refund of 30,000 points.

Furthermore, although Marriott had informed certificate holders that a one-month lockout period would be in effect while they convert the certificates on their back-end, they’ve now reneged on that position and confirmed that the new, converted certificates will be usable immediately (although my account still shows my old certificates, so presumably that’ll take some time to get sorted out together with everything else).

The end result is that the set of hotels you can book with the old certificate will be different from the set of hotels you can book with your new converted certificate – at times drastically different. For example, although most Old Category 6 hotels were assigned New Category 4, a not-insignificant portion of them became New Category 5. If you held a Category 6 certificate, you’d be locked out of booking that portion of hotels, even though you could do so before. On the other hand, you can now use all your new certificates on former SPG properties, which adds to the value proposition in terms of versatility.

Ultimately, I think most of us who held onto our hotel certificates can be reasonably satisfied once the dust settles. After all, we already got an insanely good deal out of the airline miles portion of the Travel Package, compared to what we’re ever going to get in the future!

I do, however, take issue with the way Marriott handled the changes to the hotel certificates. They issued no official communications at all – Starwood Lurkers on FlyerTalk are not really an appropriate channel – and left it to their front-line representatives to give out conflicting information.

Members were left to speculate and effectively gamble in terms of which packages to buy, and that gambling came with some people winning, some people losing, and some people losing very badly. While Marriott has handled this merger in a respectable fashion overall, I do think this is one situation in which they dropped the ball pretty badly, since they could’ve avoided all the backlash and uproar by simply announcing the changes in advance.

Conclusion

And so, life goes on. Overall, I think things have shaped up as well as we could’ve expected from a consolidation of this size. There are of course plenty of negatives – such as the reduced credit card bonuses, the reduced Amex MR transfer ratio, the devaluation to Travel Packages, etc. Meanwhile, the positives – besides the ability to book the old SPG luxury properties for cheaper – tend to be framed in the context of “things could’ve been a lot worse”.

Having said that, this program remains the most useful for Canadians looking to score some free hotel nights or leverage hotel programs to boost their balances of airline miles. Despite the fact that the merger has made our lives harder, it’s still the best option around, and can easily reward casual participants with a few free nights a year and more dedicated points collectors with insanely lucrative hotel opportunities for all their travel needs.

Hi ricky, Do you know of any better SPG promos maybe coming up beside the standard 50,000 bonus at the moment ?

Thanks, Susan

There’s a possibility that Amex offers higher promos once the new Marriott program has come into full force in 2019, although I wouldn’t count on it, since Amex historically hasn’t been too generous with special offers on these cards.

Ricky,

Hi Ricky,

I enjoy your posts tremendously, so please keep up the good work.

I am Plat Elite as well but have not been able to choose the annual choice benefit. Have you been able to choose it and if so please let me know how to do so.

Hi Ricky,

Thanks for all you do.

I had both the spa personal and business in the last year and cancelled them both in the last few months. Is there a certain amount of time we should wait to re-apply? Are we for sure going to be eligible for the new sign up bonuses?

Cheers

I typically wait at least three months before re-applying, although I know people have successfully done immediate turnarounds in the past. The eligibility restrictions on Amex cards haven’t been enforced, so yes you should be getting the bonuses.

Hi, Ricky! Thanks for your thoughtful posts as always. I’m looking for another "SPG" card now that the dust has settled. Do you still recommend the U.S. Biz SPG that you recommended earlier in the year. I would be getting it as my 3rd U.S. card.

I also wonder if you’ve had any experiences with any of the U.S. AA cards by Barclays. There are some great offers on many of those but I wonder how easy it is to be approved for a Canadian who started not too long ago with U.S. cards.

That’s a great card in my opinion, since it has a first-year fee waiver, a 100,000 point bonus, and the annual free night as well (which is worth the US$95 annual fee). Since US Amex cards have once-in-a-lifetime bonuses, I’ll be keeping that card around in order to make use of the free night.

I haven’t applied for any Barclays cards yet. I’m not 100% certain but I remember hearing that they don’t accept ITINs for applications, although I’d be happy to be proven wrong.

Hi Ricky,

Im so confused! Lol! I have the cobalt card and now Im confused about where to transfer points. I like to use points for airlines and not hotels. I canceled my spg card some time ago. What options do I have to get best value from my cobalt points now?

Thank you Ricky,

Marlene

Yep, there’s been lots of changes! Cobalt points can still only be transferred to hotels, so you could transfer them to Marriott at a 1:1.2 ratio and then transfer those points onwards to airlines. Otherwise, you could look into using Amex Fixed Points Travel to book flights at 1.5-2 cpp.

Did you notice further Amex devaluation? Platinum is 50K points and Biz Platinum is 40K. Just when I am starting to apply for credit cards. Wonder if this is going to be the future.

Those are the regular public offers available on the Amex website, and they’ve always been lower than the offers via referral links. The offers via referral links are the ones I discuss here on the blog (60K for Platinum and Business Platinum). You can also apply for the Business Platinum via Canada Post to get the 75K offer.

Hi Ricky, will you have a referral link for this card? I’d like to apply for it soon and would like to apply through you if possible.

Thanks, I appreciate that! For some reason referrals don’t seem to be available on the SPG cards at the moment (not even the $25 statement credit). I will post when the referral bonus comes back; for now, the best offer is probably via Great Canadian Rebates, where you can get $30 back on the personal card.

Hi Ricky,

I have the SPG Biz card from last year that is coming up for renewal next week. Would you recommend holding on to the card or is it better to cancel and reapply in a few months (if the bonus improves)? I know the Biz card gets a free night on the anniversary date but is there any DP that they started that or will it start from the next anniversary?

You should get the free night on your anniversary date. The question is how much you value that free night over the ability to reattain the signup bonus of 50,000 points.

On the face of it, even if the signup bonus doesn’t improve, it would be worth more than the free night (which is capped at 35,000 points), so I’d say the general direction of this card is still to cancel and reapply rather than holding on to it for the annual free nights.

If you were to hold it until the free night posted then cancel say 1 month later, would you lose the night (assuming its unused)? Just wondering if a "Hold for 13 months" pattern gets the best of both worlds?

In theory that should work – I believe it used to work like that for the old Chase Marriott card – but we don’t have any data points yet.

What about transfers to other airline programs, for example I was saving up SPG points to transfer to JAL miles book first class on Emirates, is this still an option and has this been devalued? Cheers!

Yep, that’s still an option as well, with no devaluation. The points required has simply been converted by a factor of 3x to match the new program – nowadays, your miles transfer at a 3:1 ratio, and you’ll need to transfer in chunks of 60,000 points to get the 5,000 bonus airline miles (whereas previously you needed to transfer in chunks of 20,000 Starpoints).

See: http://members.marriott.com/redeem/

To add on that, assuming all spending on the bonus category, cobalt used to give 5 cents worth of value per dollar.

With the starpoints to Aeroplan conversion, effectively this means earning 2.5 Aeroplan per dollar. Assuming a 2 cents per point value of Aeroplan, (unless I artificially try to blow up the value of an Aeroplan point by booking just a week in advance), I am still effectively achieving 5 cents per dollar in value.

Do you still it’s worthwhile to convert to Aeroplan or just book a travel and redeem the points at 1 cent per point on travel purchases organically.

To me the latter seems more simple straightforward and means nearly achieving the same value without any conversions, unless you tell me otherwise.

Yes, 5c/$ is basically the baseline of your Cobalt spending, and you should compare all other options against this baseline. However, transferring points to Marriott at a 1:1.2 ratio can still beat out the 1cpp valuation of MR Select points if you redeem them wisely towards hotel stays, or transfer them to airline miles that are otherwise tough to earn. Or you can use Fixed Points Travel to book revenue tickets at a higher return (1.5-2cpp) as well.

Hi Ricky

You are right on that, however, the credit card points required to convert to hotel points has definitely gone up which as per your first extract represents a devaluation.

For instance, I used to take chunks of 40000 cobalt points at a time to generate 20000 starpoints to generate 25000 Aeroplan.

Now I need to take chunks of 50000 cobalt points. To me that just made it 25% more expensive!

That’s correct – there’s been a devaluation on the Amex MR transfer ratio, so if that was your primary way of racking up SPG/Marriott points for airline transfers, then you’ve taken a hit.

Thanks. Is it only Marriott or can it be SPG, Sheraton etc to qualify for the 5th night?

Yes, they should all be under "Marriott" now and even SPG hotels, like the Westin, give you the 5th night free when booked on points.

Do you still get the 5th night free when booking four nights?

Yes!

I’ve been waiting to refer my SO for a card… disappointed that I won’t be getting points for that. I suspect your suggestion is that I go for it anyways and keep the points rolling vs « waiting for that referral » down the road ?

I’ve been waiting to refer my SO for a card… disappointed that I won’t be getting points for that. I suspect your suggestion is that I go for it anyways and keep the points rolling vs « waiting for that referral » down the road ?

I think we can be pretty confident that there will be a referral bonus, just not at the moment. I’d say that if you have a use in mind for the points, it’s best to apply now, and you can always get the referral bonus on the next round. Only if you don’t really need the points urgently might it make sense to adopt a “wait and see” approach.