Getting into the habit of paying annual fees on credit cards, when they’re worthwhile, is a natural part of progressing from a beginner Miles & Points collector to a more advanced user.

However, there’s undeniably a bit of a mental block that needs to be overcome at the start in order to get “comfortable” with paying significant sums of money for the privilege of getting a credit card.

In this article, we’ll look at many of the reasons why it’s worthwhile to pay annual fees as you seek to earn points, and what steps can be taken to soften the blow and make the higher outlays easier to swallow.

The Points Outweigh the Cost

The general principle is that credit card annual fees are easily justifiable if it’s outweighed by what you receive in exchange on the card, which usually takes the form of a generous signup bonus.

The two most noteworthy credit cards in our space with high annual fees are probably the American Express Business Platinum Card and the American Express Platinum Card.

The former comes with an annual fee of $499, which you pay upfront on the first statement, while the latter has an even higher price tag of $699, although the $200 annual travel credit (which can be converted to cash) brings that down to a net $499 as well.

So, you’ll find yourself at least $499 out-of-pocket in applying for each of these cards. What do you get in return?

The first factor to consider is the amount of the welcome bonus, including the number of points you’d earn from meeting the minimum spending requirement (if any).

If you were to, say, redeem the points for travel in a premium cabin, you’d likely be unlocking a significant amount of value, which could be much higher than what our Points Valuations might predict.

But perhaps you aren’t quite certain what you’ll be willing or able to redeem them for in the future. It might therefore be more useful to think about the minimum value of the welcome bonus.

For example, if a welcome bonus on one of the cards is 100,000 American Express Membership Rewards points, you’d be getting at least $1,000 of value from the welcome bonus if you were to redeem them for a statement credit at 1 cent per point (cpp).

When you factor in the net annual fee, you’re coming out at least $501 ahead, which is pretty good.

Of course, you can certainly redeem them at a much higher value by transferring them to airline partners; however, for this exercise, we’re more so focused on the minimum value to err on the side of caution.

Perks and Benefits

Looking at the signup bonus alone, you’re already coming out ahead – but what about all the other perks that come with a credit card?

Thinking again about the American Express Platinum Card and the Business Platinum Card by American Express, both offer unlimited lounge access, which is something many frequent flyers never travel without.

Lounges are invaluable to anyone who appreciates a place to relax, eat, and catch up on work before a flight, no matter which class of service they’ve booked.

Everyone will value lounge access differently depending on how often they travel, but there’s no doubt that the lounge access benefit is a net positive on any credit card, which builds upon the value provided by the signup bonus to make the annual fees well worth paying.

Another example takes the form of the Marriott Bonvoy credit cards. The Marriott Bonvoy American Express Card and the Marriott Bonvoy Business American Express Card have annual fees of $120 and $150, respectively, as well as modest welcome bonuses.

Beyond the initial influx of points, the ongoing benefits you get on every membership anniversary can even justify keeping the cards open in the long term.

Specifically, for both of these cards, you earn a Free Night Award worth up to 35,000 Bonvoy points on every card anniversary date.

You’ll need to think carefully about the optimal use of this certificate, but it shouldn’t be too hard to redeem it for a hotel night that would otherwise cost you $350+ in most circumstances.

You’re basically paying $120–150 every year for something that’s worth much more in return, so as long as travel is part of your budget and you’d be paying for hotels otherwise, it’s a good deal to keep these credit cards around.

You Will Earn Points Much Faster

The basic idea of paying annual fees is as we’ve described above: you get much more in return compared to paying the fee.

But if we zoom out and think about the practice of amassing points through signup bonuses, then we see that incorporating high-value credit cards into your strategy allows you to earn points much faster.

When people are just starting out with Miles & Points, it can be a good idea to stick to the no-fee cards, or cards that have a first-year annual fee waiver, in order to test things out and develop comfort with the process.

But the lifelong principle of “no risk, no reward” rings ever so true, and the credit cards with lower upfront outlays also tend to have lower welcome bonuses to your pad your points balance.

In fact, cards with higher annual fees almost always have a significantly higher welcome bonus than cards with smaller annual fees. In some cases, the welcome bonus may even be two- or three-times more than the lower-tiered cards. While you may incur an annual fee at the outset, the healthy injection of points into your account is by far the fastest way to earn points.

If you happen to have a lofty dream to fly an aspirational business class or First Class product, then the easiest way to get there is to earn enough points as quickly as possible, which may mean paying an annual fee to get there sooner.

Of course, if you’re happy to patiently build up your balance with as little out-of-pocket spending as possible, and aren’t in too much of a hurry to redeem your miles for a trip, then it can make sense to stick to the lower-end products.

But if you want to treat yourself to as many points-funded trips as possible, then time will be of the essence – and while you can certainly buy points (which is effectively what you’re doing in paying these annual fees), you can’t buy time!

The Points Can Offset the Cost of the Annual Fee

Even after digesting the above, some early points collectors may still be running into that mental block of paying $499 just for a credit card.

If you’d rather truly come out ahead without incurring any fees, you can sometimes use the points earned from the welcome bonus to directly offset the cost of the annual fee.

In doing so, you’re effectively maintaining a net $0 out-of-pocket expense, while still collecting some additional bonus points and getting to enjoy the perks and benefits of the card.

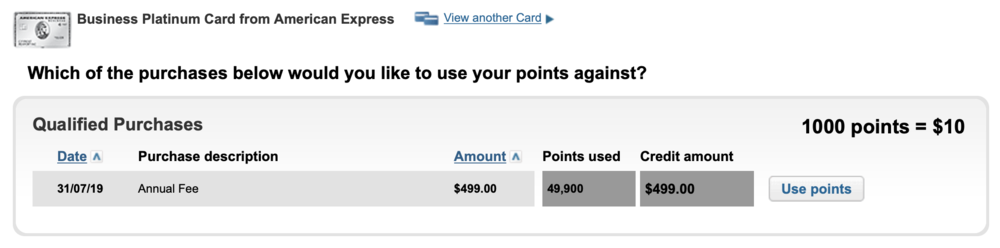

For example, points earned on the Business Platinum Card by American Express can be used at a value of 1 cent per point with the Pay with Points feature.

So, you’d take 49,900 of the total MR points earned from the welcome bonus, and use the Pay with Points feature to apply it as a $499 statement credit to offset your annual fee.

Whatever number of points you’re left with is pure profit, and if you happened to earn a juicy welcome bonus, this can still be enough for a flight in business class or a couple of flights in economy.

Of course, you can redeem your points at a much higher value by transferring them to airline or hotel partners and redeeming them for aspirational experiences. It’s not uncommon to get upwards of 5 or 10 cents per point when doing it this way.

However, this technique could be beneficial to those of you who are perhaps more cautious in your spending, or who aren’t in the financial position to stump up annual fees at the moment, but would still like to capture the additional value presented by all the different credit card offers out there.

Conclusion

Credit card annual fees are daunting at first, but taking into account all of the above, there’s really no reason to avoid them at all.

The points you earn as part of the welcome bonus generally outweigh the fee itself, and if it doesn’t, then it’s likely not going to be a card worth getting in the first place.

Meanwhile, the ancillary perks, such as lounge access, are the icing on the cake, and the fact that you get to accumulate points much faster is the cherry on top.

And if all that’s still not irresistible enough for you to take a bite, then you always have the option of using part of the signup bonus to offset the annual fee and maintain a $0 net spend at all times.

I’m a frequent traveller completing my first year with the AMEX Business Platinum card. It’s been fantastic, having made use of lounges 30 times, plus using the sign up bonus for several hotel stays, not to mention a $1,200 travel insurance claim.

May I suggest an article dedicated specifically to the process of renewing an AMEX Platinum card, with the proper wording to negotiate a retention offer, bonus points or waiving the renewal fee?