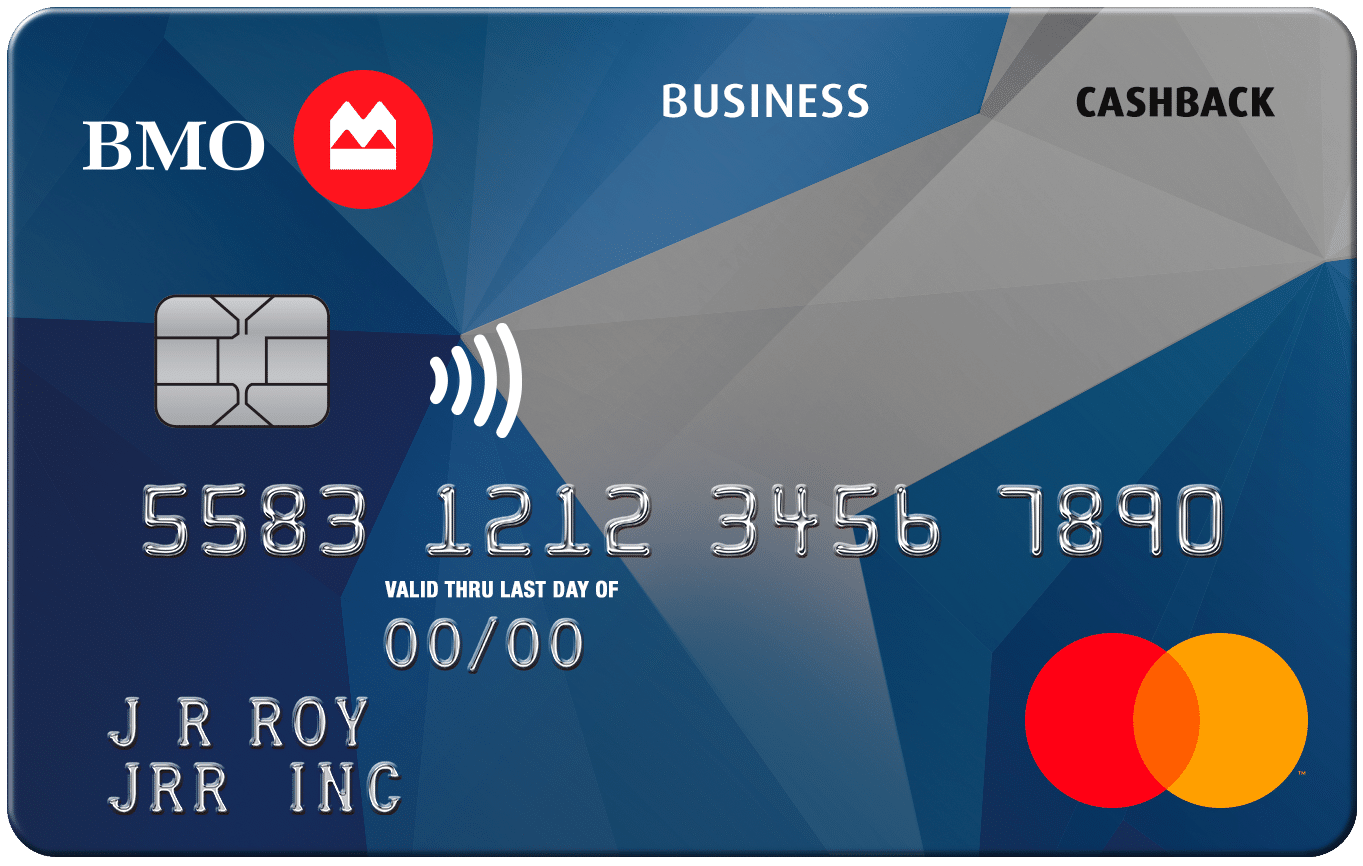

The BMO CashBack® Business Mastercard®* is a solid choice for anyone who prefers cash back and spends a fair amount every month on gas, office supplies, and recurring cell/internet bill payments. Its 10% return on gas, office supplies, and recurring cell/internet bill payments is outstanding for a no-fee card, and the flexibility of BMO’s cash back redemption options also counts in its favour.

However, the excellent 10% earning rate only applies on the first $1,500 in gas, office supplies, and recurring cell/internet bill payments for 3 months, so you may wish to compare this card against other options if your spending volume is higher.

Bonuses & Fees

As a welcome bonus, the BMO CashBack® Business Mastercard®* offers 10% cash back on the first $1,500 spent within the first three months, up to a total of $150 in cash back rewards.

The card has no annual fee, making it a great choice to keep around as a free primary or backup business credit card, all while supporting the longevity of your credit history. You could also downgrade to this card after collecting the bonus on a higher-tier BMO CashBack credit card to preserve your account history.

It’s also free to add authorized users.

Get a 0.00% introductory interest rate on Balance Transfers for 9 months, 3% fee applies to balance amounts transferred*

Earning Rewards

The BMO CashBack® Business Mastercard®* earns cash back at the following rates:

- 1.75% cash back on on purchases at Shell® gas stations.

- 1.5% cash back on on eligible gas, office supply purchases and cellphone and internet bill payments.

- 0.75% cash back on all other purchases.

A 10% return on gas, office supplies, and recurring cell phone/internet bill payments for 3 months is a competitive rate for a no-fee card. The 1.75% cash back on purchases at Shell® gas stations is also great if you fill gas at Shell®, to a maximum of $2,500 per account.

However, you’ll only get the bonus rates on your first $1,500 spent over 3 months. The card isn’t great for high spenders, but if you’re in the market for a card with no annual fee, you’re probably pretty budget-conscious to begin with.

The 0.75% cash back rate for uncategorized purchases is rather uninspiring, but it isn’t too far off of the value of the rewards on BMO’s other no-fee cards. All other things being equal, cash back is certainly a more versatile rewards currency, and a strong grocery category only sweetens the deal.

Redeeming Rewards

There are three ways to redeem your cash back on the BMO CashBack® Business Mastercard®*:

- Deposit into a BMO chequing or savings account

- Deposit into a BMO InvestorLine account

- Redeem as a credit against your credit card’s statement

Any of these three options can be requested at any time when you’ve earned at least $1 of cash back. You can also set up automatic payments, which will automatically trigger one of the above three redemption options every time you reach $25 of cash back.

BMO’s cash back redemption options are relatively flexible compared to its peers, many of which only allow you to claim your cash back earnings once a year.

Perks & Benefits

As a no-fee card, the BMO CashBack® Business Mastercard®* comes with relatively few perks.

Cardholders can get up to 7 cents off per litre on all Shell®± fuel*, until December 31, 2024. Eligible cardholders will receive 2 cents off per litre on regular fuel, and 7 cents off per litre on premium fuel, up to 1,000 litres per month.

You’ll enjoy an option to get up to 22 additional cards so that employees can easily make purchases on behalf of your business.

Insurance Coverage

Insurance benefits on the BMO CashBack® Business Mastercard®* are also limited.

The card does not offer any types of travel insurance; instead, its coverage is limited to extended warranty (doubling the manufacturer’s standard warranty, up to one additional year) and purchase protection (against accidental damage or theft within 90 days).