It seems like there’s some great news for some American Express Aeroplan Reserve Card holders: you might be getting your $599 annual fee waived for 2022.

Targeted $599 Annual Fee Waiver

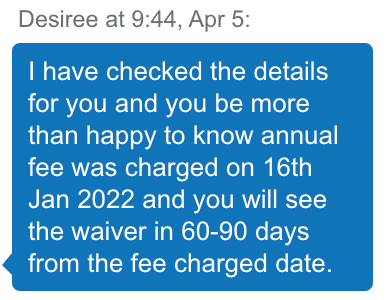

As confirmed with an Amex live chat representative and through phone agents, both by myself and several Prince of Travel members, American Express will be waiving the $599 annual fee for select American Express Aeroplan Reserve cardholders in 2022.

If you are targeted for this annual fee waiver, then the entire annual fee of $599 will be credited back to your account 60–90 days after your annual fee posts upon renewal sometime in 2022.

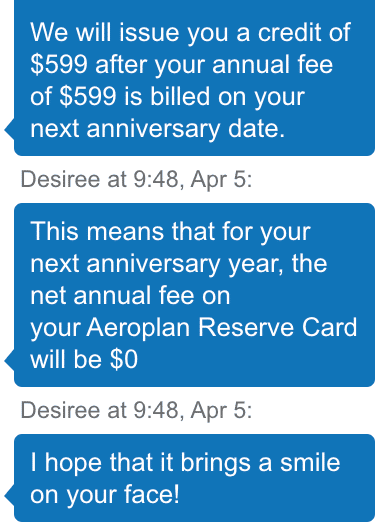

Note that if you haven’t been targeted, you’ll receive a response like this:

(For what it’s worth, an Aeroplan Reserve Card account in my household that was opened in January 2021 and had spent around $23,000 in 2021 was indeed targeted for this annual fee waiver, while accounts that were opened in September 2021 and had spent around $13,000 in 2021 were not targeted.)

This is excellent news for cardholders who are lucky enough to be targeted, as it means that they won’t have to pay for another year of the card and can continue to maximize its benefits throughout the rest of 2022 and into 2023.

American Express states that the offer is “by solicitation/invitation only”, and is being offered as cardholders haven’t had the chance to fully maximize the benefits on their card during 2021.

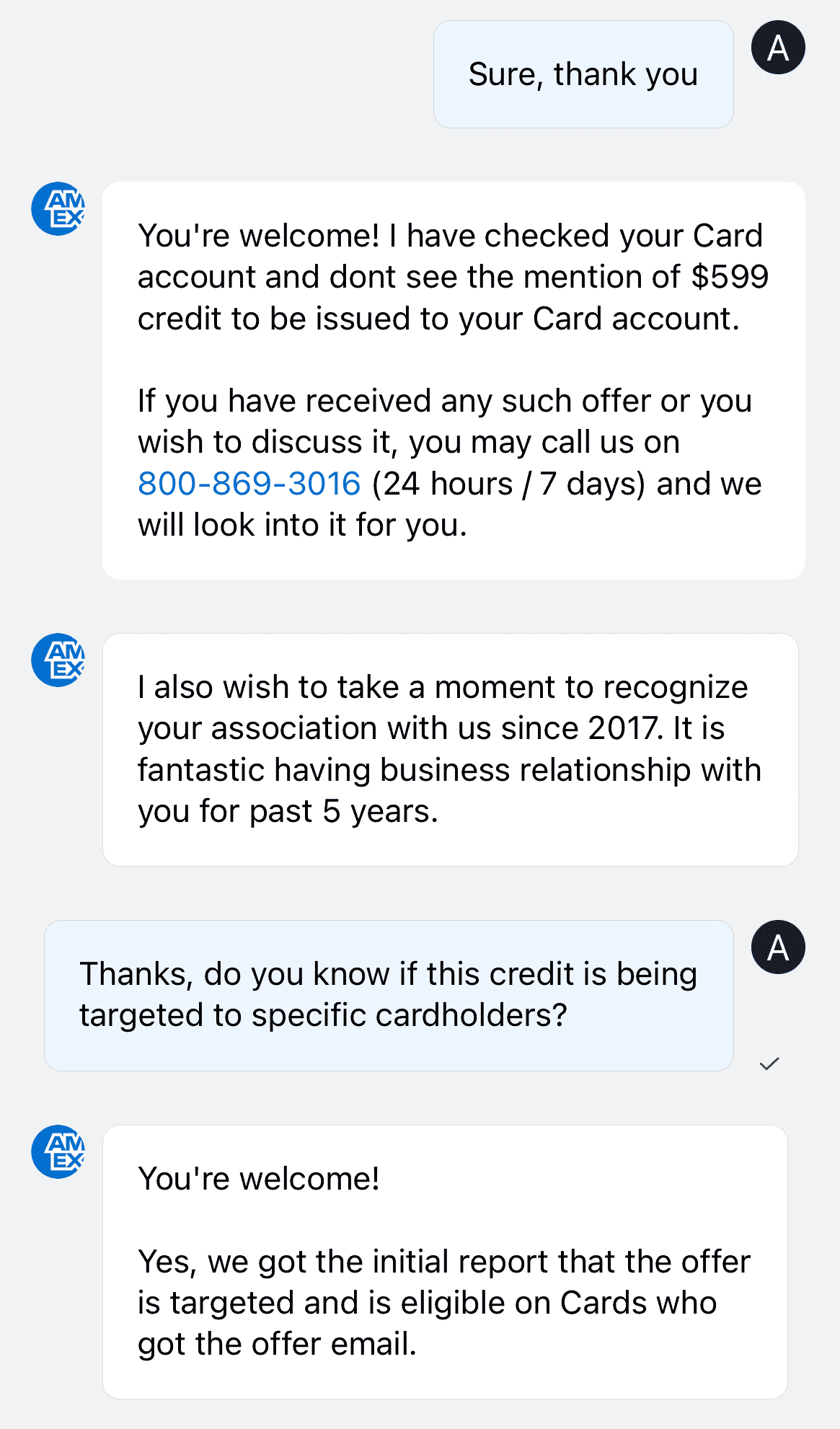

Cardholders who may have picked up the card in late 2020 when it first launched or in 2021 who weren’t able to travel as a result of restrictions can now take advantage in the upcoming year.

Personally, I think this makes a lot of sense, because many cardholders would’ve otherwise been tempted to cancel the card with the $599 fee coming up.

Amex would like cardholders to travel more this year and discover all the benefits like Maple Leaf Lounge access, priority airport services, etc. Eligible cardholders can then make a more informed decision about whether to keep or renew after their next membership year is up.

You can call or chat with Amex to see if you’ve been targeted for the $599 annual fee waiver upon renewal. If so, you definitely shouldn’t cancel your American Express Aeroplan Reserve Card this year, as there’s only pure upside to keeping it open until next year’s renewal date.

Amex Aeroplan Reserve: A Wide Range of Air Canada Travel Benefits

With the $599 annual fee waived for their upcoming renewal, eligible American Express Aeroplan Reserve cardholders can fully maximize their Air Canada travel benefits during the upcoming year.

- Priority boarding, priority check-in, and a free first checked bag on all Air Canada flights, for the primary and supplementary cardholders

- Complimentary visits to Air Canada Maple Leaf Lounges within North America for the primary and supplementary cardholders

- Preferred pricing when redeeming Aeroplan points for Air Canada flights

- The ability to earn 1,000 Status Qualifying Miles (SQM) and 1 Status Qualifying Segment (SQS) for every $5,000 you spend on the card

- The ability to rollover up to 200,000 SQMs and 50 eUpgrades per year

- The ability to earn an Annual Worldwide Companion Pass after spending $25,000 on the card per year

In particular, the $599 annual fee waiver means that targeted cardholders can now rely on rolling over up to 50 eUpgrade credits from 2022 into 2023 at no additional cost.

In addition to the Air Canada benefits, the card also offers some travel benefits via American Express, such as priority benefits (valet parking, fast track security, etc.) at Toronto Pearson International Airport.

What About the Other Amex Aeroplan Cards?

Note that this targeted promotion appears to be only for the American Express Aeroplan Reserve Card right now. It doesn’t appear to be offered on the American Express Aeroplan Business Reserve Card, which also has a $599 annual fee, nor the core-level American Express Aeroplan Card, which has a $120 annual fee.

In theory, offering the same targeted annual fee waiver to all Aeroplan co-branded card holders would make the most sense.

However, my guess is that the Aeroplan Reserve Card represents the most significant chunk of cardholders in the overall Amex Aeroplan credit card portfolio, so they’re being treated to this very generous promotion right now.

We may or may not see the offer being extended to the other cards in the near future, and we’ll be sure to update this section if so.

Conclusion

American Express is waiving the $599 annual fee for select American Express Aeroplan Reserve Card holders who renew their cards in 2022. If you’ve been targeted for this promotion, the fee will initially be posted on the account, and then credited back to the account in 60–90 days.

The fee waiver is a goodwill gesture from American Express for cardholders who were unable to travel much the past two years, and therefore were unable to fully use the card’s benefits before having to make a decision on whether to renew their cards for another $599.

For those who may have been considering cancelling the card but have now been targeted for a fee waiver, it’s best to hold off and keep the credit card for another year, as you can enjoy benefits such as Maple Leaf Lounge access and priority airport services at no cost for the year.

My first year renewal is due in a couple of weeks. I spent >$100k. No sign of any email offer.

Has anyone figured out the criteria to become eligible for the fee waiver?

Is it a set criteria that qualifies you or is this a “suite talking” exercise?

No fee waver for me, but they did offer 20,000 points as a retention bonus ($100k spent on the card in 2021).

I have the charge card version of the regular aeroplan Amex and got a $60 rebate of my annual fee after it renewed this year. I don’t remember getting an offer or anything about it, so it might have just been me. I was going to close the card this year because I don’t use it a lot (focus on Platinum/Cobalt), but with the statement credits and the rebate it paid for itself.

Looks like it is one of the few charge cards left – I thought it had changed as well.

Has anyone who paid a renewal from last Dec received the waiver or is this just for renewals in 2022?

Not me too anxious to ask, so I’ll just wait and see if I get refunded when it’s paid…. >_>

Is it too early to call as my renewal date is in July.

I can confirm that I will be getting the waiver. It’s weird cause I did not spend a lot on the card just enough to get the welcome bonus then I threw it in the drawer. But I’m still thankful.

I asked and got this back:

Amex: Thank you so much for your interest, I reviewed and found that the offer is currently based on solicitation and is sent to selected accounts, however this does not mean your account will not get one. Please keep an eye on your email and as soon as there is something for your card, it will show up there.

We try our best to keep launching more offers so that you can make the best use of the card.

Me: There’s no way to confirm that now?

Amex: I am afraid not at the moment, the marketing team have started sending offers after reviewing the accounts and will directly send it to you on your e-mail registered with us, I would request you to keep looking on the e-mail and soon you will get the offers available for the accounts.

I hope we have the updated e-mail for you?

I’ve got the same message. My annual fee was duel Feb 1 and I spend over 25k.

Similiar to others here I have a long history, big spend and had the card at the end of 2019. I called and the very polite gentleman was clear this offer was only targeted at very select people in November 2021. I had the distinct impression he meant people with a media presence to influence others. He was aware it was posted, and they have gotten calls, but there will be no additional credits.

“The current offer is based on solicitation and your card is not eligible” is the reply I got.

Got the card Dec. 2020 after being on the wait list.

$25K+ on my first year.

Yeah, same answer here, got the card in November 2020, somewhere around $50K spend in first year and pretty good spend in second year but still no joy on this offer.

Thanks for the heads up Ricky. I’ve been an Amex member for over 17 years and have held the Aeroplan Reserve Card since it was introduced. I was grandfathered in so my card is a charge card rather than a credit card. I spent over 35K last year on the card and over 25K year before that. I was billed $599 annual fee in January 2022 for renewal. I have not received this offer, so am very disappointed in this. Since it is almost 90 days since renewal, I’m not holding out much hope. Congratulations to the lucky card holders selected for this offer!

Further clarification from Amex… sort of… cardholders would have been notified in November 2021 if they were selected for this offer. Amex didn’t really specify what the selection criteria was, I guess they’re satisfied with keeping some cardholders wondering why they weren’t selected.

Thanks for the tip. Just got the reserve card July 2021. Spent close to $25k so far. I’ll follow up with Amex.

I would love to know on what basis these waivers are being handed out. I’ve spent well over $25K and my card renewed in January, but apparently I don’t get the waiver. Seems totally random and not necessarily fair?

I agree, but it seems the criteria is not random, but still somewhat secretive. Amex is going to have a lot of dissatisfaction from some cardholders. For what it’s worth, I think that this promotion was poorly conceived by Amex.

I reckon this offer is targeting newer card holders, whom Amex thinks might be “big spenders” when things return to normal. Banks are generally less generous with long time loyal clients. And I feel this needs to change. I think even a 50% fee waiver for all card holders, would have built up some nice respect points for Amex.

That being said, at least Amex allows most people to get the “welcome” bonus on their cards, even if its once in a lifetime lol. Unlike Scotiabank which denies you any welcome bonus if you ARE or HAVE BEEN a client in the past 24 months.

I spent to date 280K and my coming up renewal date is in late April. I messaged via chat and the rep didn’t have any idea what I was talking about until I pressed further. And then he said I would have to call in to see if I am eligible.

I would be astounded to see I’m not offered if I spent 280K on the card with an average monthly spend of 28 to 30K each month.

Nothing yet, guess I should ask after my fee hits?

Success! I got the fee waiver and the rep said it would apply within 60-90 days. Renewal was back in February!

Here’s what they told me when I asked them on chat……

“The offer is targeted toward the charge card

version of the card, in other words, it is

available to those who held the $899

Aeroplan charge card before Aeroplan

refreshed their program on November 6 2020.

Those card holders had their charge card

grand fathered. It is unfortunately not

available for the credit card version of the

card.”

No waiver for me. Does this statement ring true Ricky? Or should I press them a little harder or speak to someone on the phone?

Yes I was told only previous holders of the aeroplan platinum card were selected.

I was told the same thing

I’ve spent over $28k on the card this year and my renewal/reset date is Aug.03/22

And this is my first year holding the card.

I have renewal coming up in July and have $27k spend on the card. Chatted via app and told no offer. They Said lookout for email offer. On paper I meet the criteria so I don’t know if it’s just my renewal too far out.

Just called to ask. Reply…we don’t waive annual fee. I guess you need the email invite.

Ricky,

I have TD Aeroplan Visa Infinite Privilege card, I already spent $25,000 for 9 months. Do you think TD would do the same thing as Amex?

If I call TD retention department to waive $599, would it be better to call prior to anniversary date or after?

Thanks!

Best to call once the annual fee posts and within 30 days of the next statement. So if your annual fee posts in July, call once the statement is issued but so do before the August statement comes out. TD is actually pretty good about fee waivers and credits if you have a good banking relationship with them. While I don’t think you will get the full $599, even a $100 or $200 is nice ROI 🙂 for your phone call and loyalty.

I asked for a waiver for cibc or an offer they gave me $100

Thanks Ricky, confirmed with AMEX I goy the waiver too, spent YTD so far 17K

Just confirmed via chat that they are waiving my entire $599 fee. Fwiw I have spent about $26,500 on the card with renewal coming up in June. Man, I love Amex.

When did you first get the card? Did you hold the old version before the refresh?

I got my card is July 2021. Will we also get this bonus? Would be nice but I doubt it? I wonder if it has to do with the spend total as well? Perhaps if you spend over $20g they would consider you a bigger spender vs somebody who only spends to just get past the min spend and then the rest of the year uses it sparingly? Thoughts?

I think spending over $20,000 is one of the keys 🙂 I remember a mini survey they had when joining the waitlist for the Gold Card relaunch. They asked how much you plan to spend on the card and the categories where $5000, $10,000 or $20,000+ .. But spend alone will not qualify you for the offer. Amex, like any other bank, uses an internal scoring model and if you score high (as in future potential growth), then you are likely to get the waiver. Then of course, only Amex know the secret sauce lol

I’m loving my Amex reserve so far, used the maple lounge a few times, spent over $25k, which I also got my companion pass. The only thing sucks is I barely put any spent on my platinum card…..