Business Platinum Card from American Express

130,000 MR points

The American Express Cobalt Card is widely considered one of the most powerful credit cards in Canada, largely thanks to its 5x earning rate on food and drinks.

Historically, the welcome bonus on this card has hovered in the range of 30,000 MR points, with occasional periods of an elevated bonus of 50,000 MR points.

However, the welcome bonus has dropped to its lowest point in years, and comes paired with a relatively hefty monthly minimum spending requirement to boot.

The standard welcome bonus on the American Express Cobalt Card has historically been 30,000 MR points, distributed over 12 monthly periods upon spending $500 each month.

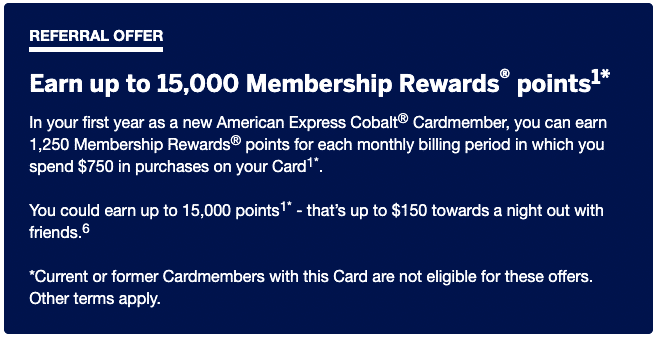

For now, the signup offer available through both public and referral channels is for up to 15,000 MR points, distributed as monthly bonuses of 1,250 points upon spending $750 each month.

In other words, the total welcome bonus is half of what it used to be, and you’ll have to spend an extra $250 each month, or an extra $3,000 over the course of the year, to fully unlock it.

It’s worth noting that the Cobalt Card hasn’t historically been known for juicy welcome bonuses, and is regarded for its prowess as a card to use for many daily expenses instead.

There’s no listed ending date to the current offer. Therefore, if you don’t currently have the Cobalt Card in your wallet, it could be worth holding out for a better offer.

However, it could be a while before we see an elevated bonus again, and since the Cobalt is still one of Canada’s best credit cards for daily spending, it’s still worth considering.

Even with the recent changes to the spending cap for category multipliers and the current low welcome bonus, the Cobalt Card remains an excellent choice for ongoing day-to-day spending.

Despite a low signup offer, it’s still one of our top picks for the best beginner credit cards, and one of the best overall credit cards in Canada.

The standout feature is the ability to earn 5 MR points per dollar spent on eats and drinks, which includes restaurants, bars, cafés, takeout, delivery, and purchases made at the grocery store.

And since the points transfer 1:1 to Aeroplan and British Airways Executive Club, 1:0.75 to Air France KLM Flying Blue, and 1:1.2 to Marriott Bonvoy, amongst others, you shouldn’t have any problems finding great ways to redeem your points.

Indeed, at 5x the points on eats and drinks:

By and large, the Cobalt Card is the easiest way for the average Canadian household to travel on a regular basis, and that’s what makes it a truly incredible product all around.

On the other hand, with a lower welcome bonus on the Cobalt Card, it could be that Amex is looking to bolster the attraction of the American Express Gold Rewards Card, which currently offers a welcome bonus of up to 70,000 points, structured as follows:

While the monthly spending requirement on the Gold Rewards Card is higher than the Cobalt, the payout is also better, earning 4x more points each month, plus a boost of 10,000 MR points upon spending $4,000 in the first three months.

If you’re choosing between the two, it could be worthwhile to side with the Gold Rewards Card for its welcome bonus for now, and then consider adding the Cobalt a bit further down the line to use as a daily driver.

The welcome bonus on the American Express Cobalt Card has been lowered to just 15,000 MR points, spread out over the course of a year. This bonus is 50% of the standard welcome bonus of up to 30,000 MR points, which has been around for most of the last two years.

If you don’t have this card already, it still remains as one of Canada’s best for beginners and daily spending, due to its excellent 5x category multiplier on eats and drinks. Even with a low welcome bonus, your points will rack up month after month.

However, since there’s no listed expiry date for this offer, you may want to weigh up the pros of having it available for daily spending against other welcome offers that may prove to be more fruitful in the short term.

Ah I just applied for this card (December 22, 2023) because I was about to book a trip. I should have waited for a better welcome bonus.

There’s no indicator that there WILL be an elevated welcome bonus, though at some point it is possible. If you can make use of the F&B and grocery spending much, then get the card asap, otherwise, you are subjected to “opportunity cost”. for not using this card for the 5x multiplier..

I have the Amex SimplyPreferred card and the Marriott Bonvoy card (received Dec 1, 2022). I just applied for the Cobalt card and received the dreaded “Your application is currently under review. Your request will take approx. 10 business days to process” So I assume that’s a rejection?

I have multiple amex cards with MR points. AMEX will no longer transfer more than one of these to Bonvoy. They said contact Bonvoy! Bonvoy says it’s an AMEX issue and AMEX says it’s a Bonvoy issue; you can only have one AMEX MR card convert points to Bonvoy. I have filed a complaint with AMEX as this renders my cards useless; the phone agent indicated I could still use the points for a statement credit!!! ha. Has anyone else had this issue? I have asked if i can move my MR points from one card to another or if I can unlink the current card and link another 😉 I’ve been told NO.

Ricky, is AMEX really enforcing the WB ? Would like to apply for the Cobalt a second time.

Hi Ricky – I spent over $3,000 within the first three months but I don’t see the 20,000 bonus points in my account balance. Is this bonus awarded at the end of the first year?

I believe you would have to wait 6-8 weeks to show up

Am I eligible for the welcome bonus as a current Amex Gold cardholder?

Yes!

Great article as usual Ricky! Just wondering do you know if AMEX do limit split between credit cards? I.e. from Aeroplan reserve to cobalt. Or if I want this one I have to apply?

Like Ron said, you’ll have to submit a new application.

Amex doesn’t do “limit split”. Need to submit a new application.

Now that MR select can be transferred to airlines does that mean we can merge our MR points with platinum card?

Nope – it looks like MR and MR Select remain two separate tiers, so cannot be combined. It’s just that MR and MR Select are virtually identical in every other way, now that MR Select points can be transferred to airlines too, so we’ll generally refer to all of them as “MR points”.

So if I have 50k Aeroplan and converted 50k Cobalt MR points into Aeroplan, does that mean I cannot book a flight that costs 100k aeroplan total?

Really wish amex would add YouTube premium to the eligible streaming services.

Ah damn. I thought today was the last day for the $10/month fee and waited. I wish i realized yesterday 🙁

Well, there’s a higher welcome bonus now, so you’re actually better off! $200+ in value > $36 savings for sure.

Would it be possible to re-post the previous Amex Cobalt Incognito offer from a couple of month ago? I applied under that expired offer and cannot locate the details of the spend threshold/time period to receive the 50,000 points. It looks like the thread was updated today with the new Cobalt offer. Thanks.

The details were exactly the same as the current offer: 2,500 MR points for each of the first 12 months that you spend $500, as well as 20,000 MR points for spending $3,000 in the first three months.

Thanks so much Ricky. Much appreciated. FYI I love your site.

I have had the Amex Cobalt card in the past. Am I ineligible to sign up and get this great bonus?

Technically, yes, you are ineligible. However, it’s still worth getting the Cobalt Card for the ongoing 5x points that can be transferred to airlines, and who knows – you might just get the bonus anyway.

Is there any word on whether the MR-S earned on the Business Edge card will become convertible to airline points? If not, the Business Edge card will be the only one with MR that are not convertible to airline points.

I just checked on the Amex MR account associated with my Business Edge card, and it appears that one can transfer these MR to airlines now.

It definitely seems like MR Select as a whole has become transferable to airlines, even though it was initially indicated that no changes were coming to the Business Edge. A pleasant surprise!

Can u send the link to the Cobalt card and, do we get extra points for sharing the link with others?

You can check out our page on the Cobalt Card for more information and to apply: https://princeoftravel.com/credit-cards/american-express-cobalt-card

Yes, once you get a card of your own, you can earn 5,000 MR points for each referral that you make from your link.

Any thoughts on when we should see a revamp of the Plat and Gold cards? With the 10x dining/grocery coming to an end soon, and the Gold card now more or less collecting dust in a drawer, I’m sick of paying big annual fees for so little earning value.

I can only offer my predictions – I think we’ll most likely see a Gold relaunch before the end of the year, and Platinum revamp next year perhaps. Again, pure speculation here though.

Will the possibility to transfer to AP appear at some later point in time? So far I see only the usual two suspects under “Transfer Points” (Bonvoy and Hilton)

It should be there now!

Other than converting to Bonvoy, is there any other advantage to the Cobalt card over the Scotia Gold Amex?

The value of Amex points are much higher.

https://princeoftravel.com/points-valuations/

Yes and no – our valuations place a premium on flexibility, and Amex also has the fixed points flight chart. If your preferred redemption is to cash out for statement credit for general travel expenses, you won’t get that extra value, and the two cards are almost identical.