The Canadian-issued Business Platinum Card from American Express and the American Express Platinum Card have received significant boosts to the welcome offers.

If you’ve been looking to expand your American Express Membership Rewards balance for an upcoming trip, you’ll certainly want to take advantage of these offers, as long as you can meet the sizeable minimum spending requirements.

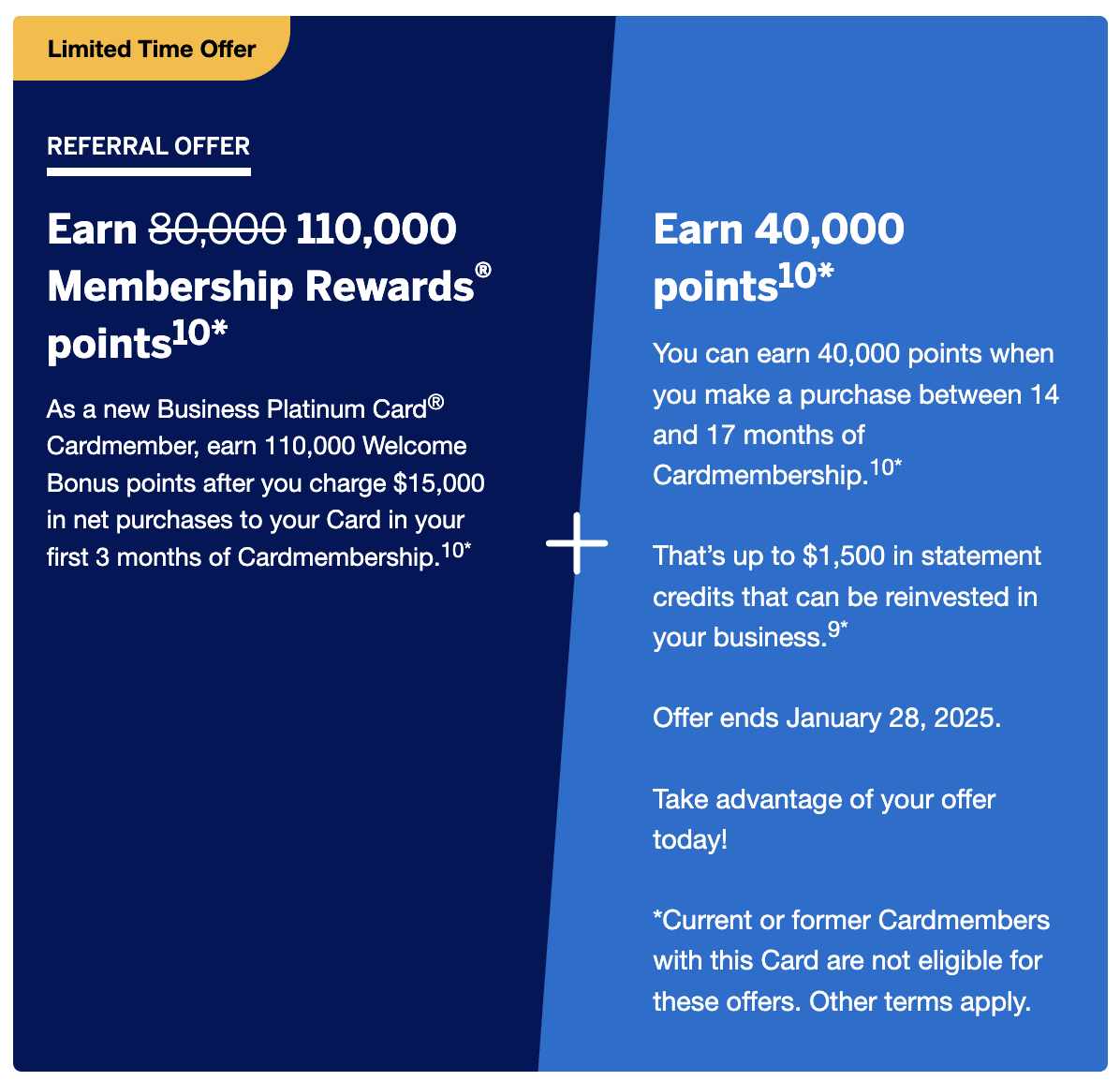

Business Platinum Card from American Express: Up to 150,000 MR Points!

The Business Platinum Card from American Express has just received a significant boost to its already-strong welcome bonus.

Currently, you can receive a welcome bonus of up to 150,000 Membership Rewards points, structured as follows:

- Earn 110,000 MR points upon spending $15,000 (all figures in CAD) in the first three months

- Earn 40,000 MR points upon making a purchase in months 14–17 as a cardholder

As a reminder, the annual fee on the Business Platinum Card from American Express stands at $799.

To help offset the increase, the card comes with a number of additional benefits, such as:

- A $200 annual travel credit

- Up to $120 in annual wireless services statement credits ($10 per month)

- A $100 NEXUS application or renewal fee credit (every four years)

Furthermore, you can earn up to $200 in annual statement credits for Dell purchases, as well as up to $300 in annual statement credits for Indeed, through opt-in Amex Offers available on your account.

The Business Platinum Card offers a flat 1.25 MR points per dollar spent on all purchases, making it an ideal card for business owners whose large volumes of spending may not fall into traditional credit card bonus categories.

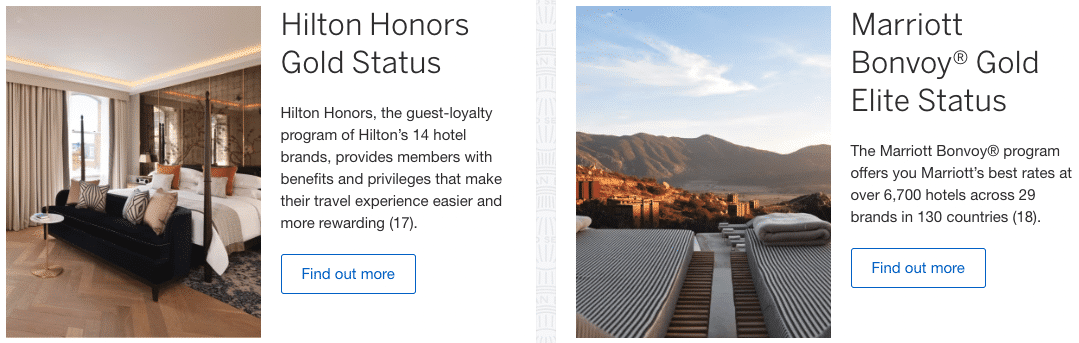

And just like the personal version, the premium travel benefits – including unlimited lounge access, Marriott Bonvoy Gold Elite status, and Hilton Honors Gold status – are what makes the Business Platinum Card a favourite product among high-flying points collectors and business owners across all the land.

In terms of the value offered from the welcome bonus, we value Amex MR points at 2.2 cents per point (CAD).

In the first year, you’d earn at least 128,750 MR points: 110,000 points from the welcome bonus, and 18,750 points from meeting the $15,000 minimum spending requirement in the first three months.

We’d value 128,750 MR points at $2,832, and when you subtract the $799 annual fee and add the $200 annual travel credit, we arrive at a net first-year value of at least $2,234. If you’re able to take advantage of the other statement credits and perks offered through the card, the value increases from there.

The second swath of 40,000 points is awarded upon making a purchase in months 14–17 as a cardholder. We’d value 40,000 points at $880, which is greater than the second year’s annual fee, and when the additional perks and credits are factored in, the value increases from there.

This offer is set to run through to January 28, 2025, so be sure to take advantage of this elevated welcome bonus before then if you’re eligible.

- Earn 110,000 MR points upon spending $15,000 in the first three months

- Plus, earn 40,000 MR points upon making a purchase in months 14–17 as a cardholder

- And, earn 1.25x MR points on all purchases

- Also, receive a $200 annual travel credit

- Transfer MR points to Aeroplan and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for business expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Qualify for the card as a sole proprietor

- Annual fee: $799

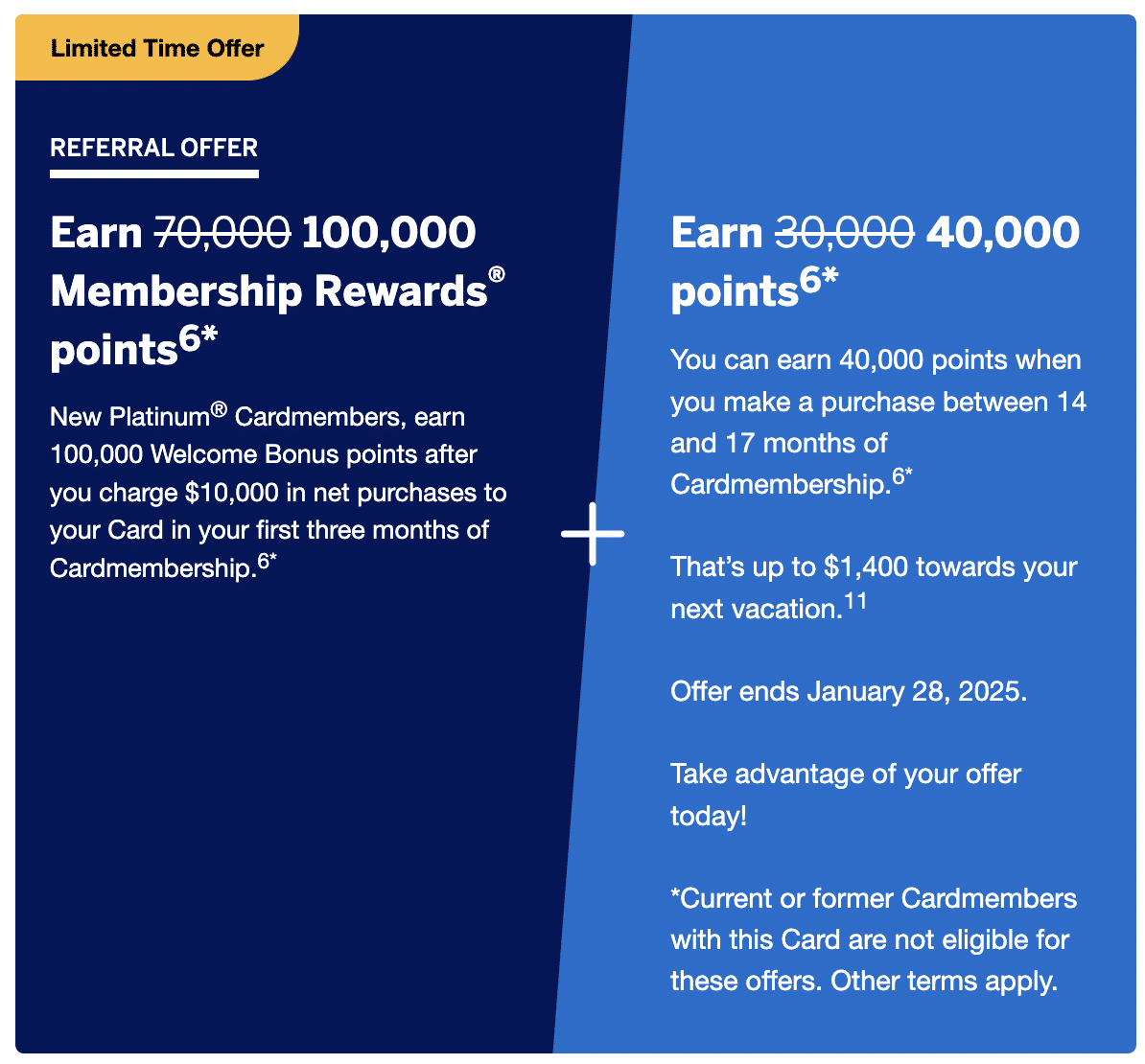

American Express Platinum Card: Up to 140,000 MR Points!

The American Express Platinum Card has also received a significant boost to its welcome bonus.

When you apply for the American Express Platinum Card with the current offer, you can earn a total of up to 140,000 MR points, structured as follows:

- Earn 100,000 MR points upon spending $10,000 in the first three months

- Earn 40,000 MR points upon making a purchase in months 14–17 as a cardholder

The card has an annual fee of $799, as well as a bevy of premium perks that help to offset the cost.

Indeed, the Platinum Card is known for its premium travel benefits, which is what makes it a card that every frequent traveller should consider.

First off, the $200 annual travel credit on the Platinum Card, which you get once every card membership year, effectively offsets against the $799 annual fee, since it’s easily redeemable on any form of travel. Additionally, there’s a $200 annual dining credit, which can be redeemed at some of Canada’s top restaurants.

You’ll also get unlimited airport lounge access to Priority Pass, Plaza Premium, Delta Sky Club, and Centurion lounges. Furthermore, the Platinum Card confers instant elite status levels (upon enrolment) in Marriott Bonvoy (Gold Elite) and Hilton Honors (Gold Elite).

Not to mention, top-tier cards like the Platinum Card routinely get the best Amex Offers, which can add hundreds of dollars of value each year.

In terms of the value offered from the current welcome bonus, we value Amex MR points at 2.2 cents per point (CAD).

In the first year, you’d earn at least 110,000 MR points: 100,000 points from the welcome bonus, and at least 10,000 points from meeting the $10,000 minimum spending requirement in the first three months.

We’d value 110,000 MR points at $2,420, and when you subtract the $799 annual fee and add the $200 annual travel and dining credits, we arrive at a net first-year value of at least $2,021. If you’re able to take advantage of the other statement credits and perks offered through the card, the value increases from there.

The second swath of 40,000 points is awarded upon making a purchase in months 14–17 as a cardholder. We’d value 40,000 points at $880, which is greater than the second year’s annual fee. Plus, when the additional perks and credits are factored in, it could be well worth keeping the card around on an ongoing basis, as long as you can make the most of the total welcome bonus and the card’s many perks.

This boosted offer is set to run through to January 28, 2025.

- Earn 100,000 MR points upon spending $10,000 in the first three months

- Plus, earn 40,000 MR points upon making a purchase in months 14–17 as a cardholder

- Earn 2x MR points on all dining and travel purchases

- Receive an annual $200 travel credit

- Receive an annual $200 dining credit

- Transfer MR points to Aeroplan and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for daily expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Annual fee: $799

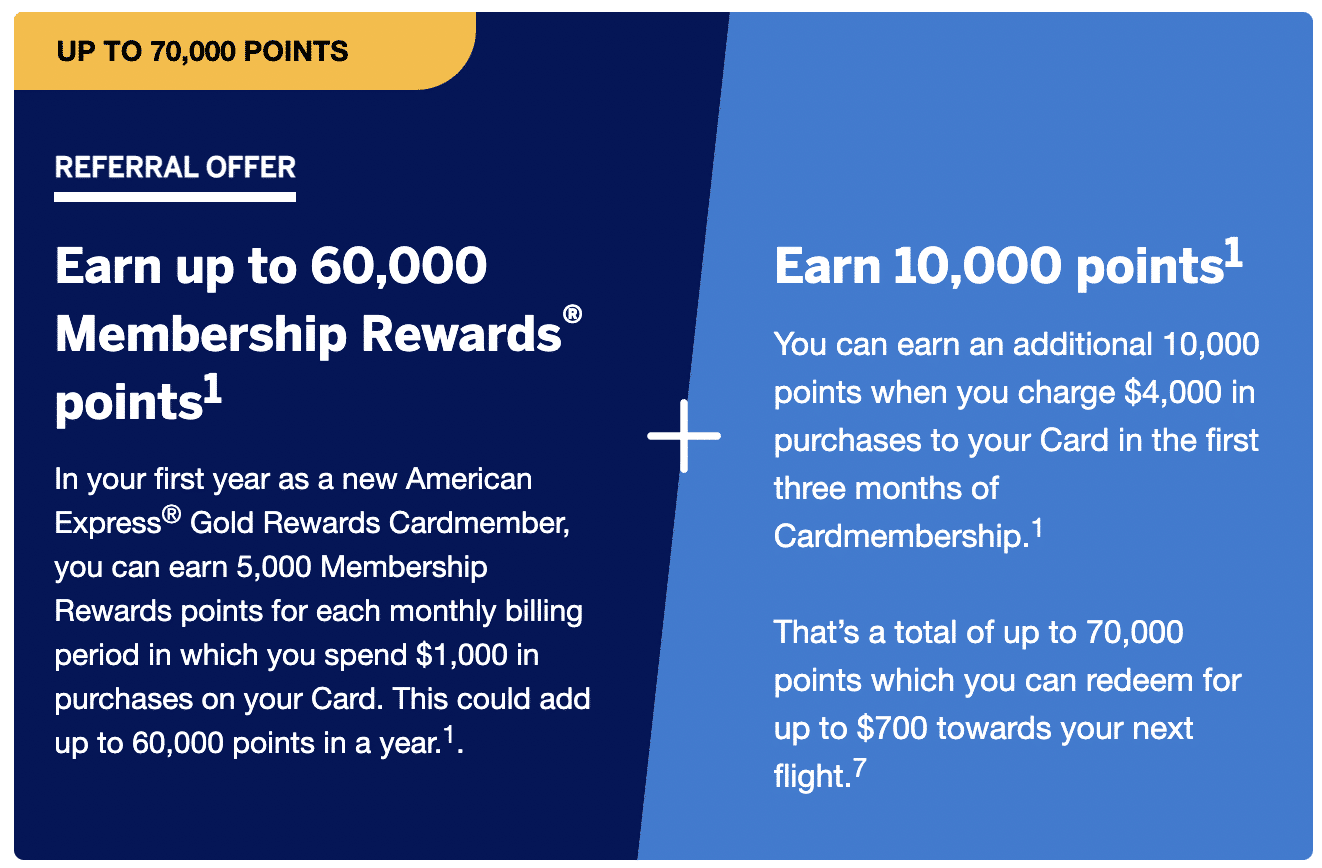

American Express Gold Rewards Card: Up to 70,000 MR Points

There haven’t been any changes to the annual fee or benefits offered on the American Express Gold Rewards Card this time around.

When you apply and are approved for an American Express Gold Rewards Card, you’ll get a welcome bonus worth up to 70,000 MR points:

- Earn 10,000 MR points upon spending $4,000 in the first three months

- Earn 5,000 MR points upon spending $1,000 in each of the first 12 months, up to 60,000 MR points

As long as you can manage and keep track of $1,000 of spending each month for the first year, you’ll have unlocked the full welcome bonus for this card. Just be sure to reach $4,000 in the first three months, as you’ll get an additional 10,000 points with this offer.

The American Express Gold Rewards Card offers a $100 annual travel credit, similar to the $200 annual travel credit on its premium counterpart, the Platinum Card.

The $100 annual travel credit can be redeemed towards any booking of $100 or more through the Amex Travel online portal, including flights, hotels, car rentals, and more.

In addition, the Gold Rewards Card also offers four complimentary visits to Plaza Premium lounges in Canada every year, allowing you to make use of airport lounges in Toronto, Vancouver, Winnipeg, Edmonton, and Montreal.

In terms of the value offered from the current welcome bonus, we value Amex MR points at 2.2 cents per point (CAD).

Since all points are awarded in the first year, you’d earn at least 83,000 MR points upon meeting the minimum spending requirements: 60,000 points from the welcome bonus, 10,000 points upon spending $4,000 in the first three months, and at least 13,000 points for completing the full minimum spending requirement in the first year ($4,000 in the first three months, and $1,000 in each of the remaining nine months).

We’d value 83,000 MR points at $1,826, and when you subtract the $250 annual fee and add the $100 annual travel credit, we arrive at a net first-year value of at least $1,676. If you’re able to take advantage of some Amex Offers or increased category earning rates, the value increases from there.

There’s no listed expiry date for this offer.

- Earn 10,000 MR points upon spending $4,000 in the first three months

- Plus, earn an additional 5,000 MR points upon spending $1,000 in each of the first 12 months, up to 60,000 MR points

- Also, receive an annual $100 travel credit and a $50 NEXUS credit

- Transfer MR points to Aeroplan and other frequent flyer programs for premium flights

- Plaza Premium membership with four annual lounge passes

- Credits and rebates for daily expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Annual fee: $250

Conclusion

American Express Canada has just released some boosted offers on two of its premium credit cards in the Membership Rewards family.

Of note, the offers on the American Express Platinum Card and the Business Platinum Card from American Express are for up to 140,000 MR points and 150,000 MR points, respectively.

If you’ve been holding out for a higher welcome bonus on one of these cards, be sure to take advantage if you can meet the spending requirements.

Be sure to apply prior to January 28, 2025, when the offers are set to expire.

There is one big benefit that I seem to have- my platinum gives 10X MR on airline/travel purchases. Does anyone know how long this is going on for? I applied for the card in spring 2021. Player 2 who applied later that year doesn’t seem to have the same earn rate.