The Scotiabank Gold American Express® Card is one of the best pound-for-pound travel cards in the Canadian market, thanks to its generous earning rates, no foreign transaction fees, and numerous travel perks.

With the card packed full of features and benefits, you might be wondering how you can get the most out of the card and really take advantage of all that it has to offer.

In this guide, we’ll show you how to maximize the potential of the Scotiabank Gold American Express® Card, including by earning and redeeming rewards and everything in between.

1. Get a Kickstart with the Welcome Bonus

You’re off to a great start in maximizing your Scotiabank Gold American Express® Card with its welcome bonus. By applying and being approved for the card, you can score a solid stack of Scene+ points, typically earned in two chunks.

The first batch of Scene+ points is generally earned upon meeting a modest minimum spend requirement within the first three months of the card account opening.

The second batch of Scene+ points is typically earned upon spending a (usually reasonable) set amount within the first year of card membership.

In recent years, the welcome bonus for this card has come in around 45,000 Scene+ points, which are equivalent to $450 that you could use on travel, groceries, and more.

2. Boost Your Balance on Everyday Spending

Once you’ve earned the full welcome bonus on the Scotiabank Gold American Express® Card, you can continue to pad your Scene+ balance with the card’s excellent everyday earning rates.

By paying for many of life’s essentials with your Scotiabank Gold American Express® Card, you can enjoy the following earning rates:

- Earn 6 Scene+ points per dollar spent at Empire Company grocery stores†

- Earn 5 Scene+ points per dollar spent at eligible restaurants and grocery stores†

- Earn 5 Scene+ points per dollar spent on eligible entertainment purchases†

- Earn 3 Scene+ points per dollar spent on eligible gas and daily transit purchases†

- Earn 3 Scene+ points per dollar spent on eligible streaming services†

- Earn 1 Scene+ point per dollar spent on all other eligible purchases (including foreign transactions)†

The card is backed by the Scene+ program, which allows you to earn and redeem points at an elevated rate at a myriad of partners, such as:

- Empire Company stores (Sobeys, Safeway, FreshCo, Lawton Drugs, etc.)

- Recipe Unlimited restaurants (Harvey’s, Swiss Chalet, East Side Mario’s, etc.)

- Cineplex (including The Rec Room and Playdium)

- Home Hardware

Likewise, the Scene+ program allows you to flexibly redeem your points towards travel purchases, merchandise, and gift cards, among other options. The flexibility of Scene+ points is also notable in that you’re able to use your points for expenses like boutique hotels or low-cost flights that aren’t bookable through airline or hotel loyalty programs.

The card is also backed by American Express, which is accepted in 160+ countries and territories – even in countries that you think it might not be, such as Nicaragua, Peru, Vietnam, and Kazakhstan. Additionally, in Canada, more businesses are accepting American Express thanks to initiatives like Shop Small.

3. Up to 6x Scene+ Points on Groceries

The Scotiabank Gold American Express® Card offers one of the highest earning rates on groceries among Canadian credit cards. By using your card at eligible grocery stores, you’ll benefit from the following earning rates:

- 6 Scene+ points per dollar spent at Empire Company’s brands, including Sobeys, Safeway, IGA, Foodland, FreshCo, and Thrifty Foods

- 5 Scene+ points per dollar spent at all other eligible grocery stores

Even better, as partners of the Scene+ program, Empire Company grocery stores let you earn more points with weekly specials and promotions. You can find many of these offers by browsing the digital or print flyer of your favourite Empire Company grocery store.

For example, you can take part in the weekly Scene+ Stock Up deal at Sobeys and easily receive thousands of extra points by simply purchasing the featured items.

Keep in mind that you may also redeem your Scene+ points for an instant rebate on your groceries at Empire Company stores at a rate of 1,000 points = $10. Moreover, you can earn and redeem Scene+ points on the same transaction and truly maximize your savings.

4. 5x Scene+ Points on Dining and Entertainment

Another exciting feature of the Scotiabank Gold American Express® Card is its accelerated earning rate of 5 Scene+ points per dollar spent on eligible dining and entertainment, which allows you to quickly build up your points balance when enjoying a night out.

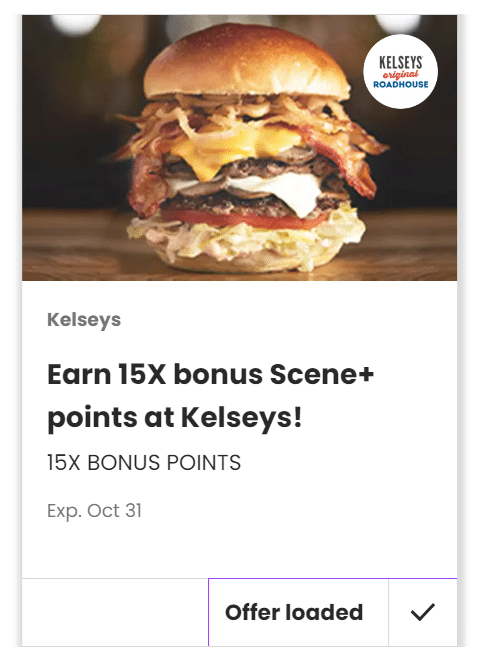

To maximize the number of points you earn beyond those earned with the credit card, you can use the Scene+ app to watch for offers from partnered Recipe Unlimited restaurants and use these to earn up to 15x more points on eligible transactions.

For instance, you could load the 15x offer at Kelsey’s Original Roadhouse and earn 15 Scene+ points per $3 spent. Plus, these earnings are on top of what you earn with the Scotiabank Gold American Express Card, with which you’ll get another 15 Scene+ points per $3 spent.

That means that by combining the special offer and spending on your Scotiabank Gold American Express® Card, you’ll earn 30 Scene+ points per $3 spent, which is equivalent to a 10% return on spending – among the most generous rewards you’ll get from a restaurant in Canada.

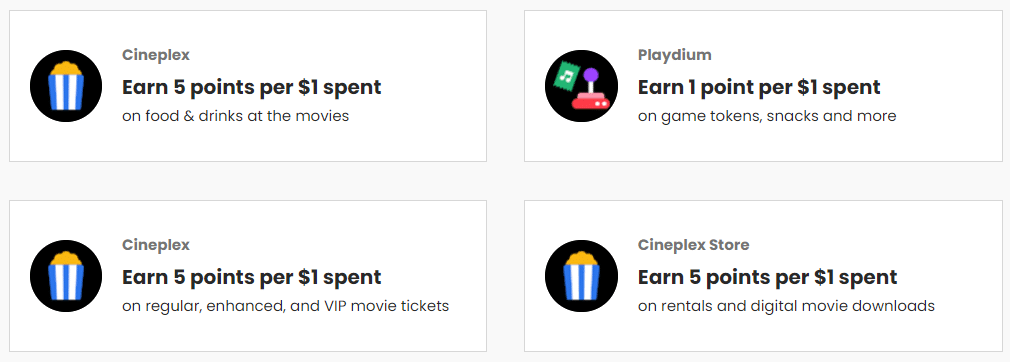

Your movie nights will also be more rewarding when you use your Scotiabank Gold American Express® Card in tandem with your Scene+ membership at Cineplex.

By using your Scene+ membership alone, you’ll earn 5 points per dollar spent on tickets, food, and drinks; however, when you use your Scotiabank Gold American Express® Card to pay, you’ll get another 5 points per dollar spent on the same purchases, doubling your earnings to 10 points per dollar spent, or once again, a 10% return.

5. 3x Scene+ Points on Gas and Daily Transit

Another valuable accelerated earning rate on the Scotiabank Gold American Express® Card is the 3x Scene+ points earned on eligible gas purchases and daily transit.

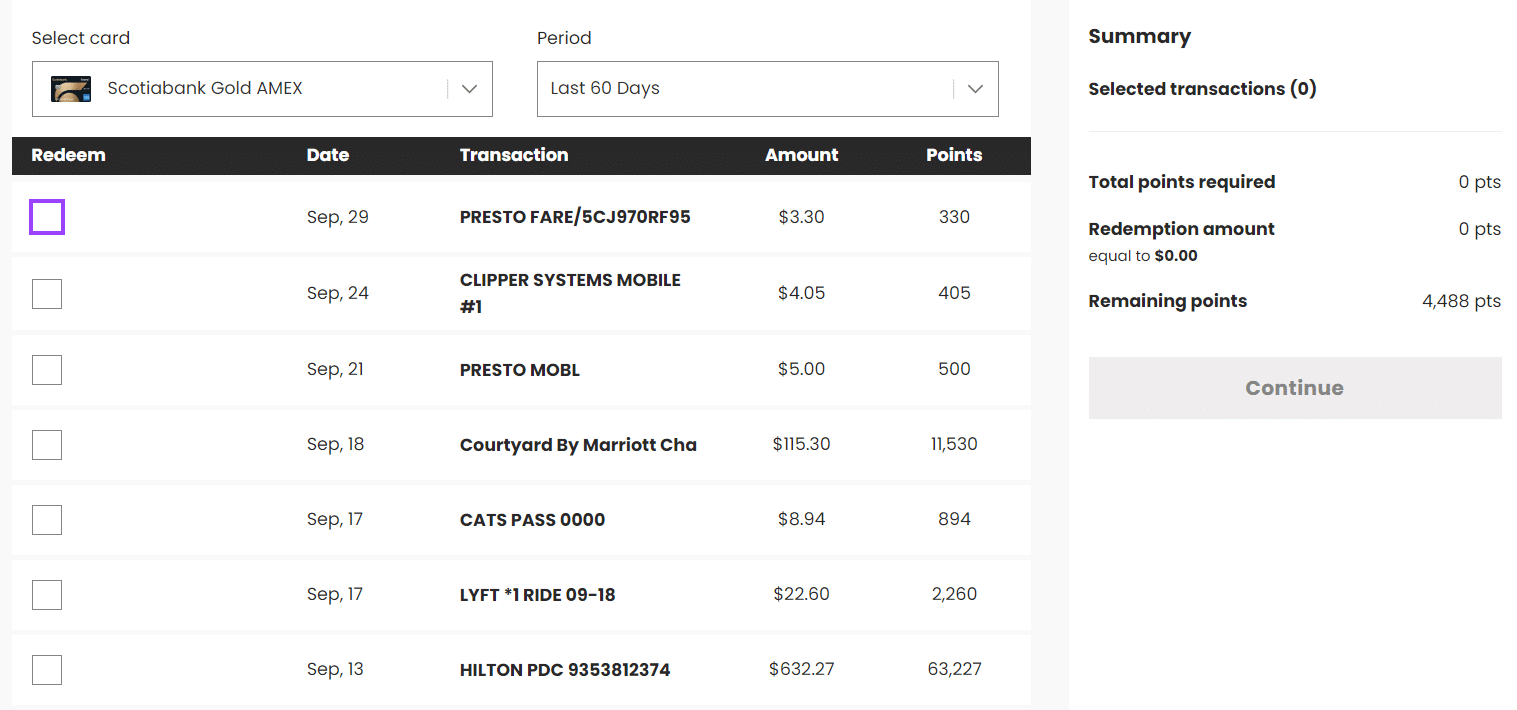

You’ll find this benefit especially valuable these days, since PRESTO, the payment system for many transit agencies in Ontario, now accepts credit cards tapped directly onto its payment devices.

That means that when you take the bus, streetcar, and subway in Toronto, you can tap your Scotiabank Gold American Express® Card directly onto the PRESTO device and easily earn 3 points per dollar spent on your fares, which is equivalent to a 3% return.

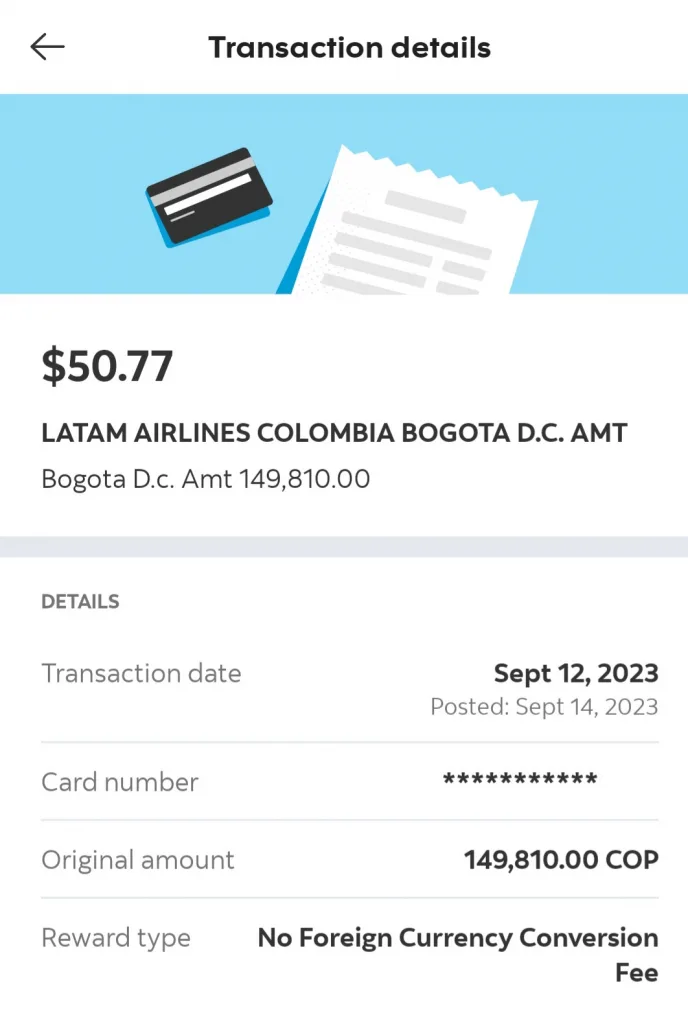

6. No Foreign Transaction Fees

One of the most compelling features of the Scotiabank Gold American Express® Card is that it does not charge a foreign transaction fee on purchases made in foreign currencies.

This means you’ll pay your foreign currency transactions based solely on the mid-market exchange rate, without any additional fees tacked on.

Most Canadian credit cards charge 2.5% or more on foreign transactions, so if you tend to spend a lot of time outside of Canada, these extra fees can really add up.

With the Scotiabank Gold American Express® Card, you’ll not only save the 2.5% on all foreign currency transactions, but you’ll also earn 1 Scene+ point per Canadian dollar spent on all foreign currency transactions (calculated after the currency exchange).

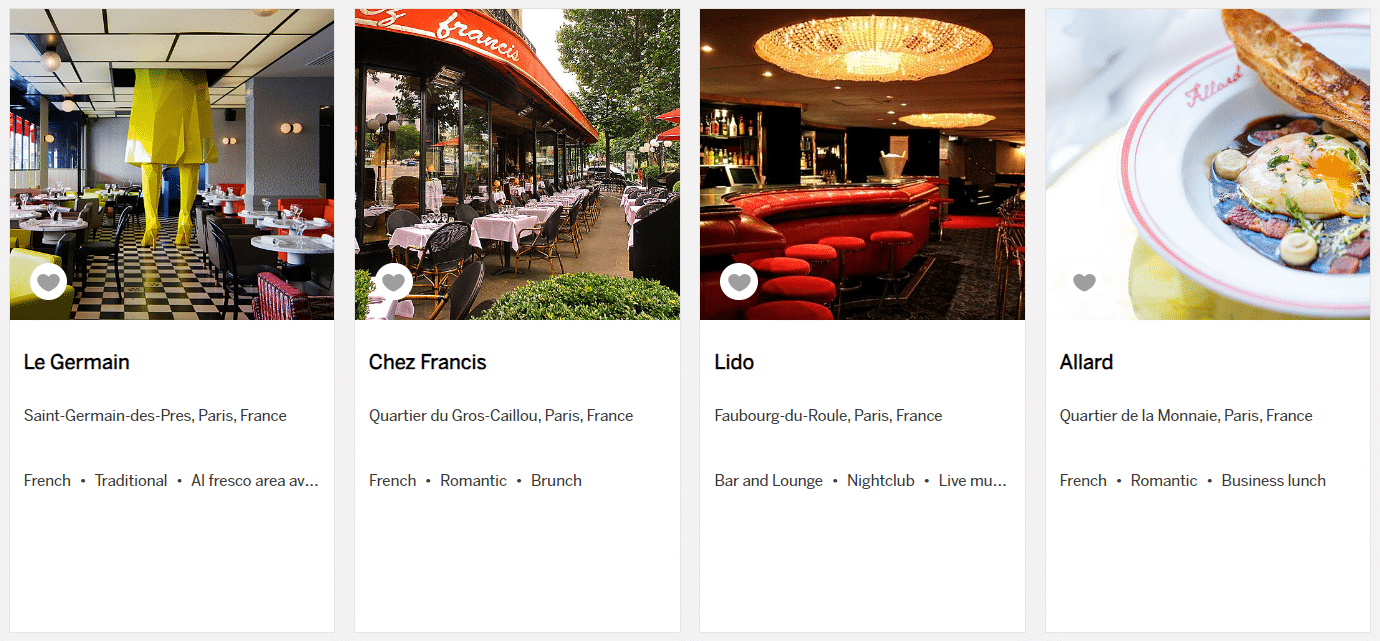

7. Complimentary Concierge Service

While the Scotiabank Gold American Express® Card is attractive for its high earning rates, it’s also supplemented by a slew of features that you can maximize for your travels.

One of these helpful features is the complimentary concierge service, which Scotiabank provides in partnership with Ten Lifestyle Group.

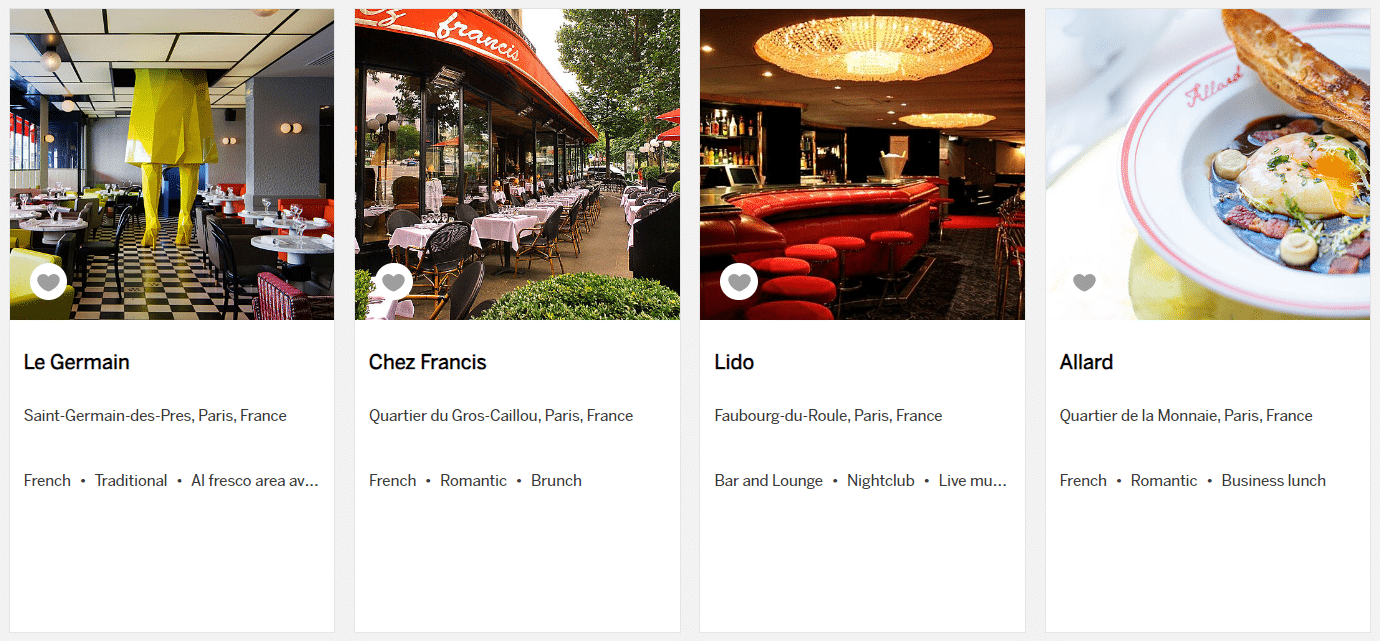

The concierge service can assist you in booking restaurants, hotels, and entertainment (among other services) in Canada and around the world. As a matter of fact, the service has specialists for each geographic region who are equipped to provide personalized recommendations.

As an example, this service can take away the hassle of getting in touch with restaurants and hotels that are in a different time zone or that speak a different language.

In addition, the concierge service offers special perks such as complimentary wine at restaurants, experience credits at hotels and resorts, and exclusive VIP tickets for sporting events.

8. Amex Offers

American Express is known for its offers that help offset its credit cards’ annual fees. Fortunately, with the Scotiabank Gold American Express® Card, you can easily take part in these offers since you can register for Amex Offers through a dedicated portal.

Some examples of popular recent Amex Offers include a $60 statement credit upon spending $250 at Marriott-affiliated hotels in Canada and the US, as well as a $150 statement credit when you spend $750 with United Airlines. In both these cases, the Amex Offer essentially lets you save up to 20% on the associated flights and hotel stays.

If you’re able to take advantage of these Amex Offers and more over the course of a year, you’ll more than offset the Scotiabank Gold American Express® Card’s modest $120 annual fee.

Conclusion

The Scotiabank Gold American Express® Card has a number of standout features and benefits just waiting for you to maximize their potential.

You can earn more Scene+ points by leveraging the card’s welcome bonus and its accelerated earning rates at other Scene+ partners, plus you can take advantage of its travel perks, such as no foreign transaction fees, the free concierge service, and the ever-lucrative Amex Offers.

No matter how you slice it, it isn’t hard to find plenty of value with the Scotiabank Gold American Express® Card.