The US-issued Aeroplan® Card by Chase, is an incredibly strong Aeroplan co-branded credit card, and the only one available outside Canada.

One of the key perks offered on the card is the Elite Status Level Up benefit, through which you can maintain or boost your Aeroplan Elite Status by completing an annual minimum spending requirement.

What Is the Aeroplan® Credit Card Elite Status Level Up Benefit by Chase?

The Elite Status Level Up benefit is one of the most powerful features available on the Aeroplan® Credit Card.

In fact, it’s a feature that’s exclusively found on the Aeroplan® Credit Card, and isn’t available on any other Aeroplan co-branded credit card.

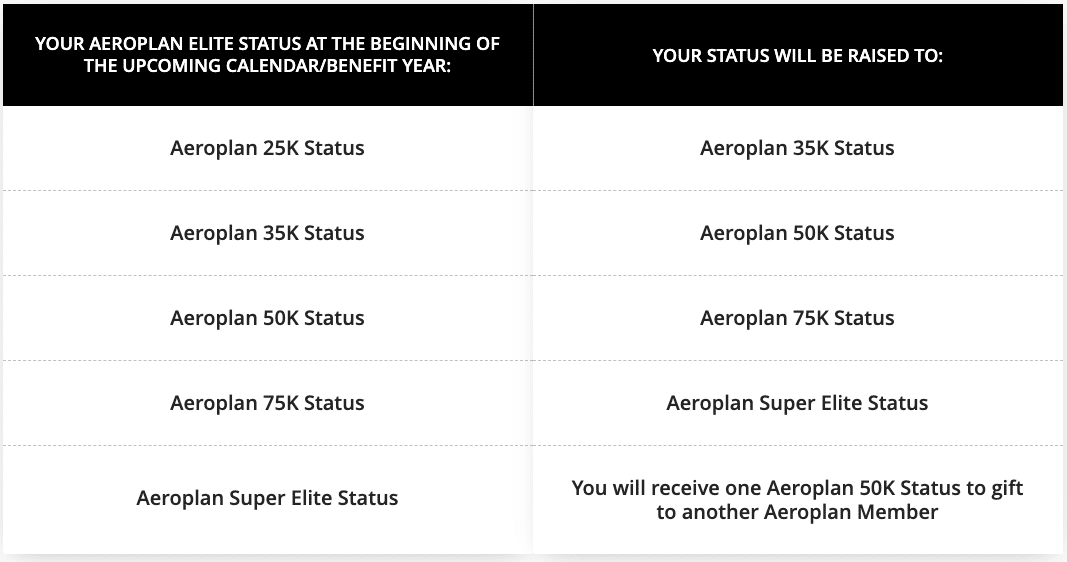

By spending at least $50,000 (all figures in USD) in a calendar year, you’ll unlock the Level Up benefit,† which boosts the Aeroplan Elite Status you have at the start of the upcoming benefit year by one level.†

For example, if you organically qualify for Aeroplan 35K status in 2024 and spend $50,000 on your Aeroplan® Credit Card in 2024, you’ll enjoy a one-level boost to Aeroplan 50K status for 2025.†

The Level Up benefit only applies to the status that you’d have otherwise earned for the next year, rather than your current elite status level.

As a reminder, Air Canada Aeroplan has five elite status levels: 25K, 35K, 50K, 75K, and Super Elite.

If you’re currently an Aeroplan 50K member, but only qualify for 25K status for the next year, the Level Up benefit will bump you up to 35K status, and not 75K status.

Furthermore, if you’ve spent $50,000 on the Aeroplan® Credit Card in a calendar year, you’d already have earned Aeroplan 35K status. This is because upon spending $15,000 in any calendar year, you’ll automatically receive Aeroplan 25K status as a benefit offered on the Aeroplan® Credit Card.†

Therefore, by spending $50,000 each year on your Aeroplan® Credit Card, you’re guaranteed Aeroplan 35K status at the bare minimum: 25K status by spending $15,000, and 35K status by spending $50,000 and unlocking the Level Up benefit.†

However, if you already enjoy an Aeroplan Elite Status level higher than 25K, then the Level Up benefit will increase you one level above that.

If you’re already a Super Elite, there isn’t a status tier to which you can elevate with the Level Up benefit. Instead, you’ll be able to gift Aeroplan 50K status to anyone of your choosing.†

It’s important to note that the one-level status increase doesn’t apply to any Level Up status you may have already earned the year before.

This means that if in the previous year you’d spent $50,000 on the Aeroplan® Credit Card, and increased your 25K status to 35K, you won’t bump up from 35K to 50K by spending another $50,000 on the Aeroplan® Credit Card this calendar year.

Instead, you’ll once again increase your status from 25K to 35K, unless you’ve organically qualified for a higher level of status.

The $50,000 total must be spent and posted to your account within a calendar year. If you make a purchase towards the end of the year, it’ll only count towards the current year if it posts to your account on or before December 31.

For example, if you make a purchase on December 31, but the transaction posts on January 1, or later, it’ll count towards spending for the next year.

However, if you make a purchase on December 28 and it posts to your account on December 31 or sooner, then it’ll count towards your current year.

How to Maximize the Aeroplan® Credit Card Level Up Benefit

It’s worth noting that spending $50,000 on the Aeroplan® Credit Card every year is certainly a lot for many people.

However, it’s worth pursuing if you’re a frequent flyer with Air Canada, since it can result in a meaningful boost to your Aeroplan Elite Status.

As outlined above, spending $50,000 each year guarantees that you’ll enjoy at least 35K status with Air Canada without ever having to fly.†

35K status comes with a number of Air Canada benefits, including access to eUpgrades, an increased baggage allowance, priority airport services, and more.

However, the most intriguing applications of the Aeroplan® Credit Card’s Aeroplan Elite Status Level Up benefit are if you organically qualify for Aeroplan 35K or 75K Elite Status through flying.

For example, if you earn at least 35,000 Status Qualifying Miles (SQM) or 35 Status Qualifying Segments (SQS) and accumulate at least $4,000 (CAD) Status Qualifying Dollars (SQD), you’ll enjoy Aeroplan 35K status.

If you were to then spend $50,000 on your Aeroplan® Credit Card in the same calendar year, you’d boost up to Aeroplan 50K status for the next year via the Level Up benefit.†

The benefits offered at the Aeroplan 50K status level are a meaningful improvement to those offered at 35K.

With Aeroplan 50K status, you’ll enjoy Star Alliance Gold status, which provides access to Star Alliance lounges worldwide when traveling in any class of service, as well as unlimited access to Air Canada Maple Leaf Lounges.

The usual requirements for Aeroplan 50K status are to earn at least 50,000 SQM or 50 SQS and $6,000 (CAD) SQD. Essentially, the Level Up benefits reduce Aeroplan 50K requirements down to the Aeroplan 35K level.

There aren’t too many meaningful changes between the Aeroplan 50K and 75K status levels; however, there are plenty of incremental benefits when moving from Aeroplan 75K to Air Canada’s top-tier Super Elite status.

Indeed, this is where the Level Up benefit is the most intriguing.

Organically qualifying for Aeroplan 75K status requires earning at least 75,000 SQM or 75 SQS and $9,000 (CAD) SQD in a calendar year.

On the other hand, organically qualifying for Super Elite status usually requires earning 100,000 SQM or 100 SQS and $20,000 (CAD) SQD in a calendar year.

However, with the Level Up benefit on the Aeroplan® Credit Card, you can essentially earn Super Elite status with the same requirements as Aeroplan 75K status.

In other words, you’re effectively reducing the requirements to qualify for Super Elite status by 25,000 SQM or 25 SQS, and $11,000 (CAD) SQD.

In this sense, leveraging the Level Up benefit from the Aeroplan® Credit Card offers the easiest pathway to Super Elite status.

As a reminder, Super Elites enjoy a suite of benefits with Air Canada, including:

- Access to Air Canada’s Concierge service

- The most powerful Priority Rewards for Aeroplan redemptions

- Complimentary changes and cancellations to Aeroplan bookings

- An eUpgrade nominee

- The ability to gift 50K status through Select Benefits

- Much more

Therefore, for anyone who’d otherwise organically qualify for Aeroplan 75K status, it’s absolutely worth considering the Aeroplan® Credit Card and working towards the Level Up benefit each year.

Conclusion

One of the unique features of the Aeroplan® Credit Card by Chase, is the Aeroplan Elite Status Level Up benefit. By spending $50,000 each calendar year, you’ll enjoy a one-tier boost to your Aeroplan Elite Status.†

If you’re able to fulfill the $50,000 minimum spending requirement year after year, you’ll enjoy Aeroplan 35K status without ever having to fly.†

However, if you already organically qualify for Aeroplan Elite Status through flying, you could enjoy a boost to your status, which can unlock meaningful benefits with Air Canada and Aeroplan.

The Level Up benefit is the most meaningful for elevating Aeroplan 35K and 75K status to 50K and Super Elite status, respectively.

Therefore, if you tend to qualify for either of these status levels, it’s certainly worth adding the Aeroplan® Credit Card to your wallet and pursuing the Level Up spending threshold.

† Terms and conditions apply. Please refer to the card issuer’s website for up-to-date information.

I have a Chase card using my US address and meet the criteria of the status benefit. I also hold a AMEX aeroplan reserve card. If at the end of the year I have 99,000 SQM and at least 9000 SQD it appears I will get bumped up to Super Elite, which is awesome. I’m curious though with the rollover benefit on the AMEX if the 24,000 SQM will get carried over to next year or they will disappear?

From what I know, Amex Canada’s rollover benefit is separate from Chase Aeroplan and they won’t stack. Chase’s “1 up” only occurs the following calendar year anyway, so the Amex Canada’s rollover won’t be trigger in the current year for the rollover benefit to come into place for the higher status

Hi T.J., if someone gifts you status (say 35k or 50k), does the +1 bump will still work? If so, what are the specifics, e.g., do you have to be gifted status on January 1st in order for the +1 bump to work? Anything else I should be aware of?

While I am not 100% sure, but it would make sense. The +1 function as elevating your current status by 1, and not by giving your more SQM/SQS/SQD to get you to meet the next level’s requirement. While it doesn’t matter when the status is given to you, Jan 1st or around the beginning of the year seems more advantageous, as the status last through the rest of the current year and the following year.

What do you mean by “it doesn’t matter when the status is given to you”? How does the Level Up benefit know which date to look at for the +1? Say I spent $50k on my Chae AP card — that means I’ll get bumped to 35k status in 2024. BUT, if I have a friend that’s willing to gift me 35k, I should be able to get a +1 bump to 50k. My question is how do the mechanics of that work? Do I need to ask my friend to gift me 35k on Jan 1, 2024? What if he’s a week late? Does that mean that I’ll already be at 35k because of my card spend, and he’ll just be wasting his 35k gift on me because it won’t do anything since I’ll already be at 35k? I’m trying to figure out the exact details of how this all works because I don’t want my friend to gift me 35k unless I’m 100% sure I’ll get bumped to 50k.

You need your friend to give you that 35k first, then you meet the card spending criteria giving you that +1 in the same calendar year. The most optimum situation is to have your friend to give you the 35k on Jan 1st, then spend US$50k as soon as possible to get you the +1 to 50k. Hope that helps.

I think you misunderstood how the Status Level Up benefit works. You need to spend $50k in the CURRENT year to get the +1 for the FOLLOWING year. You don’t get the +1 for the current year.

Yes indeed. Your +1 activates on Jan 1st the incoming Calendar year and last through Dec 31st in that same calendar year.

It’s frustrating that this is only available to those in the US. I just started playing with US cards to be able to get this one in the future, as unfortunately I don’t organically qualify for status as I am mostly flying on points.

Thank you, appreciate your time in answering.

I have a US address and meet Chase’s application criteria. Thinking it would be much easier to attain 25k status every year than with my CIBC Aeroplan VIP card/flying. Any rumors the Canadian Aeroplan VIP cards might have some changes for attaining elite status? For Chases $95 yearly fee, that is a far better package than CIBCs $495.

The Chase Aeroplan Card is indeed a very strong card for many reasons. We aren’t aware of any new status benefits coming to Canadian cards, so if you qualify, it’s definitely worth it.