It’s been a while since we touched upon the basics of credit and how your credit score works, and I’m starting to hear those persistent credit-related myths – everything from “opening new credit cards is bad for your credit” to “cancelling credit cards is bad for your credit” – being bandied about again.

In this post, let’s review the exact credit impact of every moment throughout a credit card’s life cycle, from the initial application to the closing of the card.

The goal is to understand exactly what you’re getting into when you sign up for credit cards and the credit impact of each step of the process, both in terms of the direction (i.e., whether the impact is positive or negative) and the magnitude (i.e., how much of a change in your credit score is expected).

In This Post

- How Your Credit Score Works

- 1. Application

- 2. First Statement

- 3. Subsequent Statements

- 4. Cancellation

- 5. Next Application

- Conclusion

How Your Credit Score Works

As a reminder, your credit score is calculated from the following five components:

-

Payment history (35%): How reliably you pay your bills on time

-

Utilization (30%): The closing balances on your credit card statements as a percentage of your total credit limit; it’s best to keep this in the 5–20% range for every card you hold

-

Length of credit history (15%): How long your credit history has existed for, most commonly measured by an Average Age of Accounts (AAoA) calculation

-

Recent inquiries (10%): The number of recent “hard inquiries” from credit issuers to your credit file; the fewer, the better

-

Credit mix (10%): How diverse your credit portfolio is, in terms of having multiple types of credit on file (credit cards, mortgage, car loan, line of credit, etc.); this one is the least relevant to our discussion of credit cards

You can read my guide on “All About Credit Scores”, or watch the below video, to get a more in-depth understanding of each of the above components:

There are a number of services that Canadians can use to check their credit scores or obtain copies of their credit report, such as Borrowell, CreditKarma, or Credit Verify.

1. Application

A credit card’s life cycle begins with submitting a new application. As soon as you click the “Submit” button, the credit issuer takes the information you’ve provided and verifies it against the credit bureaus’ records, creating a hard inquiry on your file in doing so.

(For simplicity’s sake, we’ll gloss over the situations where it’s possible to submit more than one credit card application for a single credit inquiry, such as some credit issuers combining all new application submitted on the same day into one credit inquiry, or CIBC branch representatives being able to re-use credit inquiries within a 90-day period, etc.)

-

Recent inquiries (10%): A new hard inquiry has been added to your credit file, which lowers this component of your credit score.

No other credit components are impacted at this stage just yet. Since recent inquiries only account for 10% of your score, you’ll probably see an impact of a 5–10 point drop in your score, but not much more than that.

After submitting the hard inquiry, the financial institution uses the information to decide whether or not to issue you the card.

If you’re declined, it’s unfortunately going to be a “waste” of a credit inquiry, in the sense that you experienced a 5–10 point drop in your credit score without getting anything in return. If you’re approved, we proceed to the next stage…

2. First Statement

Applying for a credit card and your first statement being posted are often conflated into the same event, although they are in fact two separate occurrences with distinct credit impacts.

When you apply for a new card, a new inquiry is added on your credit file. Meanwhile, at the time of your first statement being generated, the new credit card account reports to your credit file for the first time, creating, in technical terms, a new “trade line” on your list of open and/or revolving accounts.

-

Utilization (30%): The impact on utilization will depend on a few things:

-

If your first statement balance has closed in the range of 5–20% of your overall credit limit, then your reasonable utilization ratio will have a slight positive impact

-

If you’ve applied for a product that has no credit limit (such as one of the Amex charge cards), then some credit score calculation models use a “high credit” in place of the credit limit, which is the highest statement balance that a cardholder has had over a period of time; however, other credit score calculations models exclude charge cards entirely from the utilization criterion

-

-

Length of credit history (15%): Since the new trade line is a brand-new account with an age of one month, it lowers the overall AAoA calculation, resulting in this component of your score becoming slightly weaker, because your overall credit portfolio has just gotten slightly “younger”.

All things considered, because of the impact on the length of credit history component, the moment that the first statement is generated can leave another slight negative impact of 5–10 points on your credit score.

Combine that with the earlier impact from your new application, and that’s why it’s commonly accepted that a new credit card application causes your score to decrease by a small amount at first.

Furthermore, keep in mind that different credit scoring models treat charge cards in different ways. If the model uses a “high credit” in place of a credit limit, then you’ll necessarily be posting 100% utilization on your first monthly statement on a charge card, which may also exacerbate the slight negative impact of opening a new card.

3. Subsequent Statements

As your credit card generates more and more statements, you should of course doing your best to pay off your bills in full and on time, as well as maintaining a reasonable utilization rate of 5–20% on all your cards if you want to go the extra mile to take care of your credit.

(This entails pre-paying your balance to bring the closing amounts down to 5–20% of your credit limit if you happened to run up the balance with lots of purchases on a certain month.)

This period of time is where the three most significant components of your credit score, which account for 80% of the score in total, begin to work their magic:

-

Payment history (35%): As you continue to demonstrate a strong payment history, the largest component of your credit score strengthens month by month.

-

Utilization (30%): As long as your balances are kept in the healthy 5–20% range, the utilization component also grows stronger and stronger.

-

Length of credit history (15%): As your credit account gets older and older with every passing month, it makes a more meaningful contribution to the AAoA calculation, slowly strengthening this component as well.

Overall, as the months go by, a huge chunk of your credit score is strengthening behind the scenes, thus recovering quite easily from the initial negative impact that we saw from the new inquiry and the new trade line.

It’s worth noting that credit accounts that are fewer than six months old are often marked as “R0” (technical shorthand for “too new to rate”), which transforms into “R1” (shorthand for “in good standing”) at the six-month mark.

Therefore, the above positive credit impacts are much more pronounced after holding onto a card for six months, which is one reason why it’s often advised to keep cards open for at least six months before cancelling them.

4. Cancellation

In the time since opening the credit card, you’ve met the spending requirement, claimed the signup bonus, and allowed your credit card to age to the six-month mark to optimize the credit impact.

Now, you’re ready to cancel the card, perhaps before the second year’s annual fee comes due to avoid paying more out-of-pocket than you need to. What happens next?

-

Payment history (35%): After the account is closed, the card no longer contributes to strengthening this portion of your credit score on an ongoing basis. This isn’t exactly a negative impact, but rather, the previously seen positive impacts will no longer apply going forward.

-

Utilization (30%): Similar to above, while the previous positive impacts of your utilization ratio will still be on the record, the card will no longer contribute to this component on an ongoing basis.

-

Length of credit history (15%): Even though the account is closed, it remains on your credit file for at least seven and at most 10 years before dropping off the report, thus continuing to strengthen this portion of your credit score even after the account is closed

That last point is very often misunderstood – people think that by closing a credit card account, you’re wiping it off your credit file and thus reducing the AAoA.

Instead, both Equifax and TransUnion maintain records of up to 10 years, and since a closed account is still an account after all, it continues to speak to the fact that you’ve been handling credit responsibly for however many years you have.

Having said that, it’s usually recommended to keep one or two of your oldest credit accounts open forever, since you could see a major hit to your AAoA (and therefore your overall credit score) if those oldest accounts were to drop off the report after seven to 10 years’ time.

Drawing upon both the technical workings of credit and the anecdotal evidence, there is no significant credit score impact with either of the major bureaus from closing a credit card, as long as you have fully paid off the balance and you also have other credit cards that you’re continuing to use responsibly (i.e., paying off the bills on time and maintaining a reasonable utilization).

5. Next Application

When you apply for another credit card, the cycle begins all over again from the start, with a small negative impact resulting from the new inquiry and subsequent new trade line, followed by that impact being more than recovered by your strengthening components of payment history, utilization, and length of credit history.

I should remind you, however, that credit issuers rarely look at your credit score in isolation – indeed, many of them may not even see the exact score that you see, instead only receiving a copy of your detailed credit report and making assessments based on that.

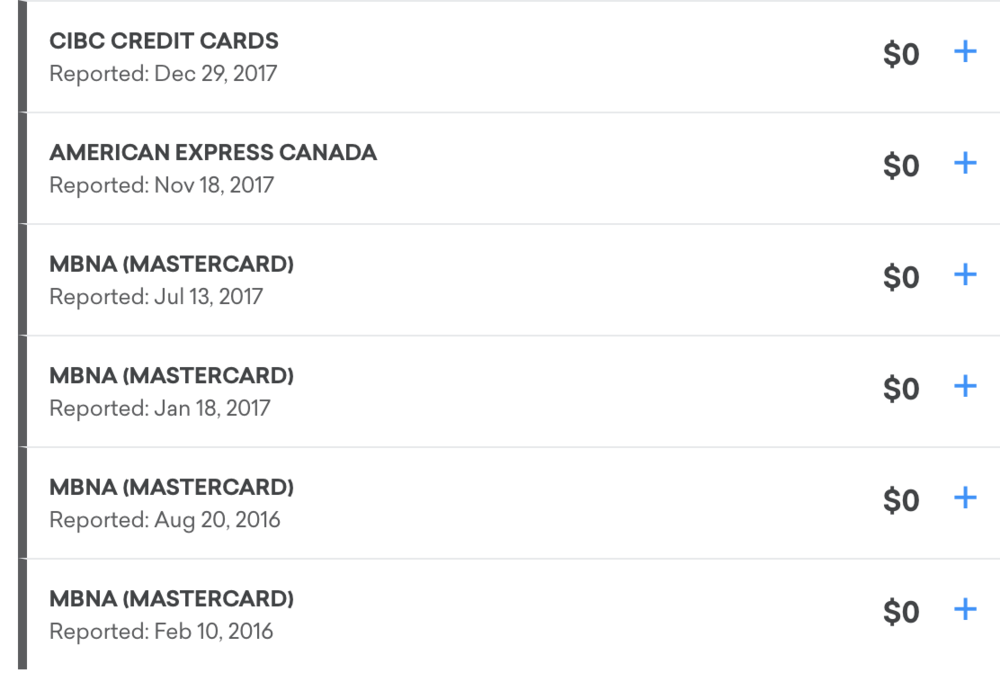

For example, MBNA is known to be quite strict on how many recent inquiries they see on your file. If they see too many inquiries within the past six months, they’re likely to deem it as “credit-seeking behaviour” and decline your for a new card, even if your score is in the high 800s.

(Thankfully, in these situations, you can always call MBNA’s credit department and persuade them to split off the credit limits from an existing MBNA card to get approved.)

There are a plethora of other ways that credit issuers could interpret the numbers on your credit report to assess your application, and even if you don’t meet their requirements at first and get declined as a result, you can often call in and make your case for the New Accounts team to reconsider.

For that reason, while it’s definitely important to get a handle on how the credit system works and how your credit is impacted by the major events of a credit card’s life cycle, you shouldn’t place too much emphasis on the score itself.

Rather, you can simply treat it as a rough indicator of your credit health, and take comfort in the fact that as long as it’s above 700, you shouldn’t have too much trouble getting most of the credit cards worth getting.

Conclusion

There has always been a great deal of confusion and hysteria around the topic of credit scores, and it tends to be the first major mental obstacle that must be overcome by those who are new to Miles & Points. I hope that this post, which outlines the exact positive and negative credit score impacts of every moment along a credit card’s life cycle from application to cancellation, is helpful to you in understanding exactly what you’re getting into.

Once you understand the basics of your credit score, there’s really no need to overthink it beyond checking your CreditKarma account maybe once a month. After all, what’s the point if having a good credit score if you aren’t going to use it to get the stuff you want – whether it’s a house, a car, or some amazing travel experiences on the credit card companies’ dimes? 😉

Hi Ricky,

I have one or two no annual fee cards that I’ve had for a very long time, however I never use them. Is it better for my credit score to close them because of the low utilization, or keep the open because of the AAoA? Thank you!

Is your credit rating affected by not using the card, once you’ve received the bonus points and paid it off?

Is there a significant difference in scoring algorithms between TU & EQ? If not, why there is a huge difference in scores, whereas there is no difference in utilization, history, or paying on time? I have TU score of 794 and at the same time EQ score of 684 !! Thats a difference of almost 110 points. Same for P2, there is a difference of almost 125 points. I dont understand this. And never show any significant improvements in EQ score over the time. TU score drops & moves up quite fast. Can you chime on this? Completely out of mind.

They each have their own proprietary algorithms, placing different weights on different factors. In addition, different credit issuers place inquiries to different bureaus (for example, Amex pulls from TransUnion, whereas TD pulls from Equifax, etc.) so that can also explain part of it.

I wouldn’t overthink this difference too much, as long as you’re taking good care of the factors that are within your control (payment history and utilization).

So, having a high Credit limit is actually a good thing? How does having a high credit limit (and not utilizing it) affect my ability to get more cards (more bonuses). Was recently approved for two high end cards; both amex. Business PLatinum card and then the (p) Bonvoy amex (21,000 limit upon instant approval)

Having a high credit limit makes it easy to keep your utilization at a reasonable level. However, having too high a credit limit, while it doesn’t affect your credit score, can cause some issuers to think that you’re "overextended" (i.e., you have too much credit available to you at the moment); some people choose to voluntarily lower their highest credit limits for this reason. This would fall into the category of individual factors that each issuer looks at that I mentioned at the end of the article.

Saw a whopping 80+ point drop in Equifax after getting a personal AMEX platinum. It’s starting to slowly recover. Over the same period of time, got a 40 point increase in TransUnion. No balances, no cancellations, no other applications, nothing unusual in utilization… I know it’s all just math, but sometimes I really don’t understand it!

Just a suggestion, but could you please make your RSS button more visible? It was a nightmare to find and I had to go through SquareSpace documentation to subscribe to your RSS feed.