Brim Financial has just released its latest offer available on the Air France KLM World Elite Mastercard®.

This time, new cardholders will get 60 XP towards earning status and first-year annual fee waiver.

Air France KLM World Elite Mastercard: Earn 60 XP

The latest offer for the Air France KLM World Elite Mastercard® allows new cardholders to earn 60 XP, which you can use to earn or maintain Flying Blue elite status.

Plus, the card’s annual fee of $132 is waived for the first year as part of this offer.

It’s worth noting that this is the baseline welcome bonus available on the card, as we’ve seen welcome bonuses of up to 60,000 Flying Blue miles or 100 XP in the past.

There’s no listed expiration date on the offer, so if you’re interested in getting a leg up on your journey towards Flying Blue elite status, consider adding this card to your portfolio.

Make sure that the details you provide on the application form match those on your Flying Blue account, including your email address and Flying Blue number.

Air France KLM World Elite Mastercard®: Earning Rates & Other Features

As for the earning rates on spending, the Air France KLM World Elite Mastercard® offers the following:

- 5 bonus miles per euro spent on Air France and KLM flights

- 2 miles per dollar spent at restaurants and bars

- 1 mile per dollar spent on everything else

- Up to 30 miles per dollar spent on Brim’s merchant partners

Breaking this down, the earning rate for Air France and KLM flights is unmatched in Canada. If you’re someone who books revenue flights with Air France or KLM, holding the Air France KLM World Elite Mastercard® offers an excellent return.

As a baseline Flying Blue Explorer member and a cardholder of the Air France KLM World Elite Mastercard®, you can earn 9 Flying Blue miles per euro spent on Air France and KLM flights: 5 miles per euro spent as a cardholder, and 4 miles per euro spent as an Explorer member.

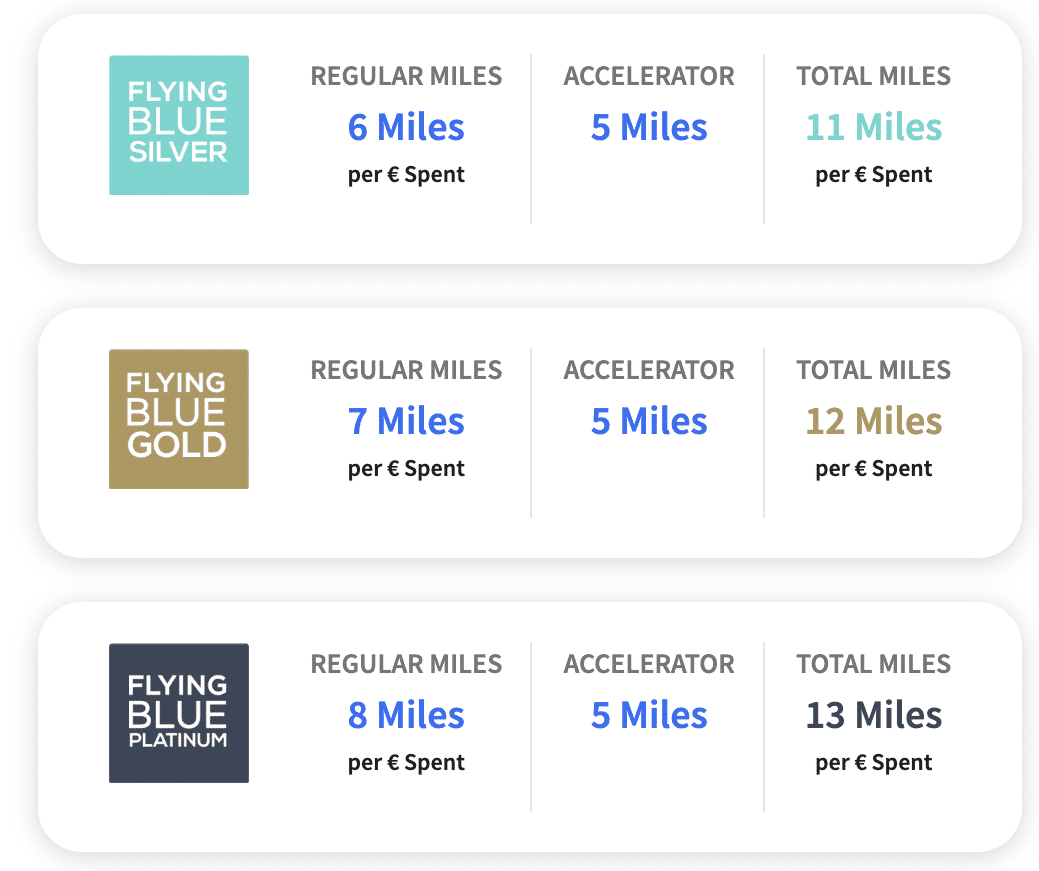

This rate is elevated even further if you happen to also enjoy Flying Blue Elite status, as you’ll enjoy the following additional earning rates depending on your status:

- Silver Elite members earn a total of 11 miles per euro spent on Air France and KLM flights

- Gold Elite members earn a total of 12 miles per euro spent on Air France and KLM flights

- Platinum Elite members earn a total of 13 miles per euro spent on Air France and KLM flights

The above multipliers only apply to eligible cardholders of the Air France KLM World Elite Mastercard® with Flying Blue status, and only on the base fare and any carrier-imposed surcharges. Additional cardholders are also eligible for the elevated earning rate, as long as they’re also Flying Blue members.

In other words, you’ll only earn the 5x bonus Flying Blue miles for tickets booked in your own name. If you make a booking for a family of four, you’d only earn 5x Flying Blue miles for yourself, unless other passengers are additional cardholders and Flying Blue members, too.

As for the card’s other earning rates, you can earn up to 30 miles per dollar spent with Brim’s partners. You’ll need to check the Brim app to see which partners are eligible for the various rates.

The earning rate of 2 Flying Blue miles per dollar spent at restaurants and bars is competitive with other airline co-branded credit cards in Canada.

The Air France KLM World Elite Mastercard® also features strong insurance coverage, including some unique coverage exclusive to cards issued by Brim.

As a cardholder, you’ll enjoy 12 complimentary 90-minute Boingo Wi-Fi sessions each year, as well as unlimited access to Boingo hotspots worldwide.

Unlike other World Elite Mastercard products issued by Brim Financial that charge a 1.5% foreign transaction fee, purchases made outside Canada with the Air France KLM World Elite Mastercard® come with a 2.5% foreign transaction fee.

Who Should Apply for the Air France KLM World Elite Mastercard®?

If you’re loyal to either Air France or KLM in any capacity, there’s a very strong argument to be made for adding this card to your wallet.

This is especially the case if you often book revenue tickets on Air France or KLM and have Flying Blue Elite status, as this card’s earning rate is unmatched in this area.

However, this card may also have broad appeal to travellers who wish to book transatlantic flights at a steep discount.

Air France KLM Flying Blue offers some of the most competitive award prices for flights between Canada and Europe.

While Flying Blue employs a form of dynamic pricing on awards, it’s possible to find the following baseline prices for award flights from Canada to Europe:

- 20,000 miles for a one-way flight to Europe in economy

- 35,000 miles for a one-way flight to Europe in premium economy

- 50,000 miles for a one-way flight to Europe in business class

Furthermore, the airlines have a strong footprint in Canada, with direct flights available to Vancouver, Edmonton, Calgary, Toronto, Ottawa, Montreal, and Quebec City.

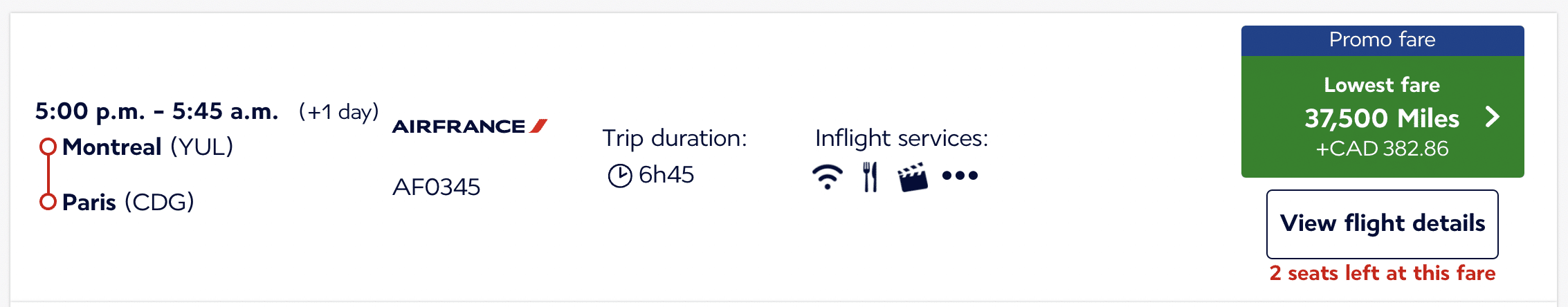

Plus, with Flying Blue’s monthly Promo Rewards, you could be able to squeeze even more value out of your miles.

For example, in the past year, we’ve seen business class Promo Rewards between Europe and Canada available for as little as 37,500 Flying Blue miles, 17,500 Flying Blue miles in premium economy, and just 15,000 miles in economy.

If you need to top up your account, keep in mind that Flying Blue is a transfer partner of American Express Membership Rewards at a 1:0.75 ratio.

Taking the transfer ratio into account, the Air France KLM World Elite Mastercard® has a superior baseline earning rate to many Canadian-issued Amex cards, and is competitive with most cards in the restaurants and bars category, with the exception of the American Express Cobalt Card.

If you already access the Flying Blue ecosystem by way of American Express Membership Rewards, the Air France KLM World Elite Mastercard® could be an excellent card to use in tandem.

Conclusion

Brim Financial has an new offer on the Air France KLM World Elite Mastercard®, giving new cardholders 60 XP and a first-year annual fee waiver.

As a loyalty program, Air France KLM Flying Blue continues to add value at a time when many other programs have been imposing devaluations and removing features.

There’s no listed end date on this offer.

†Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

I am aware that the last offer of 50K points (without 1st year fee waived) just expired. They seem to have the same promotion last year but forgot when. Do you have the history? Want to see if there might be a pattern to time the XP qualification period.

If you earn the points and then cancel the card after the first year, and after paying the two annual dues, would you still keep the points earned?

Yes you will. But if you have already paid the 2nd year’s annual fee, why not just keep the card for another 11 more months? Since you have already paid for it.

“That’s enough for a one-way flight to Europe in business class from anywhere in Canada!” …

But I’ve found very few itineraries that actually are priced at 50,000 points. And for those few, the additional taxes & fees is $342, most of which is carrier surcharge.

I calculate my cost of a one-way business class ticket as: $132 + $132 + $342, plus the opportunity cost on spending that $5000 on some other card (min 2% = $100). So that’s $706, plus waiting 14 months to get to 50,000+ points. So I dunno. :/

How would it work if my spouse is currently a supplement cardholder on my card. Does he apply first and then i cancel the supplemental card or is it the other way around?

Hi Joanne, being a supplementary cardholder would not make your spouse ineligible to apply for the card. He can apply for his own card, and you could cancel the supplementary card if it is no longer providing value to you.

This is a terrible credit card and the customer service is atrocious. There is no phone number for the Flying Blue card and Brim customer service tells you that you can only contact them by email. They do not respond in 2 business days as outlined in their email response. No miles have been credited from the card purchase or bonuses to my Flying Blue account despite payment for the first statement being processed.

Be warned when applying for this card how poor the support is as well as miles not being credited either for purchases or bonuses. Flying Blue should be embarrassed that they are associated with Brim.

On the Air France website for the card, it’s indicated that the yearly fee is waived for the first year.

Hey Nicolas, we spoke with Air France and they have confirmed that there is no annual fee waiver, this is an error on Flying Blues side and they are working to resolve this as soon as possible.

I booked KLM rickets for my wife and parents using this card and I am not seeing any miles earned for this spend. I did however see miles earned for myself. That means you only earn miles if you fly the ticket in the form if the accelerator, but don’t earn any miles otherwise for the spend on KLM. Is this correct?

Thanks.

Reward miles for flying are earned by the individual flying, not by the credit card holder who paid. You will earn credit card multiplier points for the purchase, though.

I wonder if WestJet will recognize the Brim / Flying Blue AF-KLM Silver Status as it does Delta’s for Silver level perks when booking on WestJet and adding one’s Flying Blue number to the reservation?

Hi Rohin, the annual fee was credited to my account a couple days ago so it seem they are at least crediting the fee for some new application.

$15k spend to get 60k flying blue points while also paying 2 years of annual fees? Hard pass. I mean consider the opportunity costs there, pretty huge. Clearly the guys at Brim Financial are amateurs in this space. Maybe they need a few consults from you Ricky.

There are much easier ways to earn flying blue points: Amex, Chase, Citi etc.