Porter Airlines is on fire! Just a day after announcing new routes, the airline has released another exciting news, introducing its very own co-branded credit card.

Porter Airlines, BMO, and Mastercard have joined forces to bring the BMO VIPorter Mastercard suite, set to launch in spring 2025. This new travel credit card lineup is designed to reward frequent flyers and casual travellers alike, offering more ways to earn and redeem VIPorter points on everyday purchases and travel spending.

As Porter strengthens its loyalty program, this card is expected to make travel more rewarding and accessible for Canadians.

In This Post

- A Strategic Collaboration for Canadian Travellers

- What We Know About the New VIPorter Credit Cards So Far

- Special Perks for Early Applicants

- Conclusion

A Strategic Collaboration for Canadian Travellers

This partnership brings together Porter’s growing reputation for elevated economy travel, BMO’s expertise in financial services, and Mastercard’s global payment network.

The result? A credit card program designed to offer enhanced travel benefits, making it easier than ever for Canadians to turn their everyday spending into meaningful rewards.

Kevin Jackson, President of Porter Airlines, emphasized that the new credit card suite is part of Porter’s broader strategy to expand its network and reinforce its loyalty program.

“The launch of the BMO VIPorter Mastercard suite is the first of many loyalty enhancements that will create substantial value and recognition for our VIPorter members.”

BMO’s Jennifer Douglas echoed this sentiment, highlighting the importance of providing customers with a credit card that aligns with their lifestyle and travel goals.

“Knowing many Canadians look for a credit card that bridges their lifestyle with their financial goals, we will empower our customers to accelerate their travel rewards journey, helping them make real financial progress and bringing them closer to their next travel destination.”

Frankly speaking, BMO has lagged behind other financial institutions in the credit card game, lacking a direct affiliation with an airline or hotel credit card and missing a transferable points program for frequent flyer miles.

This partnership with Porter Airlines marks a major step forward for BMO, finally giving Canadian travellers a reason to consider their credit card offerings more seriously. Whether this signals a broader expansion into premium travel rewards remains to be seen, but it’s certainly a bold step in the right direction.

What We Know About the New VIPorter Credit Cards So Far

While full details of the card benefits have yet to be disclosed, here’s what we know so far:

- Earn VIPorter points faster: Cardholders will accumulate VIPorter points on everyday purchases, making it easier to redeem flights and perks across Porter’s growing network.

- No blackout dates: Members can redeem points for any available seat on Porter flights, with flexible options including points-only and cash+points redemptions.

- Qualifying spend carryover: A Head Start feature allows members to roll over up to $3,000 in Qualifying Spend to the next year, accelerating their progress toward VIPorter Avid Traveller status.

- Confirmed PorterReserve flight certificates: Members can earn PorterReserve flight certificates, starting at $3,000 in annual spend.

Additionally, VIPorter points will be redeemable not only on Porter’s flights but also through its expanding list of global airline partners. A key aspect we’re waiting to see is the reciprocal mileage redemption plan with Porter Airlines and Alaska Airlines, which would significantly impact the VIPorter points earning strategy.

Taking some educated guesses, we hope to see accelerated points earning on Porter Airlines spending, alongside bonus categories such as groceries, dining, and transit.

A couple of other valuable perks would be complimentary carry-on baggage for credit cardholders, even on PorterClassic Basic fares, and perhaps complimentary access to the Aspire Air Canada Café at Billy Bishop Toronto City Airport (YTZ) although you can currently access with a Priority Pass or Visa Airport Companion program membership.

Special Perks for Early Applicants

To build anticipation for the launch, Porter has opened a pre-launch waitlist. You may join the waitlist by clicking here. Eligible applicants who sign up early will receive an extra 10,000 VIPorter points, in addition to the welcome bonus that will be available once the cards are officially released.

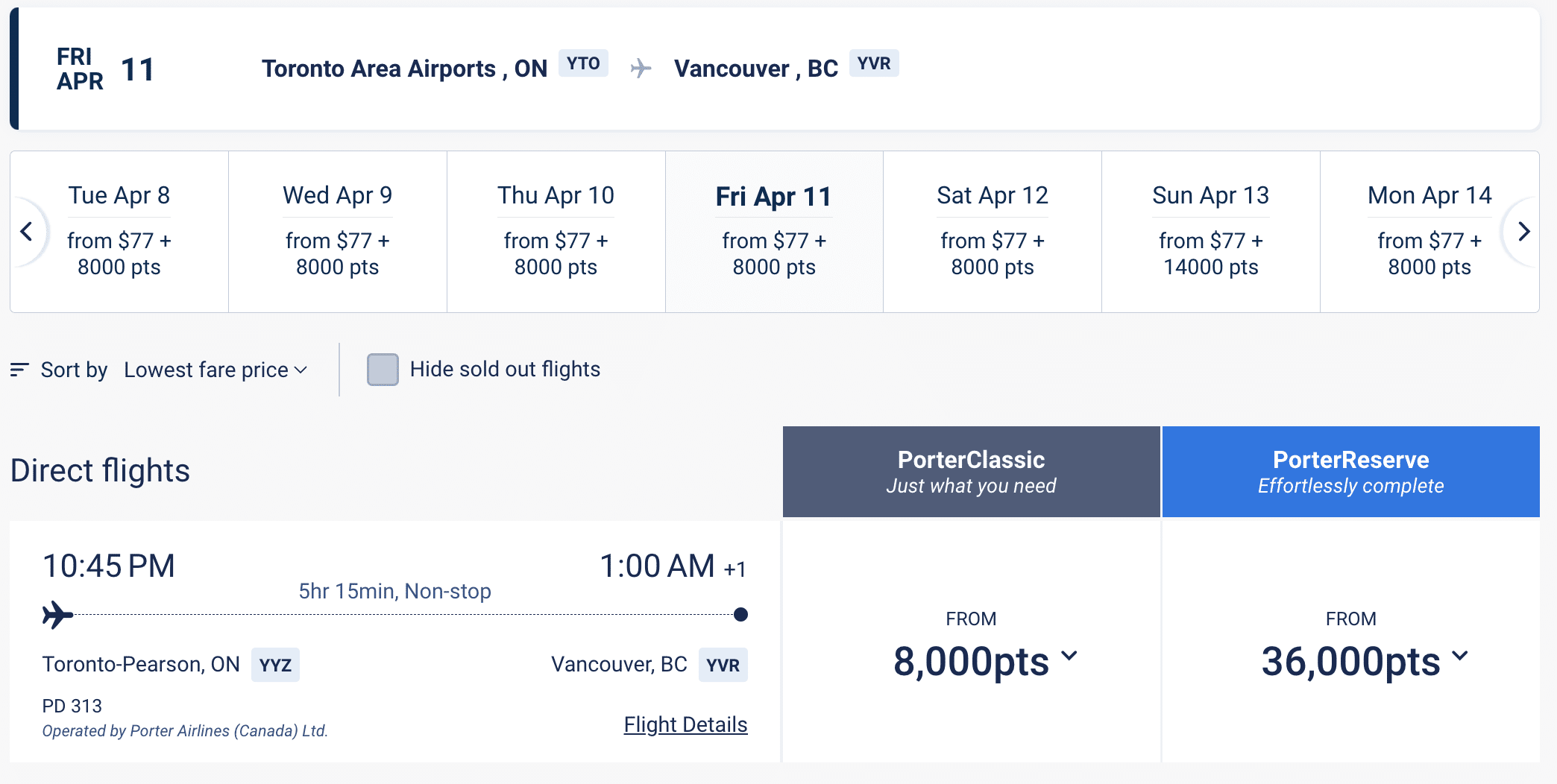

This generous bonus can already cover a Toronto (YYZ) to Vancouver (YVR) flight, which typically requires 8,000 VIPorter points.

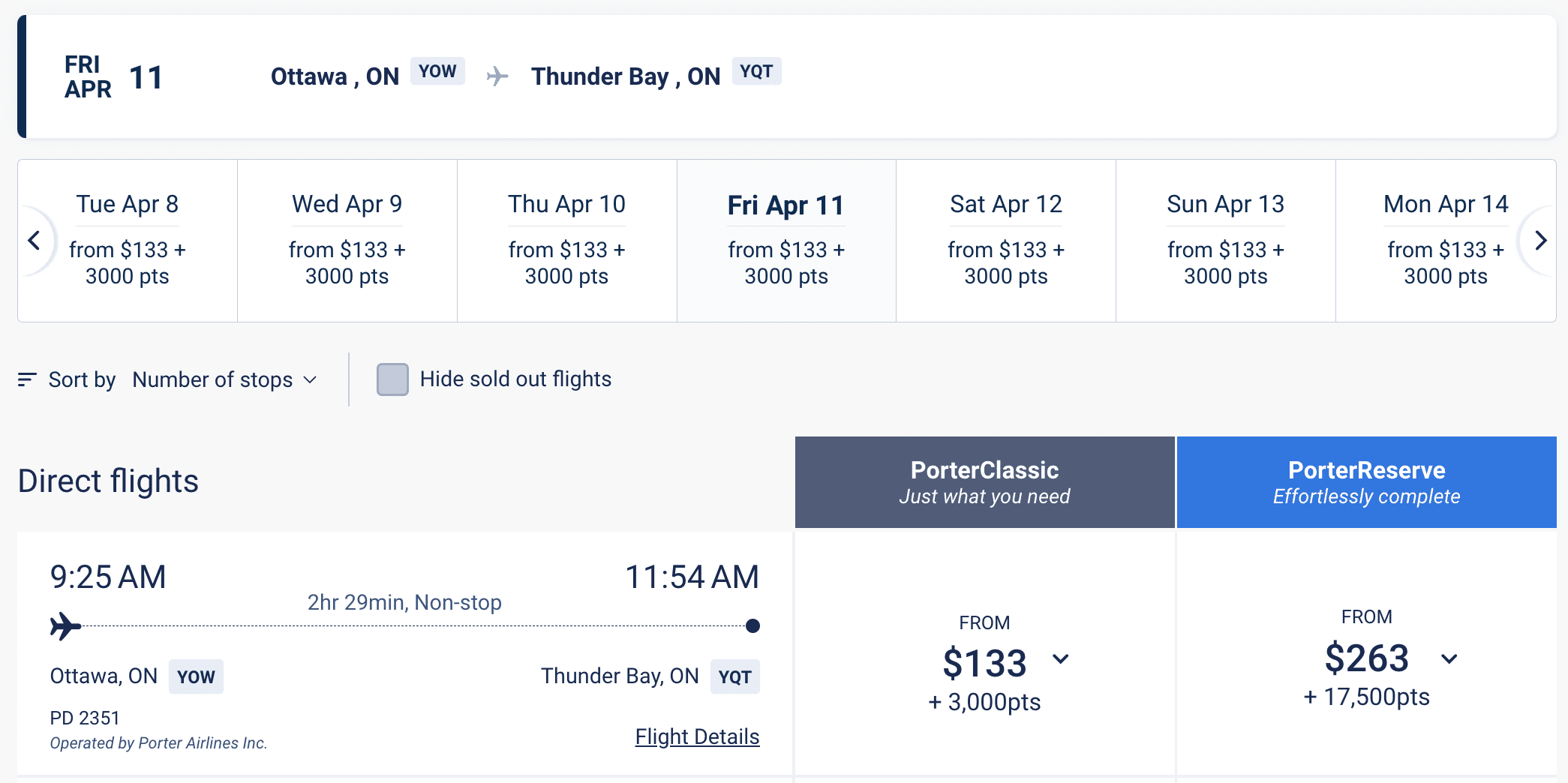

VIPorter points are also quite flexible, as they can be redeemed for 100% of the base fare or used with a cash+points option, and especially with the cash+points option, you can often redeem VIPorter points at an extremely great value.

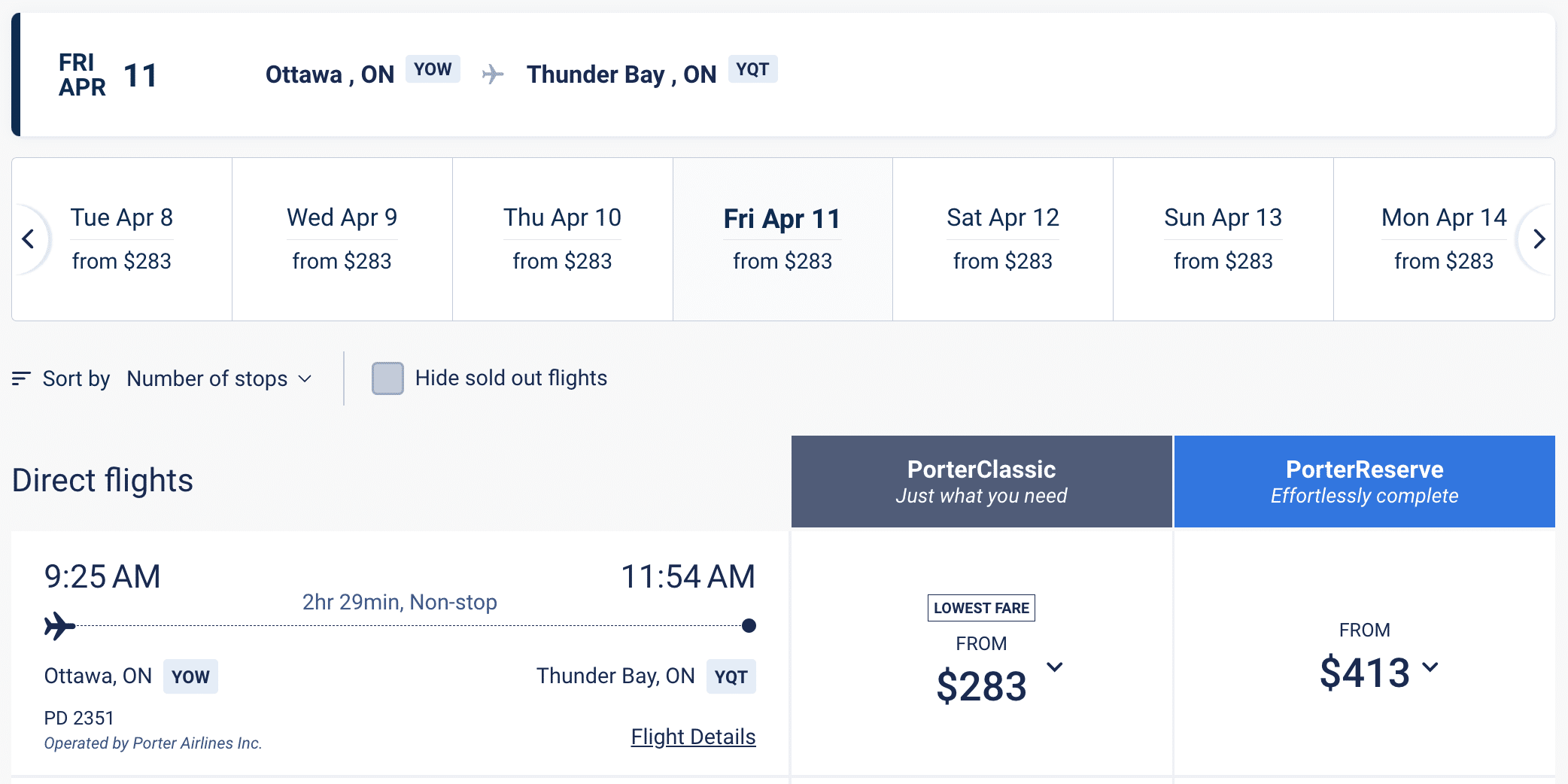

For example, a flight from Ottawa (YOW) to Thunder Bay (YQT) costs $283. But using cash+points option, it drops to $133+3,000 VIPorter points – effectively redeeming VIPporter points at a value of 5 cents per point.

Conclusion

For frequent Porter flyers and those looking for a new Canadian travel rewards card, the BMO VIPorter Mastercard is shaping up to be an intriguing option. While we’re still waiting on the final details regarding earn rates, travel perks, and fee structures, the ability to earn VIPorter points faster, access exclusive benefits, and enjoy flexible redemptions makes this an exciting development in the Canadian travel credit card space.

Stay tuned for more details when the full card lineup is revealed in spring 2025. In the mean time, make sure to join the waitlist to secure 10,000 bonus VIPorter points when the card launches.