Sad news yesterday: Chase Canada is completing their withdrawal from the Canadian market, shutting down new applications to their flagship travel credit card, the Chase Marriott Rewards Premier Visa.

As of this morning it seems like there were still a few “live” application links floating around, but those seem to have been shut down as well.

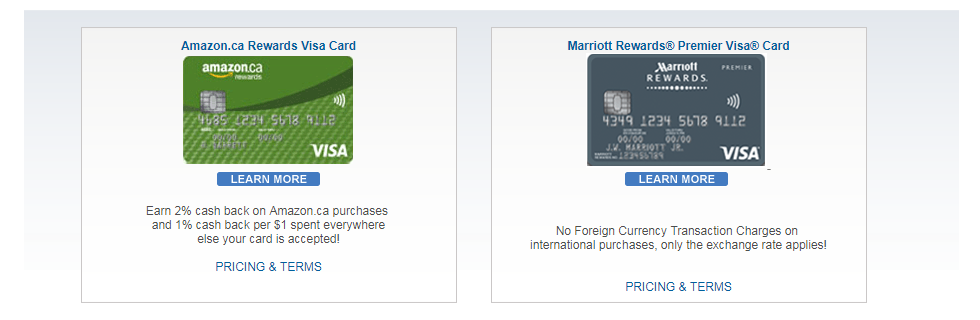

Chase used to operate a decent-sized credit card portfolio in Canada, but in 2015 they sold their Sears cards to Scotiabank, and earlier this year they shut down new applications for their popular Amazon.ca Rewards Visa card.

Farewell, Apply Now buttons…

The Marriott card in particular had been a longstanding favourite among Canadian points enthusiasts. The standard offer of 30,000 Marriott Rewards points was pretty run-of-the-mill, but there had been a promotional offer for 50,000 points that was readily available as well.

Best of all, the annual fee of $120 had always been waived for the first year, and there was no pesky minimum spending requirement in order to get the bonus points – you just needed to spend $0.01 and the points were yours.

Credit card offers going away is never fun, but I wanted to share some thoughts as to why this particular card being discontinued may not be all doom and gloom.

Existing Cardholders

If you’re an existing cardholder of the Marriott Visa, your account will continue to be “grandfathered” for the time being. You can continue to use the card and enjoy its benefits, much like holders of the Chase Amazon.ca Visa prior to March of this year can still use their accounts normally.

Meanwhile, if you applied for the card on or before September 5, 2017 (or if you were lucky, before the final few application links were pulled), it’ll still be processed as usual, and you have a good shot at snagging the signup bonus right at the death.

One of the best features of Chase’s credit cards was that they don’t charge foreign exchange fees, which is a feature that’s sorely lacking from most other Canadian card issuers. I’m glad I can still use my Amazon.ca and Marriott cards whenever I need to make a purchase in a foreign currency.

However, it remains an unfortunate truth that Chase is winding down their business in Canada. Therefore, if I had to speculate as to what’s going to happen to the Amazon.ca and Marriott cards down the road, I’d venture that one day cardholders will receive a letter in the mail from some other bank stating that they’ve bought out and taken over Chase’s old card operations.

And knowing the Big 5 banks in Canada, my intuition is that the new card operator may well scrap the No FX Fee feature.

Marriott and SPG

If you’ve been eyeing the Chase Marriott card as a way to rack up some hotel points, don’t fret. For about a year now, this card wasn’t actually the most effective way to earn Marriott Rewards points.

Ever since the Marriott–Starwood merger was announced and SPG Starpoints became transferable to Marriott Rewards at a 1:3 ratio, the best hotel rewards signup bonus shifted to the American Express SPG card series for good.

Both the personal and business versions of the SPG Card are offering 25,000 Starpoints as a signup bonus until October 18, 2017, which can be turned into 75,000 Marriott Rewards points per card.

While it’s true that the 50,000 points on the Chase Marriott card came with a first year fee waiver, Chase cards were also much harder to get approved for compared to American Express. I myself have only held the Chase Marriott card once, and I had been declined twice for a repeat application in 2017 alone. On the other hand I get approved for several Amex cards every couple of months.

So while the news is disappointing, perhaps the loss of the Chase Marriott card might not be so keenly felt, since you can always focus on the Amex SPG cards. This is especially true while their limited time promotional offer of 25,000 Starpoints is still on the table.

I think it’s also important to remember that a major shakeup was likely to occur with the Marriott/SPG credit card portfolio sometime in 2018 anyway, even if Chase hadn’t decided to shut down their Canadian operations.

There’s no telling what the new program will look like, but knowing what we know now it’s safe to say that Chase won’t be issuing the new program’s co-branded credit card, at least in Canada.

It’ll probably be American Express, unless one of the other banks were to (gasp!) make a play for launching a hotel rewards credit card, which they seem unlikely to do. (Just look at how few hotel rewards programs have Canadian credit cards – there just doesn’t seem to be enough of a market here to make, say, a Hyatt or IHG credit card appealing for any issuer).

To me, it’s good news if Amex issues the new program’s credit cards, since they offer strong signup bonuses and they’re generally easy to get approved for, especially when repeatedly applying for the same card.

What’s more interesting, in my opinion, is what’ll happen in the US. Many Canadians dabble in applying for US credit cards, and whether or not Chase or Amex takes over the combined Marriott/SPG portfolio south of the border can greatly affect the volume of available bonuses. Here’s hoping they both retain a portion of the new portfolio!

Other No FX Fee Cards

As I mentioned, one of the greatest reasons to get the Chase Marriott Visa was the ability to spend in foreign currency without being dinged an extra 2.5%. While existing account holders can continue to use their cards for now, there are still a few options remaining if you’re looking for a Canadian credit card with a No FX Fee feature, or something similar.

While the Rogers Platinum MasterCard and the Fido MasterCard both charge a 2.5% FX fee, they also give you 4% back on purchases made in a foreign currency, meaning that you receive net cash back of 1.5% on all your FX spending. That’s not bad at all, and these cards can also be handy to have around if you’re a Rogers or Fido customer.

The HSBC Premier World Elite MasterCard also recently came to my attention as a potentially attractive option. As Canadian Kilometers writes, the card doesn’t charge FX fees, and also offers 3 HSBC Rewards points per dollar spent, which can be transferred to other frequent flyer programs like British Airways Avios, Asia Miles, and Singapore Airlines KrisFlyer.

Conclusion

Don’t get me wrong, Chase pulling out of the Canadian credit card scene is sad news. Their Amazon.ca Rewards card was a great no-fee card to keep around, and the Marriott card’s competitive signup bonus and annual free-night certificate will be missed. Moreover, the hotel rewards credit card marketplace now looks remarkably bleak, with only the Amex SPG cards and the MBNA Best Western card holding down the fort.

Nevertheless, it isn’t all doom and gloom since there’s still a handful of credit cards offering the elusive No FX Fee feature, and a major shakeup was likely coming to the Marriott/SPG rewards sphere anyway. Here’s hoping for a strong showing from Amex once the new program arrives.

What are we going to do Ricky?! :'(

If your main goal is to avoid the 2.5% foreign exchange fee, then take a look at the Home Trust Visa card:

http://go.hometrust.ca/preferred-visa-ca

This one seems like the direct replacement for the Amazon Visa card.

Does the SPG one have and annual fee? Also has the Amex Gold Aeroplane 25000 point no annual fee also been discontinued?

Hey Matt,

Yes, the SPG has an annual fee of $120 for the personal card and $150 for the business card. And yes unfortunately the FYF offer on the Gold Rewards Card is no longer available as of this September.

Chase closed my card on Nov. 4th even if I was a $10,000 per month user. I switched to SPG.

Chase closed my card on Nov. 4th even if I was a $10,000 per month user. I switched to SPG.

Crazy. Did they give a reason for shutting down your card?