It’s been a wacky month in the world of credit card points.

Staples and Sobeys both dumped Air Miles.

BMO decided to stop loafing about and made its in-house BMO Rewards program palatable to the casual enthusiast for the first time in years.

Finally, the Scene+ juggernaut remained unassailable, as its credit card portfolio ploughed its way into becoming one of the most competitive in Canada.

The last place anyone expected to see a parry come from was the direction of National Bank – but Canada’s sixth-largest bank are indeed responding in force.

A Recap of National Bank’s Products

National Bank is one of the smaller players on the Canadian financial scene. Their presence is primarily limited to the province of Quebec, where they have a small but dedicated customer base.

However, none of this prevents any Canadian from getting their excellent travel-oriented premium credit cards: the National Bank World Elite Mastercard and the National Bank Platinum Mastercard.

Let’s quickly recap which benefits these products offer to cardholders before getting into the really exciting news.

Keep in mind that both are about to become much better, with the World Elite poised to join the highest tier of lucrative rewards credit cards in the country.

Both of these credit cards earn National Bank’s in-house À la carte Rewards, which have a flat redemption value of 1 cent per point (cpp) on travel purchases made with National Bank’s in-house travel agency.

While this isn’t the most flexible redemption option, it is a far better value than the 0.83cpp that National Bank provides on using À la carte Rewards for straight cash back.

While the World Elite card comes with the customary $80,000 personal / $150,000 household income requirements for high-end Mastercards, the present offer has no annual fee for the first year and offers a welcome bonus of 20,000 À la carte Rewards, or $200 in travel when using via À la carte’s dedicated travel agency, after spending $3,000 in the first three months. These points are worth $167 when redeemed for any other purchase.

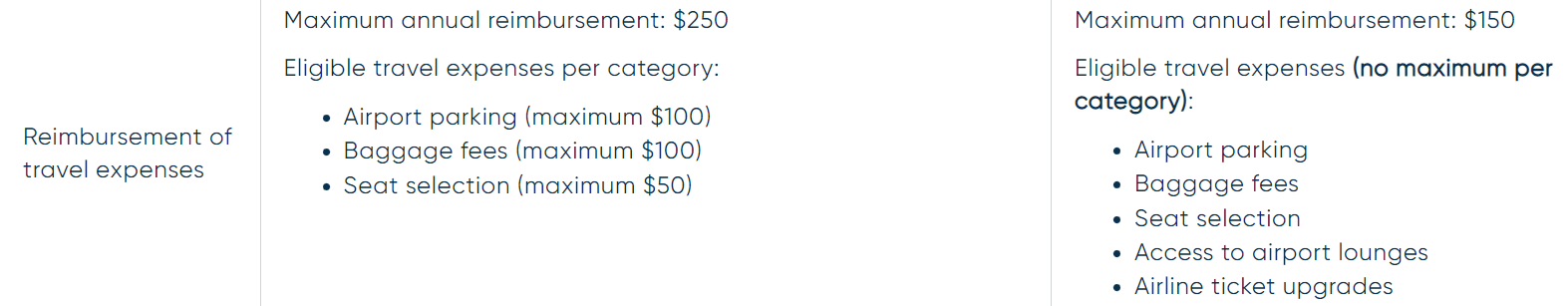

On top of this, you get up to $250 in credits for amenities, such as airport parking, baggage fees, and seat selection fees.

For those who want a card with no annual income requirement, the Platinum card remains a viable choice for its 20,000 À la carte Rewards for the same spending requirement of $3,000 over the first three months.

The annual fee of $89 is also waived, and will in fact be reduced to $70 after the following changes take place.

Coming September 1: The Highest Earning Mastercard in Canada

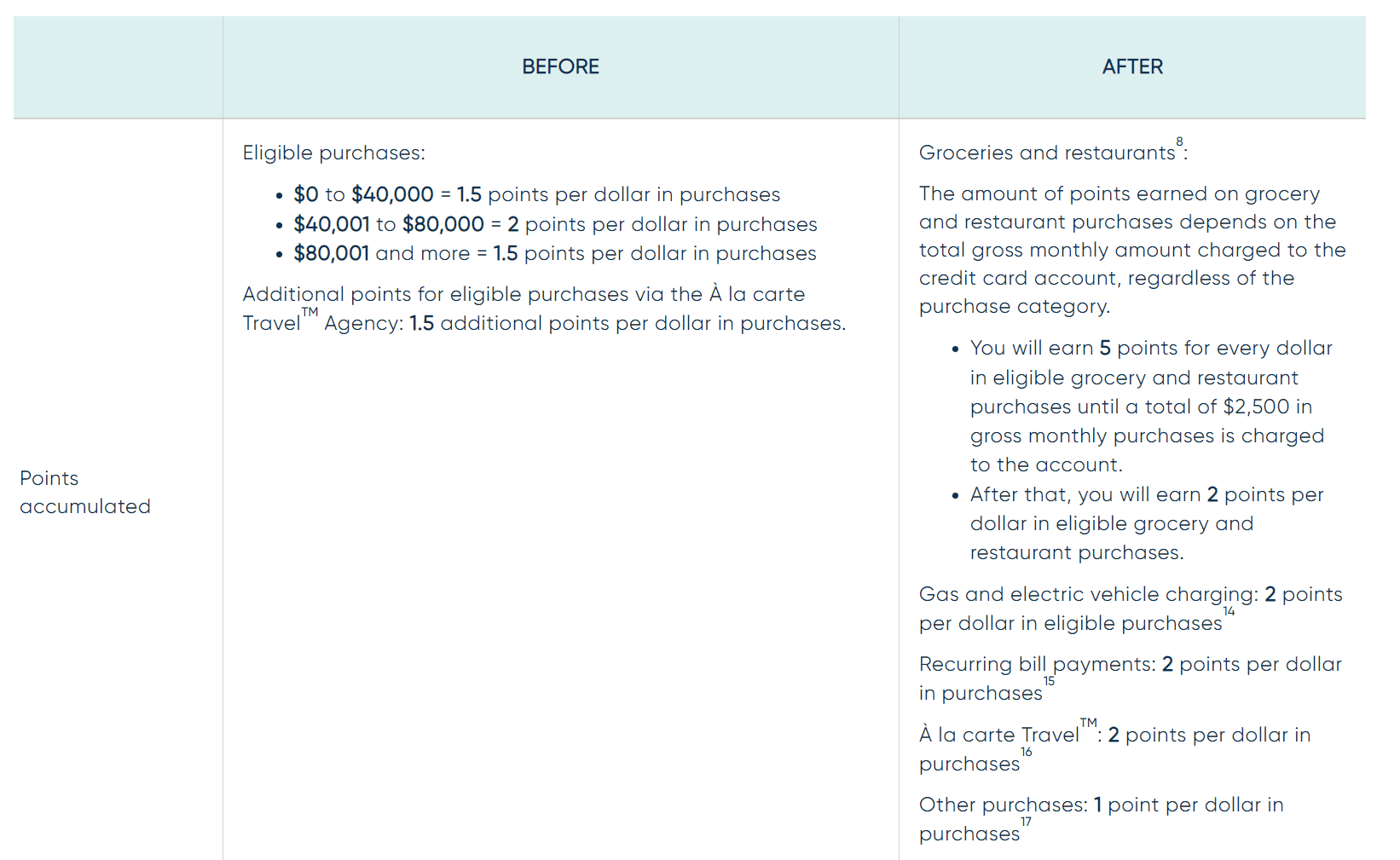

The earn rates on these cards are about to experience some exciting changes. Let’s start with how the World Elite’s daily rewards are being pumped by over double the current value as of September 1, 2022:

By pressing a few buttons on the keyboard, National Bank is turning their World Elite Mastercard from one with an antiquated tiered spending rewards system into one of the only true 5x points cards on the market.

The World Elite is also seeing an increase in earn rates on the categories of gas/EV, recurring bill payment, and use on the À la carte Rewards travel portal.

Earning an effective 5% back on travel puts this product on par with the Scotiabank Gold American Express Card, and could even give the the American Express Cobalt Card a run for its money.

The $2,500 cap on 5x on all expenses per month is interesting as it’s broken down monthly, rather than annually. For example, if you spend $1,000 on grocery and eats at the 5x earning rate, and then spend another $1,500 on other purchases, you’d be reduced to earning 2x on restaurants and grocery thereafter.

Still, if one were to spend all $2,500 of this limit per month on the elevated grocery and restaurant category, then the National Bank World Elite Mastercard effectively has the same rewards ceiling as the Amex Cobalt Card.

While this byzantine cap system may be confusing, it definitely incentivizes cardholders to specialize their National Bank World Elite Mastercard on one category!

On the flipside, the National Bank product always earns a minimum of 2x points on groceries and eats, meaning that even if you hit this $2,500 cap early each month, you at least have a decent rate of return to fall back on.

For my money, these changes are a direct shot across the bow by National Bank to prove to bigger players, such as Scotiabank and BMO, that this plucky financial institution isn’t finished yet.

The 5x multiplier on the grocery and restaurant category, boosted base rate after hitting the $30,000 cap, and ability to redeem at 1cpp on travel or 0.83cpp on everything else also feels like a swipe against BMO Rewards, whose signature card, the BMO eclipse Visa Infinite, is 5x in name only and has a “true” earning rate of 3.67% per dollar spent.

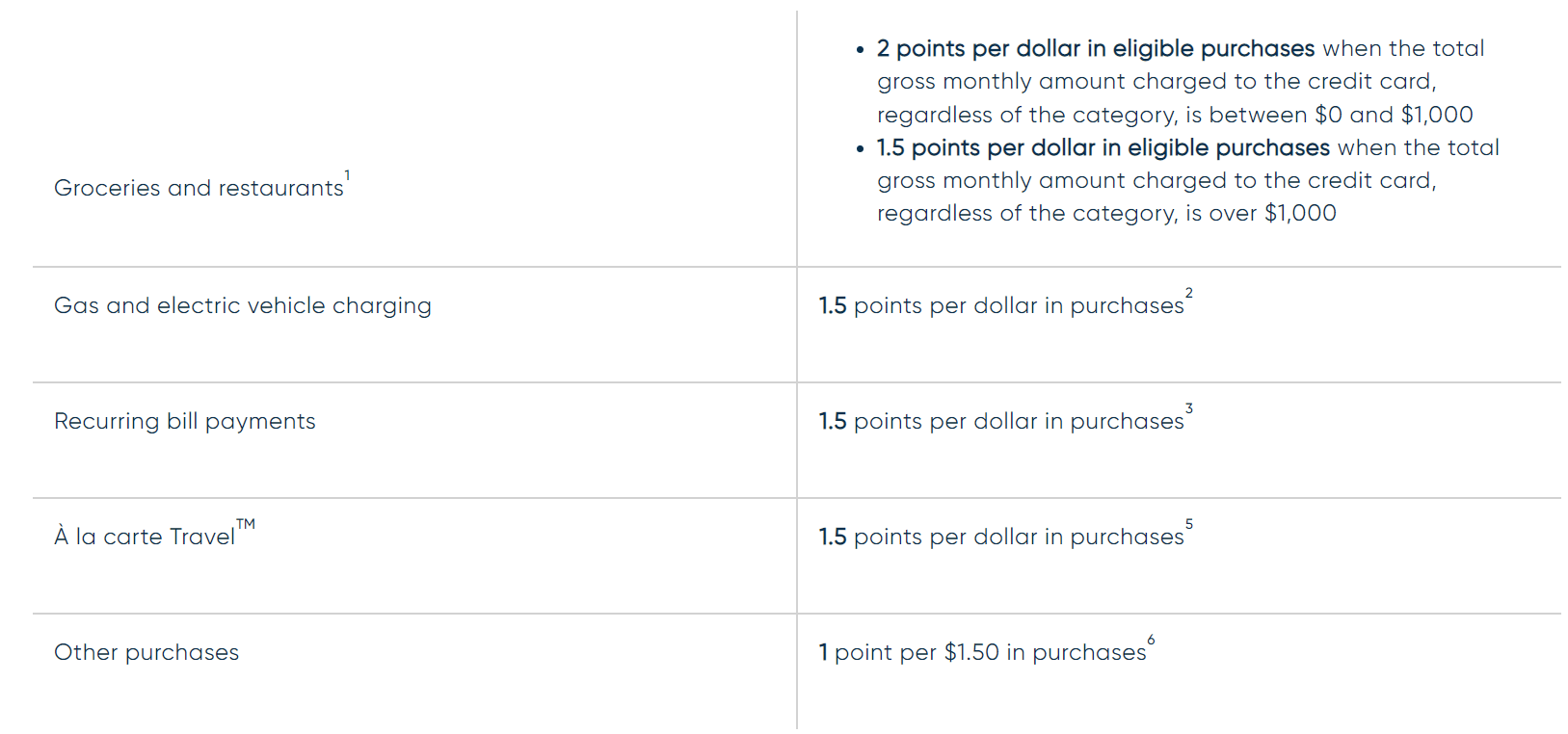

While the World Elite is the brighter star of the two National Bank products to be receiving a facelift, the Platinum card is getting a modest boost, too:

It’s unlikely anyone will complain about this improvement, but it’s not enough to market the card on its own merit. After all, the base rate of 1 point per $1.5 spent, or 0.66%, also disincentivizes this product’s long term viability.

Travel Credits: Rigid $250 to Flexible $150

On a more uneven front, the National Bank World Elite Mastercard is seeing its travel credits of $250 on airport parking, baggage fees, and seat selection fees be reduced to $150.

Although the absolute amount of reimbursements you’re being offered is going down, the flexibility is much nicer. One of the most consistent complaints I’ve heard about NBC’s travel expense credits is how hard they were to liquidate.

The new ability to redeem the revised $150 credit toward accessing airport lounges or upgrading your seats makes this credit much easier to use and more relevant.

Think about the consequences of leaving your “Player 2” outside the airport lounge because you don’t have unpaid guest privileges. With NBC’s changes, you won’t have to face them.

Insurance: One Step Forward, Two Steps Back

Changes to the insurance of the National Bank Mastercard family are where my feelings are most mixed.

First, the good news. On September 1, 2022, both the Platinum and World Elite products are getting mobile device insurance to protect your device against loss, theft, or damage up to $1,000.

This assumes that you bought your phone on in its entirety via a single purchase on your National Bank card, or have uninterrupted pre-approved payments for your phone and bill pre-emptively arranged on your National Bank Mastercard. What’s more, this second option also lets you take advantage of the new 2x recurring bills category.

The negative changes are that some of National Bank’s traditionally strong insurance coverages will be weakened.

The World Elite is losing the $2,000 coverage it possessed for personal goods lost or stolen out of a rental vehicle.

The Platinum, meanwhile, is also losing the personal goods rental car coverage, as well as seeing its trip cancellation coverage reduced from $1,250 to $1,000. Further, its trip interruption insurance is nearly getting halved from $2,500 to $1,500.

Mobile device insurance is welcome, but in the era of record long lineups at Canadian airports, the reduction in inconvenience protection is unwelcome.

Conclusion

The past month of madness in the world of credit cards and loyalty programs is now being topped with yet another impressive effort – this time by National Bank – to bump up the value proposition of their products. Let’s hope the gamble pays off for them.

It’s fascinating to see a smaller player like National Bank feeling fit to introduce such a dynamic new product with a 5x earning rate. With Canadian credit cards gradually becoming more competitive, we hope that other banks take notice and bolster their offers accordingly.

The drop in annual fee on the Platinum card from $89 to $70 is also a great move – if World Elite cards start taking those kinds of fee cuts, that would be even nicer!

Until next time, harvest 5% back on all your groceries.

The $2500 monthly cap is actually pretty bad as it includes spending on non-boosted categories. If you were to spend $2500 on a 1x category during the month and then get some groceries, you wouldn’t get the bonus points.

“The amount of points earned on grocery and restaurant purchases depends on the total gross monthly amount charged to the credit card account, regardless of the purchase category. “

The problem with A la carte system is that it’s only good to buy flight and travel package like all inclusive resorts. You can’t use it to book hotel room, Air BnB, rent a car.

Actually the a la carte travel on this card lets you buy anything that is travel related. Car rental, hotel rooms, cottage rental, stand alone flights, etc. Furthermore the author made a mistake. There is no obligation or limitation to using the in house travel agency. There are also no blackout dates on traveling

Actualy you are right, it’s possible to use BNC Récompenses to covert your hotel stay, car renting etc. but it will be at lower return of your points. 12000 : 100$ ( 0.0083 CPP)or 11000 : 100$(0.009) if you exchange 55000 points for the transaction.

I should have said that if you want to get the maximum value of your points (0.01) your have to use A la carte and book travel package or flight.

100% disagree about the flexibility of the travel credits – these were always easy to liquidate via RHT. The move down to $150 is a purely negative one in my view.

Definitely downgrade

It’s a 100 profit card and will be downgraded to no AF card

Author doesn’t seem truly understand the change,