The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Last week, Capital One announced a new US credit card, the Venture X card. As of today, the card is now open for applications.

It’s always an exciting day when a new financial product enters the market. Here’s our first look at how the top-tier card compares, and how it fits into a Canadian rewards strategy.

In This Post

- Signup Bonus: 100,000 Miles

- Everyday Spending: Up to 10x Rewards on Travel

- Fees and Credits: Annual Credits Galore!

- Travel Benefits: Lounges and More

- Capital One Miles and Capital One Travel

- How to Get Capital One Cards for Canadians

- Conclusion

Signup Bonus: 100,000 Miles

The Capital One Venture X card is offering a tantalizing welcome bonus:

- Earn 100,000 miles upon spending $10,000 (all figures in USD) in the first six months†

- For a limited time, get a $200 credit towards vacation rentals such as Airbnb or VRBO†

The points portion alone is impressive enough to put the Venture X card on par with top-tier offers from its chief competitors, with the The Platinum Card® by American Express currently offering a welcome bonus of 125,000 Membership Rewards points, and with the Chase Sapphire Preferred® Credit Card recently ending its offer for 100,000 Ultimate Rewards points.

There is a very high spending requirement before you’ll receive your welcome bonus miles with the Capital One Venture X; however, you’ll fortunately have a generous six months to meet the $10,000 threshold, and the bonus is very achievable by averaging $1,667 spent per month.

The vacation rental credit has to be used in the first year, and it must be used all at once. Given this, it’s best to credit it against a booking greater than $200, otherwise you’ll lose any remaining credit.

I’m intrigued by the wording of the accommodation credit being “for a limited time” – it implies that the 100,000-mile welcome bonus might be here to stay.

Everyday Spending: Up to 10x Rewards on Travel

After you’ve earned the welcome bonus, you’ll continue to rack up travel rewards quickly on everyday spending with the following earning rates:

- Earn 10 miles per dollar spent on hotels and car rentals booked through Capital One Travel†

- Earn 5 miles per dollar spent on flights booked through Capital One Travel†

- Earn 2 miles per dollar spent on all other purchases†

First of all, 2x rewards on every purchase is fantastic. Many other premium credit cards earn 1–1.25 points per dollar spent, plus bonuses on specific spending categories. While there’s no dining bonus (a popular category), the Venture X card is supercharged for general purchases instead, filling a unique niche.

5x rewards on airfare is also on par with the industry standard, matching the rate offered by the The Platinum Card®.

10x rewards on hotels is an incredible rate, far exceeding the value of the rewards you’d earn by using co-branded Marriott Bonvoy, Hilton Honors, or World of Hyatt credit cards. If you’re not particularly loyal to one hotel program and would prefer to earn flexible rewards, you might benefit more with the Venture X card (although you may not get elite status benefits by booking through Capital One Travel).

Plus, not many cards offer such strong rewards on car rentals, making the Venture X card an obvious choice in that category.

Also, there’s no limit to the bonus rewards you can earn in the travel categories. If you frequently book a lot of cash airfares, hotels, and car rentals, you could significantly benefit by using the Venture X card.

Fees and Credits: Annual Credits Galore!

While the welcome bonus and earn rates are already best-in-class, it’s the ongoing perks that set this card apart.

As a premium credit card, the Venture X commands a $395 annual fee. At first glance, that sounds rather steep, but there are ample credits to offset it.

You’ll get a $300 annual statement credit for bookings made through Capital One Travel. Unlike the $200 credit that comes with the welcome bonus, the annual $300 credit is cumulative, so you don’t need to use it all on a single transaction.

Additionally, starting in your second year with the card, you’ll receive an anniversary bonus of 10,000 miles every year† These can be redeemed at a minimum value of 1 cent per mile via Capital One Travel, making this benefit worth at least $100.

Already, that’s $400 value coming back each year, against a $395 annual fee. In short, you can effectively have a premium credit card for no net annual fee! That’s simply too good to pass up.

The Venture X card isn’t the only one doing this. We’ve seen similar rebates on other top-tier US credit cards:

- The Marriott Bonvoy Brilliant® American Express® Card offers a $300 Marriott credit against a $450 fee

- The Hilton Honors American Express Aspire Card offers a $250 Hilton credit and a $250 airline credit against a $450 fee

- The Chase Sapphire Reserve® Credit Card offers a $300 travel credit against a $550 fee

Travel Benefits: Lounges and More

The Venture X card has an awesome package of travel benefits.

Most notably, cardholders get a Priority Pass membership with unlimited visits to over 13,000 participating airport lounges. You’ll be able to enter Priority Pass restaurants too, an area where Amex is lacking.

Capital One is also launching their own Capital One Lounges at airports, similar to the Amex Centurion lounges. They have one in Dallas–Fort Worth (DFW), with plans to open more in Denver (DEN) and Washington Dulles (IAD) in 2022.

They have some interesting facilities planned for these lounges, including a fitness centre, and cardholders get unlimited visits and can bring two guests each time.

Authorized users also get the same lounge access, and best of all, there’s no annual fee for adding a secondary cardholder! This is a great way to share travel benefits with others.

As is standard with premium US travel cards, the Venture X card has no foreign transaction fees. That makes it an excellent choice for Canadians, even when spending at home. Plus, as a Visa card, it’s accepted more widely worldwide than Amex.

As usual, the premium card provides premium travel insurance, including $1,000,000 common carrier accident coverage, car rental insurance, and mobile device protection.

There’s also a $100 credit towards TSA PreCheck® or Global Entry†, similar to the NEXUS benefits we’ve seen on many Aeroplan cards and others in Canada.

Finally, you’ll get Hertz President’s Circle status, the top tier in this program. This perk is unquestionably superior to the Hertz benefit on the Amex Platinum cards, as these cards only match you to mid-tier Five Star status, which doesn’t guarantee a complimentary upgrade.

Capital One Miles and Capital One Travel

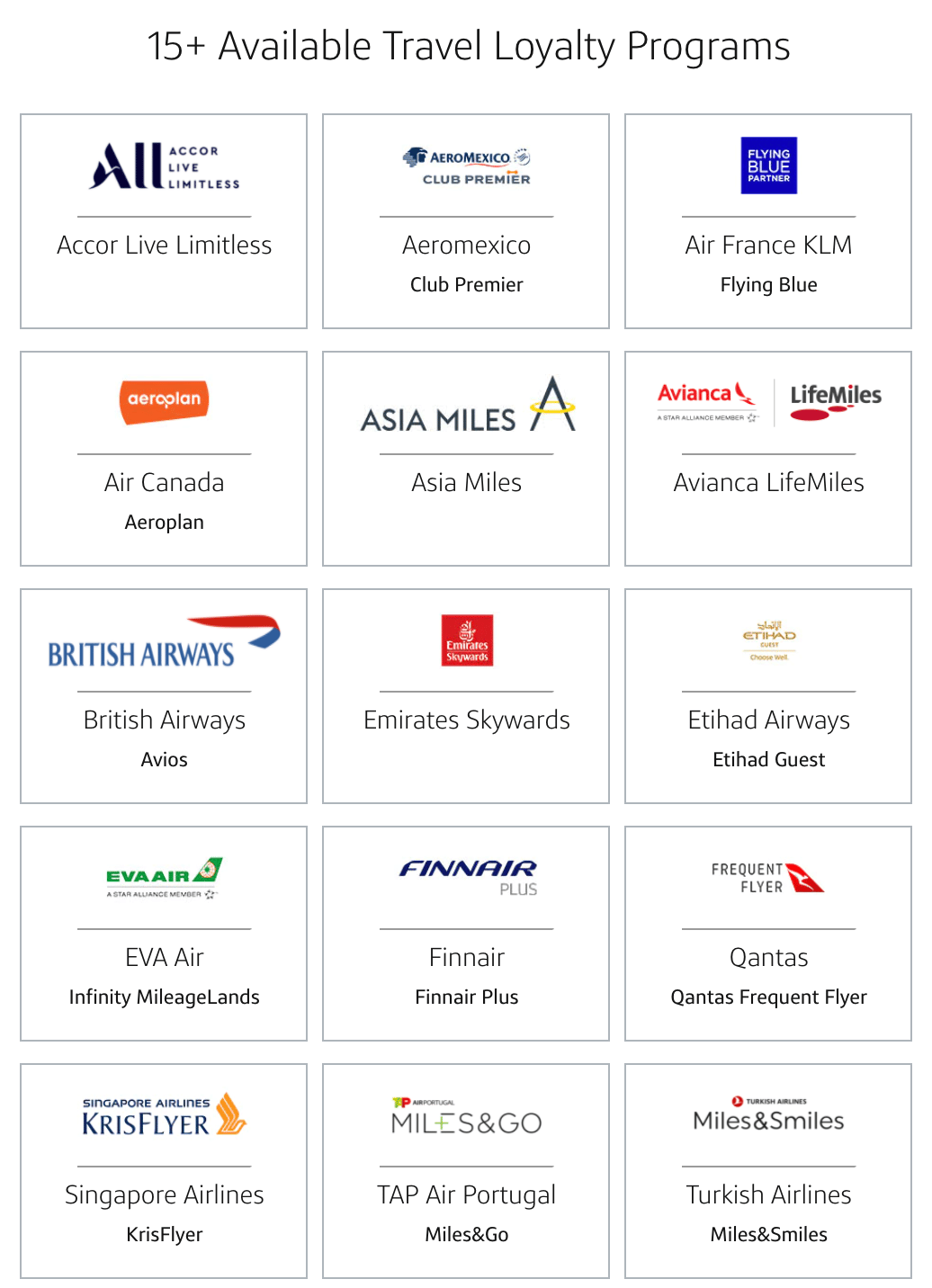

Like other major US credit card issuers, Capital One miles are transferable to frequent flyer and hotel loyalty programs. In total, they have 15 transfer partners:

Capital One also recently improved the transfer ratio for its airline partners. Before, you could transfer at a rate of 2:1.5, but now you can transfer at a rate of 1:1. This change brings the rate in line with Amex, Chase, and Citi’s rates for transfers to airline partners.

There’s a mix of familiar and exclusive transfer partners here:

- For a conventional approach, you could use your Venture X miles to top up your Aeroplan, British Airways Avios, or Cathay Pacific Asia Miles accounts. All of these programs have countless co-branded cards and transfer partners in Canada and the US. By concentrating your efforts, you can quickly earn tons of rewards for programs which you understand quite well.

- Alternatively, look into sweet spots for using foreign programs for domestic routes. In particular, you can sometimes find Air Canada routes that cost fewer Singapore KrisFlyer miles than Aeroplan points.

- Many aspirational airlines, including Singapore Airlines and Emirates, don’t release award space to partners. The only way to book Singapore Suites First Class or Emirates First Class on points is with their own loyalty programs.

- Capital One is the only transfer partner for Accor Live Limitless, making the Venture X card the easiest way to earn points which can be used for Fairmont stays.

- Finally, ambitious globetrotters could transfer to Aeromexico Club Premier for a round-the-world odyssey on SkyTeam airlines.

We at Prince of Travel value Capital One miles at 1.7 cents per point.

While transferable rewards are the best way to get outsized value for travel, the revamped Capital One Travel portal also has some enticing opportunities. They actively adjust their prices to match the best rates available on other online travel agencies like Expedia, and they even have a price-matching policy within 24 hours of making a booking.

You’ll want to use the Venture X card as often as possible for 5–10x rewards on travel bookings through the portal. Their commitment to competitive pricing is hugely reassuring, and you’ll always be confident that you’re paying the best available rate while also maximizing your rewards.

Otherwise, you can use your rewards for travel booked through the portal, or as statement credit for travel booked other ways. Any way you look at it, your miles on the Venture X card are quite flexible.

How to Get Capital One Cards for Canadians

The Capital One Venture X card is a US credit card, but Canadians are still eligible to apply.

To get a US credit card, you’ll need a US address and a US bank account.

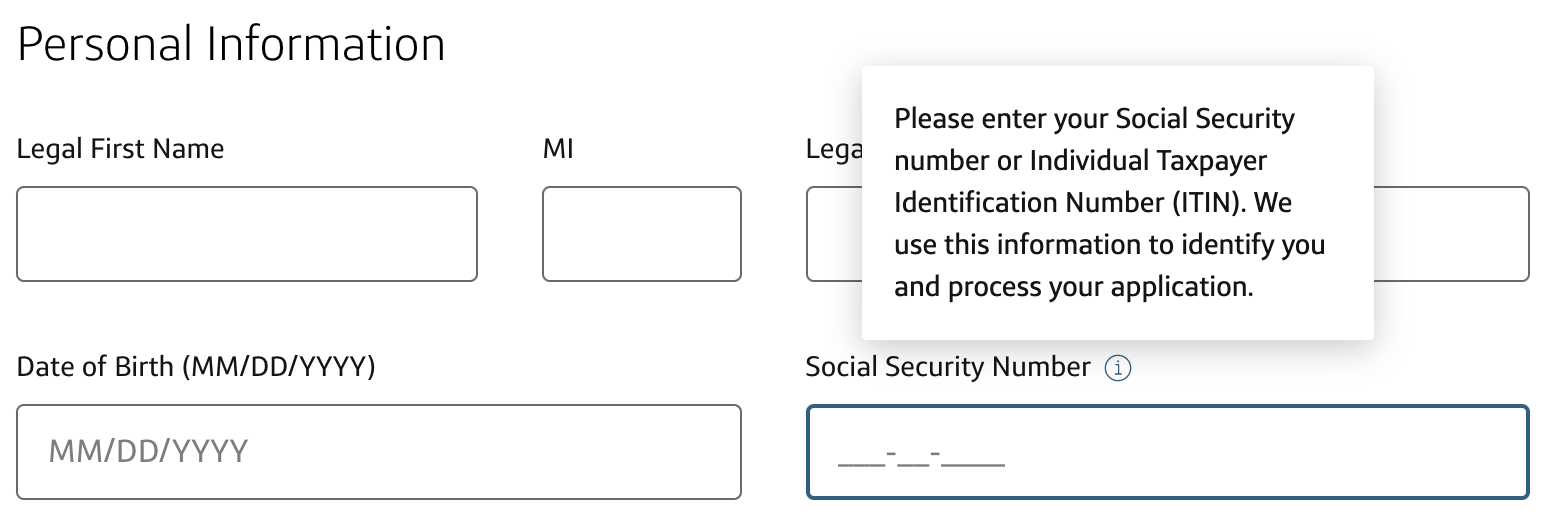

To apply for Capital One cards, you need to enter a social security number or an international taxpayer identification number (ITIN).

Before you apply, it’s best to begin building US credit history with another bank. Canadians without a SSN or ITIN can easily get credit cards from Amex US, or from the American arm of a Canadian “Big 5” bank (BMO, CIBC, RBC, Scotiabank, or TD).

You will, however, eventually need a SSN or ITIN attached to your US credit history. Capital One does a credit inquiry against all three US credit bureaus – TransUnion, Equifax, and Experian – and they’re unable to find your credit profile without an identifying number linked to your name.

We already have at least one data point from a Canadian-based Prince of Travel Royal Platinum member who was approved for the Venture X card today! This member has a long US credit history and a SSN.

Conclusion

Capital One has stepped up to the plate with the new Venture X card, making a big splash with their first truly premium credit card as they seek to compete with the likes of Amex, Chase, and Citi in the US. I definitely think it’s a worthy competitor, and I find it more compelling than their entry-level VentureOne and mid-tier Venture cards.

I’m happy to see that Capital One is putting emphasis on both the earning and redeeming sides. Not only are they improving their credit card products, they’ve also recently boosted their transfer partner redemption rates and are adding airport lounges to enhance the travel experience itself.

I’m a big proponent of using annual credits to offset high fees in order to maintain the benefit of premium credit cards long-term. I’ll absolutely be looking to add the Capital One Venture X card to my wallet as a potential keeper credit card at my earliest convenience.

Visit the Capital One website to apply for the card.

Seems like a great card to add to the US lineup. Any indication from Capital One how long the 100,000 point WB will last?

The Hertz Status benefit from the Venture X card is not Five Star, it’s Presidents Circle, Hertz’ highest tier. (“Venture” car holders get Five Star, Hertz’ middle tier.) Presidents Circle offers higher upgrades than Five Star and a wider vehicle range in the Ultimate Choice lot. Book a Malibu or a Ford Fusion, drive a Mustang convertible or a Jaguar. Just last week I booked a fullsize for $45/day in ONT and Mustang convertible was one of the cars waiting in the Presidents Circle corral, along with several premium SUVs.

Good catch – corrected. That is indeed significantly better!

I was about to comment the same thing! Where in ONT did you get lucky with the car choices? I often rent at Union Station, they barely have any cars.

As a frequent Hertz customer, I hope Hertz President’s Circle will be great.

ONT is an airport in Southern California. I’ve had good experiences with Herta at YYZ T1. It’s worth the ride to the airport if I’m renting for a week or more. I’ve also found that YYZ weekly rentals are very cheap if begun on a Saturday night.

Any data points of being approved for this card, or the Capital One Ventrure card, with less than three years of US credit history? Capital One says it requires “Excellent Credit” and its web site defines it as at least three years of US credit history, among other criteria.

It’s not everyday you see a six figure transferable point welcome bonus on an actual keeper card. Capital One has had a very good year.

Josh, is this Venture X credit card a Visa card?

It is indeed a Visa card.

Just wondering how you verify your state ID for Capital One when you are a Canadian. The text verification method also doesn’t seem to go thru to Bell. Any thoughts?

How would you even have a State ID if you are Canadian, unless you actually live in the USA?

I had mixed results with TextFree. some US banks can text to it, some can’t. Voice quality was so bad I gave up and got a dual-SIM phone and signed up for Google Fi. A few months later I gave up on that cuz I got fed up paying USD$30 just so banks could text me. Nobody has a good clean answer to your question, Curious, for less than USD$25/mo.