In Summer 2023, Calgary-based Neo Financial announced an upcoming partnership with Cathay Pacific to launch a credit card.

The card, officially known as the Cathay World Elite® Mastercard® – powered by Neo, is now open for applications, and we now know more details about the full array of the welcome bonus, fees, perks, and benefits associated with the card.

The Brand-New Cathay World Elite® Mastercard® – Powered by Neo

Neo Financial has officially launched the Cathay World Elite® Mastercard® – powered by Neo, and the product is open for applications.

First announced in August 2023, the card is now the only way to directly earn Asia Miles on daily spending in Canada, ever since the RBC Cathay Pacific Visa Platinum was closed to applications earlier this year and the airline’s partnership shifted to Neo.

Beginning with the basics, the card commands an annual fee of $180 (all figures in CAD), and adding supplementary cardholders costs $10 apiece. To be eligible, you must have a minimum personal annual income of $80,000, or a minimum annual household income of $150,000.

The inaugural welcome bonus on the card is for up to 30,000 Asia Miles, structured as follows:

- Earn 15,000 Asia Miles upon activating the card

- Earn 15,000 Asia Miles upon spending $3,000 within three months of activating the card

However, if you applied for the waitlist, you’re eligible for a welcome bonus of up to 45,000 Asia Miles, structured as follows:

- Earn 15,000 Asia Miles upon activating the card

- Earn 30,000 Asia Miles upon spending $3,000 (CAD) within three months of activating the card

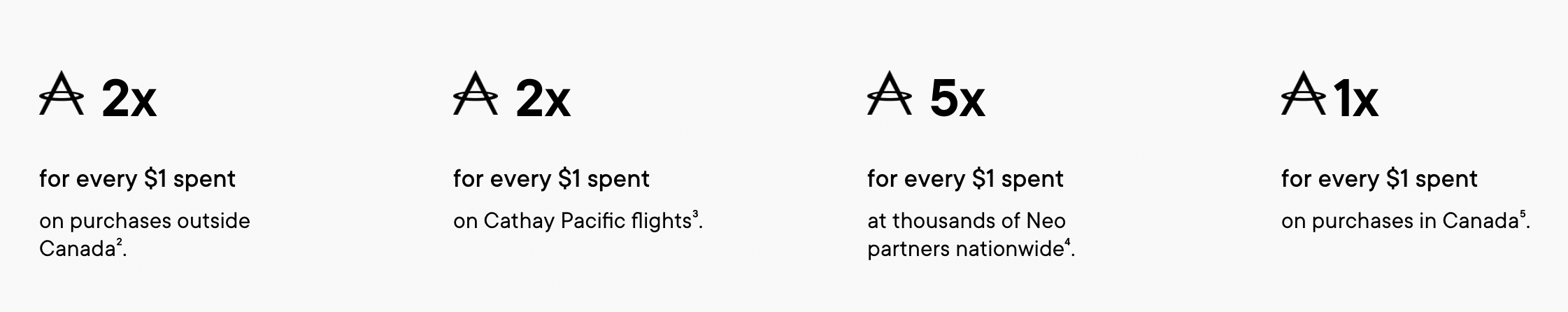

The earning rates on the Cathay World Elite® Mastercard®, powered by Neo, are as follows:

- Earn 2 Asia Miles per dollar spent on Cathay Pacific flights

- Earn 2 Asia Miles per dollar spent outside Canada

- Earn 1 Asia Mile per dollar spent elsewhere

You’ll also be able to earn up to 5x Asia Miles through Neo’s partners across Canada; however, the list of partners at which you can earn up to 5x Asia Miles isn’t publicly available.

As a cardholder, you’ll enjoy the following travel benefits:

- Priority check-in, additional baggage allowance, and spacious seat selection on Cathay Pacific flights (see below)

- Access to Mastercard Airport Transfer (fees apply)

- Access Mastercard Airport Security Fast Track at select airports (fees apply)

When it comes to the benefits on Cathay Pacific flights, there aren’t a lot of details provided on the card’s landing page. In fact, it seems that they may just be the same as the benefits offered to Cathay Pacific Green members, which is granted to anyone who is an Asia Miles member.

If this turns out to be the case, it just means that you’re eligible to redeem Asia Miles for extra baggage and spacious seats, and it doesn’t come as a free perk for cardholders.

Furthermore, there aren’t any airports in Canada that offer Security Fast Track, and even if there were, you’d have to pay to use the service.

The card also comes with a range of insurance coverage. The full breakdown can be found on the Neo website; however, here are some highlights:

- Emergency medical insurance: up to $1,000,000; up to 14 days, must be aged 60 and under

- Trip cancellation/interruption insurance: $1,000 per person, up to $5,000 per insured trip

- Flight delay insurance: up to $250 per day; maximum of $500 per occurrence

- Lost/delayed baggage insurance: up to $1,000; baggage must be delayed by six hours or more

- Hotel/motel burglary insurance: up to $1,000

- Car rental insurance: up to $65,000 MSRP

- Purchase protection: up to 90 days

- Extended warranty: double the manufacturer’s warranty, up to one additional year

As a Mastercard World Elite® product, you’ll also enjoy the following perks:

- Mastercard TravelPass membership, powered by DragonPass

- 12 free 90-minute in-flight Boingo Wi-Fi sessions per year, as well as unlimited access to Boingo hotspots worldwide

There don’t appear to be any complimentary lounge visits included for cardholders, which means that you must pay to access any lounges. The Boingo Wi-Fi perk is a staple for World Elite® Mastercard® products, which can save you some cash for in-flight Wi-Fi on select carriers.

During the initial announcement, cardholders were offered a 10% discount on Cathay Pacific flights departing from Canada. There’s no mention of the offer on the new landing page, and it’s unclear if waitlist members are eligible or not.

If you’re new to Canada or are building your credit history, there’s also a secured version of the card, which comes with the same welcome bonus, fees, and perks. You’ll still need to meet the minimum income requirement to be eligible; however, it’s unique to see a secured version being offered.

A New Way to Earn Asia Miles in Canada

Ever since the card’s upcoming launch was announced in August 2023, we’ve been keen to see a full breakdown of the card’s features, benefits, and fees. Now that we have all the information, it’s worth taking stock of the inaugural offer, and how it compares to similar products available in Canada.

We value Asia Miles at 1.6 cents per point (CAD). If you were to maximize the waitlist or public welcome bonuses, you’d wind up with a minimum of 33,000 Asia Miles (public offer), or 48,000 Asia Miles (waitlist offer), when you take into consideration the minimum number of miles earned by meeting the $3,000 minimum spending requirement.

We’d value those Asia Miles at $528 (public offer), or $768 (waitlist offer). Once you take the card’s $180 annual fee into consideration, we’d arrive at a first-year value of $348 (public offer), or $588 (waitlist offer).

In both cases, you’re looking at getting a solid bonus in exchange for a relatively low minimum spending requirement. If you’re looking to bolster your Asia Miles balance, both offers are certainly worth considering.

However, the annual fee for this card is higher than similar mid-tier airline co-branded cards in Canada, including the WestJet RBC® World Elite® Mastercard ($119), the TD® Aeroplan® Visa Infinite* Card ($139), Brim’s Air France KLM World Elite Mastercard ($132), and the RBC® British Airways Visa Infinite† ($165), to name a few. Some of these cards also come with a first-year annual fee rebate.

When it comes to daily earning rates on the Cathay World Elite® Mastercard®, the only notable multiplier is for Cathay Pacific flights, at 2 Asia Miles per dollar spent.

Since the list of Neo partners with elevated earning rates isn’t publicly available, it’s difficult to say how meaningful they are. And since the card levies foreign transaction fees, you’ll earn 2 Asia Miles per dollar spent outside of Canada, but you’ll be paying a premium for it, and you’re likely better off with a card with no foreign transaction fees instead.

Otherwise, the card’s baseline earning rate of 1 Asia Mile per dollar spent, including for popular categories such as groceries, gas, and travel, for which other cards offer increased earning rates, is pretty much par for the course.

When it comes to cardholder benefits, there aren’t too many exclusive features that stand out on the Cathay World Elite® Mastercard®, especially when paired with the $180 annual fee.

Notably absent are perks such as free checked bags on Cathay Pacific flights, the ability to earn a companion voucher of some sort, loyalty program-specific benefits such as preferred award pricing, and perhaps a complimentary lounge visit or two.

Many of the card’s features are either universal benefits offered to World Elite® Mastercard® cardholders, or, as it seems, to all Asia Miles Green members, which simply requires opening an account.

It’s worth noting that Asia Miles underwent a devaluation on October 1, 2023. Award prices for economy flights weren’t significantly affected; however, prices for premium economy, business class, and First Class flights went up, in some cases by a significant margin.

Cathay Pacific currently offers flights to Vancouver and Toronto in Canada, and the new award pricing on these routes is as follows:

- Vancouver–Hong Kong: 27,000 miles (economy), 50,000 miles (premium economy), 84,000 miles (business class)

- Toronto–Hong Kong: 38,000 miles (economy), 75,000 miles (premium economy), 110,000 miles (business class)

On the other hand, the amount of award flights available in the program has improved since the devaluation.

While this is certainly a positive change, as award availability had been dismal for quite some time, the reality is that you’ll have to pay more than you used to for many redemptions through the program than you used to earlier this year.

It’s also worth noting that Cathay Pacific Asia Miles is a transfer partner with other points programs in Canada, including the following:

- RBC Avion, at a 1:1 ratio

- American Express Membership Rewards, at a 1:0.75 ratio

- HSBC Rewards, at a 25:8 ratio

- Marriott Bonvoy, at a 3:1 ratio, with a bonus of 5,000 miles upon transferring 60,000 points

Therefore, the Cathay World Elite® Mastercard® – powered by Neo, could be a worthy addition to your portfolio if you’re looking to bolster your Asia Miles balance.

You can then supplement it with higher earning rates from cards that earn transferable points, and then move them into your Asia Miles account as needed for redemptions.

Conclusion

The Cathay World Elite® Mastercard® – powered by Neo, has officially launched, and if you’re interested, you can head to the Neo website to submit an application.

If you put yourself on the waitlist, you’re eligible for a welcome bonus of up to 45,000 Asia Miles, while the standard inaugural offer for the card is for up to 30,000 Asia Miles.

With this launch, the card becomes the sole credit card in Canada on which you can directly earn Asia Miles.

Neo Financial is a scam. I had never applied for a card with them. I had a profile a long time ago but I never applied for anything from them. I applied for a Cathay card. No bonus points. They claimed that because I had a profile with them I was not eligible., It did not matter if I applied for a product as long as I had a profile no points.

I received the waitlist email yesterday but it asks you to complete a Neo profile first, and once you do it stops there, so the links/process is broken. However the waitlist offer was in my account so I could access the application from there. Application took a couple of minutes and instantly got my virtual card number and added to Apple Wallet.

Hello, same question as I was on the wait list, but did not receive any emails with a link to apply for the card. Thanks in your advance for your advice.

Do we know if there is a timeline for the waitlisted people to accept the boosted bonus offer?

If we applied for the waitlist, should we wait to receive an invitation before applying on-line? Just want to make sure I get the extra welcome bonus.