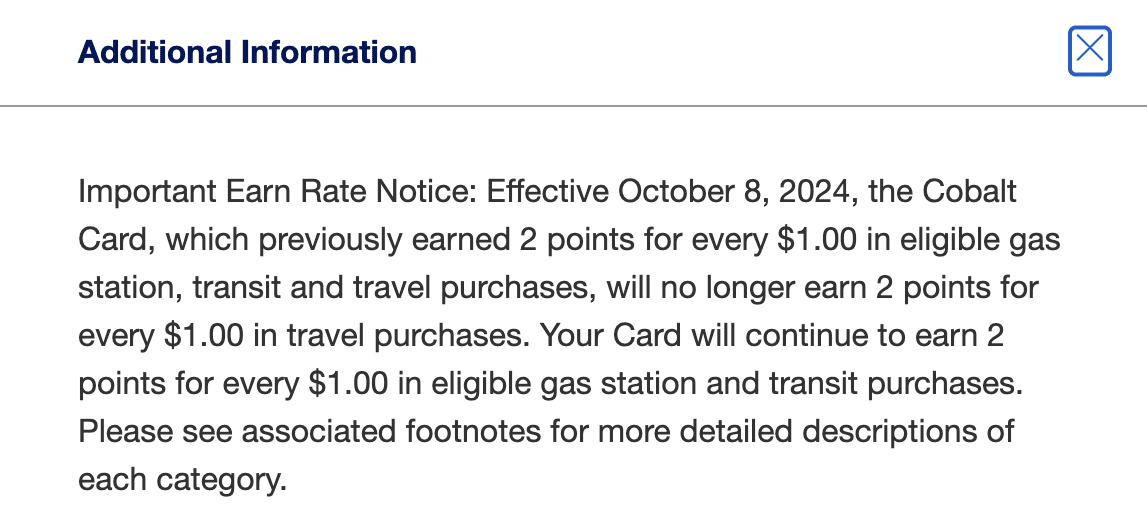

American Express has announced an upcoming change to the earning rate structure on the American Express Cobalt Card.

As of October 8, 2024, the card’s earning rate for travel purchases will be cut in half, which may warrant a shift in spending habits for some cardholders.

Upcoming Change to the Earning Rate on the American Express Cobalt Card

Later this year, American Express will make a change to earning structure on the American Express Cobalt Card.

As of October 8, 2024, cardholders will no longer earn 2 Membership Rewards (MR) points per dollar spent on travel purchases, as the earning rate will drop down to 1 Membership Rewards point per dollar spent on travel.

Importantly, the rest of the card’s earning structure – which is the strongest in the country – remains the same.

Once the changes take effect, the Amex Cobalt Card will have the following earning rates:

- 5 Membership Rewards points per dollar spent on groceries and dining

- 3 Membership Rewards points per dollar spent on streaming services

- 2 Membership Rewards points per dollar spent on gas and transit purchases

- 1 Membership Rewards point per dollar spent on all other purchases (including travel)

The upcoming changes to the Amex Cobalt Card come after a similar shift was made to the earning structure on the American Express Platinum Card last fall, which had the earning rate for dining drop from 3 to 2 Membership Rewards points per dollar spent.

Should You Charge Travel to a Different Card?

For years, the American Express Cobalt Card has offered the best all-around earning rates on daily spending in Canada.

While other banks may offer cards with higher baseline earning rates or higher category multipliers, what makes the Cobalt Card particularly powerful is that it earns Membership Rewards points, which can be transferred to six airline partners and two hotel partners.

Cards offered by other banks in Canada don’t have points that are as versatile as Membership Rewards points, even if you might earn more points.

It’s unfortunate to see the earning rate for travel expenses drop to 1 MR point per dollar spent on the Cobalt Card later this year; however, there’s an argument to be made for there being better cards to use for travel purchases, both in terms of earning rate and insurance coverage.

In the American Express Membership Rewards family of cards, your best options are either the American Express Gold Rewards Card or the American Express Platinum Card, which both earn 2 Membership Rewards points per dollar spent on travel.

The Amex Gold Rewards Card is better suited to someone who travels a few times a year and can make use of the four complimentary Plaza Premium lounge visits, $100 annual travel credit, and a welcome bonus that tends to be much stronger than the Cobalt’s.

For frequent travellers, consider the American Express Platinum Card, which comes with unlimited lounge access, a $200 annual travel credit, a $200 annual dining credit, and a juicy welcome bonus.

With both the Amex Gold Rewards Card and the Amex Platinum Card, you’ll also get stronger insurance coverage for travel charged to the cards than you would from the Cobalt Card. Notably, the Cobalt Card doesn’t offer Trip Cancellation/Interruption insurance, while the Gold Rewards Card and the Platinum Card do.

Alternatively, if you’re someone who flies exclusively on award bookings, consider the National Bank® World Elite® Mastercard, as it comes with the most generous insurance coverage in Canada (including on award bookings)

Conclusion

American Express is making a change to the earning rate on the Amex Cobalt Card. Effective October 8, 2024, you’ll earn 1 Membership Rewards point per dollar spent on travel, which is down from the current rate of 2 MR points per dollar spent.

While it’s unfortunate to see the earning rate change for the worse, the Cobalt Card will still remain the most powerful credit card to use for daily spending in Canada. Fortunately, the 5x earning rate on groceries, dining, and drinks remains unscathed, and the other category multipliers will also remain in effect.

If you tend to spend a lot of money on travel, consider shifting your spending to a different credit card, both to earn more points and to enjoy more generous insurance coverage.