In mid-August 2023, American Express posted information about some upcoming changes to the Canadian-issued American Express Platinum Card and the Business Platinum Card from American Express. Both cards will have an increase to the annual fee, as well as some changes to the included perks and benefits.

These changes are set to kick in as of September 26, 2023, which leaves just a few more days to pick up either card with a lower annual fee for the first year.

Upcoming Changes to the American Express Platinum Card

The American Express Platinum Card will see a number of changes that take effect as of September 26, 2023.

The card’s annual fee is set to increase from $699 to $799 (all figures in CAD) per year. If you currently have a Platinum Card, this fee will come into effect on your next card anniversary date after September 26, 2023.

It’ll also cost more to add a supplementary Platinum Card to your account, as the cost is rising to $250 per year from $175. Adding up to two Gold Cards to your account will continue to come at no cost, and $50 per Gold Card thereafter.

To offset the rise in the annual fee, the Platinum Card will have a $200 annual dining credit added as a perk. Note that this is in addition to the $200 annual travel credit that comes with the card.

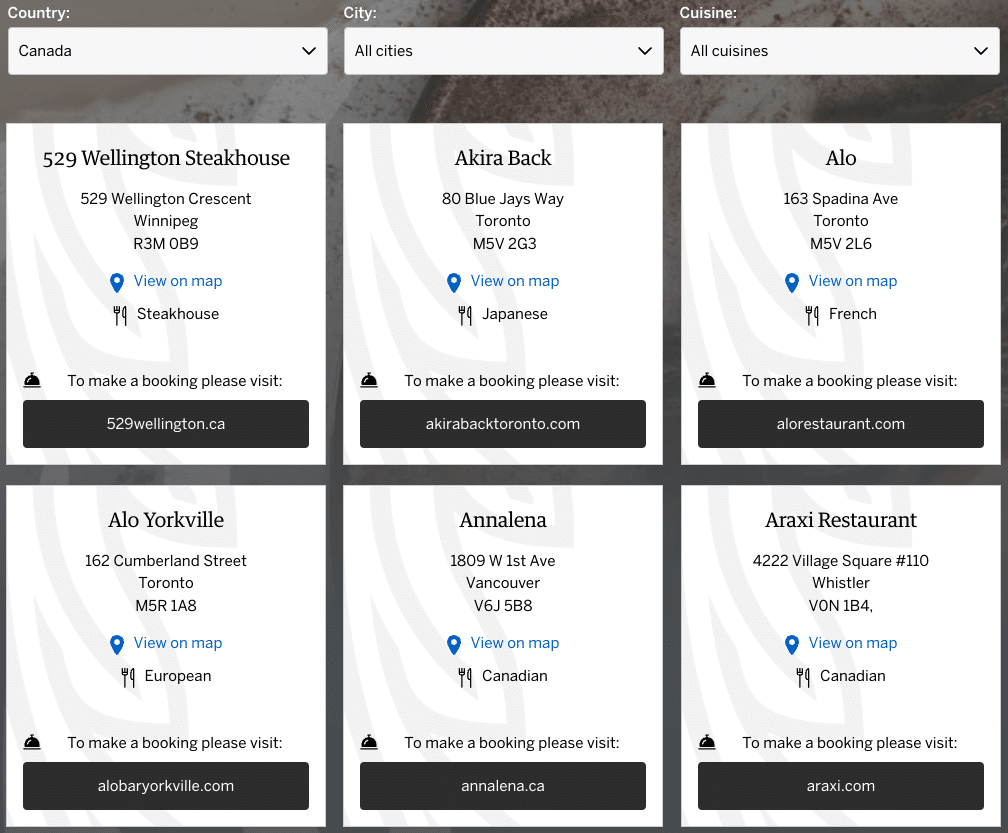

To use the credit, you’ll have to spend at least $200 in a single transaction at one of the restaurants listed on the American Express website.

Unfortunately, the Canadian website hasn’t been functional since the changes were announced; however, it’s possible to access the dining credit landing page from another country, and then switch the country to Canada to see which restaurants might be eligible.

The dining credit will run per calendar year, and you’ll need to initially enroll for the credit through the Amex Offers dashboard in your account. Once you’re enrolled, it’ll automatically renew for future redemption periods.

The initial enrollment period will be from September 26–December 31, 2023, which means that you should be able to use two $200 annual dining credits within a single annual billing cycle.

Unfortunately, you won’t earn as many American Express Membership Rewards points for your dining purchases, as the earning rate on dining is set to decrease from 3 MR points per dollar spent to 2 MR points per dollar spent.

Going forward, the category earning rates on the Platinum Card will be as follows:

- Earn 2 MR points per dollar spent on dining and travel

- Earn 1 MR point per dollar spent on all other purchases

Current cardholders will enjoy the elevated 3 points per dollar spent on dining until October 26, 2023. After that point, the earning rate will drop to 2 points per dollar spent on dining.

Upcoming Changes to the Business Platinum Card from American Express

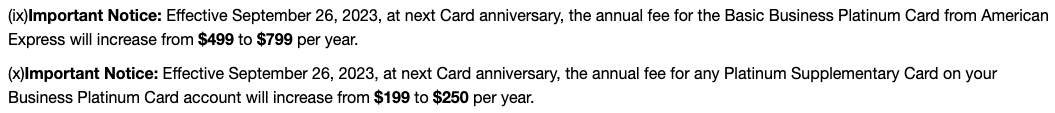

The Business Platinum Card from American Express is also set to see some changes, which likewise kick in as of September 26, 2023. Some of the changes are printed on the card’s landing page, buried at the end of the terms and conditions, and others were confirmed separately through Amex and through letters sent out to cardholders.

The card’s annual fee is set to increase from $499 to $799. Compared to the personal Platinum Card, whose annual fee will increase by $100, this is a significant jump of $300.

Furthermore, adding Platinum Cards to your account will cost $250 each year, which is an increase of $51 from the current cost of $199 per additional card.

While there aren’t any other published changes on the Amex website, we could confirm through the Amex Chat feature that the card will receive a number of new additions to help offset the increased annual fee.

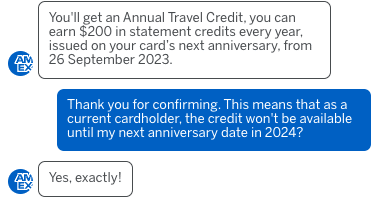

The Business Platinum Card will soon feature the $200 annual travel credit, which is currently available on the personal version of the card. It appears that the credit will become available to current cardholders as of their next anniversary date, and not as of September 26, 2023.

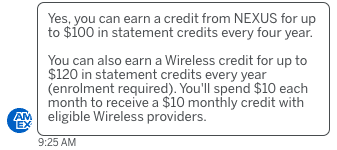

Cardholders will also benefit from a $100 statement credit for NEXUS applications and renewals every four years. This feature is also currently on the personal version of the card.

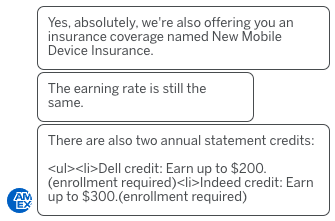

Furthermore, cardholders will receive an annual $120 wireless statement credit ($10 per month) from eligible wireless providers, up to $200 in annual statement credits from Dell (enrolment required), and up to $300 in annual statement credits from Indeed (enrolment required).

Lastly, the Business Platinum Card will have mobile device insurance added to its list of coverages.

A Major Shakeup to the Platinum Cards

The upcoming changes to Amex Platinum Cards are a bit of a mixed bag.

For the personal American Express Platinum Card, the new $200 annual dining credit arguably makes up for the $100 increase to the annual fee. If you’re able to make use of the credit each year at one of the 109 restaurants on the list, then the effective annual fee is $399, considering the $200 annual travel credit as well.

On the other hand, the other changes to the card are undoubtedly negative. You’ll have to pay more for adding Platinum Cards to your account, and the earning rate will drop to a less competitive 2 MR points per dollar spent on dining.

It’s worth noting that the American Express Cobalt Card still reigns superior for dining purchases, as it earns 5 MR points per dollar spent.

It’s a similar story with the Business Platinum Card from American Express. At first glance, a $300 increase to the annual fee is quite significant, especially since the other changes to the card aren’t currently published on the Amex website.

However, the addition of the $200 annual travel credit effectively reduces the annual fee to a more reasonable $599, and if you’re able to make use of the other statement credits being added to the card, it goes down from there.

If you don’t have either of the cards already, consider applying prior to September 26, 2023, as you’ll benefit from lower annual fees for the first year for either card.

In the case of the American Express Platinum Card, you’ll also enjoy the $200 annual dining credit for the latter part of 2023, as well as a new one available in early 2024.

Conclusion

American Express will introduce some major changes to the Canadian-issued American Express Platinum Card and the Business Platinum Card from American Express on September 26, 2023.

Both cards are seeing the annual fee increase to $799, and the cost to add supplementary cardholders is rising to $250, too.

The personal Platinum Card will see a reduced earning rate on dining purchases, as well as the introduction of a $200 annual dining credit. The Business Platinum Card will get the $200 annual travel credit, as well as a handful of other statement credits.

The changes are set to come into effect on September 26, 2023, so be sure to apply for either of the cards before then to take advantage of the lower annual fee for the first year.

I was considering applying for an AMEX card, specifically to get access to the lounges. But I recently ran into a sticky situation at my home airport YUL, which makes me wonder if it is worth it. I was travelling domestically, from YUL to Calgary. I tried to get access to one of the two Premium Pass lounges, under another program. Because the two PP lounges are in the International concourse, and I was travelling domestically, I was barred from entering the International concourse, thus could not access the lounges. Air Canada lounge, on the domestic side, did not partner with my provider, and I was unable to enter the only lounge on the Domestic side. Does any credit card fix this situation? Thanks for any hints. Blue Yonder.

Hi, indeed, the only lounge in YUL domestic terminal is the Air Canada lounge which does not partner with any lounge membership program except with the Aeroplan Reserved American Express card and its business version:

https://princeoftravel.com/credit-cards/american-express-aeroplan-reserve-card/

https://princeoftravel.com/credit-cards/american-express-aeroplan-business-reserve-card/

If getting into this lounge is important to you, then this may be your solution, as they allow you access to all Air Canada Maple Leaf lounge in North America

Any ideas how to use the wireless credit?

You’ll find the wireless credit under the Amex Offers on your account, titled “Wireless Credit Benefit”. Once you’ve enrolled, you’ll enjoy a $10 statement credit upon spending $10 each month at eligible wireless providers.

Oh I see it, but I can’t find a wireless provider accepting Amex. Are we talking about an Internet company here?

My Amex Business Platinum with an anniversary in late August was just billed $799 (on Sept 27, 2023). I called Card Services in mid-Aug 2023 to confirm the fee will be $499 for another year, and they confirmed this was correct because my anniversary date was before Sept 26. Today, over a month later, I was billed $799 so I called again and the Card Services person thought it was a mistake and from what they knew it should have been $499, but, after being put on hold a few minutes, the higher ups said $799 was correct. They are escalating and will get back to me. I think their programming/billing team and their marketing team were given conflicting information resulting in this mistake which is probably effecting any existing card holders who are billed on or after the 26th of the month. Anyone else in the same boat?

Hello, I think I know where the error is.

When we first got approved for a card, the Annual Fee doesn’t show up for a while; from maybe a few days to a few weeks. The subsequent Annual Fees usually occur 365 days after the first time your first Annual Fee is posted. This is where the error is. Amex views your anniversary as the date which your usual Annual Fee date is posted each year, contrary to when you were approved of your card. So now, depending on which date Amex is following in regards to the Annual Fee ($499 vs $799). I hope they would choose the approval date for you. Good luck!

Follow up result from Amex: After a week or so, Amex basically said that I was right and that they would charge me $499 this year, but that I wouldn’t get the $200 travel credit (which is what I expected and wanted). They made this change for a bunch of people in my situation. I was given a $300 credit on my statement, so all is as it should be now. It was a bit frustrating dealing with them knowing I was right and getting a hard line, but they sorted it out in the end. Just wish Amex was accepted more places in Canada and internationally outside the US.

My wife has applied for the card last night and received a review notification, not automatically approved, her first amex card. Will she still pay the lower annual fee since the application was put in on Sept 25? Thank you for the referral link.

So the dining benefit went live today….trying to figure out if the participating restaurants are limited to the list of Canadian ones on the website. If that is the case the value of this card is even worse than I thought. Hello TD Infinite Privilege

Just checked – only Canadian restaurants on the list for the benefit – none of the global ones listed on the Singapore site. $100 more, fewer points, and no restaurants where I live. Not a lot of value left in this card.

Anyone know where I can get a response regarding the custom Amex Business Platinum welcome bonus mentioned in the PoT Axem Business Platinum info page? It says to send a email for a custom $75k/4mth welcome bonus which I’ve done 2x, tried Fackbook, FB Messenger, and commenting on 2 blogs. Just need to know if that elevated offer still exists otherwise I’ll just do the 100k WB one listed.

I emailed pot and they got back to within a few days with the 200k offer. Keep in mind for that much spend you can likely leverage multiple cards and get many more points than the 200k

Anyone know whether the Dell credit can be used retroactively? So if I buy something now can I reimburse once the new changes come out?

It can’t be used retroactively; however, it should already be available through the Amex Offers on your card.

You’re right – thanks!

My Plat just had the annual fee post at the old rate. Do we know if I and other such people will get the new dining credits? That would be a good deal! Your article makes it sound hopeful 🙂

On September 26, you should see the dining credit available on your Amex Offers. It will be valid until the end of the year, and then it will auto-renew after that.

Thanks T.J. That sounds great.

I’ve been trying to decide if I could keep the Platinum Card or the TD Aeroplan Infinite Privilege. The devaluation made up my mind. The 3x on dining going to 2x removed the value. There are zero restaurants in the $200 benefit were I live.

And it’s even harder when you see the benefits and transfer partners with the US card. They really tanked the value of the card, at least for me.

Still searching for where to apply for the dining credit in Canada….can any one help? I don’t see it anywhere in my offers.

It won’t be available until September 26, 2023. It will appear in your Amex Offers at that point.

Thanks!

The promo material also mentions new Member extras – but they just seem like the same offers we already get from Holt Renfrew and Lulu…any addt’l info here?

Will probably cancel before my renewal in March. Prefer the maple leaf lounge access from the aeroplan reserve to the plaza premium lounges. Actually meant to cancel last March but at least now I can use the dining credit twice before I ditch it lol.

It appears that the $200 of extra value is just from existing Amex Offers.

indeed…a bit disappointing, especially since the offers seem less enticing than padt years.

thanks for the reply.

I was considering cancelling my Platinum (renewal in October), but today I got a paper letter from Amex about this devaluation. 200 CAD dining benefit is not applicable to me (for religious reasons). And not everyone is able/needs to spend 200 CAD in one transaction. If they would offer 200 CAD grocery credit (like they did during Covid times), then it makes more sense to keep the card.

Well, it seems like the decision was made for me and no regrets now for cancelling it…

Hello there! It seems that this article is being referenced by various US-based readers which is causing a lot of chaos and confusion on various forums and groups. If possible, I wonder if the title can be changed to referred Canadian AMEX cards. Sorry about this 🙁

As usual, the benefits are great for those in Toronto, but not so great for Montreal… been thinking of getting rid of my Platinum, and this just pushed it over the edge.

I feel you man, exactly in the same boat. Won’t be renewing either.

Yikes!! That’s a massive increase of $300 (60% increase). I like the benefits but I don’t use all of them. The Priority Pass (lounge access) is the key for me as a benefit. The Fine Hotels etc… aren’t always the best deal, especially at those room rates. This increase is going to be hard to justify. Maybe the $200 dining credit will soften the blow. That I’ll use.

I’ll look at other Amex cards before I decide.