With the BMO Rewards points earned through welcome bonuses and daily spending on the bank’s credit cards, you can redeem them at a fixed value in a variety of ways, including for travel or cashing them out to a BMO investment account..

In this guide, we’ll cover all the ways to earn and redeem BMO Rewards, including the best ways to squeeze value out of them.

Earning BMO Rewards Points

The only way to earn BMO Rewards points is through BMO credit cards.

As it stands, BMO has five credit cards that earn BMO Rewards points, including four personal cards and one business card:

- BMO eclipse rise Visa Card*

- BMO eclipse Visa Infinite* Card

- BMO eclipse Visa Infinite Privilege* Card

- BMO Ascend World Elite® Mastercard

- BMO World Elite®* Business Mastercard®*

The fastest way to rack up points is by taking advantage of credit card welcome bonuses; however,, you’ll also continue to earn BMO Rewards points on day-to-day spending as well.

Credit Card Welcome Bonuses

Welcome bonuses may fluctuate throughout the year; however, you can expect to earn anywhere from 20,000–90,000 BMO Rewards points after meeting the minimum spending requirements.

Some cards will also include a first-year annual fee rebate as part of the offer, which lets you test-drive the card without any out-of-pocket cost in the first year.

The current welcome bonuses, as well as the cards’ annual fees, can be found below:

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

Up to 100,000 BMO Rewards points

First Year Free

|

Up to 100,000 BMO Rewards points | $804 | Apply Now |

|

100,000 BMO Rewards points

First Year Free

|

100,000 BMO Rewards points | $670 | Apply Now |

|

Up to 70,000 BMO Rewards points

First Year Free

|

Up to 70,000 BMO Rewards points | $549 | Apply Now |

|

Up to 200,000 BMO Rewards points

$599 annual fee

|

Up to 200,000 BMO Rewards points | $177 | Apply Now |

Also included in the list is the newly launched BMO eclipse rise Visa* Card, the only no-fee product among BMO Rewards-earning cards.

Credit Card Spending

BMO Rewards points can also be earned on eligible day-to-day spending on the credit cards mentioned above.

- Earn 5 BMO Rewards points per 2 dollars spent on eligible recurring bills, groceries, dining, and takeout/delivery purchases†

Earn 1 BMO Rewards point per 2 dollars spent on all other eligible purchases† - BMO eclipse Visa Infinite* Card

- Earn 5 BMO Rewards points per dollar spent on eligible dining, groceries, gas, and transit purchases, up to the first $50,000 in purchases per calendar year†

- Earn 1 BMO Rewards point per dollar spent on all other eligible purchases†

BMO eclipse Visa Infinite Privilege* Card

- Earn 5 BMO Rewards points per dollar spent on eligible travel, dining, groceries, gas, and drugstore purchases, up to the first $100,000 in purchases per calendar year†

- Earn 1 BMO Rewards point per dollar spent on all other eligible purchases†

BMO Ascend® World Elite® Mastercard®

- Earn 5 BMO Rewards points per dollar spent on eligible travel purchases, up to the first $15,000 spent per calendar year†

- Earn 3 BMO Rewards points per dollar spent on eligible recurring bill payments, dining, and entertainment purchases up to the first $10,000 spent per category per calendar year)†

- Earn 1 BMO Rewards point per dollar spent on all other eligible purchases†

BMO World Elite® Business Mastercard

- Earn 4 BMO Rewards points per dollar spent at eligible gas stations, on office supplies, and on recurring internet/telephone bill payments†

- Earn 1 BMO Rewards point per dollar spent on all other eligible purchases†

Redeeming BMO Rewards Points

BMO Rewards points have a fixed redemption value that can help offset the cost of travel expenses or add to your BMO investment account.

You can also redeem BMO Rewards points for statement credits and gift cards, but you’ll get a lower redemption rate than if you redeem them for travel expenses or your investment account.

Redeeming BMO Rewards points for travel will get you a fixed value of 150 points = $1, or 0.67 cents per point. This means that every 10,000 BMO Rewards points will get you a value of up to $67.

To redeem your points for travel, you can book with any travel provider and then apply BMO Rewards points against the purchases through your BMO Rewards account with the “Pay with Points” tab.

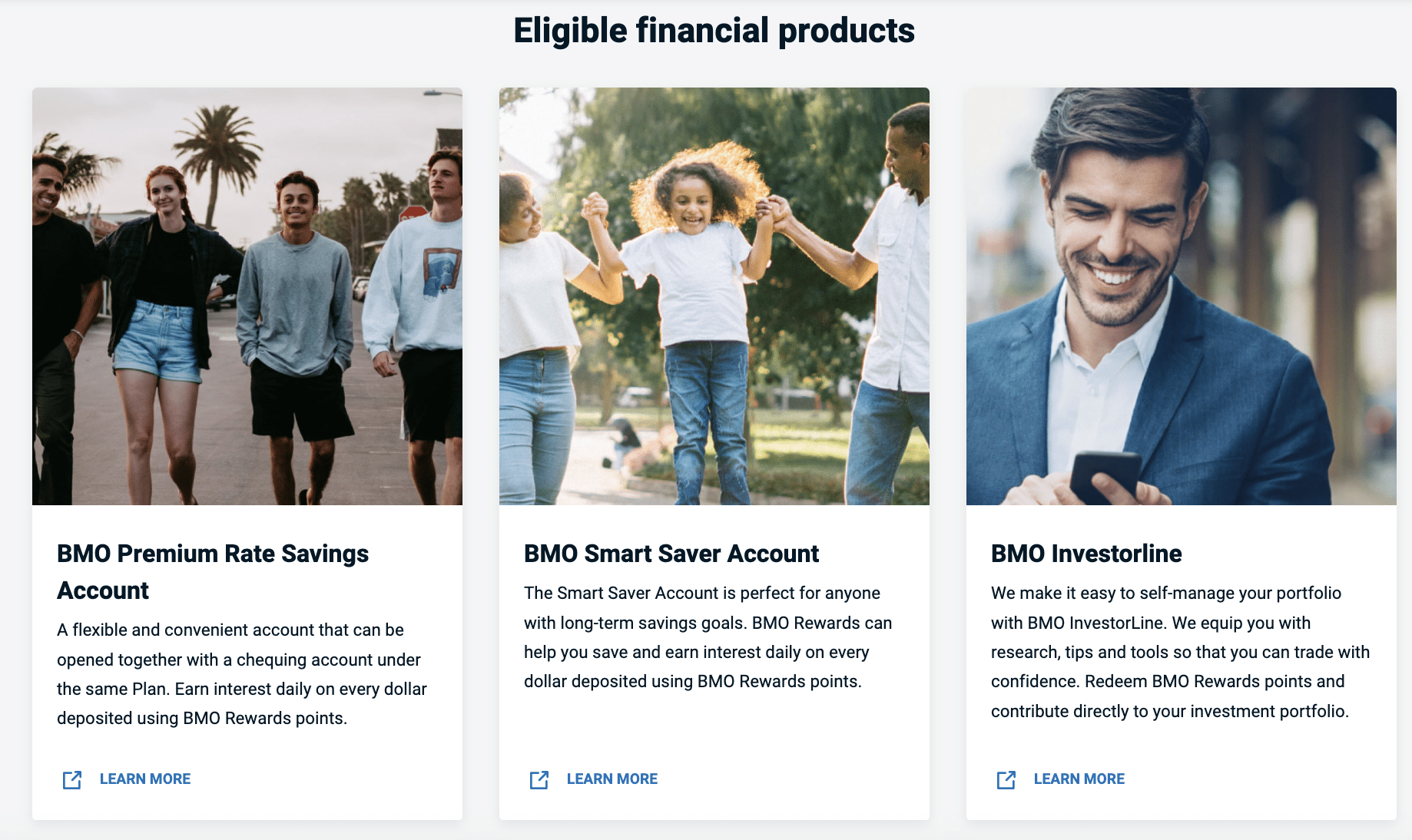

Similarly, you can redeem BMO Rewards points at the same rate by turning the points into cash, and having that cash deposited directly into your BMO investment account.

With this option, you must redeem in increments of 15,000 BMO Rewards points, which will result in $100 being deposited into your investment account.

If you don’t have a BMO investment account, and you have no travel plans, BMO Rewards offers other redemption options.

You can redeem BMO Rewards points for gift cards, merchandise, or as a statement credit against your BMO Rewards credit card.

If you redeem BMO Rewards points for gift cards and merchandise, you’ll only get a subpar average redemption value of about 0.54–0.56 cents per point.

With both of these options, it’s worth waiting for a promotion, such as holiday sales or Black Friday discounts, during which BMO will often offer promotions of 15% off redemptions.

The last way to redeem BMO Rewards points is directly as a statement credit at a rate of 15,000 points = $50, or 0.33 cents per point.

Prior to redeeming your points this way, keep in mind that this is only half the value you get when redeeming BMO Rewards points for travel or for cash in an investment account.

Conclusion

BMO Rewards points are great for their simplicity in earning and redeeming. You won’t have to deal with award availability or having to work to get the most value for your points.

Instead, BMO Rewards points are worth 0.67 cents per point against travel or when cashed out through an investment account. Plus, they’re easy to earn with welcome bonuses from one of the five BMO Rewards credit cards, or from spending on day-to-day purchases on those same cards.

If you wish, you can also redeem BMO Rewards points for gift cards, merchandise, or credit card statement credits, giving you ample ways to engage with the program.

† Terms and conditions apply please refer to the BMO Website for the most up to date information.

Well written article. Rather than booking a car rental and canceling, if you wanted to redeem your points for cash you would choose the investment option and choose to redeem to a premium rate savings account. You would get the maximum redemption value and have the cash in hand since it’s just in a savings account.