CIBC Aventura® is the flagship travel rewards program by the Canadian Imperial Bank of Commerce, which can only be earned on CIBC’s Aventura-branded credit cards.

CIBC Aventura® is a fixed-value points currency, meaning that points can be redeemed only at a fixed value, through multiple ways.

These aren’t necessarily the points to use for luxury hotels and First Class flights; however, they’re great to offset the cost of other travel expenses, including boutique hotels, train tickets, economy flights, and other incidentals.

Earning Points via Signup Bonuses

The only way to earn CIBC Aventura® is from the bank itself, via its suite of Aventura-earning credit cards.

- The CIBC Aventura® Visa* Card is a no-fee card, which typically comes with a small signup bonus.

- The CIBC Aventura® Gold Visa* Card is an entry-level product among the CIBC Aventura cards. The card frequently puts on promotions for first-year annual fee rebates, along with a sizeable welcome bonus, which typically ranges between 20,000–50,000 CIBC Aventura Points.

- The CIBC Aventura® Visa Infinite* Card is a mid-range offering by CIBC. The card frequently puts on promotions for a first-year annual fee rebate, along with a sizeable welcome bonus of 20,000–50,000 CIBC Aventura Points.

- The CIBC Aventura® Visa Infinite Privilege* Card is the premium offering by CIBC. For a substantial annual fee, cardholders will have comprehensive travel insurance coverage, and elevated earnings on CIBC Travel Rewards purchases.

- The CIBC Aventura® Visa* Card for Business is the CIBC Aventura-earning card aimed at business owners. The card sometimes puts on promotions for a first-year annual fee rebate, along with a welcome bonus of 20,000–60,000 CIBC Aventura Points, though typically paired with a high minimum spending requirement.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

Up to 70,000 CIBC Aventura Points

First Year Free

|

Up to 70,000 CIBC Aventura Points | $1,050 | Apply Now |

|

60,000 CIBC Aventura Points†

First Year Free

|

60,000 CIBC Aventura Points† | $650 | Apply Now |

|

60,000 CIBC Aventura Points†

First Year Free

|

60,000 CIBC Aventura Points† | $600 | Apply Now |

|

Up to 80,000 CIBC Aventura Points

$499 annual fee

|

Up to 80,000 CIBC Aventura Points | $276 | Apply Now |

| 12,500 CIBC Aventura Points† | $99 | Apply Now |

Earning Points via Daily Spending

Beyond signup offers, you can earn CIBC Aventura Points through daily spending on the above credit cards. The earning rates are as follows:

- CIBC Aventura® Visa* Card:

- 1 Aventura Point per dollar spent at gas stations, grocery stores, drugstores, and on travel purchases via the CIBC Travel Rewards Centre

- 1 Aventura Point per $2 spent on all other purchases

- CIBC Aventura® Gold Visa* Card:

- 2 Aventura Points per dollar spent on travel purchases via the CIBC Travel Rewards Centre

- 1.5 Aventura Points per dollar spent at gas stations, grocery stores, and drugstores

- 1 Aventura Point per dollar spent on all other purchases

- CIBC Aventura® Visa Infinite* Card:

- 2 Aventura Points per dollar spent on travel purchases via the CIBC Travel Rewards Centre

- 1.5 Aventura Points per dollar spent at gas, grocery stores, and drugstores

- 1 Aventura Point per dollar spent on all other purchases

- CIBC Aventura® Visa Infinite Privilege* Card:

- 3 Aventura Points per dollar spent on travel purchases via the CIBC Travel Rewards Centre

- 2 Aventura Points per dollar spent on dining, entertainment, transportation, gas, and groceries

- 1.25 Aventura Points per dollar spent on all other purchases

- CIBC Aventura® Visa* Card for Business:

-

2 Aventura Points per dollar spent on travel purchases via the CIBC Travel Rewards Centre

-

1.5 Aventura Points per dollar spent on gas and other travel purchases

-

1 Aventura Point per dollar spent on all other purchases

-

From an everyday spending perspective, the CIBC Aventura® Visa Infinite* Card is a clear winner.

Earning 1.5 Aventura Points per dollar spent on gas and groceries is quite good, and unless you spend quite a bit in those categories, it’s not necessarily worth paying a $499 annual fee to earn 2 points per dollar on the CIBC Aventura® Visa Infinite Privilege* Card.

If you’re looking to offset cash expenses for travel, such as tours, cruises, short-term rentals, or independent hotels, then redeeming Aventura Points directly against other travel purchases is an excellent use.

Redeeming CIBC Aventura Points

CIBC Aventura offers various redemptions, from a the CIBC Aventura Airline Rewards Chart to redeeming for financial products.

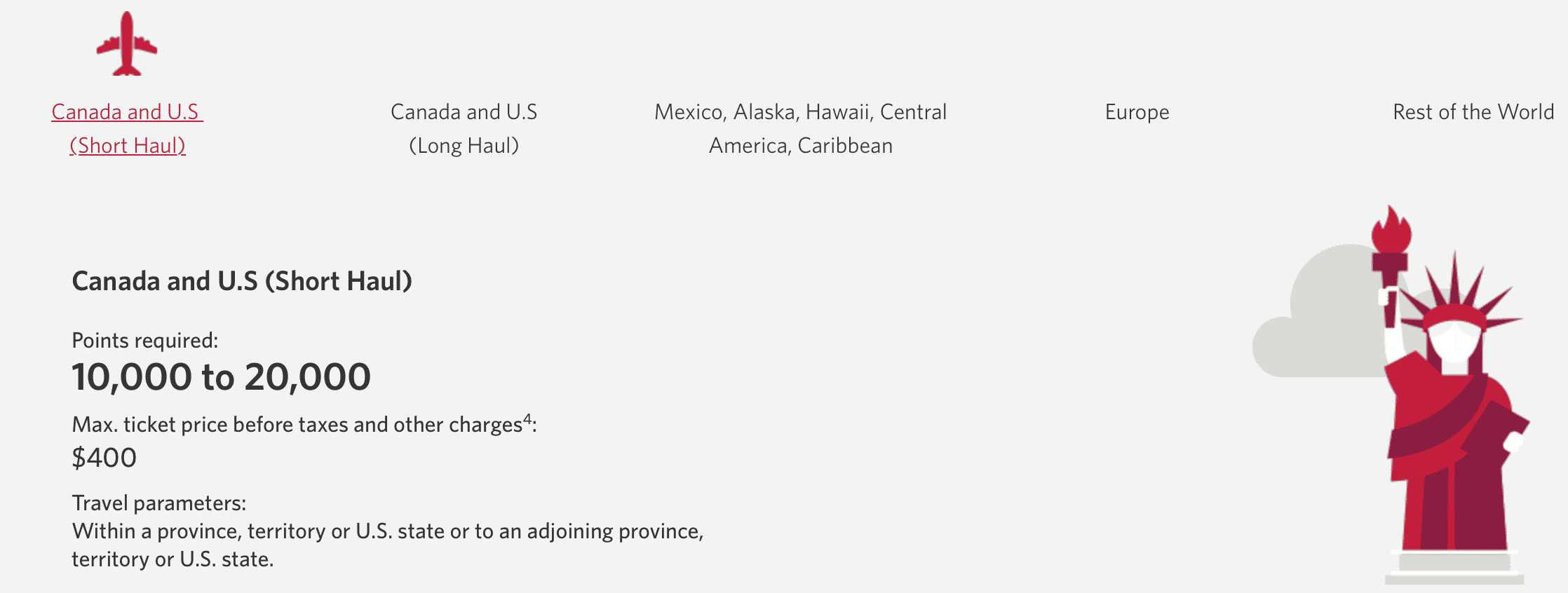

Aventura Airline Rewards Chart

Using the Aventura Airline Rewards Chart, you can earn up to 2.29 cents per point in value. The chart works by applying a fixed number of points to any cash ticket to a certain region.

You can apply the number of points indicated on the chart to any cash ticket at or below the maximum ticket price that CIBC dictates.

For example, for short-haul flights in Canada and the U.S., you’ll need 10,000–20,000 Aventura Points to book a one-way flight with a maximum cash ticket price of $400.

Note that the maximum ticket price only includes the base fare, and does not apply to any additional taxes and fees. If you wish to apply points towards the additional taxes and fees, you can at the fixed travel rate of 1 cent per point.

Redeeming points this way results in a value of up to 2.29 cents per point.

CIBC Rewards Travel Centre

You can redeem Aventura Points at a set value of 1 cent per point for any bookings made through the CIBC Rewards Travel Centre, including flights, hotels, car rentals, and cruises.

You might be wondering why flights are included if there’s already a flight reward chart above. Well, CIBC’s online travel portal can be limited in airlines it displays, so if you wish to redeem on low-cost-carriers or for flights with smaller airlines like Harbour Air, you’ll have to do so via calling in to the CIBC Rewards Travel Centre.

If you’re using Aventura Points to redeem for hotels or car rentals, the usual warnings of using an online travel agency apply.

You won’t earn any hotel status benefits or accrue elite qualifying nights at hotels. For car rentals, you won’t earn things like Hertz points or free rentals through National Free Days.

This doesn’t apply to airfare, though, as you’ll still accrue the same amount of elite qualifying miles, segments, and dollars. As long as you have your frequent flyer number attached to your booking, or add it in at the check-in counter, your travel should count towards elite status qualification.

One major thing to note about using CIBC to book airfare is that any and all changes and cancellations must be done through the third-party booking agency, and can’t be done through the airline.

Considering all of the above, it’s still worthwhile to book car rentals or hotels, especially if it’s a one-off rental agency you’re not concerned about accruing status for.

Similarly, if you’re planning to stay at a boutique hotel where there’s no such thing as status, then booking through CIBC Travel won’t make a difference.

Redeeming for Financial Products

You can also redeem CIBC Aventura Points towards a statement credit on the following CIBC-branded financial products:

- Mortgage

- RRSP

- TFSA

- Investor’s Edge Portfolio

- Line of credit

These come at a fixed rate of 0.83 cents per point, and you must have at least 12,000 points in order to begin redeeming.

Redeeming for these financial instruments is done using the “pay with points” feature in CIBC’s online banking interface.

Gift Cards & Merchandise

Redeeming CIBC Aventura Points for merchandise isn’t always a bad idea, especially if there’s a holiday or promotional sale. Outside of those circumstances, though, you’ll be looking at between 0.4–0.8 cents per point, depending on the item.

This doesn’t take into account any additional points or savings you could accrue through the Aeroplan eStore and cash back portals, among others.

With gift cards, it’s almost always going to come out to 0.71 cents per point in value. The only exception to this is redeeming for CIBC prepaid Visa cards, which have the lowest redemption value at just 0.63 cents per point.

Statement Credits

Speaking of 0.63 cents per point, this is also the rate you’ll redeem at if redeeming Aventura Points against all other non-travel, non-financial products.

Simply apply your using points in the CIBC online banking interface using the “pay with points” feature.

Needless to say, redeeming points at 0.63 cents each is a bad idea, and you’d be much better served with a cash back card.

CIBC Experiences

CIBC also runs auctions for special experiences, such as a Bermuda island retreat or tandem skydiving in British Columbia.

Due to the nature of such redemptions, it’s difficult to assign a cent per point value, but some of the bids can end up being quite reasonable. So, it’s always worth a look to see if nobody is bidding for what’s sure to be a good time.

Conclusion

CIBC Aventura Points are optimally used via the Aventura Airline Rewards Chart, but that might be restrictive for folks who want to apply their points to a greater set of all travel purchases.

Otherwise, you can think of CIBC Aventura Points as a stop-gap for miscellaneous travel purchases on your travels around the world, between traipsing from hotel to hotel and flight to flight.

Use them for train tickets, entrance fees, and all the other incidentals you may rack up on your journey.

†Terms and conditions apply. CIBC is not responsible for maintaining the content on this site. Please go to CIBC.com for the most up to date information.

Do I need the full value in Aventura Points to “Pay with Points” on my statement? I.E Can I offset a portion of the cost?