Marriott Bonvoy is the loyalty program of Marriott International, the largest hotel chain in the world.

It came about as a result of the Marriott–Starwood merger of 2016, which eventually witnessed the legacy programs of Marriott Rewards and Starwood Preferred Guest combining into a singular program in August 2018 and taking on the Marriott Bonvoy name in February 2019.

Marriott’s vast international footprint, composed of over 8,500 properties, means that there’s something in the Bonvoy program to cater to every type of traveller out there, whether you’re looking for luxury resorts or roadside inns.

And for North American travellers, it’s is one of the easiest and most accessible hotel loyalty programs for obtaining free hotel stays and taking advantage of elite perks and benefits.

Let’s take a closer look at how you can get the most out of Marriott Bonvoy.

Earning Marriott Bonvoy Points

Fortunately, there are many ways to accumulate Marriott Bonvoy points in Canada and the United States.

Canadian Credit Cards

The easiest way to rack up a large number of points is through welcome bonuses and daily spending on co-branded credit cards.

In Canada, there are two co-branded credit cards: the Marriott Bonvoy American Express Card and the Marriott Bonvoy Business American Express Card. Both cards come with similar welcome bonuses of up to 110,000–130,000 points at best, while the base offer is typically for around 50,000 points.

Both cards also offer the following benefits:

-

15 elite qualifying nights per calendar year

-

An anniversary Free Night Award worth 35,000 points

-

Gold Elite status when you spend $30,000 on the card in a calendar year

The return on daily spending on these cards will also earn Bonvoy points. The Marriott Bonvoy American Express Card earns:

-

5 Bonvoy points per dollar spent at Marriott hotels

-

2 Bonvoy points per dollar spent on all other purchases

Meanwhile, the Marriott Bonvoy Business American Express Card earns:

-

5 Bonvoy points per dollar spent at Marriott hotels

-

3 Bonvoy points per dollar spent on gas, dining, and travel purchases

-

2 Bonvoy points per dollar spent on all other purchases

Transferring from American Express Membership Rewards

Another way to earn points via Canadian credit cards is to transfer American Express Membership Rewards points over to Marriott Bonvoy at a ratio 1:1.2. In other words, for every 1,000 American Express MR points, you’ll get 1,200 Marriott Bonvoy points.

Since the welcome bonuses on the Amex MR credit cards tend to be much larger than those on the Bonvoy credit cards, this represents a good way to supercharge your Bonvoy earnings.

From time to time, Amex runs transfer bonuses to Marriott Bonvoy, typically offering a 30% bonus – boosting the ratio to 1:1.56. So if you’re considering a transfer, it’s usually best to wait for one of these promotions to get more value out of your MR points.

That said, there are also more valuable potential uses of Amex MR points out there (such as transferring to airline frequent flyer programs), so that’s the tradeoff you’ll need to consider.

Credit Card

Best Offer

Value

130,000 MR points

$1,794

Apply Now

70,000 MR points

$1,676

Apply Now

110,000 MR points

$1,581

Apply Now

70,000 MR points

$846

Apply Now

15,000 MR points

$372

Apply Now

12,500 MR points

$242

Apply Now

US Credit Cards

By diversifying into US credit cards, you can gain access to an even wider pool of Bonvoy bonuses. The cards you can potentially apply for include the following:

- Marriott Bonvoy Brilliant American Express Card

- Generous welcome bonuses

- Free Night Award worth up to 85,000 points

- Instant Platinum Elite status

- Earn 6 points per US dollar spent at Marriott properties

- Marriott Bonvoy Bevy American Express Card

- Generous welcome bonuses

- Earn 6 points per US dollar spent at Marriott properties

- Earn a Free Night Award upon spending $15,000 year year

- Marriott Bonvoy Business American Express Card

- Moderate welcome bonus

- Earn 6 points per US dollar spent at Marriott properties

- Earn a Free Night Award each year worth 35,000 points

- Chase Marriott Bonvoy Boundless Card

- Generous welcome bonus

- Earn 6 points per dollar spent at Marriott properties

- Free Night Award worth 50,000 points every year

- Chase Marriott Bonvoy Bountiful Card

- Moderate welcome bonus

- Earn 6 points per US dollar spent at Marriott properties

- Earn a Free Night Award every year upon spending $15,000 (USD)

- Chase Marriott Bonvoy Bold Card

- Moderate welcome bonus

- Earn 3 points per dollar spent at Marriott properties

- No annual fee

The Amex US cards in particular are easy for Canadians to obtain by way of initiating an American Express Global Transfer, as long as you have a Canadian Amex card that’s been open and in good standing for at least three months.

There’s also the Marriott Bonvoy American Express® Card (distinct from the Brilliant and Bevy), which carries a $95 (USD) annual fee. This card isn’t available via direct application — it’s only accessible by downgrading from the Brilliant or Bevy.

Similarly, the Chase Ritz-Carlton Card still exists, but it’s not open to new applicants. It can be obtained by upgrading from one of the Chase Bonvoy cards after holding the card for over a year. It offers some unique perks like unlimited Priority Pass and a 85,000-point Free Night Award every year.

Staying at Hotels

Outside of credit cards, the primary way to earn points is through spending at Marriott hotels (room rates, dining, on-property incidentals, etc.). The amount of points you’ll earn depends on your elite status with Marriott (we’ll cover this below).

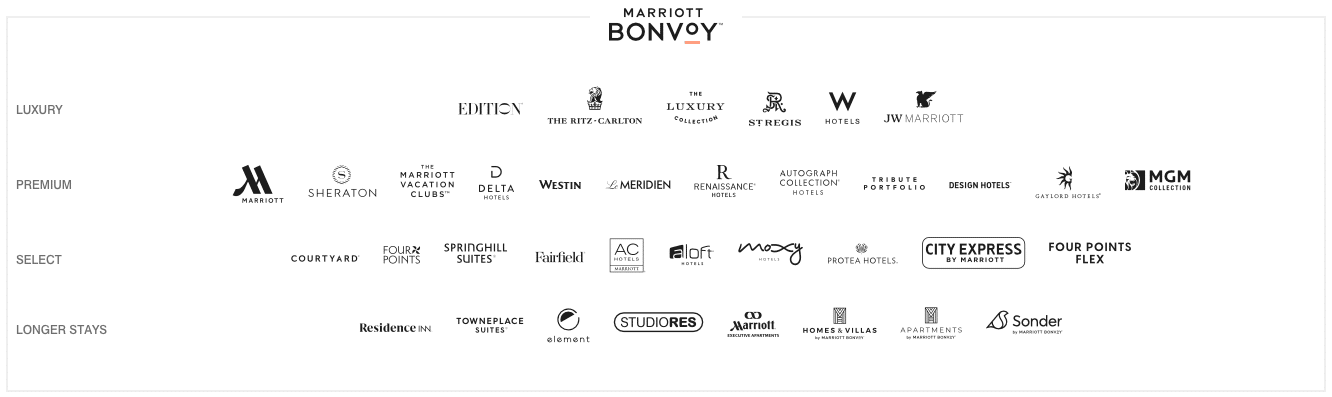

The base earning rate depends on the brand you’re staying at:

10 points per US dollar spent

- Luxury & Premium brands: EDITION, The Ritz-Carlton, The Luxury Collection, St. Regis, W Hotels, JW Marriott, Marriott Hotels, Sheraton, Marriott Vacation Club, Delta Hotels by Marriott, Westin, Le Meridien, Renaissance Hotels, Autograph Collection, Tribute Portfolio, Design Hotels, Gaylord Hotels, MGM Collection with Marriott Bonvoy,

- Select brands: Courtyard by Marriott, Four Points by Sheraton, SpringHill Suites by Marriott, Fairfield by Marriott, AC Hotels by Marriott, Aloft, Moxy Hotels

- Longer stay brands: Sonder by Marriott Bonvoy Hotels

5 points per US dollar spent

- Longer stay brands: Residence Inn by Marriott, TownePlace Suites, Element, Homes & Villas by Marriott Bonvoy, Sonder by Marriott Bonvoy (Apartments)

- Regional & niche brands: Protea Hotels, City Express by Marriott, Four Points Flex by Sheraton

4 points per US dollar spent

- StudioRes

2.5 points per US dollar spent

- Marriott Executive Apartments

Keep in mind that elite night credits don’t accrue equally across the board. At Protea Hotels, City Express, and Four Points Flex, you’ll earn 1 Elite Night Credit for every 2 nights stayed. At Marriott Executive Apartments, you’ll earn 1 Elite Night Credit for every 3 nights.

From that baseline, elite members earn the following bonus multipliers on top of base points:

- Silver Elite: +10% bonus (11 points per US dollar spent)

- Gold Elite: +25% bonus (12.5 points per US dollar spent)

- Platinum Elite: +50% bonus (15 points per US dollar spent)

- Titanium & Ambassador Elite: +75% bonus (17.5 points per US dollar spent)

In order to maximize your earning potential, be sure to combine your elite status with the best possible earning rate on a credit card, many of which earn up to 6x points per dollar spent at Marriott properties.

Promotions

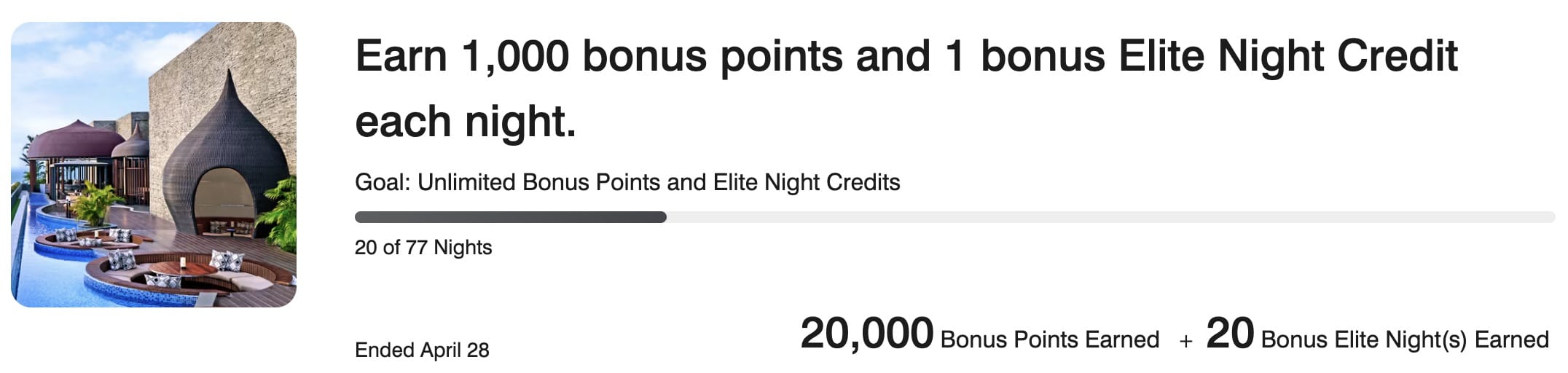

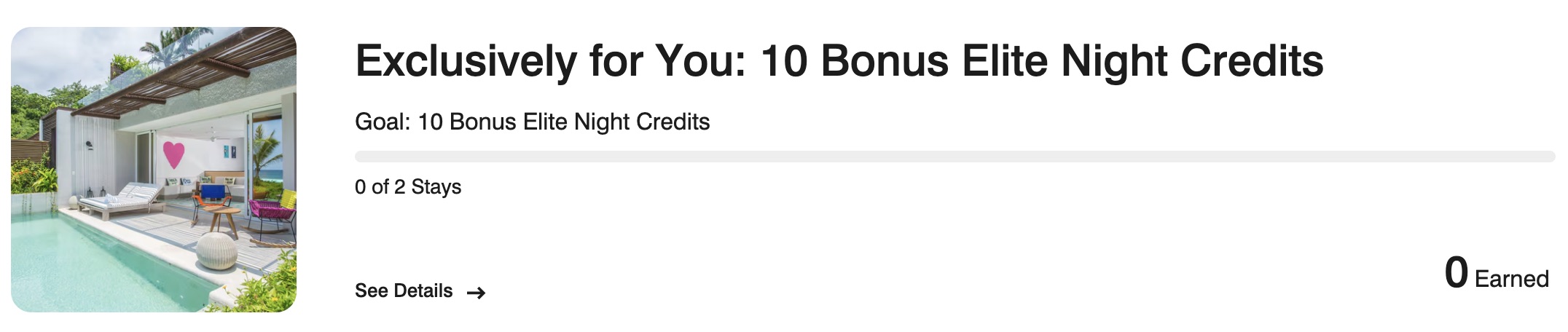

Marriott regularly runs promotions to incentivize member activity. The rules for each promotion are different, but usually you’ll earn some extra elite qualifying nights or a solid chunk of promotional points (think 1,000 to 10,000 points) based on your stay activity with Marriott.

These promotions are rarely generous enough to justify booking a stay just for the sake of them (a practice known as “mattress running”). Still, they’re worth watching for — especially if you have travel plans that can align with the promo window.

Occasionally, Marriott launches a genuinely valuable offer. One of the best examples is the double elite night credit promotion, which helps fast-track elite status (and lifetime elite status).

For instance, if you’re holding a Canadian Marriott Bonvoy American Express card that grants 15 elite night credits annually, you’d only need to stay 18 paid nights under a double elite promo to hit Platinum — much more achievable than the usual 35 nights you’d need otherwise.

Some promotions are global, open to all members. Others are targeted, meaning they’re only offered to select individuals — and there’s no clear rhyme or reason behind who gets what. One person might receive a meaningful offer like bonus elite nights, while another gets bonus 1,000 points after a stay.

Regardless of the offer, it’s always smart to register as there’s no penalty if you don’t end up using it.

Host an event at a Marriott hotel

You can also earn Marriott Bonvoy points by hosting an event at a Marriott hotel. Examples of events can include meetings, weddings, conferences or any other type of happening.

To begin, you’ll earn 2 points per US dollar spent on rooms, food, drinks, and other charges. If you happen to also have elite status, you’ll earn the corresponding bonus on these charges, too.

Additionally, you can earn one elite qualifying night per 20 room nights booked when you host an event. This really only applies to large-scale events; however, it could get you closer to the next status tier, or to qualifying for lifetime elite status.

Redeeming Marriott Bonvoy Points for Hotel Stays

Naturally, as a hotel loyalty program, Marriott Bonvoy points are generally best used towards free nights at one of the program’s 8,500+ participating properties worldwide.

All Marriott hotels are priced dynamically, depending on the season, and even the day of the week. That being said, there are some general ranges you can expect hotels to price at:

Low-end hotels: 5,000 points – 15,000 points per night

Mid-tier hotels: 20,000 points – 60,000 points per night

High-end hotels: 70,000–200,000+ points per night (luxury properties like The Ritz-Carlton and St. Regis can reach 150,000–225,000 points per night during peak periods)

Keep in mind that the “tier” the hotel falls into is also highly dependent on the market it’s in, so you can expect the Fairfield Inn and Suites near Disneyland, California to price at mid-tier levels even though it’s a limited-service brand.

“No Blackout Dates”

Marriott has a “No Blackout Dates” policy, which means that as long as a hotel has a standard room available on a certain date, then it can be booked using either cash or points. In other words, hotels can’t control points inventory separately from cash bookings – if a standard room is available, then either form of currency must be accepted for it.

This policy works decently well, and means that you generally won’t have too much trouble finding availability for points bookings on your travel dates.

However, keep in mind that each hotel is free to determine what they consider a “standard room”, so once all of its standard rooms are booked up, then any higher-tier room (such as a Deluxe Room, Executive Room, junior suite, and full suites) may be capacity-controlled when it comes to points bookings.

Stay 5, Pay for 4

When you redeem points for five consecutive nights at the same hotel, you can make use of the Fifth Night Free benefit and only pay for four nights. With dynamic pricing, this is less of a “Fifth Night Free” and more of “Cheapest night free when you stay for at least five”.

When booking a stay of at least five nights, the cheapest night will be free; when booking for ten nights, the cheapest two will be free, etc.

Along this logic, it may make sense to break longer stays into increments of five nights to increase the value of your free night.

For example, if the cost in points for a five-night stay is 50,000 points per night, you’d only pay 200,000 points for the entirety of the stay with the Fifth Night Free benefit.

Cash + Points

There’s also a Cash + Points redemption option, which highly depends on each property and what they choose to offer, and it also won’t be available at every hotel. Sometimes, you’ll be allowed to use Cash + Points for the base room, while other times, it’ll be for premium rooms (i.e. a cash upgrade supplement to an overwater villa).

Generally, Cash + Points makes sense in two circumstances: when you don’t have enough points to pay for the full points redemption, and when the cash rate is disproportionately high.

Say you’re looking to stay somewhere on New Year’s Eve, or when there’s a major conference or sporting event in town. In these circumstances, redeeming points for the room will be a great deal, but if you don’t have enough points to do so, then Cash + Points represents a way to capture some of that value and save yourself a chunk of change.

However, note that just because a room is available to be booked on points, doesn’t mean that it’s available at the Cash + Points rate. In fact, Cash + Points availability tends to be rather scarce, so the occasions on which you’ll be able to make use of it will be rather limited.

Transferring Marriott Bonvoy Points to Airlines

Besides redeeming Bonvoy points for hotel stays, the other valuable way to use points is to transfer them to one of 38 airline frequent flyer programs, such as Aeroplan, The British Airways Club, Atmos Rewards, and more.

The full list of participating programs can be found on the Marriott website. Basically, if it’s a major frequent flyer program with potential sweet spots, then you’ll likely be able to transfer Marriott Bonvoy points over in order to earn miles with the program.

The transfer ratio is 3:1 for most programs, and Marriott will also give you a bonus of 5,000 airline miles when you transfer in chunks of 60,000 Bonvoy points. This means that the optimal strategy is to transfer 60,000 Bonvoy points into 25,000 airline miles.

The exceptions to the 3:1 ratio are Air New Zealand AirPoints (200:1), and United MileagePlus (60,000 Bonvoy points = 30,000 United MileagePlus miles).

Additionally, American Airlines AAdvantage, Avianca LifeMiles, and Delta SkyMiles are all excluded from the bonus of 5,000 miles when transferring 60,000 Bonvoy points.

Depending on the program, transfers typically take at least three business days to complete, so you’ll want to leave enough buffer time if you’re planning to book an award flight using your airline miles. Additionally, the name and address should match between your Bonvoy account and your airline account, in order to prevent delays in the process.

Transferring points from Marriott Bonvoy represents the easiest way that Canadians can earn miles in “hard-to-reach” programs like Japan Airlines Mileage Bank, and Virgin Atlantic Flying Club. They can also be a great way to top-up your earnings in programs like Atmos Rewards or American Airlines AAdvantage if you’re chasing a big flight redemption.

Marriott Bonvoy Elite Status

Elite status plays a significant role in the Marriott Bonvoy loyalty program, as the perks and benefits you receive as an elite member go a long way to making your stays at Marriott hotels more enjoyable.

Qualifying for each tier of elite status is based on earning elite qualifying nights. Every night you stay at a Marriott hotel (whether paid with cash or points) will earn you one elite qualifying night. The status levels are as follows:

Status level | Required nights | Credit cards |

Silver | 10 nights | Marriott Bonvoy American Express Card (US) Chase Marriott Bonvoy Boundless Card (US) Chase Marriott Bonvoy Bold Card (US) |

Gold | 25 nights | Chase Ritz-Carlton Card (US) |

Platinum | 50 nights | |

Titanium | 75 nights | |

Ambassador | 100 nights + $23,000 (USD) spending |

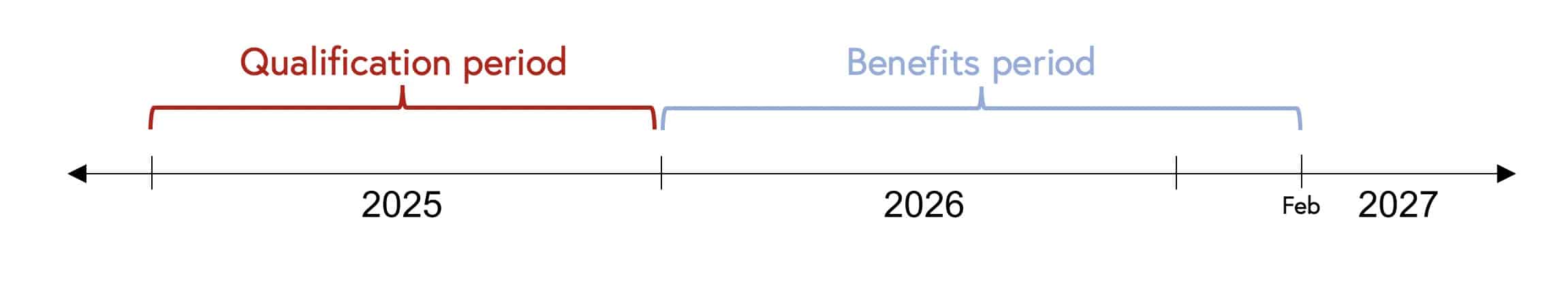

Status levels are granted based on how many nights you stay during a calendar year. Unlike other loyalty programs, there are no separate qualification criteria for “stays” vs. nights.

Once you earn a certain status level, it’s valid until the February two years later. Essentially, the status begins when you earn the required number of nights during a calendar year, and is valid until 14 months after the end of that calendar year.

For example, let’s say you earn Platinum Elite status in 2025 by staying 50 nights during the year. Then you’d enjoy your Platinum status benefits until February 2027.

For example, let’s say you earn Platinum Elite status in 2025 by staying 50 nights during the year. Then you’d enjoy your Platinum status benefits until February 2027.

When January 2026 rolls around, your new qualification period begins, while still holding the Platinum Elite status. If you requalify by staying 50 nights in 2026, your benefits extend through February 2028, and so on.

A detailed listing of all the elite benefits can be found in our guide to Marriott Bonvoy Elite status.

Essentially, Silver Elite status delivers minimal benefits, given how easy it is to earn simply by holding a co-branded credit card. Gold Elite benefits are also not too exciting, with the 2pm late checkout (based on availability, not guaranteed) being the most appealing one.

It’s really at Platinum Elite that the real benefits start to kick in: lounge access, free breakfast, suite upgrades, 4pm late checkout, etc. You achieve Platinum Elite status at 50 elite qualifying nights, although there are a few creative ways to help you reach that threshold.

By far the easiest way is to be a cardholder of the Marriott Bonvoy Brilliant American Express Card. By simply keeping the card active and paying the annual fee of $650 (USD), you’ll enjoy Platinum status year after year without having to hustle for it.

If that annual fee sounds a bit hefty, consider how much you’d need to spend at hotels to earn 50 elite qualifying nights.

In the event that you don’t have access to US credit cards, then you can also finesse your way to Platinum with co-branded credit cards in Canada.

For example, you’ll already earn 15 qualifying nights from holding one of the Bonvoy credit cards here in Canada or if you’re in the US game, you can hold both of their Business and Personal Bonvoy credit cards to earn a total of 30 elite qualifying nights. Then, you just need to stay 20 more nights with Marriott in order to secure Platinum status.

It’s worth noting that the Marriott Bonvoy Brilliant American Express Card gives you 25 qualifying nights, which can be stacked with the 15 from the American Express US Marriott Bonvoy Business Card for a total of 40 qualifying nights. However, since you’ll already have Platinum status, this is only helpful for moving up to Titanium status, which requires 75 nights per year.

Unfortunately, having one Canadian and one US card doesn’t mean that you’ll wind up with 30 nights.

If you hold the following combination of Marriott Bonvoy co-branded credit cards... | You will receive... |

Canadian personal + Canadian business | 15 elite qualifying nights |

Canadian personal + US personal | 15 elite qualifying nights |

Canadian personal + US business | 15 elite qualifying nights |

Canadian business + US personal | 15 elite qualifying nights |

Canadian business + US business | 15 elite qualifying nights |

US personal + US business | 30 elite qualifying nights |

Amex US Bonvoy Brilliant + US business | 40 elite qualifying nights |

One of the additional perks of Platinum Elite status is an Annual Choice Benefit of one of the following:

-

Five extra elite qualifying nights

-

Give the gift of Silver Elite status to another member

-

40% off your favourite hotel mattress

-

$100 (USD) charity donation

Of these, the clear winner is the Nightly Upgrade Awards, which allow you to guarantee a suite upgrade (availability permitting) up to five days prior to your arrival at a property, rather than seeing if a suite is available upon check-in.

Titanium Elite is achieved at 75 qualifying nights, although at the moment doesn’t deliver too many benefits over and above Platinum Elite, with the exception of another Annual Choice Benefit.

The choices are largely the same as those for Platinum Elite, with the exception of a Free Night Award worth 40,000 points.

Lastly, Ambassador Elite is achieved at 100 qualifying nights and $23,000 (USD) of annual spend. At this level, you get assigned a personal Ambassador who can help you with all your Marriott booking needs.

Unless you’re a heavy spender with Marriott, this elite level will be pretty out of reach for most, and doesn’t provide many incrementally greater benefits above and beyond Platinum or Titanium.

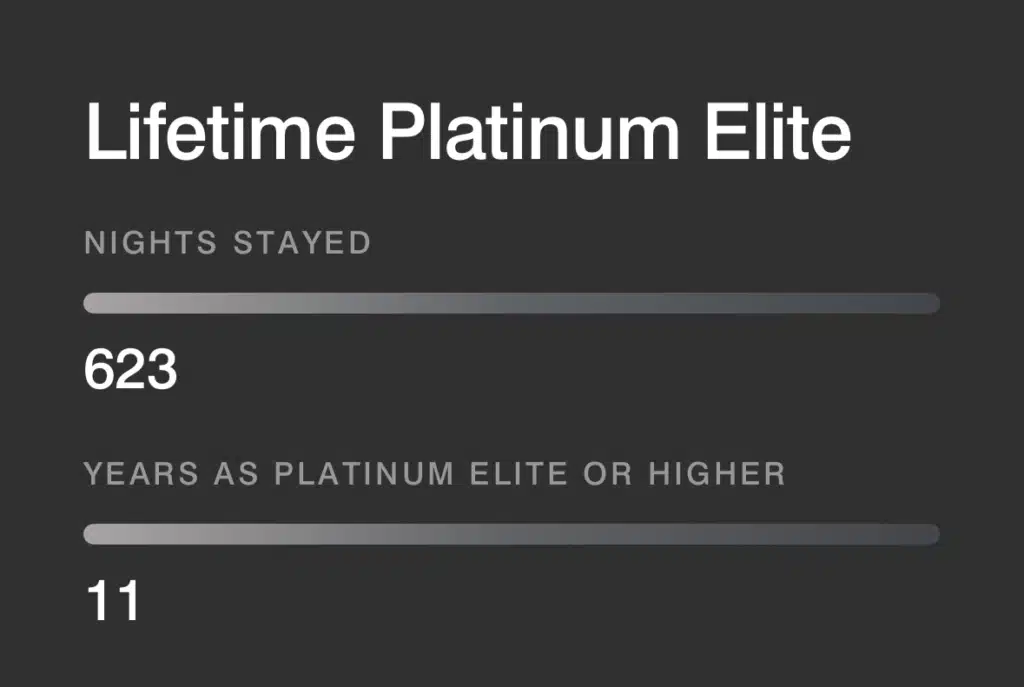

Lifetime Elite Status

Marriott Bonvoy offers a clear path toward Lifetime Elite Status, with three tiers available: Silver, Gold, and Platinum. Once achieved, lifetime status is valid permanently and does not require ongoing requalification.

To qualify, you must meet both a lifetime elite qualifying night threshold and a minimum number of years holding the relevant status tier:

Members can view their progress toward lifetime status by logging into their Bonvoy account and navigating to the “Activity” section on the website or mobile app.

At this time, Marriott Bonvoy does not offer Lifetime Titanium or Ambassador Elite status. Titanium Lifetime status was offered as a one-time opportunity during the 2018 program merger for members who had 750 nights and 10 years at Platinum between the legacy Marriott Rewards and Starwood Preferred Guest programs.

Tips & Tricks

Like most loyalty programs, there are plenty of little tricks you can keep up your sleeve once you dabble with the program a bit. Here are just a handful…

Maximize the Fifth Night Free: As mentioned above, the Fifth Night Free benefit allows you to book five nights on points for the price of four, and is one of the most valuable perks in the program.

However, even if you only need four nights, you can go ahead and book five nights since it’s the same cost anyway! This effectively gives you late checkout on your fourth day until however late you want, and also an extra elite qualifying night to help you achieve a higher status level.

Sharing Points: You can transfer up to 100,000 Marriott Bonvoy points between members’ accounts per calendar year. This is done by calling Marriott to initiate the transfer process or by doing the transfer yourself online.

It’s a great way to pool points earned by different members of a household into one account; however, the 100,000-point limit is rather strictly enforced, so you’ll want to plan accordingly if, say, you want all the bookings to be done under one household member’s account in order to achieve elite status faster.

Upgrades & Nightly Upgrade Awards: A fancy upgrade can really make the difference between a good hotel stay and a fantastic and unforgettable one. As a Platinum Elite member and above, you’re entitled to the best available upgrade upon check-in, including standard suites.

If you’re a Platinum Elite member or above, you can also use your Nightly Upgrade Awards to “lock in” a suite upgrade up to three days in advance – again, depending on availability.

If you’re only a Gold Elite member, don’t count on receiving a complimentary suite upgrade, but you can still get lucky if you contact your hotel in advance and tell them you’d love to have a suite upgrade if there are any.

RewardsPlus with United Airlines: Marriott and United have a partnership through which each program’s top-tier elite members get reciprocal benefits with the other program.

If you earn Titanium Elite status with Marriott Bonvoy, you’ll automatically be given an upgrade to United MileagePlus Premier Silver status, which is also Star Alliance Silver status.

Frequently Asked Questions

What is the value of a Marriott Bonvoy point?

Depending on the specific circumstances, redeeming Marriott Bonvoy points for hotel stays can get you anywhere from 0.5–1.5 cents per point (cpp) in value, and sometimes even more.

Can you pool points across different Marriott Bonvoy accounts?

Yes, you can pool points between different Marriott Bonvoy accounts, although each account is limited to sending 100,000 points per calendar year and receiving 500,000 points per calendar year.

How quickly do points from the Amex Bonvoy credit cards post to your account?

In Canada, it typically takes 2–3 business days from the credit card statement closing date before you’ll see the Bonvoy points in your Bonvoy account.

How do you transfer Marriott Bonvoy points to airline programs?

Transfers are initiated on Marriott’s website, under About Marriott Bonvoy > Redeem Points > Travel > Transfer Points to Miles. From there, you can convert points to airline programs at the listed exchange rate.

Conclusion

With many co-branded credit cards available in Canada and the United States, the ability to transfer points from American Express Membership Rewards at a 1:1.2 ratio, as well as from American Express US Membership Rewards and Chase Ultimate Rewards at a 1:1 ratio, and its vast footprint of over 8,500 hotels around the world to redeem points, Marriott Bonvoy remains one of the best programs for North Americans to rack up free hotel nights and save money along their travels.

Hello sir:

I seek your assistance in figuring out the $/points redemption value math.

Somehow I must be missing something as when I take the cash price (using the full price option) such as usd$119 (CAA rate) and then compare to the 20,000 points required, I end up with a result of 0.00595.

This does not seem to align with the 0.06 (average range) of all the various travel mavens.

Please explain the errors of my ways, thank you.

For your annual free night, which is capped at 35k points, can you pay the difference for a higher category night? Thanks Ricky!

Nope, although there are rumblings that this feature may be in the works for a future rollout.

Hi,

What is the limit of points you can receive as a gift? I am hoping to load up next point sale and am confused on the limit I will be able to receive from friends. The fine print states “members may purchase or receive as a gift a new combined maximum of 100,000 points per calendar year when purchased on this site”. However, on this spage you state you can receive up to 500k points. Can you please confirm this.

Thanks

Hi Ricky,

According to this https://www.marriott.com/loyalty/earn/hotels.mi you normally get 10pts per $1 USD booking spend. If I pay with a bonvoy credit card, do I get the 5x bonus on top (e.g. both stack)?

Yes, they do. We’ll be sure to add the points-earning rate based on stays to this guide.

Do you accumulate points if pay for your stay using points? If so, at what rate?

No.

Is it possible to transfer Aeroplan to Bonvoy points?

No, only the other way around.

If staying on 4 for 5 (5th night free) do the five night earn elite night credit or do you have to add a paid night to get credits at Cat 7 hotel ?

Free nights counts as an elite-qualifying nights. You don’t need a paid component of your stay to earn elite nights, it can be all points and it’ll still qualify. Hotel category has no impact on earning elite nights.

Do the elite benefits apply for everyone in the room? ie. lounge access? If I have elite Titanium Elite access, but my husband does not? Kids? Thinking more for breakfasts 😉

Lounge and breakfast benefits are typically meant to be for the elite member and one guest. However, many hotels are happy to extend access to a family when travelling together as a courtesy.

Do the 15 elite qualifying nights from the cards count towards your lifetime elite status?

Yes.

I already have the Amex Platinum, and this gives me the Gold Elite Status. If I get the Marriott Bonvoy Amex in Canada, it comes with 15 elite qualifying nights. Would this mean I only need 10 more nights to get Platinum Elite or does it not stack that way? Thanks in advance!

Does not stack.

So you basically have to start from scratch with qualifying nights? The Amex Platinum doesn’t help at all?

Is the point purchase limit and the point transfer limit associated or completely seperate? Can I buy 100,000 points and have a friend transfer me another 100,000 from his account in the same calendar year?

Yes, they’re separate.

The wording on the current Marriott points purchase page suggests otherwise – unless it specifically applies only to 2021.

“You can purchase up to 100,000 points… Points that have been already purchased or received as a gift in 2021 are included in the 100,000 points purchase limit”

There’s a distinction here between “gifting points” and “transferring points”. Gifting points is when someone buys points directly for you and they get deposited into your account. Transferring points is when someone transfers points (which may or may not have been bought) into your account, to the tune of 100,000 points per year (send limit) or 500,000 points per year (receiving limit).

Ah, I see what you are saying. That was not clear to me at all. What would I do without you, Ricky 😂

“The Amex US cards in particular are easy for Canadians to obtain” – one would need a US address, US bank account and a US SIN number for the global transfer to be fulfilled?

No need for a SSN for the Global Transfer / Nova Credit. An ITIN would only be required for subsequent Amex cards or Chase cards.

So if I have a CAD Bonvoy and US Bonvoy, I get 15 + 15 Elite Nights? If I go for all 4 cards (CAD & US Business Cards), I can get Platinum Elite?

Nope, you can only get 15 elite qualifying nights per year from any combination credit cards, with only one exception: holding a US personal card and a US business card will give you 30 elite qualifying nights.

Have you heard if this rule is changing for the Canadians holding both the Canadian personal and business Marriott Cards ?

Bump – also interested in this! Seems unfair that its separate for the US but not Canadians

Can’t say I’ve heard of any plans to implement this for the Canadian cards.