Banks often run promotions to attract new customers to their products. As long as you haven’t taken advantage of an offer for a few years, you’re usually eligible to sign up for a new account and take advantage of a great deal when it comes along.

Until January 31, 2023, TD has a fantastic promotion for opening a new chequing account, in which you stand to earn a $300 Amazon gift card and 10,000 Aeroplan points.

If you choose to include a new savings account and overdraft protection, you can get another $100 in Amazon gift cards, bringing the total to $400 and 10,000 Aeroplan points.

Let’s take a look at the fine print.

Get a $300 Amazon Gift Card and 10,000 Aeroplan Points with a Chequing Account

By signing up for either the TD Unlimited Chequing Account or the TD All-Inclusive Banking Plan before January 31, 2023, you could be eligible to receive a $300 Amazon gift card and 10,000 Aeroplan points.

This is one of the best bank account offers we’ve seen in a while, and fulfilling the promotion’s requirements shouldn’t be too difficult for most individuals.

The full details, as well as the application, can be found on the promotion’s landing page.

Aside from signing up for an eligible account, you must complete two of the following by March 28, 2023 in order to earn the bonus:

- Set up a recurring direct deposit from your employer, pension provider, or the government

- Set up a recurring pre-authorized debit payment of at least $50

- Make an online bill payment of at least $50 through EasyWeb or the TD app

Any of these conditions should be fairly easy to meet, which puts this promotion squarely in the “low hanging fruit” category. One simple combination is to set your TD account up with pre-authorized debit for your cell phone bill, and then make a payment of at least $50 to any credit card through your TD account.

Upon fulfilling any two of the conditions, your $300 Amazon gift card will be sent by email to the account provided. It must be accepted by May 31, 2023, otherwise the offer will expire.

Similarly, the 10,000 Aeroplan points will be deposited into your account within 12 weeks of meeting the promotion’s requirements. Note that you must be a current cardholder of the TD Aeroplan Visa Infinite Card, the TD Aeroplan Visa Infinite Privilege Card, or the TD Aeroplan Visa Platinum Card to receive the bonus points.

The terms and conditions for this offer state that you won’t be eligible if:

- You have a TD chequing account that was closed on or after November 1, 2021

- You don’t provide a valid email address by January 31, 2023

- You have received any chequing account offer from TD in 2019, 2020, or 2021

As long as you haven’t opened a TD chequing account in the last year or so, and if you haven’t taken advantage of any similar offers in the last few years, you should be eligible for this promotion.

Be sure to check with your local TD branch if you’re unsure of your eligibility, and also ensure that you provide a valid email address when you sign up.

Also: Get $100 in Amazon Gift Cards with a Savings Account and Overdraft Protection

After selecting a chequing account to apply for on the bank’s website, you’ll see two more offers on the subsequent page. One is for a $50 Amazon gift card for opening an eligible savings account, and the other is for a $50 Amazon gift card for adding overdraft protection.

If you include these additional offers with the chequing account offer, you can get a total of up to $400 in Amazon gift cards and 10,000 Aeroplan points, which is a great deal.

To be eligible for the $50 Amazon gift card from the savings account, you must open a new TD ePremium Savings Account or TD Every Day Savings Account by January 31, 2023, as well as complete one of the following by March 28, 2023:

- Set up and complete at least one weekly, biweekly, monthly, or twice-monthly Pre-authorized Transfer Service

- Set up Simply Save, and have at least one transaction processed

Lastly, to earn another $50 Amazon gift card, you must also apply and be approved for either Monthly Plan Overdraft Protection or Pay As You Go Overdraft Protection on your chequing account, and keep the account active and in good standing for at least 30 days.

The Monthly Plan costs $5 per month, and the Pay As You Go Plan costs $5 per transaction, with a 21% per annum interest rate on overdraft amounts.

As long as you don’t plan on using overdraft protection, the Pay As You Go Plan is the more cost effective option.

Should You Take Advantage of These Offers?

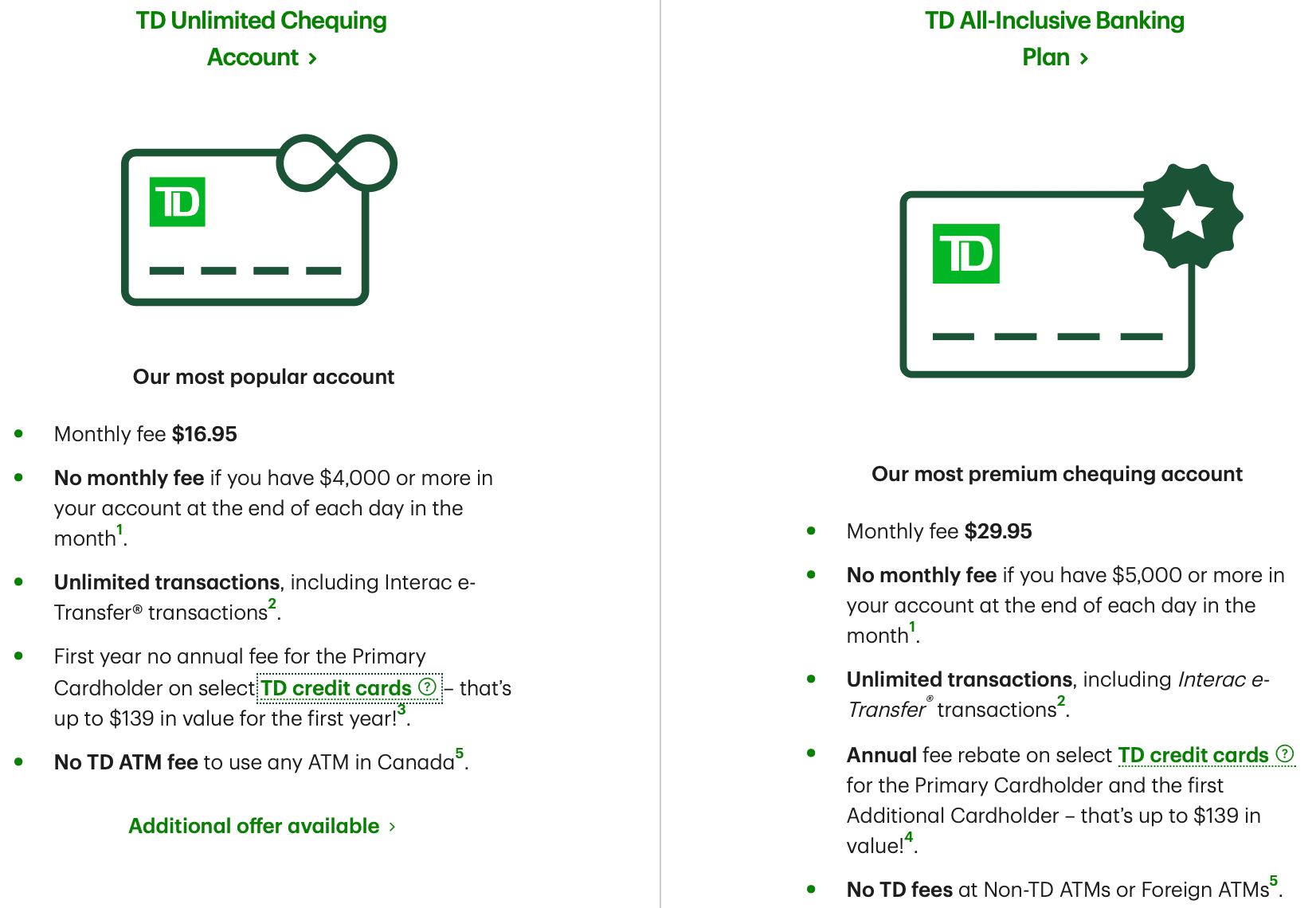

Taking a look at the eligible chequing accounts in detail, you’ll notice that both are premium accounts with a monthly fee that can potentially be waived, and come with a host of included perks.

The TD Unlimited Chequing Account has a monthly fee of $16.95, which can be waived by having at least $4,000 deposited in the account at the end of each day in the month. This account includes unlimited transactions and no withdrawal fees at any ATMs in Canada.

Meanwhile, the TD All-Inclusive Banking Plan is TD’s most premium chequing account, with a monthly fee of $29.95 that can be waived by maintaining a balance of at least $5,000 at all times. This account also includes unlimited transactions and no TD-imposed fees for using any non-TD ATMs or foreign ATMs.

Of particular interest, both these accounts waive the first year’s annual fee for the primary cardholder on select TD credit cards, offering a value of up to $139:

- TD Aeroplan Visa Infinite Card

- TD Aeroplan Visa Platinum Card

- TD First Class Travel Visa Infinite Card

- TD Platinum Travel Visa Card

- TD Cash Back Visa Infinite Card

Moreover, the TD All-Inclusive Banking Plan takes it one step further by offering a yearly annual fee rebate on the same cards for both the primary cardholder and the first additional cardholder. This is significantly more valuable than the Unlimited Chequing Account, since many cards already offer First Year Free.

Since the savings accounts don’t have a monthly fee, and as long as you don’t use the overdraft protection from the Pay As You Go Plan, you won’t incur any additional expenses with this promotion.

In sum, we can value the annual fee rebate at $139, the Amazon gift cards at face value of $400, and 10,000 Aeroplan points to be worth $210 using our Points Valuations. Therefore, the potential first-year value of taking full advantage of this promotion is $749, which is well worth the price of admission.

Even if you don’t maintain a minimum balance to have the account fees waived, $749 of value easily outweighs the monthly fees, which would cost at most $359.40 with the All-Inclusive Banking Plan over the course of a year.

Conclusion

TD is currently offering a $300 Amazon gift card and 10,000 Aeroplan points for new customers who open an eligible TD chequing account and set up a recurring deposit, a recurring debit, and/or make an online bill payment. Along with an annual fee rebate for select credit cards, you stand to gain up to $649 of value through this promotion.

You can get another $100 in Amazon gift cards by opening a no-fee savings account and being approved for overdraft protection, as long as you fulfill the transaction and account requirements.

No matter which chequing account you open, you’re likely to come out hundred of dollars ahead, even when taking the monthly fees into consideration. As long as you meet the eligibility requirements, you should consider adding this to your end-of-year to-do list, especially if you want an extra $400 in Amazon gift cards to put towards holiday shopping.

The deadline to apply for an account is January 31, 2023, so be sure to act before then to take advantage of this outstanding offer.

I clicked on the link to the landing page, and it seems that the eligibility criteria has changed:

“To be eligible for this offer, you must be a new TD Chequing Customer and must not have had a TD Chequing account in the last 12 months.”

In other words, as I currently bank with TD and has a chequing account open, I would not be eligible.

I checked the T&C, maybe I missed it, but is there a minimum length of time the account must remain open for?