Last week, American Express US came out with a new round of historically high welcome bonuses on their Delta co-branded credit cards, allowing new cardholders to earn 70,000–95,000 Delta SkyMiles on the personal and business Delta Gold, Platinum, and Reserve products.

While Delta SkyMiles might not be the most valuable points currency that you can earn, they do play a unique role for Canadians who often travel within North America, thanks to their partnership with WestJet.

Let’s take a look through why you might consider incorporating one of these limited-time Delta offers (available until July 28, 2021) into your US credit card strategy.

The Role of Delta SkyMiles for Canadians

The Delta cards tend to take a backseat in our usual discourse on the US credit card game, especially compared to Amex US’s other product lines like Membership Rewards, Marriott Bonvoy, and Hilton Honors.

That’s because Delta SkyMiles is generally viewed as a lower-value frequent flyer program, thanks to its lack of a transparent award chart, dynamic pricing on its own Delta flights, and relatively uncompetitive pricing on partner redemptions in both economy and business class.

For many Canadian points collectors, it’s doesn’t seem worth going through the trouble of collecting Delta SkyMiles when there are more valuable and more accessible points currencies (such as Aeroplan and Alaska miles) right here in Canada.

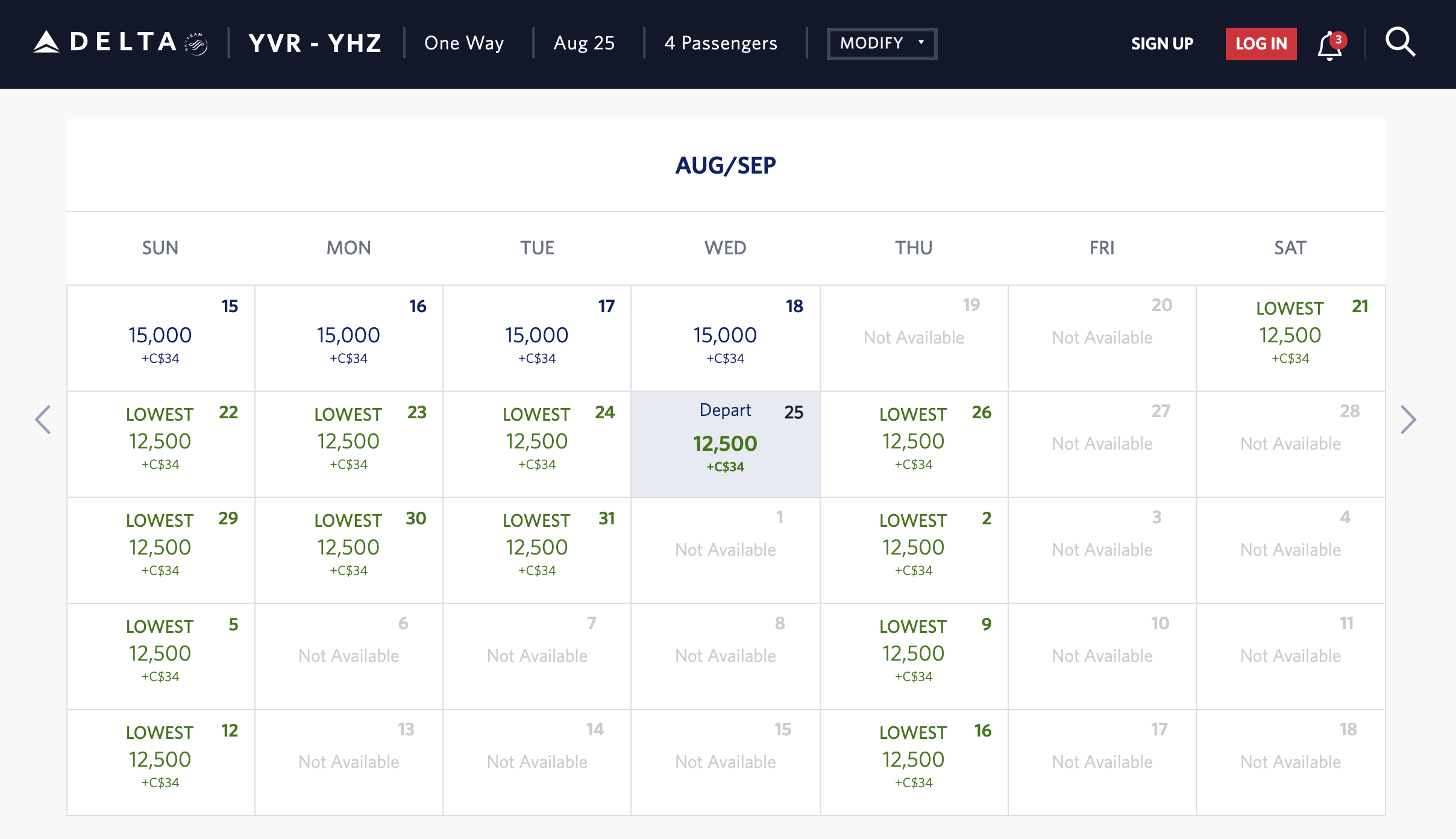

However, I do think that Delta SkyMiles now offers a unique and often-overlooked value proposition from a Canadian perspective: the ability to book WestJet flights within Canada for a fixed rate of 12,500 SkyMiles one-way, akin to the WestJet Member Exclusive fares of bygone days.

I’ve covered this sweet spot in a previous article on “Booking Domestic Canadian Flights with Foreign Airline Programs”: even though the fixed pricing on intra-North America WestJet flights of 125 WestJet Dollars through WestJet Rewards is no more, it’s still available if you use Delta SkyMiles as a backdoor channel.

Just like the old Member Exclusive fares, there are typically four seats available on every WestJet flight when booking through Delta SkyMiles, making this a potentially very useful solution for those of you who often travel within North America as a family or larger group.

For example, here’s the award calendar for Vancouver–Halifax, four passengers, in late summer:

If your travel goals will be focused on domestic trips over the next little while, you might just consider signing up for one of these elevated Amex US Delta offers and covering a handful of round-trip transcontinental flights on WestJet at very generous fixed rates.

Amex US Delta Gold Cards: 70,000–75,000 Delta SkyMiles + First Year Free

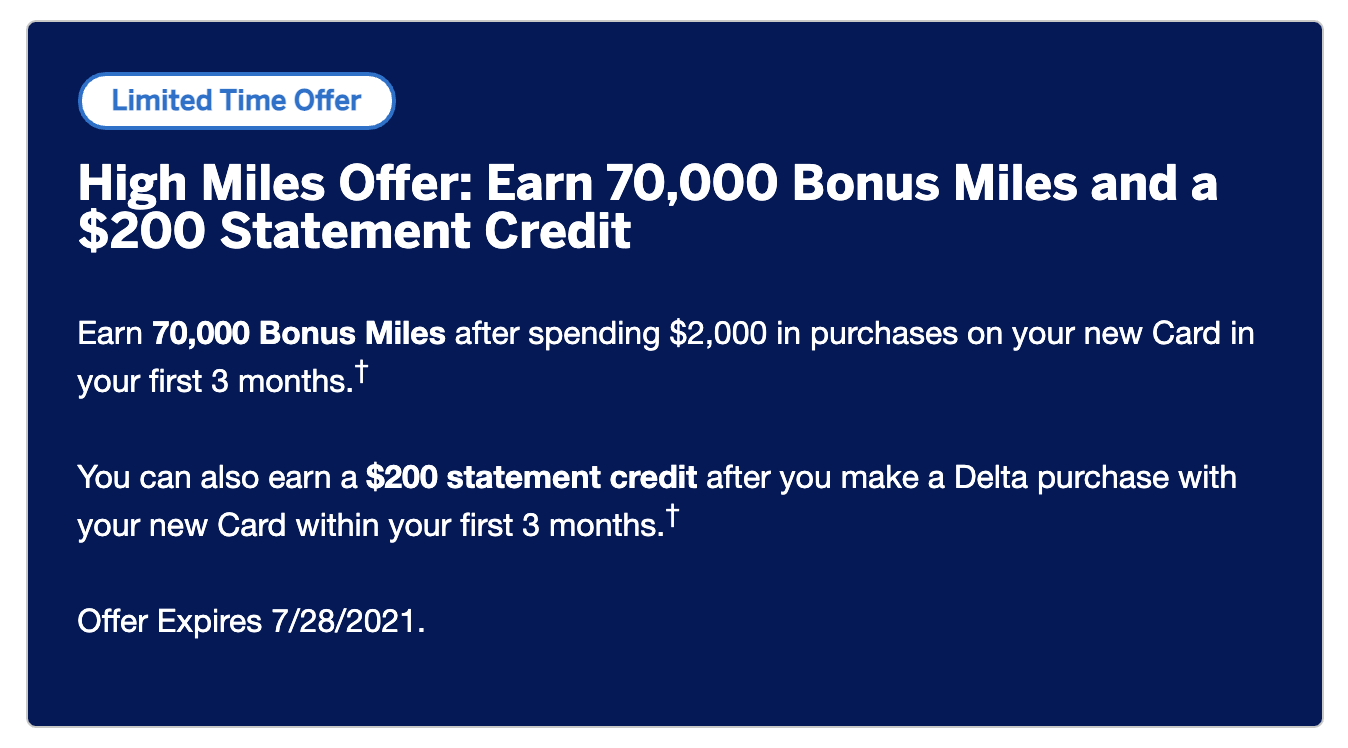

The Amex US Delta Gold Card is offering 70,000 Delta SkyMiles upon spending US$2,000 in the first three months. The annual fee of US$99 is waived for the first year.

On top of that, the card is offering a US$200 statement credit after you make a Delta purchase within the first three months.

Even though the terms state that gift card purchases are excluded, according to many data points, a US$50 Delta gift card purchase has been successful in triggering this statement credit in the past.

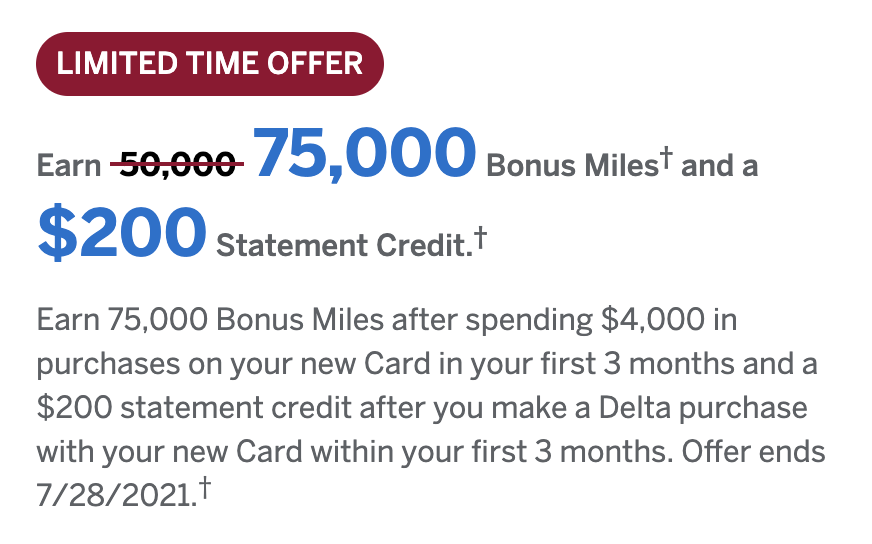

Meanwhile, the Amex US Delta Gold Business Card is offering 75,000 Delta SkyMiles upon spending US$4,000 in the first three months, along with the same US$200 statement credit after a Delta purchase. The annual fee of US$99 is waived for the first year.

Between the two versions, you should consider the personal Delta Gold Card if you’re in the early stages of the US credit card game, since you want to build up at least one or two long-term personal cards that will contribute to your US credit history in the long run.

Meanwhile, consider the Delta Gold Business Card if you’ve already gotten started with US credit cards, and are looking to preserve Chase 5/24 “slots” with a view of applying for Chase cards down the line.

(The same advice applies to the Delta Platinum and Delta Reserve card families that we’ll discuss below).

With either of the Delta Gold cards, the 70,000–75,000 Delta SkyMiles will be enough to cover five or six one-way WestJet flights within Canada – not bad for a single credit card signup bonus with no first-year annual fee!

Plus, if you actually fly Delta at some point (perhaps on a cheap SkyMiles redemption down to the US), you’ll enjoy a free first checked bag and priority boarding on your Delta flights.

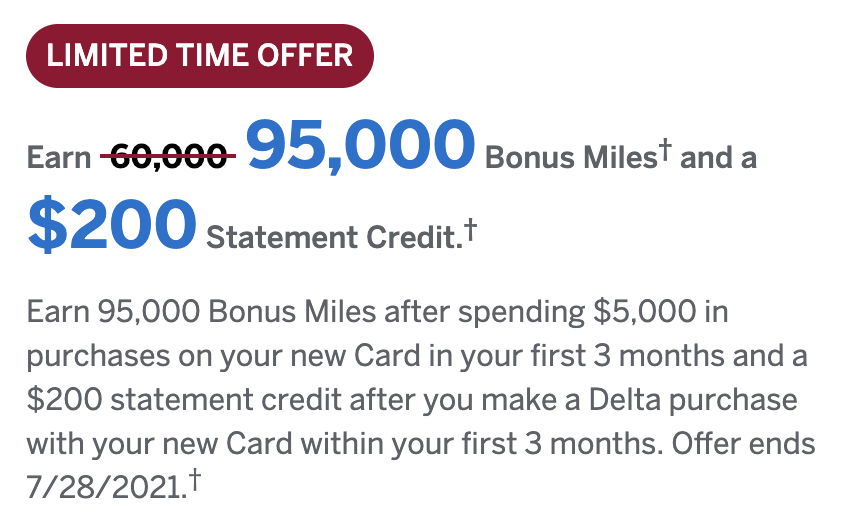

Amex US Delta Platinum Cards: 90,000–95,000 Delta SkyMiles + US$250 Annual Fee

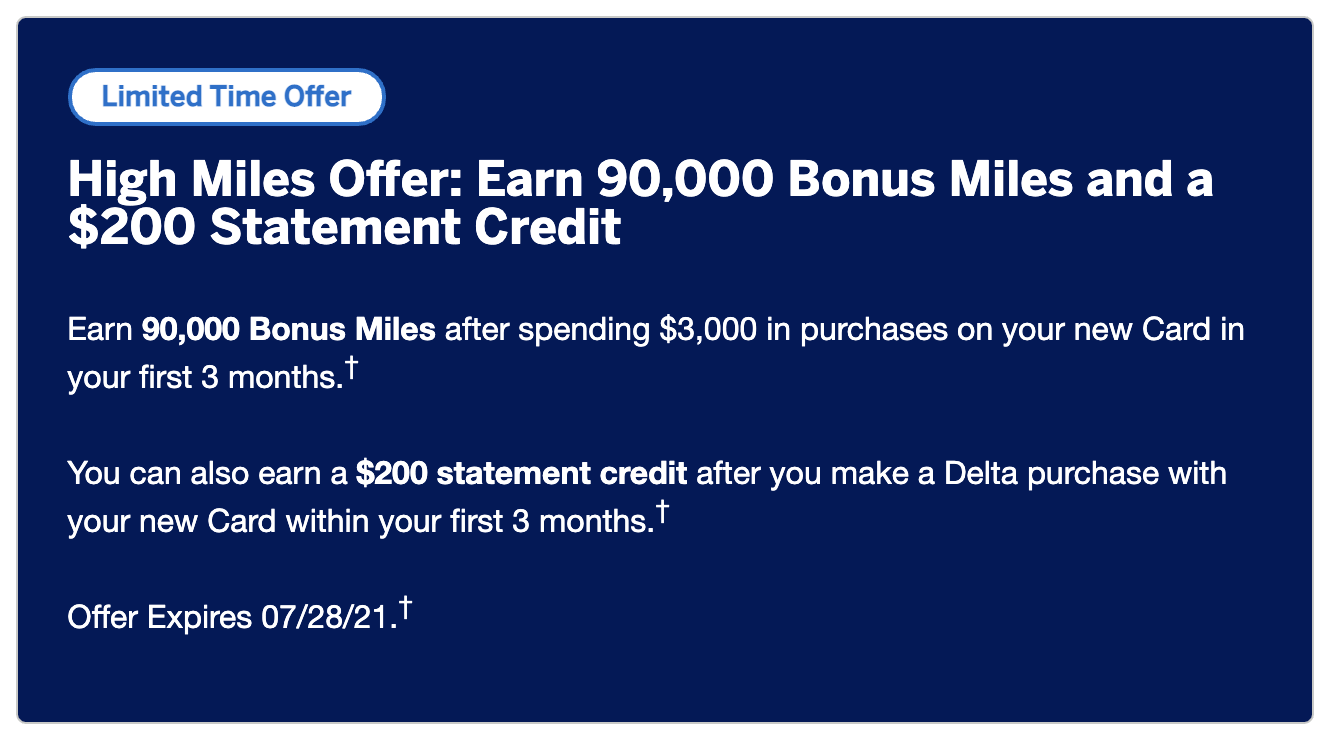

The Amex US Delta Platinum Card and Amex US Delta Platinum Business Card are offering 90,000 and 95,000 Delta SkyMiles upon spending US$3,000 and US$5,000 in the first three months, respectively. The cards have annual fees of US$250.

Both the personal and business versions come with the same US$200 statement credit upon making a Delta purchase. These could bring your net annual fee for the first year down to US$50.

With either of the Delta Platinum cards, the 90,000–95,000 Delta SkyMiles will be enough for at least seven one-way WestJet flights within Canada, which is outstanding for a single credit card signup bonus.

From a Canadian perspective, the Delta Platinum family doesn’t offer too many perks that are useful beyond the free first checked bag and priority boarding.

There’s an annual companion voucher for travel on Delta, but it’s only valid within the continental United States, so you’d have to pop down to Seattle or Buffalo to make good use of it.

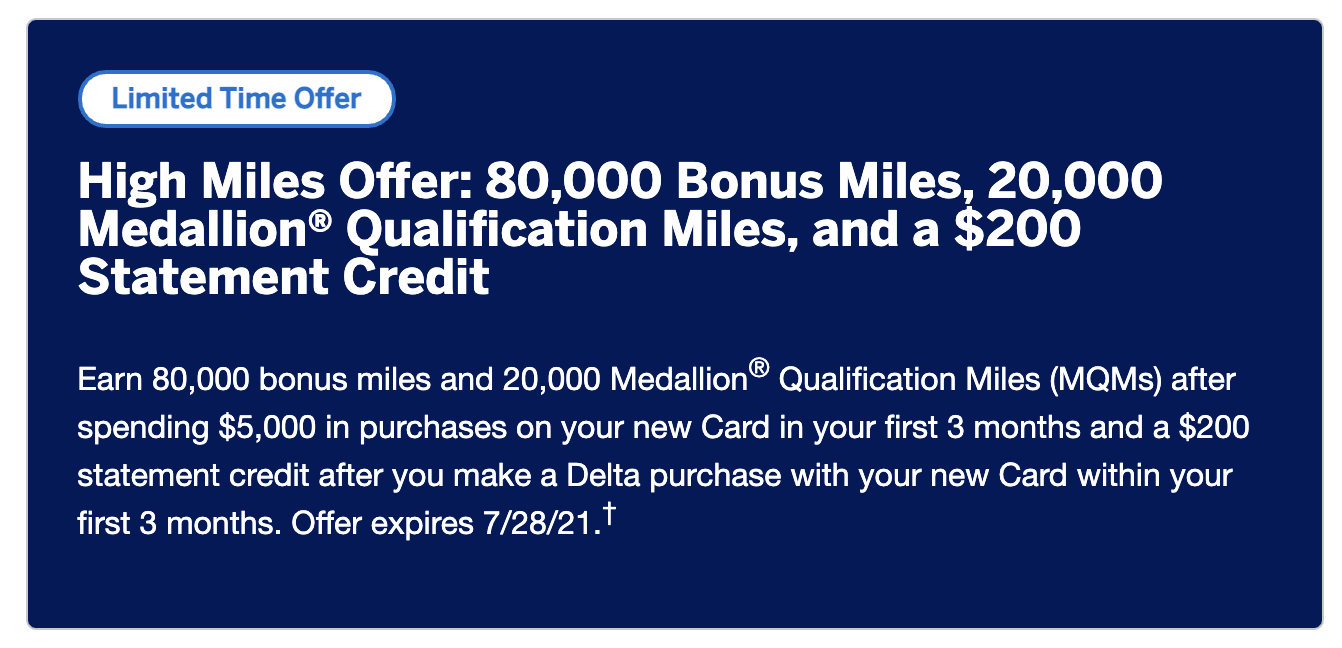

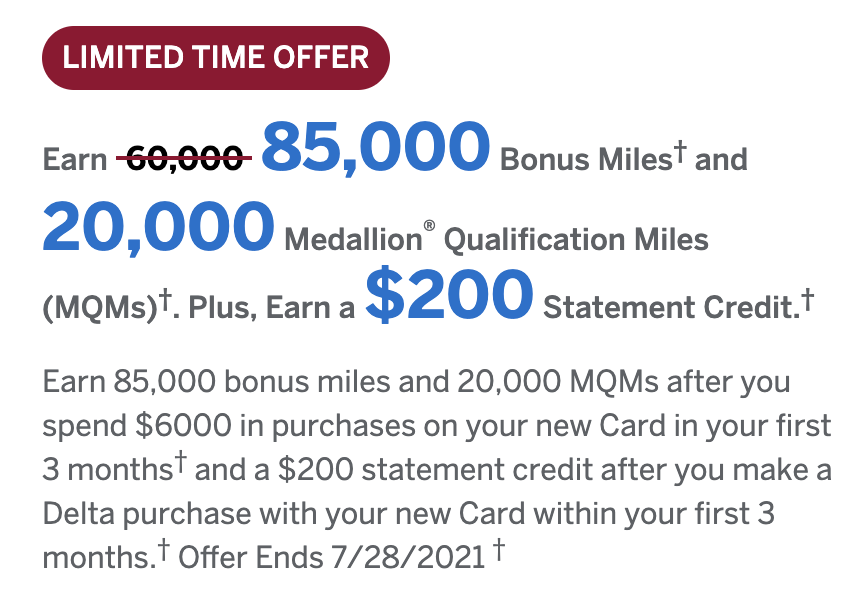

Amex US Delta Reserve Cards: 80,000–85,000 Delta SkyMiles + US$550 Annual Fee

The Amex US Delta Reserve Card and Amex US Delta Reserve Business Card are offering 80,000 and 85,000 Delta SkyMiles (as well as 20,000 Medallion Qualifying Miles) upon spending US$5,000 or US$6,000 in the first three months, respectively. The cards have annual fees of US$550.

Just like the Delta Gold and Delta Platinum, the personal version of the Delta Reserve comes with the same US$200 statement credit on US home furnishing stores.

As before, both the personal and business versions come with the same US$200 statement credit upon making a Delta purchase, which could bring your net annual fee down to US$350.

The main appeal of the Delta Reserve cards (and what goes a long way towards justifying their high annual fees) is the fact that they can help Delta’s frequent flyers achieve and retain Medallion status within the program, which probably won’t be applicable to most Canadians. I’d say that the lower-tier Gold and Platinum families would be a better fit if your primary objective is to earn SkyMiles for redeeming on fixed-price WestJet flights.

Nevertheless, if you do roll the dice on the Delta Reserve cards, the 80,000–85,000 Delta SkyMiles will be enough for at least six one-way transcontinental WestJet flights within Canada, which is still a very strong return on the US$550 annual fee.

After the First Year: Downgrade to the Amex US Delta Blue Card

With US credit cards, it’s important to consider the long-term strategy for each card that you sign up for.

Cardholders are almost never eligible for repeat signup bonuses in the future, and you don’t want to cancel too many accounts if you want to build up a strong US credit history over time.

Thankfully, the Delta card family offers what’s known as a “downgrade path” among the personal cards, allowing holders of the Delta Gold, Platinum, and Reserve cards to downgrade to the no-fee Amex US Delta Blue Card after one year if they no longer want to pay the annual fee.

(You can’t downgrade the Delta business cards to the Delta Blue Card; the lowest they can go is the Delta Business Gold Card, which still has a US$99 annual fee. If you’re applying for one of the business cards, it’ll probably make sense to cancel after the first year is up, unless you see yourself flying with Delta with some regularity.)

Conclusion

The Amex US Delta co-branded credit cards have bumped up their welcome bonuses until July 28, 2021. The personal offers appear to be available through the refer-a-friend channel, while the business offers are not.

While these won’t be the most appealing offers (nor Delta SkyMiles the most appealing program) if your goal is to travel in international premium cabins, they do offer a backdoor method for the frequent Canadian domestic traveller to access up to four fixed-price award seats on every WestJet flight, similar to the old WestJet Member Exclusive fares.

The sweet spot among the offers is probably the Delta Platinum Business Card, which lets you earn enough SkyMiles for seven transcontinental one-ways for only a net fee of only US$50 in the first year. The Delta Gold Business Card isn’t bad either, enough for six transcontinental one-ways along with a US$200 statement credit and no first-year fee.

And don’t forget, you can always top-up your Delta SkyMiles balance by transferring at a 1:0.75 ratio from Canadian-issued Amex MR points, or a 1:1 ratio from Amex US MR points.

Hi,

regarding the $200 statement credit. To clarify, there are DP’s that making $50 gc purchase will trigger $200 credit??

Yes, a few DPs indicate so.

Can the Delta Skymiles points be used for international Westjet flights?

The Business Delta cards also have offers – they’re just referral only at the moment.

Yes, we’ve covered these in the article. The special offers on the business cards are actually superior to the referrals, as I don’t believe the referrals come with a $200 statement credit.

I’m just starting out, I have my 24/7 Parcel address and my Harris account. With the pandemic and Canadian spending on American cards, it’s not working in my head. How can an American spend in Canada if he is not allowed to be here?

The current redemption is great, but traveling is limited now.

I would consider applying for the card for future use but with the Delta and WJ always

devaluing their currency at any point, I would

be hesitant to do so.

Good article as usual though.

You can also get a better offer on the personal delta gold card if you go on delta’s website and you try to book a flight. https://i.redd.it/mmgym7n9y6m61.png

200$ Statement credit on a delta purchase + 70000 points. Not bad for a card that’s free on the first year if you fly delta at all. Considering the pandemic cancellation policies, it would be pretty easy to convert that 200$ statement credit into 200$ of delta credit…

Excellent input, Ced. I’ve added this to the article.