The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

In the United States, American Express issues four business cards in the Membership Rewards family. The two most powerful cards for travellers are the Business Platinum Card® from American Express and the American Express® Business Gold Card.

Currently, there are some excellent welcome offers available on both cards, which are certainly worth considering if you’re looking to boost your Membership Rewards points balance.

The Business Platinum Card® from American Express: 200,000 Membership Rewards Points

Right now, the Business Platinum Card® from American Express is once again offering a staggering 200,000 Membership Rewards points upon spending $20,000 in the first three months as a cardholder.†

To earn this full eye-popping welcome bonus, you’ll want to be sure you’re able to meet the minimum spending requirement, which averages out to $6,667 in each of the first three months.

Importantly, American Express enforces a strict once-in-a-lifetime rule on welcome bonuses. Therefore, the dominant strategy is to time your application when there’s a particularly lucrative offer on the table.

200,000 MR points on the Business Platinum Card® most certainly fits that bill, so if you’ve never held this card before and are prepared to dive into the high spending requirement, now’s a great time to do so.

If you need some inspiration, here are some examples of where 200,000 Membership Rewards points could take you:

- Transferring to Virgin Atlantic Flying Club to book ANA First Class to or from Japan for 72,500–85,000 Virgin Points per direction

- Transferring to Emirates Skywards to book Emirates First Class from Washington to Dubai for 163,500 miles per direction

- Transferring to ANA Mileage Club to book an ANA round-the-world award with eight stopovers and four open-jaws

- Transferring to Singapore Airlines KrisFlyer to book elusive Singapore Airlines business class, First Class, and Suites Class awards

The Business Platinum Card® commands an annual fee of $695 (see rates and fees), which is the highest annual fee among the major American Express products in the United States. That certainly appears very intimidating at first glance, but the card also boasts a series of credits that can ostensibly lower the annual fee.

Each calendar year, you’ll get up to $200 in airline incidental fee credits† and up to $400 in Dell US credits ($200 from January through June and $200 from July through December).† If you can maximize these credits, your net annual fee can essentially be reduced to $95.

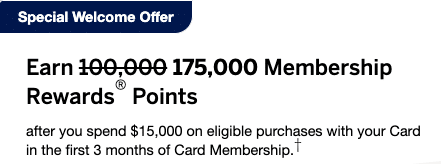

The American Express® Business Gold Card: 175,000 Membership Rewards Points

The Business Platinum’s junior counterpart, the American Express® Business Gold Card, is also offering a solid welcome bonus of 175,000 US MR points, upon spending $15,000 in the first three months.†

175,000 Membership Rewards points would be enough for round-trip flights between the US and Japan in ANA business class (via Virgin Atlantic Flying Club) or round-trip flights on Emirates First Class (via Emirates Skywards) from Miami to Bogota, in addition to many powerful premium redemptions via ANA Mileage Club, Singapore Airlines KrisFlyer, Cathay Pacific Asia Miles, Air France KLM Flying Blue, Air Canada Aeroplan, and more.

The American Express® Business Gold Card has an annual fee of $375, without much in the way of credits to offset it.†

Instead, the card’s value proposition lies in its unique 4x earning rate in the categories of technology purchases, shipping, advertising, dining, gas, and airfare.† The 4x earning rate applies to the two categories with the highest spend on each billing statement, up to a combined total of $150,000 per calendar year.†

In particular, the American Express® Business Gold Card is a very popular card for businesses who spend lots of money on online advertising.

Conclusion

Two of American Express’s business cards currently have excellent welcome offers, giving you some solid opportunities to quickly rack up some Membership Rewards points.

The Business Platinum Card® from American Express is offering new applicants up to 200,000 MR points,† which is in the ballpark of some of the highest welcome bonuses we’ve ever seen on the card.

Meanwhile, the American Express® Business Gold Card is offering new applicants up to 175,000 MR points,† which is excellent relative to the card’s $375 annual fee.

If you’re eligible and interested in learning more, be sure to check out the offers soon!

†Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Thank you Ricky. I used your link and was approved for Biz Platinum with 150,000 MR. The first try it only give me 120,000. I then switched to Incongnito and it gave me 150,000.

Hi Ricky,

I tried applying using your link but it takes me to a page to “Add Platinum” where I have to log in with my current US Amex account. Then after logging in, it says this offer is no longer available and shows me available offers, which is only 120k MR points for business platinum. Any ideas how to get the 150k offer without having to log in?

Does the US Biz Platinum have a strong referral bonus (like for the Canada version of 20k MR points)? If so, would this be a good card to get first to refer card biz cards for P2? If this does not have a good referral bonus, can you advise which US biz card has the best referral bonus?

I find it quite complicated to start the process for obtaining US credit cards (English not being my mother tongue and, well, let’s say it, my age! do not help). I just checked on Nova Credit and clicked on the ‘’No SSN or ITIN required’’. It seems I could get the Business Amex and 75K or the Gold card and 60K without having a SSN and ITIN. I suppose only a bank account in the U.S. would be needed. Is there a reason I should go for the Hilton no-fee first? Thanks!

There is also a 160,000 US MR offer for the Business Platinum Card floating around.

This offer is no longer available. If you’d still like to apply for a Business Card from American Express click here.

Hello Ricky. On an unrelated matter, I wanted to let you know on my recent experience. I last week applied and got the Amex Aeroplan Reserve card. However, I did not get the Air Canada Spend offer in ‘Amex Offers’ ($ 400 x 5 for a total $ 250). I called Amex and tried to persuade them that this should not be a time limit offer (it requires registration with Air Canada by June 30, 2021) and that it should be available to all card holders, just like it is with CIBC and TD premium card offers. They however declined. They view their offer as only for cardholders who existed at May 13, 2021 , rather than for new Amex Reserve cardholders. Bottom line – I cannot avail the Amex benefits. I am therefore considering cancelling the card as frankly the loss of $ 250 benefit is significant. Just to let you know that I was not aware that Amex was treating its offer for only existing card holders at the date. Thanks

Dang that’s good! Too bad I don’t spend that much!

I don’t think United Travel Bank works anymore for the US200 incidental credit. Can anyone please confirm?