The American Express Cobalt Card was the first credit card of its kind, geared towards millennials and running on an innovative month-by-month structure for its fees, spending requirements, and points bonuses.

Notably, the card also earns a different class of Membership Rewards points compared to the traditional quartet of the Gold Rewards Card, the Platinum Card, the Business Gold Card, the Business Platinum Card.

Instead of the highest-tier MR First points or regular MR points, the points you earn on the Cobalt Card are known as MR Select points.

- Earn a total of 15,000 MR points upon spending $750 in each of the first 12 months

- Earn 5x MR points on groceries, restaurants, bars, and food delivery

- Earn 3x MR points on eligible streaming services

- Earn 2x MR points on gas and transit purchases

- Transfer MR points to Aeroplan, Avios, Flying Blue, or Marriott Bonvoy

- Enjoy the exclusive benefits of being an American Express cardholder

- Bonus MR points for referring family and friends

- Monthly fee: $12.99

In general, transferring regular MR points to frequent flyer programs like Aeroplan or British Airways Avios tends to be the best way to use them, since the value you can capture from these programs far outstrips the various other uses of MR points.

But of course, the big difference with MR Select points is that airline transfers are off the table, leaving us with the question: what’s the best way to redeem MR Select points from the Cobalt Card?

There are quite a few possibilities, and which one works best for you will depend on the exact situations that crop up as you’re planning your travels.

Generally speaking, though, three options come to mind:

-

Redeeming against all purchases (Pay with Points) at 1 cent per point (cpp)

-

Redeeming for flights via Amex Fixed Points Travel at 1.5–2cpp

-

Transferring points to Marriott Bonvoy at a 1:1.2 ratio

Redeeming Points Against Purchases

Let’s start with the baseline scenario. One of the perennial selling points of Amex Membership Rewards points is the Pay with Points feature: the ability to redeem points against your credit card purchases at a fixed rate of 1,000 points = $10, thereby realizing a flat value of 1cpp.

This means that any purchase that you charge to your Cobalt – travel, groceries, gas, bills, etc. – can be essentially stricken from your statement by redeeming your MR Select points at 1cpp.

(Previously, only travel purchases qualified for the 1cpp redemption, whereas other purchases were limited to 0.7cpp when using Pay with Points. However, as of May 2021, the 1cpp redemption option has now been extended to all purchases.)

As part of its standard signup bonus, the Cobalt Card offers 2,500 MR Select points per month for every month that you spend $500 on the card. The annual signup bonus therefore totals to 30,000 MR Select points, which if used in this way, would equal $300 towards any of your travel purchases.

So there we have it: you can do no worse than getting 1cpp in value on your MR Select points. Now, how can we do better?

Amex Fixed Points Travel

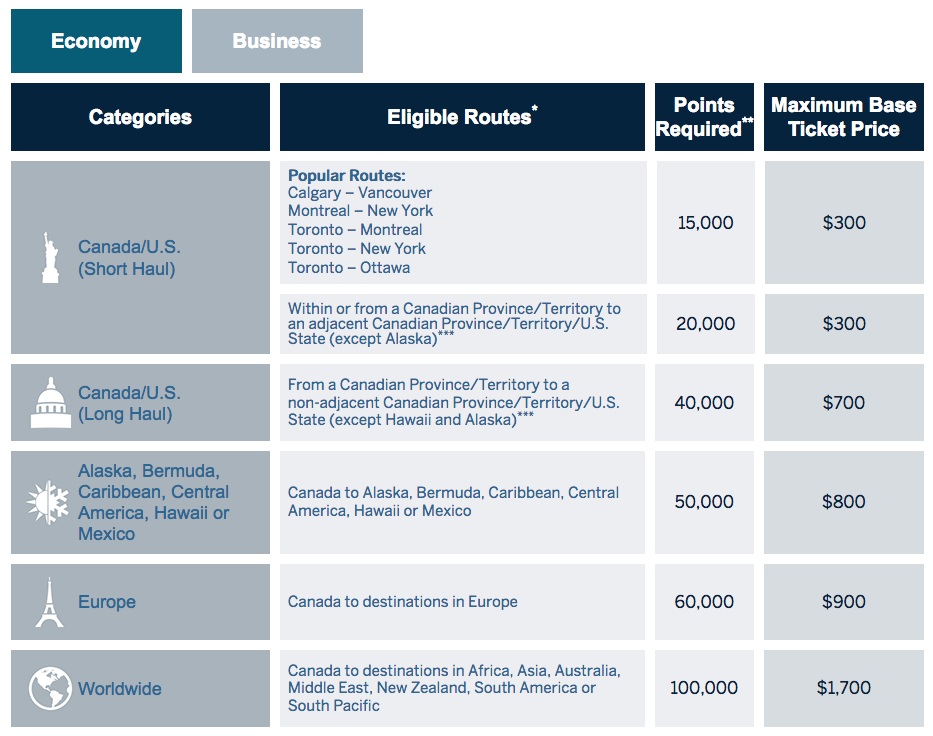

Amex Fixed Points Travel allows you to exchange your MR Select points for round-trip flights departing from Canada, according to a certain geographic redemption chart. Here’s the chart for round-trip flights in economy class:

Compared to other similar reward structures operated by RBC and CIBC, the good thing about Amex Fixed Points Travel is that there is a decently compelling redemption chart for business class flights as well:

As you can see, depending on the geographic zone you are flying to, you’ll have to redeem a certain amount of points in exchange for a certain “maximum ticket price” of the flight, which refers to the regular price of the flight if you were to pay for it using cash. Note that this maximum price covers the base fare only; the taxes and fees will be extra.

The good thing is that compared to redeeming points via a traditional frequent flyer program like Aeroplan, using Fixed Points Travel means that you don’t have to deal with limited award availability. In most cases, if you see a flight on Google Flights, you’ll be able to redeem MR Select points for it via Fixed Points Travel.

Now here’s the important thing: the amount of points you pay will be the same, whether or not you actually “achieve” the maximum ticket price. This means that how good of a deal you’re getting will vary directly with the cash price of the ticket you’re looking at.

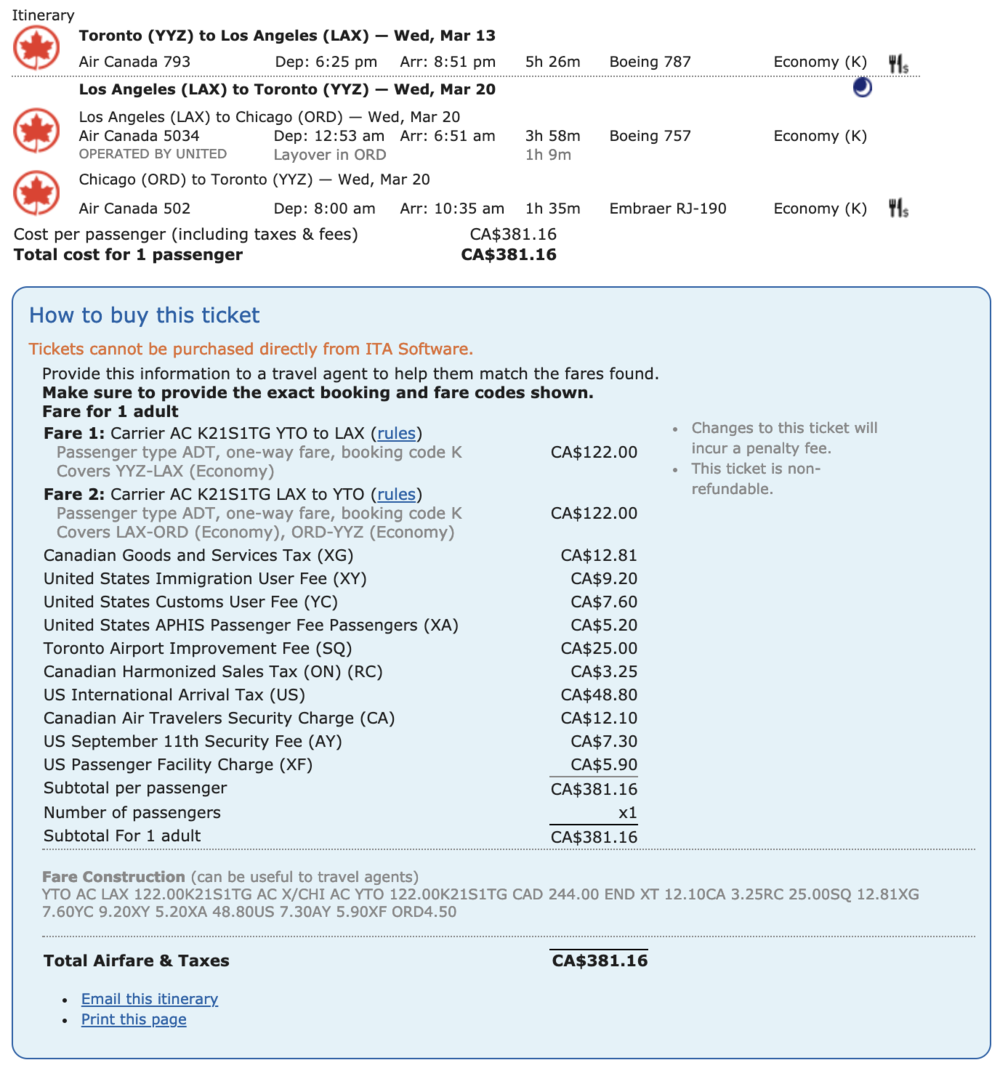

Here’s an example. Imagine that you wanted to fly round-trip from Toronto to Los Angeles. With a little advance planning, this route can often be booked for a pittance – in fact, in the below example, the base fare only comes to a paltry $244, with the remaining $137 being composed of various taxes and fees.

If you were to redeem 40,000 MR Select points under Fixed Points Travel (based on the Canada/US long-haul award pricing) for this itinerary, you’d be getting a downright terrible value of $244 / 40,000 = 0.61cpp, in addition to having to pay that extra $137.

As we saw above, in this case, you’d be much better off purchasing the full fare of $371 and offsetting the charge at the baseline ratio of 1cpp – you’d only spend 37,100 MR Select points this way, and you wouldn’t have to pay anything extra on top of that.

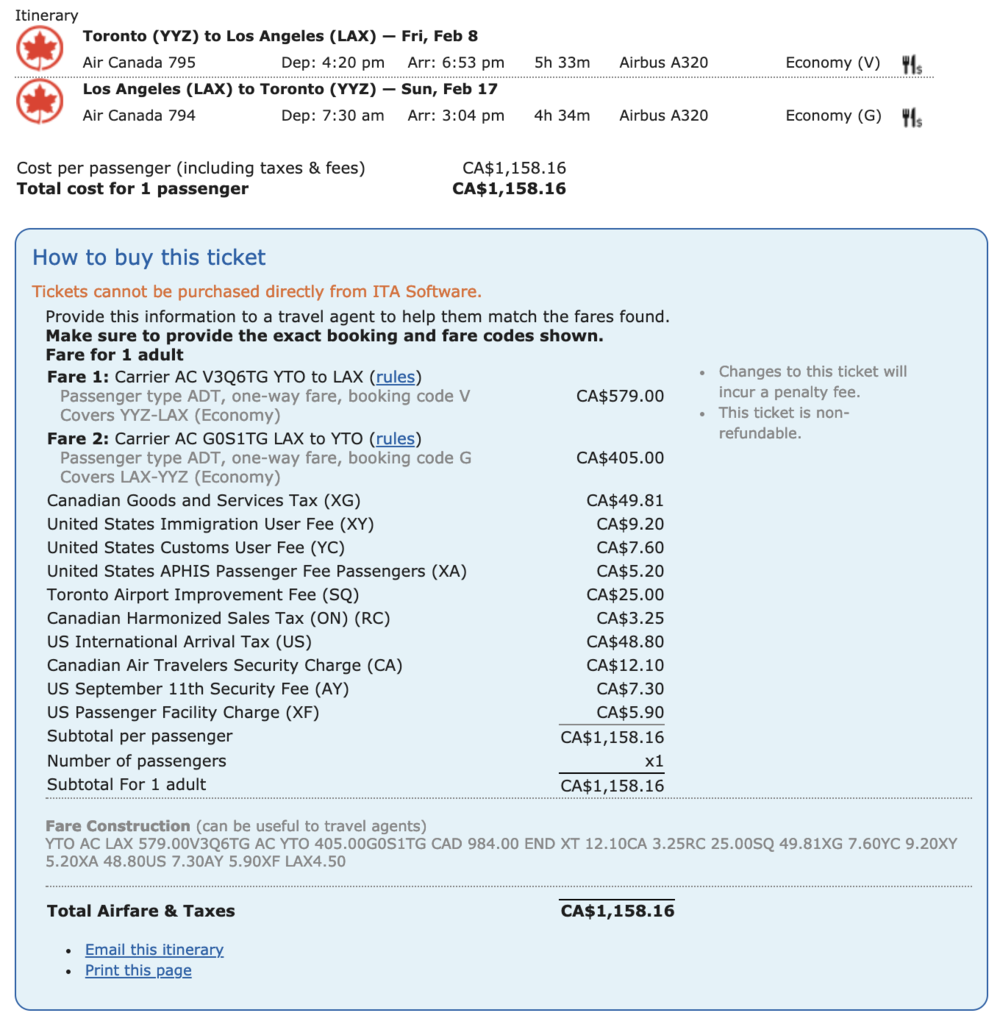

On the other hand, as the date of departure approaches, the Toronto–LAX fares can shoot up quickly. In the below example, the base fare is a total of $984, with the remaining $170 representing taxes and fees.

In this case, your 40,000 MR Select points would use up the full maximum ticket price of $700, with the remaining $284 in base fares and $170 in taxes and fees being paid out-of-pocket. You’d get the maximum possible value of $700 / 40,000 = 1.75cpp for your MR Select points, but you’d still have to pay that extra $284 + $170 = $454.

As you can probably guess, the sweet spot for Amex Fixed Points Travel is achieved when the base fare exactly equals the maximum ticket price. When that happens, you’re maximizing the value for your MR Select points, and you’re also minimizing your extra out-of-pocket expense, since the only thing you just pay is the taxes and fees.

If you do the math on the award chart, you see that the maximum value you can get out of Amex Fixed Points Travel lies somewhere between 1.5cpp (in the case of Canada to Europe in economy class) and 2cpp (in the case of popular short-haul routes in economy class).

That can certainly be a respectable return on your MR Select points, especially considering that you can book virtually any flight out there that has empty seats available.

And yet, Fixed Points Travel comes with quite a few limitations: your travel must originate in Canada, and your itinerary must be round-trip. Plus, the occasions when you can hit the exact maximum ticket price threshold with your base fare tend to be rather limited. Can we do any better?

Transferring Points to Marriott Bonvoy

One of the most popular uses of Amex Cobalt points is to transfer them to Marriott Bonvoy.

The transfer ratio is 1 MR Select point = 1.2 Marriott Bonvoy points, meaning that the standard annual signup bonus of 30,000 MR Select points would equate to 36,000 Marriott Bonvoy points.

Getting excellent value for your points through Marriott Bonvoy is certainly quite achievable; however, just because you can get good value doesn’t mean that you always will. Again, you’ll have to have a discerning eye as to which potential use of MR Select points is best suited to your specific situation.

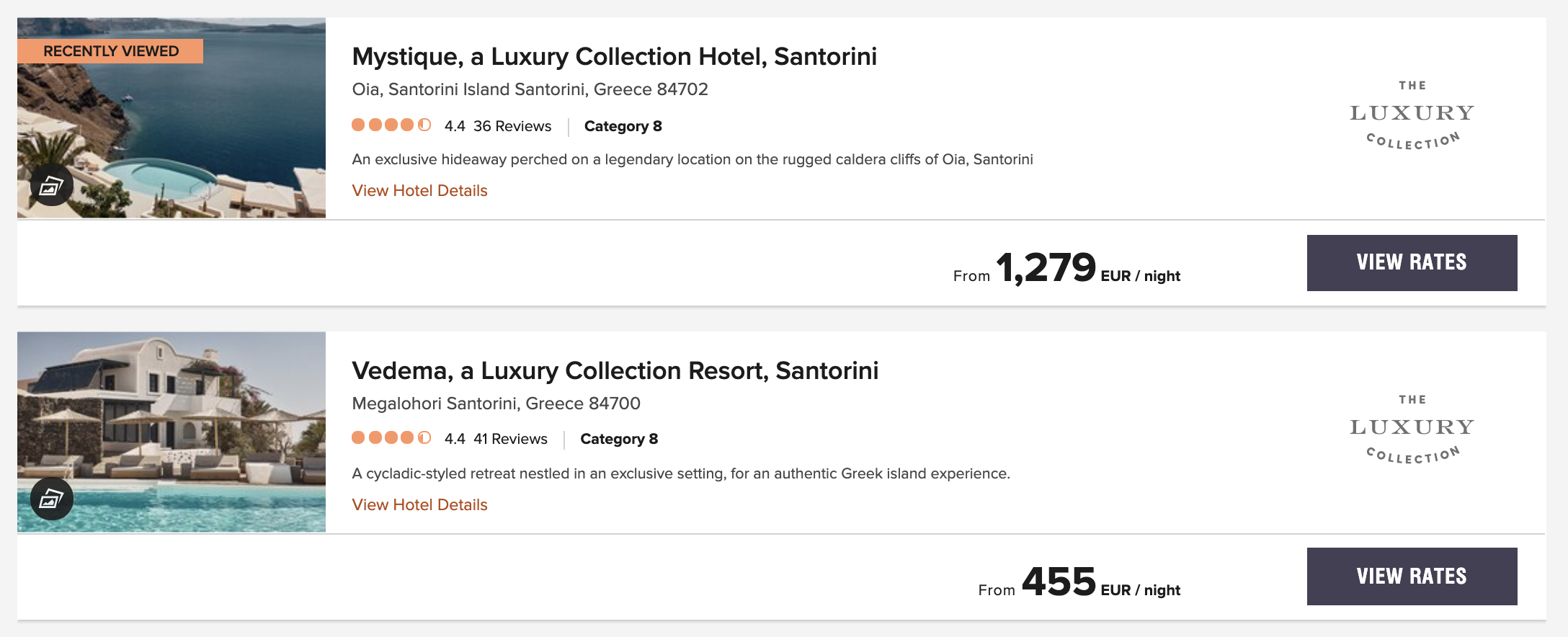

Let’s imagine you’re choosing between two luxury hotels in Santorini: Mystique and Vedema. Both are bookable for 85,000 Bonvoy points for a free night, which is equivalent to 70,833 MR Select points.

However, when you compare the cash rates, you see that Vedema can be booked for just €455 ($671) a night, while Mystique will run you €1,279 ($1,887) a night.

Running the numbers, then, we see that the value you’d get from redeeming 70,833 MR Select points would be $671 / 70,833 = 0.94cpp in the case of Vedema and $1,887 / 70,833 = 2.66cpp in the case of Mystique.

Can you see where I’m going with this? That’s right – transferring MR Select points to Marriott to book a night at Mystique would be a fantastic deal, while doing so for a night at Vedema would be a terrible one.

If you did want a free night at Vedema, the best course of action would in fact be to book the cash rate. Then, instead of transferring over 70,833 MR Select points, use only 67,100 MR Select points to offset the charge at the baseline 1cpp ratio!

This is merely one example, although you can apply it across all your potential Marriott hotel bookings. The thresholds you should be following are as follows:

If you're redeeming points for... | You'll need this many Marriott points... | Which equals this many MR Select points... | So the cash price better be at least... |

Category 1 | 7,500 | 6,250 | $62.50 |

Category 2 | 12,500 | 10,417 | $104.17 |

Category 3 | 17,500 | 14,583 | $145.83 |

Category 4 | 25,000 | 20,833 | $208.33 |

Category 5 | 35,000 | 29,167 | $291.67 |

Category 6 | 50,000 | 41,667 | $416.67 |

Category 7 | 60,000 | 50,000 | $500.00 |

Category 8 | 85,000 | 70,833 | $708.33 |

Note that this value exercise only applies when you’re considering transferring your MR Select points to Marriott.

If you earned your Marriott Bonvoy points through other channels, such as the Marriott Bonvoy American Express Card or Marriott Bonvoy Business American Express Card, then it wouldn’t make sense to run this comparison.

Putting It All Together

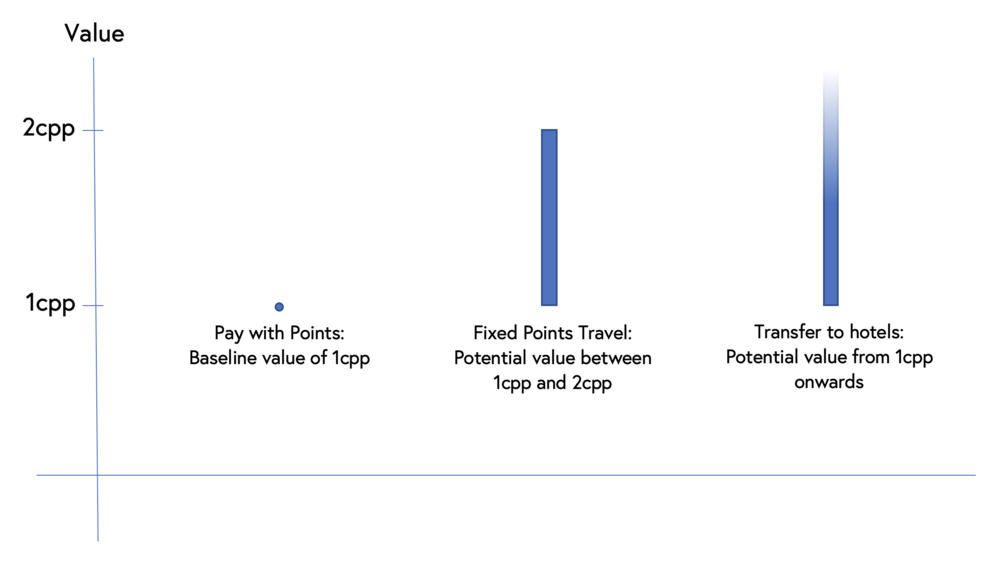

Let’s look at the overall picture now. There are three major uses of Amex Cobalt points: a 1cpp baseline redemption, a potential 1.5cpp to 2cpp via Amex Fixed Points Travel, and potentially even more value out of transferring to Marriott.

The optimal course of action therefore depends on each individual’s travel needs. If you don’t have much of a need for free hotel nights (or your travel plans aren’t taking you to places where Marriott would get you more than 1cpp in value), but you do travel frequently on routes that fall under Amex Fixed Points Travel, then getting 1.5cpp to 2cpp via Fixed Points Travel would be your best option.

If you can’t extract good value out of Amex Fixed Points Travel – perhaps the fares you book don’t quite meet the maximum ticket price, or you usually only book one-way trips – but you do stay with Marriott frequently, then your best bet would be transferring your MR Select points to Marriott Bonvoy and using them for high-value hotel redemptions.

If both Amex Fixed Points Travel and Marriott Bonvoy fit your travel needs, then it’s a question of which redemption avenue will bring you the most value.

Fixed Points Travel will get you a maximum of 2cpp in value, so if you can outstrip that with Marriott, then that’s the way to go. On the other hand, if you consistently travel on the popular short-haul routes and get 2cpp in value doing so, then that might be the best general strategy, since redemptions of 2cpp+ with Marriott can be pretty rare to come by.

Lastly, if neither option fits in with your upcoming travel plans, then you can always rely on the ability to redeem your points against any credit card purchase at 1cpp.

And indeed, as we’ve demonstrated, even when you plan on using either Fixed Points Travel or Marriott Bonvoy, it’s important to double check that it’s actually worth doing so, and that the value you’re getting exceeds the baseline value of 1cpp!

Conclusion

The American Express Cobalt Card allows you to earn 5x points on groceries and dining out, but as we’ve seen, figuring out the best use of these MR Select points can be surprisingly tricky.

It all depends on which flights and hotels you plan to book, and whether these travel plans might align with the sweet spots of Amex Fixed Points Travel or transferring out to Marriott Bonvoy. If not, the ability to redeem points against any credit card purchase at 1cpp is always a safe fallback.

If I travel via Air Canada or United only, but let’s say one international trip and one domestic flight every one or two years… am I better suited with Cobalt instead Aeroplan cards?

This is an old article, and an important part of it is outdated: your American Express Cobalt points transfer directly to Aeroplan 1:1. No more of this workaround needed. This was changed 6 months ago basically.

Cobalt is great because it’s good value for non-travel rewards too. No reason not to do both!

Well, this pretty much confirms it then. I should get back to Cobalt and organically get Aeroplan points when the promo justifies it and through flights or transfers via Marriott.

Any ideas when should I cancel Gold to not get banned? Would it be wise after the AF?

Thanks a lot Josh.

Cobalt for everyday use + Aeroplan for big promos is a good plan, similar to what I do.

I’d cancel after the fee – can’t hurt.

Thanks a lot !

Is it worth it to buy a $500 prepaid visa at a grocery store for 5x points with cobalt or does the $7 activation fee outweigh the points? Can someone break it down for me please

500$ * 5x points = 2.5k points

(+ 2.5k points if you’re in your first year of holding the card = 5k points)

2.5k points = 25$ at the baseline 1cpp redemption value. (5k points = 50$)

25$ (and 50$) > 7$, so to answer your question strictly speaking, the point value does outweigh the activation fee.

Can we transfer MR-S to US MR so the value in reality is better in terms of AP?

1 MR-S= 0.77 US MR=0.77 AP vs 1 MR-S =0.5 AP via Marriot

Hi there, I had a Cobalt for a year and I’ve collected all the points. Now i wanted to cancel is because I just have too many cards to manage. Because of COVID now we cant travel much, so does it make sense to transfer to Marriott ? Can i transfer points from Marriott to Aeroplan maybe ?

Michelle, Maybe this answer is late, but yes you can transfer Marriott to Aeroplan, and it is a excellent time when they have a bonus for transfer. Marriott have many other transfer partners also.

You can transfer MR’S to Marriott but not Marriott to Aeroplan.

Actually I believe you can transfer Marriott to aeroplan but I dont think its good value or something!

I recently got the cobalt card, but I didn’t know that I can’t transfer points to aeroplan. My question is, if I get the gold card now, can I combine cobalt points with gold and then transfer them to aeroplan? And if I can, will the transfer ratio still be 1:1?

No, MR Select points from the Cobalt Card cannot be combined with regular MR points from the Gold Card.

Is it possible to transfer MR Select points into your spouse’s Marriott Bonvoy account? I read that it is do-able in the US as long as the spouse is an authorized user on your account. Not sure if this can be done on CDN accounts.

I believe that if your last names and address are a match between both accounts, then there’s a good chance of the transfer going through.

Hi Ricky,

I am thinking about transferring my Amex points to Aeroplan through Marriott, 1:1.2

Correct me if I am wrong, from what I understood, the best use of the points is to directly book a flight via Amex portal or buy a ticket from say Google Flights and apply the points to that purchase price?

Also, there are promotions for Aeroplan 25-30% I believe when transfering Marriott points to Aeroplan, so given the promotion, the 5000 bonus if transfering more than 50000 MR, and given the fact that you can get to silver/black status with Aeroplan to cut cost of ticket even further. Would you say this is better than the above fixed method?

I mainly travel to Europe economy, and the ticket price is anywhere from 600-1200. I buy them from Google flights I find it to be easier to browse and cheaper, maybe Expedia or Kayak, but I am not sure if the price of the ticket is higher when buying from Aeroplan or American Express, and they don’t always have the same flights that the other sites show

I need some suggestions to get the best value for those MR points…I’d appreciate your input

50k MR select>3:1 to 60k MB with 15k bonus-> 25k miles

So MR select to Aeroplan=1:0.5, this is the worst value you can possibly get for Aeroplan Miles. You might as well get the AmEx Gold instead, so that you can transfer 1:1

I have a different way of looking at this – I use the Cobalt for groceries and restaurants. $1 = 5 MR Select points.

Transfer those 5 MR Select to Mariott = 6 Bonvoy points.

Transfer those to Aeroplan = 2 Aeroplan points.

Therefore – $1 spent on Cobalt for groceries or restaurants = 2 Aeroplan points – which is equal to Gold for groceries, and double Gold for restaurants. (Platinum is 3 points for restaurants, so, that’s the best choice there – but Cobalt is better than Platinum for groceries!)

But wait – that calculation is without the Bonvoy transfer bonus. If you get a bonus you’re now talking 2.16 points for every 5 MRS.

So – it can be quite a good deal – and that’s why I hold my Cobalt.

Now if only Loblaws would accept AMEX… argh… 🙂

If you book a flight using the cobalt, would you want to pay off your cobalt before applying the points to your charge so that you also get the points on your flight booking? Then once you pay the cobalt balance, go back and apply the points to the charge?

I have an Amex gold, and now debating between the cobalt or scotia gold. Which of these two do you think could best somehow (or at all) combine my points earned? I’m obviously after the Sign-up bonuses at first.

I guess I could book different legs of my trip with different cards, but I find that to not workout well when it comes to flight delays that cause a missed flight. Perhaps two one way tickets. Eventually I’ll get all 3 cards, just deciding on my second one for now.

The only way to combine points between Amex Gold and Cobalt is to transfer the points into Marriott Bonvoy or Hilton Honors. Scotia Amex Gold isn’t compatible with any American Express issued Amex.

Depending how many points you have, you could use Amex Gold to book your flight, Amex Cobalt to book your hotel and then Scotia Gold to pay for a car rental (as an example).

Great post, Ricky. As usual. I especially appreciate the cash-price minimum column for hotel bookings on stays shorter than five nights.

So currently trying to decide between the AMEX Cobalt or Gold (I’d need to transfer these points to BA Avios as I gain them) – So my question is, there’s nothing stopping me from transferring my MR Select Points to Marriott Bonvoy points and then from Bonvoy to my Executive Account correct?

Just wanted to confirm before I dedicate myself to one Card?

Thanks for the help.

Yes, there’s nothing stopping you from doing that.

Hello,

I need help. I am trying to use my many cobalt points but I can’t seem to log on to the fixed point travel website. https://www.americanexpress.com/canada/en/fixedpointstravel.html

I get a deadlink.

Once logged in to the regular site, when I hit "Travel" it just gives me an "authentication error".

Any ideas?

Does the travel site have a different password than the regular Amex Canada page?

Thanks,

S

I got that a few times using Chrome as well. Try using a different browser.

As far as I know and log in, it’s all the same password. AmEx has maintenance sometimes so better check later. If you need to book your tickets asap, you can call AmEx Travel at Phone 1-855-804-9600 (416-868-0955) or Email: CA-Travelonline@service.americanexpress.com

Thanks – really needed this breakdown!

excellent article. Another benefit of Amex Fixed Points Travel is that it is an actual revenue ticket, meaning you can earn points for this flight. Unlike an Aeroplan award flight.

This is the exact article I have been searching for, for some time now. Thank you for the write-up and explanations; wonderful work as always!

Follow up – I know it would be better to transfer MR points directly to airlines but if I already have flights covered, I’m looking at using MR points with pay with points as it’s a better deal than using marriott points based on your charts. Plus it helps me meet minimum spend on card, and I can then write off hotel expenses against my business. Does this make sense or am i missing something.

Correct – if you aren’t going to transfer MR points to airlines, then your choices boil down to the MR Select choices outlined above. In that case, you should use the chart I provided to determine whether it makes sense to transfer to Marriott for hotels vs. booking directly (remember to search for best rate guarantees!) and offsetting at 1cpp.

Besides MR (not MRS) points being transferable directly to airlines, if I am looking at hotels with MR , could I still use this chart?

If you ONLY use the Cobalt for groceries and restaurants you get 5 x points. You can covert those 5 points into 6 Marriott points and then convert those 6 Marriott points into 2.5 Aeroplan points if you have enough to take advantage of the 5K bonus conversion. Therefore you are essentially earning 2.5 Aeroplan points for every $1 spent on the Cobalt. This is a good deal in my eyes. Again – only use the Cobalt for food and groceries – use a better points earning card for everything else.

Steve – I was thinking along these lines too – but I did the math on it, and if you value Aeroplan at 2c Canadian a piece (which is generous), 2.5 points x 2c = 5 cent value. And just applying the MR points on travel purchases, 5 MR points = 5 cent value. So… you’d have to be achieving better than 2c value on your use of Aeroplan points (possible, but rare in my experience) for that to be worthwhile. Otherwise, the AMEX fixed points program or Bonvoy use for hotels actually delivers the best value, because 5 MR points = anywhere from 7.5 cents to 10 cents depending on your usage.

Of course, as with anything, these companies actively are looking to screw us over at the expense of more profits, while we few who do our homework try to find any route to maximize the value…

Cobalt: $1=5pts on grocery/restaurants/food delivery up to $30000/year; MR select>1:1.25 to MB>3:1 aeroplan miles; So $1=5*1.25/3=2.08 miles

Gold: $1=2pts on grocery/restaurants/gas/drugstores in Canada; 1:1 to Hilton Honors, Aeroplan & British Airways Avios; So $1=2 miles

Is missing out on a large chunk of gas rewards for 0.08 mile/dollar difference worth it?

I have to correct my calculation:

Mileage transfer to frequent flyer programmes: 1:1.25 MR select to MB>3:1 MB to miles, every 60,000 MB pts for 5,000 bonus miles (2.4:1)=25,000 miles; So without bonus $1=5*1.25/3=2.08 miles, with bonus $1=5*1.25/2.4=2.6 miles

In addition, AmEx Gold MR has a $1=4 Aeroplan and BA Avios miles;

However, the rate of conversion drops significantly for other airlines: 1:0.75 to Alitalia MilleMiglia, Delta SkyMiles, Etihad Guest, Asia Miles,so $1=2*0.75=1.5 miles;

Cobalt is superior to Gold when transferring 60k MB pts to frequent flyers programmes that are not Aeroplan or British Airways; However, if you use Avios or Air Canada, Gold is the no brainer.

Ricky, can you delete my comments? The calculation errors at this point is embarrasing: AmEx Gold MR has a $1=2 Aeroplan, not 1 to 4: $1=2pts=2 miles on grocery/restaurants/gas/drugstores in Canada.

Embarrassing…

And even more value if you transfer to an airline with a promo transferring bonus like 35% from a hotel program.

Agreed!

An excellent review and explanation of the use of MR Select.

Would it make sense to cancel the Cobalt after the bonus points year is up, then use the Amex Gold for 4 or 5 months for groceries etc., then reapply for the Cobalt to make use of the bonus year again?

Or is this needless complication given the 5X for food anyway?

Depends on how much you take advantage of that 5x food category, I’d say. Unless you spend loads of money on groceries and dining out, I imagine it would be worth cancelling and reapplying in a few months.

If you’re playing in two-player mode, you can have your partner hold onto the Cobalt while you cancel, and vice versa.

AMEX changed the rule, and welcome bonus only offer to NET NEW cardmember. If you have the card before (no matter how long ago), they will not given the welcome bonus points. I just experience this hick up with them.

Thanks again Ricky. My intention would be to transfer to Convoy and then something like Aeroplan. Is that a good idea and how is it done.

As the Kingslayer himself pointed out, the optimal ratio would be 50,000 MR Select points = 60,000 Marriott Bonvoy points = 25,000 Aeroplan miles. Not as good as transferring regular MR points at a 1:1 ratio, but nevertheless another possibility for racking up airline miles.

60,000 Marriott Bonvoy = 25,000 Aeroplan

Thank you so much for the chart at the end! It was super helpful.

Excellent information Rick, I have always wanted to ask you about the best use of MR Select, you help me figuring out the complicated and best use of it. One question here, when you figured out the best value of MR Select, do you book, say the hotel, through the Amex Travel site and do the MR Select payment after, or at the time of your booking transaction?

You charge the purchase to your Cobalt Card, then you use the Pay with Points feature on your Amex dashboard (pictured near the top of the article) to offset the charge.