It’s time to say goodbye to the Canadian-issued American Express SPG Card and American Express Business SPG Card as they officially evolve into their Marriott Bonvoy-inspired final forms: the American Express Marriott Bonvoy Card and the American Express Marriott Bonvoy Business Card.

Both cards will adopt a sleek new look, featuring a slate-grey colour palette and the “circles and lines” design element that Marriott Bonvoy has been drawing upon. Existing Amex SPG cardholders can order their replacement cards at any time.

With all due respect to our new Bonvoy overlords, I can’t help but feel a slight tinge of sadness as we bid farewell to the deep ruby of the legacy SPG cards. These cards have certainly served us well throughout the years – they were by far the most compelling option for daily spending in the heyday of the SPG program, lest we forget!

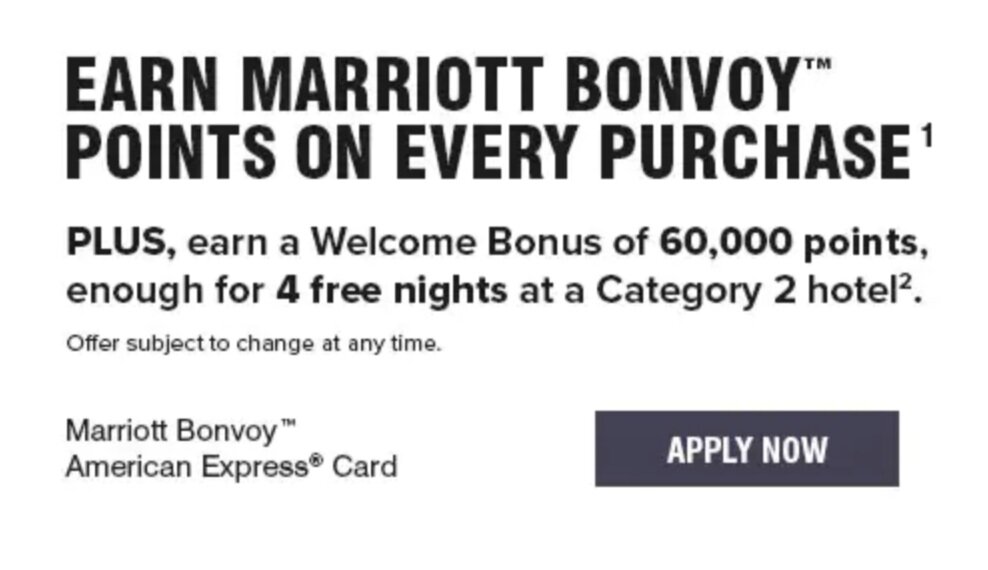

Anyway, in addition to the nominal and cosmetic transitions, the cards are also offering a higher signup bonus of 60,000 Marriott Bonvoy points upon spending $1,500 in the first three months. The annual fees remain unchanged at $120 and $150 for the personal and business versions.

The other good news is that until March 27, Great Canadian Rebates is offering increased cash back offers on these cards:

-

The Amex Marriott Bonvoy Card is now offering $50 cash back, bringing the net annual fee down to $70 for the first year.

-

The Amex Marriott Bonvoy Business Card is now offering $60 cash back, bringing the net annual fee down to $90 for the first year.

New Signup Bonus of 60,000 Points

The signup bonus of 60,000 Marriott Bonvoy points represents a very welcome 20% increase upon the previous level of 50,000 points, which is what the card had originally launched with when the transition from SPG Starpoints to the Marriott ecosystem had taken place in August 2018.

I personally think 60,000 points is the perfect signup bonus for this card, and that Amex ought very much to keep it at this level for the long-term. That’s because one of the biggest selling points of Marriott Bonvoy is the ability to transfer points to 40+ airline partners at a 3:1 ratio, and the program gives you a 25% bonus whenever you initiate transfers in chunks of 60,000 points. Thus, the signup bonus on the Amex Bonvoy cards can also be viewed as 25,000 airline miles in the frequent flyer program of your choice.

Of course, 60,000 points can also be redeemed for Marriott hotel stays, in which case it’s good for:

-

One night at a Category 5–7 hotel or a Future Category 8 hotel if redeemed before March 5, 2019

-

Two nights at a Category 3–4 hotel

-

Five nights at a Category 2 hotel

-

Nine nights at a Category 1 hotel

For everything you need to know about redeeming Marriott Bonvoy points, you can refer to the Complete Guide to Marriott Bonvoy that I published recently.

Hôtel de Berri, a Luxury Collection Hotel, Paris

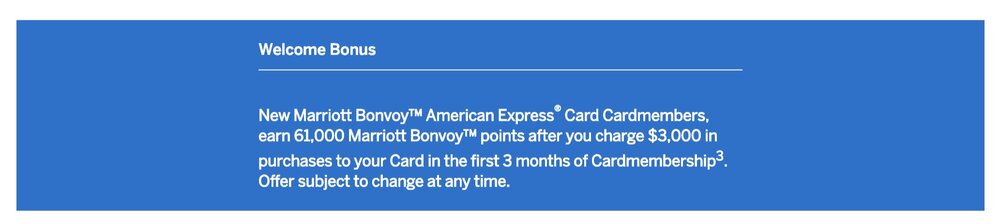

Interestingly enough, it seems that if you were to apply via a referral link, you’d earn an extra 1,000 Marriott Bonvoy points, for a total of 61,000:

This definitely strikes me as American Express’s way of making up for the fact that referral offers have a higher minimum spending requirement than the public offer ($3,000 in the first three months, compared to $1,500). A paltry 1,000 points feels like a bit of a joke to me, but it’s better than nothing, I guess.

If you were to apply for both the personal and business cards, and you used the referral link on the first card to apply for the second, you’d end up with a total of 140,000 Marriott points (taking into account the points you earn from meeting the minimum spending).

That’s a very healthy points balance that, if deployed correctly, can take care of up to a full week’s worth of accommodations along your travels for the minuscule outlay of $270 in annual fees.

Features of the Amex Bonvoy Cards

Here’s a recap of the details of these cards that Amex is promoting heavily with this change, but ultimately we already knew:

-

Both cards will earn 5 Marriott Bonvoy points per dollar spent at Marriott hotels and 2 Marriott Bonvoy points per dollar spent on regular purchases.

-

The business version of the card, specifically, will also earn 3 Marriott Bonvoy points per dollar spent on gas, dining, and travel purchases.

-

The cards will come with 15 elite qualifying nights, which automatically qualifies you for Silver Elite status within the Marriott Bonvoy program and helps you get closer to the higher status tiers. However, the 15-night credits are not stackable among multiple credit cards, and you can only earn one 15-night credit per account per year.

-

You’ll receive a bump up to Gold Elite status upon spending $30,000 on the credit card within each year. The Gold Elite status is an automatic bump and does not come with the 25 elite nights usually required for Gold status.

-

You’ll earn a free night certificate worth up to 35,000 Marriott Bonvoy points every year on your card account anniversary.

If You Recently Applied for the 50k Bonus…

What if you’ve only recently signed up for the SPG Card or Business SPG Card and only earned 50,000 Bonvoy points for your troubles? Indeed, those of you who find yourself in this position might feel a little aggrieved at the timing of the increased bonus.

The good news is that back in 2017, Amex had implemented a similar increased signup bonus on the SPG cards. The standard offer at the time was 20,000 Starpoints, and it temporarily went up to 25,000 Starpoints for a few months. When this happened, many customers were successful in contacting Amex via Secure Message to ask for the extra 5,000 Starpoints as a goodwill gesture!

There’s no guarantee the same thing will happen this time around, but it’s definitely worth a try. If you find yourself wishing you had waited to apply for this card to obtain its higher signup bonus of 60,000 points, get in touch with Amex via Secure Message and garner some sympathy!

Conclusion

I would’ve been disappointed if Amex didn’t introduce an increased signup bonus to go with the Bonvoy-ing of the SPG cards, so I’m happy that they did. In my mind, 60,000 Marriott Bonvoy points is the right level for the signup bonus on these cards, since it aligns with the optimal transfer ratio for airline miles, as well as the short-lived opportunity to book top-tier Future Category 8 hotels at the discounted price.

For the annual free night. Since it is for 35,000 points, can you use it towards a higher category hotel that requires 60,000 points/night and just pay the difference using points?

Hi Arbitrage,

Unfortunately Marriott hasn’t been known to allow individuals to "upgrade" the free night certificates received from credit cards. If you have a certificate, you can always try calling and asking if it can be done, but I wouldn’t count on it.

I had the old SPG card and closed in early 2018. Applied for the new Bonvoy card, exceeded minimum spend requirement in the first billing cycle but did not receive the welcome bonus on the first statement. I only received points matching my spend. Any hope that I might receive the welcome bonus on the second statement or am I SOL?

Wondering if your points every showed up. I’ve read elsewhere that with the Amex Bonvoy, they may deny you the points if you "recently" had a sign up bonus on a different Bonvoy card. Not sure how legit that is. Anyway, would be curious to hear if your points appeared eventually.

There’s always a chance of the points showing up later (I’ve had this happen on more than one occasion on the old SPG products), but by the letter of the law you aren’t supposed to get the repeat bonuses again.

Thanks Ricky for another great post! Don’t know what we would do without your awesome site. I received this card in late Jan with the 50,000 points offer and just now requested a bump up to 60,000. It appears they are not going to offer the 60,000 to those who missed out as a goodwill gesture. 🙁 Here is their reply:

Good afternoon from American Express. I hope your day has been pleasant so far!

I am afraid to inform you that offer cannot be matched with new offers. System trigger the same offer which was available at the time of applying for the card.

We keep changing offers to our prospective card members and sometime we increase the points or sometime we decrease them as well. However, to ensure our card members receives what they applied for, we do not make changes to the offer they applied online and the same has been mentioned under Offer Terms.

We also reduce the offers at times. And even in such cases, we don’t reduce the offer already given to you because that’s been promised to you already. In the same manner, we don’t increase the offer and I hope you understand that

Plus, even if we were to change the offer on just your account, that won’t be fair to the other Card Members now, would it. We take pride in treating everyone equal.

I appreciate your understanding in this regard.

You are most welcome to contact us with any other query that you may have through live chat, over the call and secure message for further assistance.

Wish you a wonderful day!

Sincerely,

*****************

Email Servicing Team

American Express Customer Care

‘Twas worth a try!

I signed up for the personal SPG card early 2018 and cancelled late 2018. Anyone else apply for this card and get the points? Just confirming before signing up

Thanks Ricky great recap, always come to you to see what’s new out there.

If I already hold a Amex cobalt, which points are better for hotel stays? Is it worth switch from cobalt to this new card?

You’d have an unbeatable earn rate on food & drinks with the Cobalt (equivalent to 6 Bonvoy points per dollar spent), although the base-category earn rate is better with the Bonvoy cards (2 Bonvoy points per dollar spent vs. 1.2)

In my view, it’d be worth having both and using each where it’s advantageous, especially given the increased bonus on the Bonvoys at the moment.

Last year I self-referred from SPG personal to SPG Biz but did not get referral points. Upon inquiring I was advised by Amex that you cannot get referral points for self referral. Is this typically the case or was I just unlucky?

I’d say this was unfortunate on your part – most referral bonuses have been posting smoothly. I’ve had SPG referral points show up many months after the fact, though, so don’t be surprised if you suddenly see some points appear in your account.

Is it good idea to buy Marriott gift card to satisfy initial spending requirement?

Fine print seems to indicate that if you previously held an SPG card that you won’t get the bonus points.

Does anyone have any experience in the re-applying game?

Your thoughts on if I already hold what was previously an SPG Biz Amex?

Cancel and re-apply in 3+ months?

Change it to the Bonvoy version and self-refer to the Personal Bonvoy Amex?

Refer to the personal Bonvoy card, get the 10k referral bonus and 61k signup bonus, then cancel the business one and do it again in 3+ months as you described.

Is this considered a new card for churning purposes? Or is it just a rebrand of the SPG cards? If I already hold the SPG card(s) can I still apply, or refer, to these new ones?

It’s a rebrand, so I personally doubt that you’d be able to hold both the old SPG card and the new Bonvoy card at once.

If you currently hold the personal version, though, you can certainly refer yourself to the business version for the 60k bonus, or vice versa.

By doing self referral, can I link both personal card and business card to one Marriott rewards account?

Yes!