American Express has announced that its flagship lifestyle credit card, the American Express Cobalt Card, will be undergoing a transformation as of August 16, 2021.

The card will get a new earning rate of 3x MR points on streaming services, mobile device insurance of up to $1,000, and – most significantly – the ability to transfer MR points to airline partners. In exchange, the monthly fee is increasing by 30% to a reported $12.99 per month.

You can take a look at American Express’s FAQ page about the changes to learn more. While we’re still seeking clarity on some details, let’s take a look at everything we know so far.

Monthly Fee Increasing to $12.99

Let’s get the bad news out of the way first.

The Cobalt Card is unique among American Express’s product lineup, and indeed among Canadian credit cards as a whole, for charging users on a monthly rather than annual basis.

Since its launch in 2017, the card has commanded a monthly fee of $10, and this fee appears set to increase $12.99 as of August 16.

This represents a 30% increase, and a hike of the overall annual fees from $120 to $155.88. The new monthly fee will apply on the first statement following your card anniversary.

As the Amex live chat agent explains:

Effective August 16, 2021, the monthly fee for the Basic American Express Cobalt Card will increase from $10 per month ($120 annually) to $12.99 per month ($155.88 annually). The $12.99 monthly fee will be charged to your account on the first statement after your next Cardmembership anniversary following August 16, 2021, and once a month thereafter (regardless of Card activation).

For example, if your Cardmembership anniversary is November 1, your account will be charged a $10 monthly fee on each of your September and October statements. You will be charged the new $12.99 fee on the first statement following your next Cardmembership anniversary.

Thus, there’s a huge benefit to signing up for the Cobalt Card right now prior to the fee hike, since you’ll continue to pay the $10 monthly fee all the way through to July 2022, and you’ll be charged $12.99 starting in August 2022!

Nevertheless, with all Cobalt cardholders facing an eventual 30% fee increase, the key question is: are the card’s benefits also increasing by a commensurate 30% or more? I’d certainly say so.

Cobalt Card Now Earns Regular MR Points!

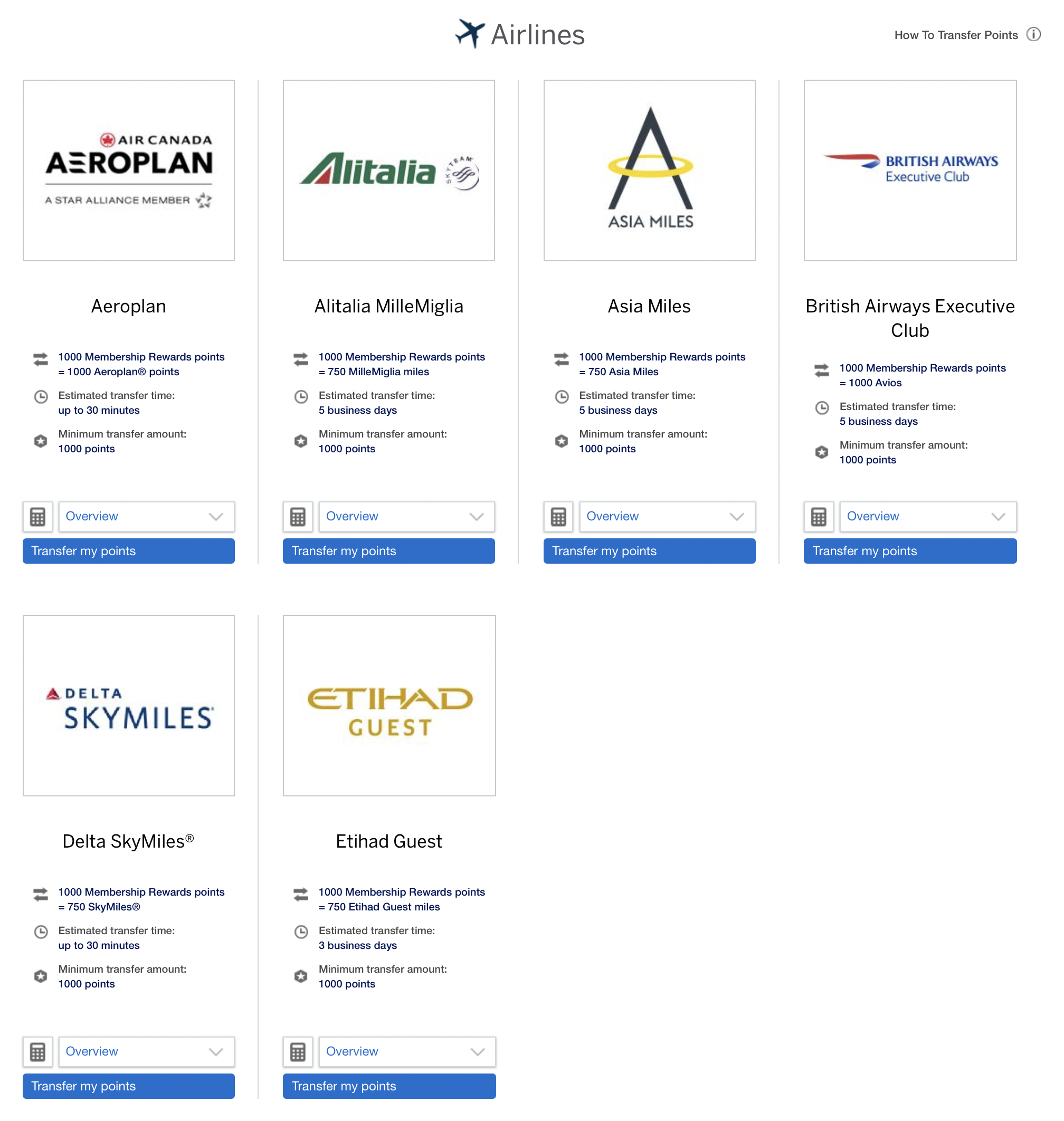

Following the bad news, let’s get to the downright incredible news: the Cobalt Card will begin earning regular MR points instead of MR Select points after August 16. This means that the points will now be transferrable to airline partners like Aeroplan and British Airways Avios, in addition to hotel partners like Marriott Bonvoy.

Until August 16, Cobalt cardholders are limited to either redeeming their MR Select points directly at 1cpp, booking flights via Amex Fixed Points Travel, or transferring to Marriott Bonvoy at a 1:1.2 ratio.

After August 16, cardholders will have the ability to convert these points at a 1:1 ratio to Aeroplan or British Airways Avios, as well as a 1:0.75 ratio to a variety of other frequent flyer programs.

This is a monumental change for anyone who prioritizes earning airline points over hotel points, which is a sensible strategy, given that optimized airline redemptions can usually unlock much higher value for your points compared to hotel redemptions.

Prior to this change, the best way to convert the Cobalt Card’s MR Select points into, say, Aeroplan points was one of the following:

- Transfer points to Marriott Bonvoy at a 1:1.2 ratio, and then to Aeroplan at an optimal ratio of 60:25, resulting in an overall effective transfer ratio of 1:0.5 from MR Select to Aeroplan

- Use a backdoor conversion opportunity via Air Canada’s flexible booking policy to achieve an effective transfer ratio of ~1:1, albeit at a cost

After August 16, there’s no need to worry about these conversion tactics anymore, as the Cobalt Card’s MR points will be directly transferable to Aeroplan, Avios, et al.

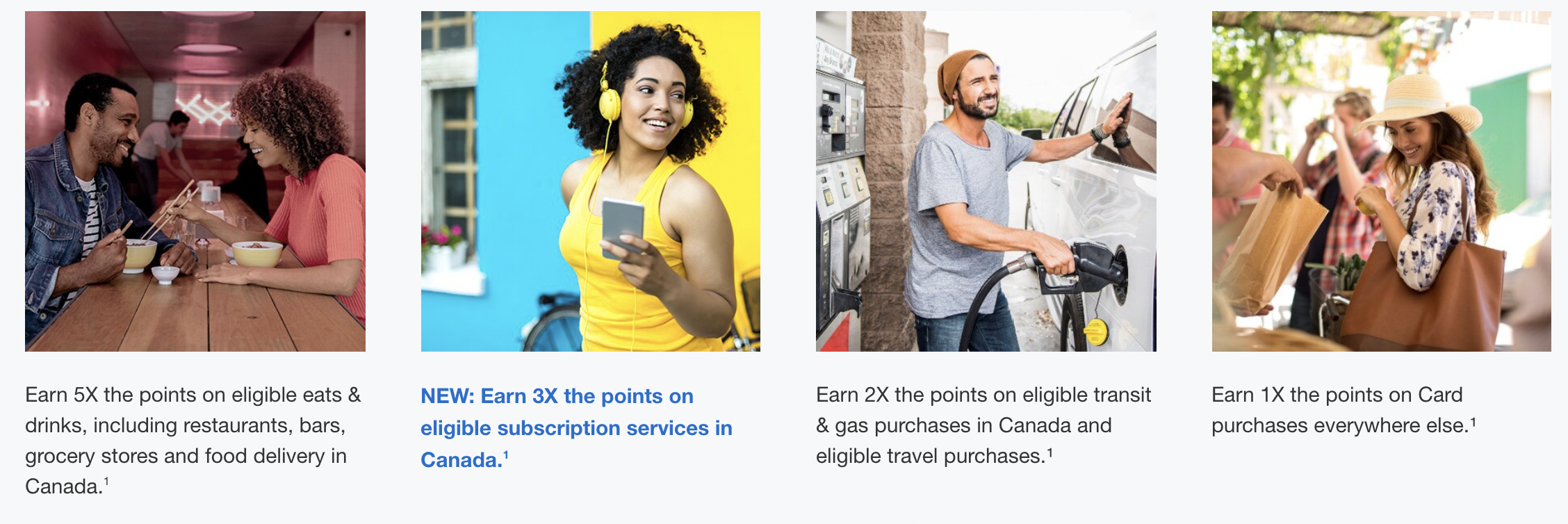

Remember, the star attraction of the Cobalt Card is the ability to earn 5x points on eats and drinks, which includes dining, bars, cafes, and grocery stores (where you can buy gift cards for other retailers), on up to $30,000 of spend per membership year.

At 5x the points on eats and drinks:

- A mere ~$4,000 of spending in this category would earn you a transcontinental business class flight at ~20,000 Aeroplan points

- A mere $11,000 of spending in this category would be enough to unlock a business class flight from Vancouver to Tokyo at 55,000 Aeroplan points

- Maximizing the $30,000 spend allowance for the 5x earning rate would earn you a total of 150,000 MR points per year from the Cobalt Card, already enough for round-trip business class to Europe or a luxurious First Class flight to Asia

Combined with the summer 10x offers on eats and drinks on the Platinum Card and Aeroplan co-branded cards, and I have a feeling that the lineups at grocery stores’ Customer Service desks across Canada are about to get a lot busier!

New 3x Earning Rate on Streaming Services

The Cobalt Card will get a new 3x earning rate on streaming services as of August 16, 2021. You’ll be able to earn 3 MR points per dollar spent on eligible streaming services in Canada, including:

- Apple TV+

- Apple Music

- Crave

- Disney+

- fuboTV

- hayu

- Netflix

- RDS

- SiriusXM Canada

- Spotify

- TSN

It’s awesome to see that this list includes the most popular streaming services like Netflix and Spotify, as well as a variety of other popular services like Apple TV+, Crave, and Disney+.

Simply change your streaming service’s billing information to the Cobalt Card and you’ll start earning 3x points on your monthly purchases, which will now get you closer to the next airline redemption in addition to your next hotel stay.

To summarize, the Cobalt Card’s complete earning structure after August 16 will look as follows:

- 5 MR points per dollar spent on eats and drinks

- 3 MR points per dollar spent on eligible streaming services

- 2 MR points per dollar spent on gas and transit

- 1 MR point per dollar spent on all other purchases

New Mobile Device Insurance

In another boost to the card’s value proposition, the Cobalt Card will soon offer up to $1,000 of mobile device insurance in the event that your smartphone, smartwatch or tablet is lost, stolen or accidentally damaged.

This works similarly to the mobile device insurance found on other Canadian credit cards: simply charge the full purchase price of the mobile device to your Cobalt Card, or use your card to pay for the financing charges on the mobile device, and you’ll be covered for a period of up to two years.

Mobile device insurance is becoming increasingly common as a card benefit on lifestyle-oriented credit cards, so it’s no surprise to see American Express adding this to the Cobalt Card’s overall insurance package.

Choice Card Also Now Earns Regular MR Points

Parallel to this change, an Amex representative also confirmed via live chat that the Choice Card from American Express will also be changing its rewards currency from MR Select to regular MR points.

The Choice Card has no annual fee, meaning that we’ll now have a no-fee Amex card where you can “park” your MR points.

If you’ve racked up a sizeable sum of points from, say, the Platinum Card’s offer of 150,000 MR points or the Business Platinum Card’s offer of 100,000 MR points, and you decide not to keep the cards but don’t feel like committing the points to a specific usage just yet, you should in theory be able to get the no-fee Choice Card to keep your MR points active.

Outside of this use-case, the Choice Card doesn’t carry too much appeal, given its limited earning rates and benefits.

Update: It’s been confirmed that the Choice Card will also rebrand as the American Express Green Card as part of this transformation on August 16, 2021.

Conclusion

After a year of austerity in 2020, American Express is pulling out all the stops to retake its dominant position in the Canadian credit card market in 2021.

The upcoming changes to the American Express Cobalt Card – in particular, the ability to convert points to airline frequent flyer partners – will dramatically raise the value proposition of the card and make it easily one of the best credit cards in Canada.

The increased $12.99 annual fee will be more than outweighed by the newfound ability to convert points to airlines, while the new 3x earning rate on streaming services and mobile device insurance benefits are very much the cherry on top.

With these upcoming changes set to kick in on August 16, if you haven’t yet picked up the Cobalt Card as a long-term spending option for eats and drinks, now is the best time to add some Cobalt to your lifestyle.

If you apply prior to August 16, then you’ll only pay a $10 monthly fee until your cardholder anniversary in 2022, allowing you to take advantage of the Cobalt Card’s newfound benefits while staving off the fee increase for a full year.

anyone see the aeroplan option on the cobalt?

It’s there!

Hi Ricky & co, I currently hold the Cobalt and the Business Edge. While I am over the moon to learn that points from Cobalt will transfer to airlines, I’m concerned that due to having one combined MR select points balance between the two cards may result in me getting screwed over on the airline transfer ability.

I would be perfectly happy if I was only allowed to transfer the points earned on Cobalt (and not Biz Edge) but will be VERY disappointed if I can’t transfer any of the points I earned so far on the cards. Do you guys know anything about this scenario? Thanks!

It’s a bit unclear at the moment, but in my opinion it’s far more likely that you’ll end up being able to transfer all the points on your linked account than not being able to transfer any of them.

Awesome, thanks for getting back to me! I will inquire with Customer Service via chat this week and post back if they are able to confirm anything.

Do you get the multipliers on purchases at Loblaws and LCBO? Do purchases on travel agencies like Priceline also get multipliers?

Loblaws doesn’t take Amex, whereas LCBO isn’t coded as Eats & Drinks (although you can buy LCBO gift cards at a grocery store that does take Amex). Priceline should code as travel.

If we sign up now, get the welcome bonus (which I’m assuming is ~50K MR Select points), will they get converted 1:1 to MR regular points (which I can then then transfer 1:1 with aeroplan)? Or will they get converted at a lower rate to MR?

I signed up for a cobalt card last month. I was initially bummed at the immediate increase in cost. But transferring to Aeroplan is huge. Do the points accumulated to date become available to transfer to aeroplan? For the next 10 months I get 2,500 points per month as part of my opening offer. If these an ultimately be transferrable to Aeroplan, I’ll be VERY happy!

Yes, as of August 16 they will.

Can one hold both Gold and Cobalt without worry of Amexile?

Yes.

This additional 20k pts offer, has it been removed, because I don’t see it either through your referral link or Amex site.

>Plus, earn an additional 20,000 MR Select points upon spending $3,000 within the first three months.

It’s an incognito offer, so try a few different browsers or a VPN to get it to show up: https://princeoftravel.com/blog/american-express-cobalt-card-offer/

Wasn’t able to get the “incognito offer” to show up. Tried two browsers, a vpn, erasing cache of browser, incognito mode, private mode. Settled on using Great Canadian Rebates to get the $120 fee back. Not 20 000 MR but about the equivalent of 12 000 MR. Plus saving the $36 (~3 600MR) increase in annual fees that Ricky helped me avoid means I was able to get about 15 600MR of value. I think it was worth it.

I see it now by simply going to Amex homepage in incognito! When I try to open your referral link in incognito, it only show 30k. As comments in the separate post you put the link for, it probably won’t work with a referral?

Thanks a lot, Ricky!

I can still see it

I still cannot find it at all. In highlights, it mentions about possible 2,500pts x 12mo, earning rates in each category, then Front of the Line, and using the points as statement credit. In the footnotes, I can’t find any mention of 20k bonus points.

Rewards Canada isn’t listing additional 20k pts as a part of welcome bonus, either. I also tried incognito mode.

I am actually wondering – I have about 100K points on this card. Will these points be transferable to Air Canada as well, or just those that will be earned after Aug 16?

Are we certain the price won’t increase for new registrants as well? The site seems to suggest anything about increasing after the first anniversary “$10* Important Notice: Effective on August 16, 2021, the Basic Card monthly fee will increase to $12.99.”

“The monthly fee will be increasing to $12.99 on the next Cardmembership

anniversary date on or after August 16, 2021.”

From: https://www.americanexpress.com/content/dam/amex/en-ca/homepage/hero-new/Cobalt-NOC-EN.pdf

From

For anyone interested in applying for this card, Great Canadian rebates is offering a $120 rebate on this card which would make it free for the first year.

I just noticed that the GCR offer appears to give 30000 MR points vs. 50000 on the American Express website so if you can spend $3000 in the 1st 3 months, it may be better to go through American Express directly.

As long as you’ve never had the card before. Remember the once in a lifetime rule. Since you wont be getting the signup bonus on a repeat application , the GCR route is the best way to go! FREE card for a year! 🙂

That is absolutely awesome. Thank you.

Wow, this is incredible. I signed up in Feb of last year and have accumulated 110K points to date. Huge spender on food so being able to transfer all of it into AP is a game changer.

Just got an information package in the mail about this. The wording specifically says “membership rewards select tier cardmembers will now have the option to transfer points to airline programs”. So it’s not saying that cobalt cardholders will earn the same points as plat, simply that they can now transfer points to miles. It is quite possible the transfer ratio to AP will not be 1:1. We will soon find out…..

It’s confirmed that the transfer ratio will be the same as it is now.

Think they will also change business edge to MR? That would make for a very interesting card for business owners.

As far as I’m aware, the Business Edge is remaining on MR Select for the time being.

So if I apply on Aug 15 then I will only pay $120 for the first year?

Your next cardmember anniversary after August 16 would be in August 2022, so yes.

as of aug 16 will the cobalt sign up bonus also change?

We’ll find out then.

thank goodness i missed the 30% bonus in June, I was going to cancel this card this month, now not so much. I’d like to see what airline partners will be in the mix, but it will likely be the usual suspects as per the article. But just incase Krisflyer or Skywards get added to the mix… That’ll be beyond revolutionary.

No indication of any new airline partners yet, but knowing Amex this summer… we can’t rule out any surprises!

With the new changes, except for first baggage fees all Aeroplan cards will feel inadequate. You can practically get 5x Aeroplan point with Amex Cobalt on everyday purchases, compared to 3X with most prestigious Aeroplan cards ($599 AF) on Air Canada purchases.

Thank you for the article. If you didn’t publish it by next week I would have transferred 65k points to Marriott Bonvoy.

What other Amex cards have the mobile device insurance? I’m planning on getting the Personal Plat, AP Reserve and the Biz Plat, in the next few months. Does anyone know whether these cards have the mobile device insurance?

This seems a little too good to be true…is devaluation for AP coming soon?

though devaluations can happen anytime Amex mr point earning on cards have nothing to do with Aeroplan or other frequent flyer programs

Great article, thanks for the update! I’m glad that I didn’t transfer my points to Marriott haha.

That is an incredible value for $156 a year in AF. As soon as I’ve met all the minimum spend requirements on my Aeroplan Reserve (150K), this will probably be the next one to look at. Very curious to see what they will do with the Gold Card in the near future.

This begs the question: does it make sense to keep the platinum card in the long run? How can Cobalt have higher earning rates than Platinum?

Cobalt will have 5X on wats and drinks vs 3X on Platinum.

Cobalt will have 2X on gas, transit and travel vs 2X on travel only for platinum.

I never cared to collect MR select points so never applied for Cobalt for now everything changes.

wondering this as well…if Platinum keeps its original 3x,2x,1x spending category then it probably makes more sense for most people to grab the Cobalt instead.

It seems that Amex is making the Plat more of travel card rather than a points earning card.

Hmm, to keep the personal platinum card for the perks or no…

Does the 5x restaurant eat and drink worldwide like the US gold card? Or within Canada only?

Cardholders have been able to get 5x on eats and drinks outside of Canada, too.

Are you sure? The Amex Cobalt webpage suggest that points are only earned on purchases in Canada?

Yes.

You have any links to more details on this? Is it on all eats & drinks outside of Canada, or is hit and miss? What about travel & transit? I was currently planning to only use another no-fx credit card when travelling, but now I’m wondering if I should use the Cobalt in some cases.

I’ve used the Cobalt in Australia and the USA at restaurants and got 5x points. You pay the fx fee though.

Did i miss this in the article? But what happens to current MR Select balances? Do they get converted or is it just on new spend?

Yes, existing Cobalt cardholders will be getting the ability to transfer their points to airlines as of August 16.

To clarify, will our currently accumulated MR-select points be converted to regular MR points? Or will we only get regular MR points on new spending after August 16? Thanks.

Technically, your current points are also MR points, since they’re all known as “MR points” in the Amex dashboard but we refer to them as “MR Select points” because they can’t be transferred to airlines. On August 16, the ability to transfer to airlines will be enabled for Cobalt cardholders on their existing points balances and any new points that they earn.

This makes the Gold card irrelevant, no?

Unless we see further changes to the Gold (which I think we will).

So this begs two questions, I’m assuming once this change takes effect, that would be the opportune time to convert our points to Aeroplan? Is there ever a case where keeping MR points to book a flight is better than using Aeroplan to book a flight? I believe there are still cases where Fixed Points offers a better bang for your MR points?

Also, I just signed up yesterday to the Personal Platinum with the original goal of keeping it long-term. However, with the these changes on the Cobalt card, it really has me wondering what I will do when it’s time to renew the Platinum card. Aside from the additional travel insurance and lounge access (something I don’t often use), I don’t see the value add in keeping the Platinum card long-term.

I am in the same boat! Recently applied for the platinum personal. With these features, I am happy that I can merge the points I’ve already earned on cobalt with the points I will earn from platinum (especially the signup bonus)

But I might not renew the platinum card for a second year (I might do one more year for the 30k points depending on the value I get). But cobalt looks stronger than platinum now. Especially if someone is not a VERY high earner.

How would you merge the points? I’m assuming we can’t transfer MR points between AMEX cards can we? Otherwise we would have to transfer them to an airline partner to merge the points there?

I’m going with the same line of thinking as you – waiting to see how things look closer to the next anniversary date to determine whether it’s even worth keeping for the additional 30k points. I do worry about being in AMEX’s bad books though as I do think they have the best customer service of the bunch and offer a very good lineup of cards.

@Marco: you can have one MR account for multiple cards that generate Membership Rewards. MR Select is a different “currency” so they couldn’t be combined. i’d be curious to know what will happen to current MR Select points. Will they just automagically become full-fledged MR points? if so, i’m not going to be too happy that i just wiped out my balance with the 30% bonus offer to Bonvoy.

my first question upon reading this news was what was going to happen to earn rates. i found this answer on the amex website faq: “Your other earn rates remain the same, so you can continue to live life your way and get rewarded”

So it seems like we’ll be earning 5 aeroplan points per $ on the eats category. In other words, less than $30k spend will get you a round trip ticket to europe in business (at the current points cost)

the cobalt card will eat into the platinum market for people like me who don’t use the platinum perks. this will be doubly true if they raise the plat’s price in canada as they have recently done in the US.

That’s exactly what I was thinking. I typically don’t use the lounge access because often times we are flying with other friends or family members who may not have access. The only thing Cobalt is missing is Trip Interruption and perhaps a few insurance enhancements. I get nervous book travel on the Cobalt card for that reason.

However, as you’ve mentioned, these benefits and changes are crazy good for Cobalt card holders. It sounds like MRS become MR points. If that’s the case, we should then be able to do as you indicated above, add them to our MR account instead of having to track those points separately.

Yes! I was thinking of transferring to an airline partner to merge the points.

I highly doubt just closing a card would put anyone in the bad books. Especially as other cards are in good standing

This is excellent news..American Express is very aggressive this summer. Beginning with their Aeroplan Cards and then the new 10X points on Platinum and now the Cobalt Card. If I am not wrong Cobalt Card is the only credit card that will start earning MR points others are charge cards.

Yeah. Great update. Thx Ricky. Just seems so many free Aeroplan points being thrown around. Seems all the airlines everywhere are throwing around the feee points. Earn and burn them don’t save them up!

Much lesser known fact that MR Select can also be transferred to Hilton 1:1

Apparently this is much less valuable than transferring to Mariott

I can only smell the TRAP when there was 30% Marriott bonus promo

I trust you held off on transferring your points then 😉

I just transferred 50k MR points to Marriott…